Where Chinese Tourists Are Traveling After ‘Zero-COVID’

Key Takeaways

52% of Chinese adults say they are interested in taking a trip abroad, a 24-point increase since last year.

Chinese adults’ interest in leisure travel has grown, but where they want to travel has changed: More are interested in visiting the Middle East and North Africa, and far fewer want to take a trip to North America.

Brands need to be aware of the many factors — including those outside of consumers’ control, such as geopolitical tensions and China’s softer-than-expected economic recovery — that are influencing these decisions in order to capitalize on the return of Chinese outbound travel.

For a daily briefing on the most important data, charts and insights from Morning Consult, sign up for Our Best Intel.

The importance of Chinese international travel to the global tourism sector was well known before COVID-19, but it was clearly reinforced when the country essentially closed its borders for three years in response to the pandemic. Prior to 2020, Chinese travelers accounted for a sizable portion of global tourism spending, but in 2020 the number of outbound international travelers dropped to about 13% of 2019 volume, and in 2021 those numbers grew only slightly.

So when China reopened its borders in January 2023, the industry breathed a collective sigh of relief. However, while pent-up demand is leading to high interest in international travel, behaviors have changed since 2019. Specifically, interest in visiting North America has dwindled, with Chinese travelers instead setting their sights more on the Middle East and Europe. As a result, U.S. brands expecting a resurgence may have to wait a bit longer.

Interest in international travel has skyrocketed since China’s reopening

In an encouraging sign for the global travel industry, Chinese adults are excited to travel abroad after years of heavy-handed “zero-COVID” policies. Over half now say they want to travel internationally for leisure, a 24-point increase compared with last year. Though interest in all types of travel has increased, the leisure category represents the most significant change, followed by interest in business travel, which rose 21 points over the same period.

Chinese Adults Are More Interested in Traveling Abroad Relative to Last Year

Interest in going abroad will likely translate to increased bookings. Over three-fourths of Chinese adults with leisure trips planned in the next year said those plans would “definitely” or “probably” involve international travel, up from 45% in July 2022. It makes sense that more Chinese travelers are eager to cross the border given that planning a trip abroad in the summer of 2022 was more aspirational than realistic.

In comparison, Chinese appetites for domestic travel have declined slightly since last year: 85% of those with leisure plans say they’ll travel within China this year, compared with 89% in 2022. Clearly, the opportunity to travel to different countries is pulling some volume from the domestic tourism market, which experienced an uptick when it was impossible to leave the country. But trips abroad are not completely replacing trips closer to home, as 91% of those with plans to travel internationally also say they plan to take a domestic trip.

Of course, while the end of the international travel restrictions instituted under zero-COVID has been an accelerating factor, interest has also been bolstered by a notable drop in concern about the coronavirus. Last summer, potential travelers were more likely to worry they might become sick with COVID-19 or, even if not exposed, to worry about logistical complications like mandatory quarantines and extended isolation. This summer is a different story. COVID-19 infection is no longer the top reason Chinese adults say they won’t travel internationally. In fact, it’s the least pressing concern, having dropped 30 points compared with June 2022.

COVID Concerns Are Less Likely to Keep Chinese Travelers From Going Abroad

Other concerns related to international travel have fluctuated far less, though another notable drop is in worry about anti-China bias at the destination, down 8 points since last summer. During the height of the pandemic, stories about the origins of the COVID-19 virus proliferated in the global news media, stoking Sinophobia and leaving many Chinese people on the defensive. Moreover, stories about global anti-China bias were a common feature in China’s state-run media.

Fear among would-be travelers is not unfounded. Violence and hate directed against Asians appeared to be on the rise in numerous global destinations during the height of the pandemic. While worries about anti-China bias among Chinese travelers may no longer be top of mind — or at the forefront of the news cycle — as the pandemic recedes, fears still exist. Among Chinese adults, 37% cited anti-China bias as a major reason not to travel, with an additional 45% citing it as a minor reason to avoid specific destinations.

High travel costs are top of mind amid China’s soft economic recovery

While many concerns have abated since last year, one notable increase is among those who say cost is a major reason they won’t travel abroad. This is undoubtedly tied to current economic realities in China: Consumer confidence plummeted in the months before Beijing suddenly shifted away from its stringent pandemic management policies in late December 2022. Despite an early rebound, China’s overall economic recovery since reopening has been softer than many expected. The latest data from Morning Consult shows that monthly consumer confidence among Chinese adults has been declining since May.

Chinese Consumer Confidence Is Declining

Economic conditions are making consumers hesitant to spend on big purchases, and they are instead seeking out discounts. This behavior is likely affecting travel decisions as well, compounded by the rising price of travel in general and scarcity that makes discounts in travel & hospitality difficult to come by. Fewer flights are operating in and out of China than during pre-pandemic times, meaning the balance of supply and demand has shifted and travelers are shelling out much more for airfare.

Chinese travelers heading abroad are increasingly interested in the Middle East

As Chinese travelers do venture abroad, the lingering question for many in the global travel industry is a simple one: Where will they go? Before the pandemic, top destinations were in Asia, including Thailand, Japan and Vietnam, with the United States the only non-Asian destination ranking in the top 10. But preferences have changed since 2019 and are continuing to evolve, with some notable shifts since just last year.

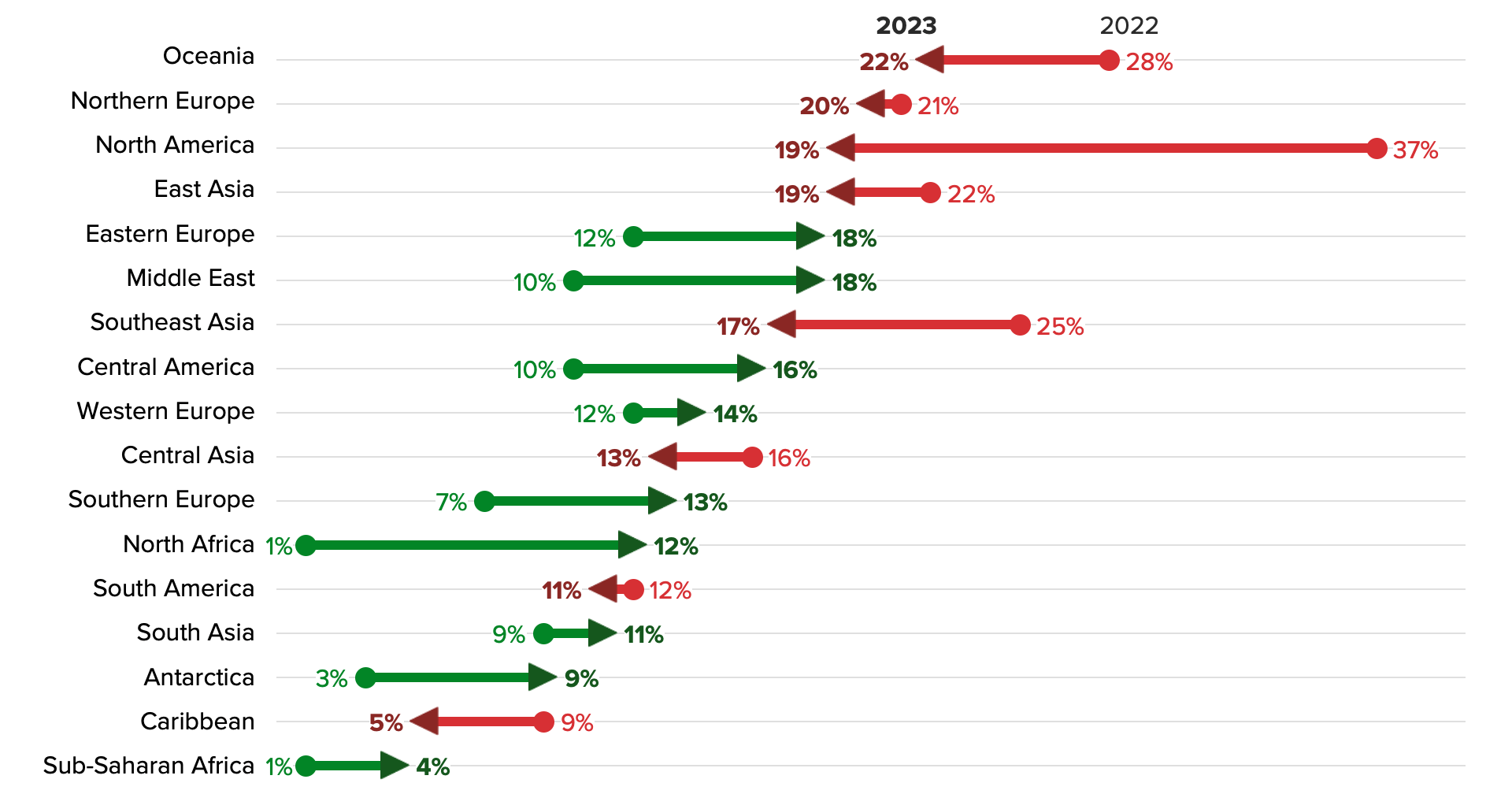

Chinese Adults’ Preferred International Travel Destinations Have Shifted

The Middle East and North Africa are emerging hot spots for Chinese travelers. Among those with international travel plans, the shares who said they will visit the Middle East and North Africa are up 8 and 11 points, respectively. Interest in Europe is also trending up, with the share who said they were “very interested” in traveling there growing by 14 points, driven by gains in more off-the-beaten-path destinations.

These bumps in particular regions appear to come at the expense of closer-to-home destinations such as East, Southeast and Central Asia, which all saw declines since last summer. But the most notable change was observed for North America, which declined 18 points since last year.

On one hand, some contributing factors to this decrease are logistical. While flight routes in and out of China are generally down, connections to the United States have been even slower to come back. Fewer than 6% of the flights operating between China and the United States before the pandemic have resumed, and those that have are prohibitively expensive for many. Additionally, timelines to obtain a visa to visit the United States are long, meaning many Chinese tourists may have to wait months to be cleared for travel.

Geopolitical tensions are shaping Chinese tourists’ travel concerns

There are also geopolitical considerations at play when travelers choose international destinations. Nearly 2 in 5 Chinese adults said poor relations between China and a foreign country would be a major reason to avoid visiting. While this represents a 3-point decline from the previous year, the negative impact of geopolitics on travel decisions rose in relative terms, from the fifth to the third most commonly cited major reason to avoid international travel. Reservations about poor bilateral relations ranked behind only concerns about terrorism and violent crime, tied with rising worries about petty crime and ahead of concerns about anti-China bias and COVID-19.

China’s relationship with the West, and with the United States in particular, has grown increasingly fraught over the last year, dampening interest in travel to North America. As of June, majorities of Chinese adults said they expect military and economic tensions between the United States and China to get worse over the next 12 months (52% and 58%, respectively).

Moreover, pessimism has risen for much of the past year. Expectations of worsening military tensions increased 22 points between May 2022 and May 2023, while the share expecting economic tensions to grow rose 14 points over that same period, peaking at 77% in March. Although June saw declines in these shares — perhaps from renewed optimism over high-profile visits by U.S. Secretary of State Antony Blinken and Treasury Secretary Janet Yellen — the outlook among most Chinese adults remains dire, and this will continue to influence their travel decisions.

Over Half of Chinese Adults Expect Sino-U.S. Tensions to Worsen in the Coming Year

The war in Ukraine has reshaped global flight maps and Chinese travel

Perhaps the most impactful geopolitical issue over the past year has been Russia’s ongoing invasion of Ukraine. While China has officially remained neutral in the conflict, Beijing’s refusal to formally reprimand Moscow or Russian President Vladimir Putin has led to growing tensions between China and Ukraine’s many Western allies. Europeans, despite their displeasure, have been hesitant about being pulled into the growing discord between China and the United States with a war already raging in their backyard. This may partially account for Chinese adults’ sustained interest in European travel.

Still, fallout from the war has left China more diplomatically isolated than at any time in recent history. A growing need for allies and partners has led Beijing to launch a recent charm offensive in the Middle East. And a focus on the broader region, including emphatic coverage in Chinese media, could be stoking interest in both the Middle East and North Africa among Chinese travelers.

But the war has had more direct effects on travel as well, especially when it comes to flights between China and North America. In response to the invasion, numerous countries including Canada and the United States enacted punitive sanctions against Russian business interests, including closing their airspace to Russian airlines, to which Russia responded with reciprocal bans.

This has made the prospect of flights from Canada and the United States to China lengthier and more expensive for carriers that would normally fly over Russian airspace, and has dampened incentives to resume pre-pandemic routes. The issue has been exacerbated by the fact that Chinese airlines are not subject to such restrictions, leaving those that are impacted frustrated over the competitive disadvantage, and even less inclined to add more routes. However, Chinese airlines recently added a small number of additional routes to the United States that also avoid Russian airspace, and this unspoken compromise could leave the door open to reciprocal additions by North American carriers moving forward.

Chinese adults are optimistic about the future of travel

Travel to and from the United States may be a challenge at the moment, but encouragingly, most Chinese adults find it relatively easy to book flights and hotels for their trips, whether domestic or international. And there are signs of optimism for the future: A majority also think booking travel will get even easier in the coming year, with around a quarter saying it will stay the same and only small shares predicting that it will become more difficult.

Most Chinese Adults Find Booking Travel to Be Easy, and Predict It Will Be Easier Still in the Future

The similarities in sentiment between domestic and international bookings suggest that logistical concerns aren’t putting anyone off traveling abroad, and the general optimism points to an appetite for travel that won’t subside anytime soon. However, brands must be aware that there is some variability in this optimism. Specifically, young people — who tend to be more concerned about their finances and unemployment, and generally less optimistic than their older counterparts — are more likely to predict that it will get more difficult to book travel in the future.

Specific demographics at scale: Surveying thousands of consumers around the world every day powers our ability to examine and analyze perceptions and habits of more specific demographics at scale, like those featured here.

Why it matters: Leaders need a better understanding of their audiences when making key decisions. Our comprehensive approach to understanding audience profiles complements the “who” of demographics and the “what” of behavioral data with critical insights and analysis on the “why.”

For brands that want to capitalize on the return of Chinese outbound travel, streamlining the booking process will be key. This includes, of course, highlighting deals and offers to combat price sensitivity amid ongoing economic uncertainty.

On a larger scale, brands and destinations across the globe need to keep a close eye on geopolitics and monitor the sort of macro events that can disrupt expectations and shape Chinese consumer travel preferences and outcomes. Chinese travelers returning to the skies will be a boon to global travel brands and destinations, but industry professionals expecting a return to pre-pandemic normality must recognize that the world has changed, and so too have China’s outbound travelers.

Lindsey Roeschke is an analyst whose work focuses on behavior and expectations of consumers in the travel & hospitality and food & beverage categories, particularly through a generational and cultural lens. Prior to joining Morning Consult, she served as a director of consumer and culture analysis at Gartner. In addition to her research and advisory background, Lindsey has more than a decade of experience in the advertising world. She has lived and worked in seven cities across four continents.

Scott Moskowitz is senior analyst for the Asia-Pacific region at Morning Consult, where he leads geopolitical analysis of China and broader regional issues. Scott holds a Ph.D. in sociology from Princeton University and has years of experience working in and conducting Mandarin-language research on China, with an emphasis on the politics of economic development and consumerism. Follow him on Twitter @ScottyMoskowitz. Interested in connecting with Scott to discuss his analysis or for a media engagement or speaking opportunity? Email [email protected].