Global Sentiment Edges Higher, but the U.S. and China Show Signs of Weakness

See June 2023 global consumer sentiment data here.

Global consumer sentiment continued to rise in May, adding to steady gains made since December 2022. The 0.6% increase in Morning Consult’s GDP-weighted measure of consumer sentiment was driven by rising confidence in France, the United Kingdom and Japan.

In the United States, consumer sentiment rose for the better part of May, lifting the monthly average compared with April. However, confidence materially weakened at the end of the month, bringing into doubt the longevity of an uptrend that has been broadly in place since July 2022. The steep decline in U.S. consumer sentiment seen in the last 10 days of May was led by adults from households earning $100,000 or more annually. Among adults from high-income households, sentiment fell nearly 10 points in the closing days of the month. According to Morning Consult labor market data, the incidence of lost pay and income among higher earners has been rising quickly as layoffs in the high-paying tech and financial services fields spill over into other white-collar roles. Job loss expectations are also elevated among high-earning Americans, causing sentiment to deteriorate.

For full access to Morning Consult's consumer confidence data, see our listing on the Snowflake Data Marketplace.

Across Europe, slowing inflation continues to drive improvements in consumer confidence. In May, sentiment rose in 15 of the 16 economies tracked by Morning Consult, with only the Czech Republic experiencing a month-over-month decline. Morning Consult data shows that indirect inflation expectations are also falling rapidly in Europe’s largest economies, providing a tailwind to confidence.

China’s Recent Surge in Sentiment Appears to Be Waning

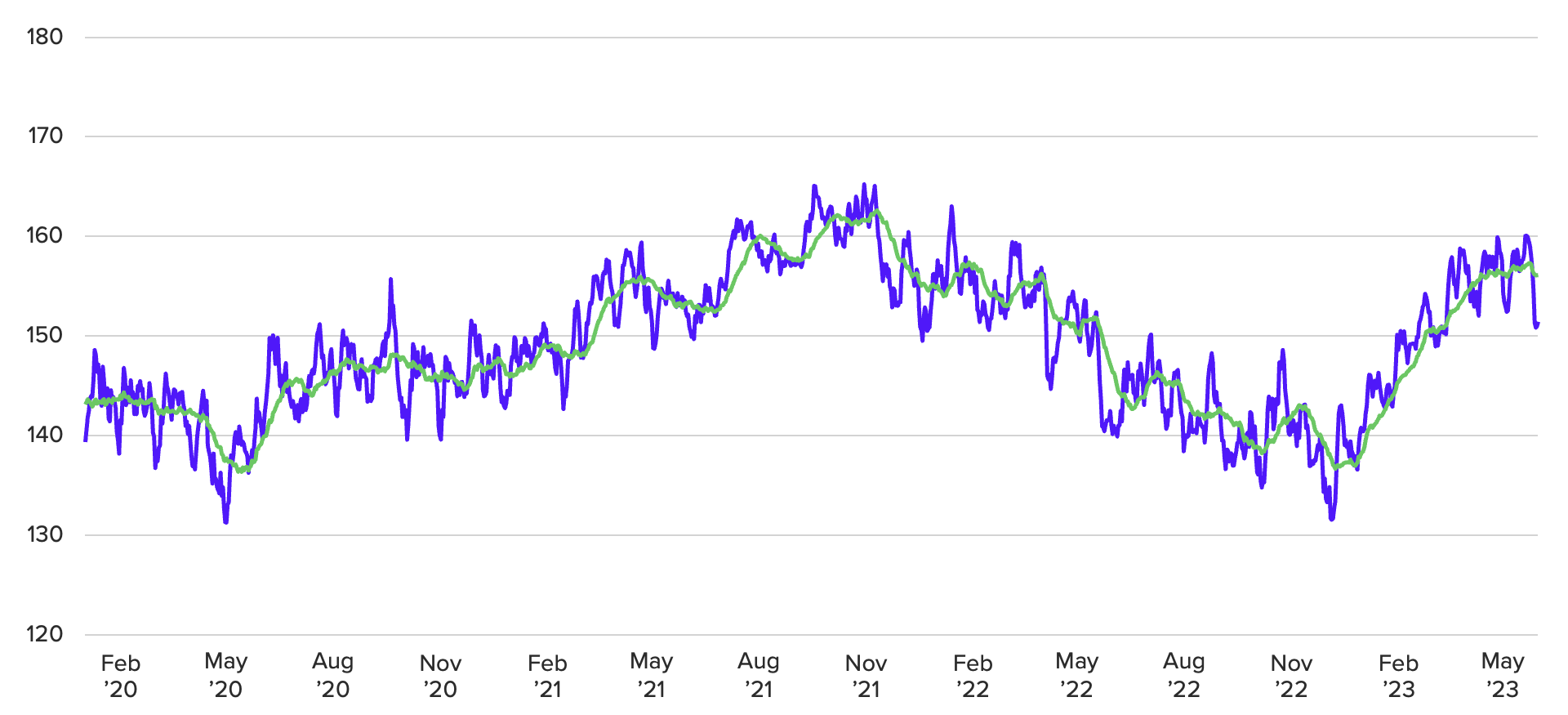

5-day moving average (purple) and 30-day moving average (green)

Since the start of 2023, the 30-day moving average of the Morning Consult China Index of Consumer Sentiment has increased by 17.8 points, or 12.9%. With a large amount of accumulated savings after years of lockdowns, the Chinese consumer has the means to spend, and rising confidence could well provide the spark needed to reignite growth. Consumers are at the heart of Beijing’s plans for stronger economic growth this year, as manufacturing has been stunted by external headwinds from weakening global demand.

However, Morning Consult data shows early signs of waning momentum in Chinese consumer sentiment. In the past month, growth in sentiment has slowed, and three of the five ICS components fell from the previous month.

This memo offers a preview of Morning Consult’s June Global Consumer Confidence Report. Morning Consult Economic Intelligence subscribers can access the full report here.

Jesse Wheeler previously worked at Morning Consult as a senior economist.

Akber Khan is an economist at decision intelligence company Morning Consult, where he supports the research efforts of the Economic Intelligence team by applying a combination of data science, data engineering and econometric forecasting methods to deliver insights into global macroeconomic trends. Previously, he worked for the Federal Reserve Board as a financial analyst, covering issues such as banking and finance, short-term funding markets, and monetary policy. He received a bachelor’s degree in economics from Bentley University.

Follow him on Twitter @AKhanMC. For speaking opportunities and booking requests, please email [email protected]