To See What’s Next For Consumer Spending, Take a Closer Look at High-Income Consumers’ Confidence

Key Takeaways

Since retail sales and expenditure data is not available immediately, Morning Consult has been watching a key component of our daily consumer confidence tracking – the Current Buying Conditions (CBC) Index – for real-time indicators on consumer spending.

This metric has quickly become the strongest indicator of real-time consumer spending in the pandemic.

The lack of real-time consumer spending data has never been more apparent than during the pandemic. Retail sales for December were released on Jan. 15, and personal consumption expenditures for December were released on Jan. 29. That lag is leaving businesses and economists with no easy way to grasp the current strength of consumer spending as the country navigates the next phase of the pandemic.

The gap consumer confidence fills: Since expenditure data is not available immediately, Morning Consult has been closely watching a key component of our daily consumer confidence tracking: the Current Buying Conditions (CBC) Index.

- The CBC Index tracks daily consumer views regarding whether or not now is a good time to make a major household purchase.

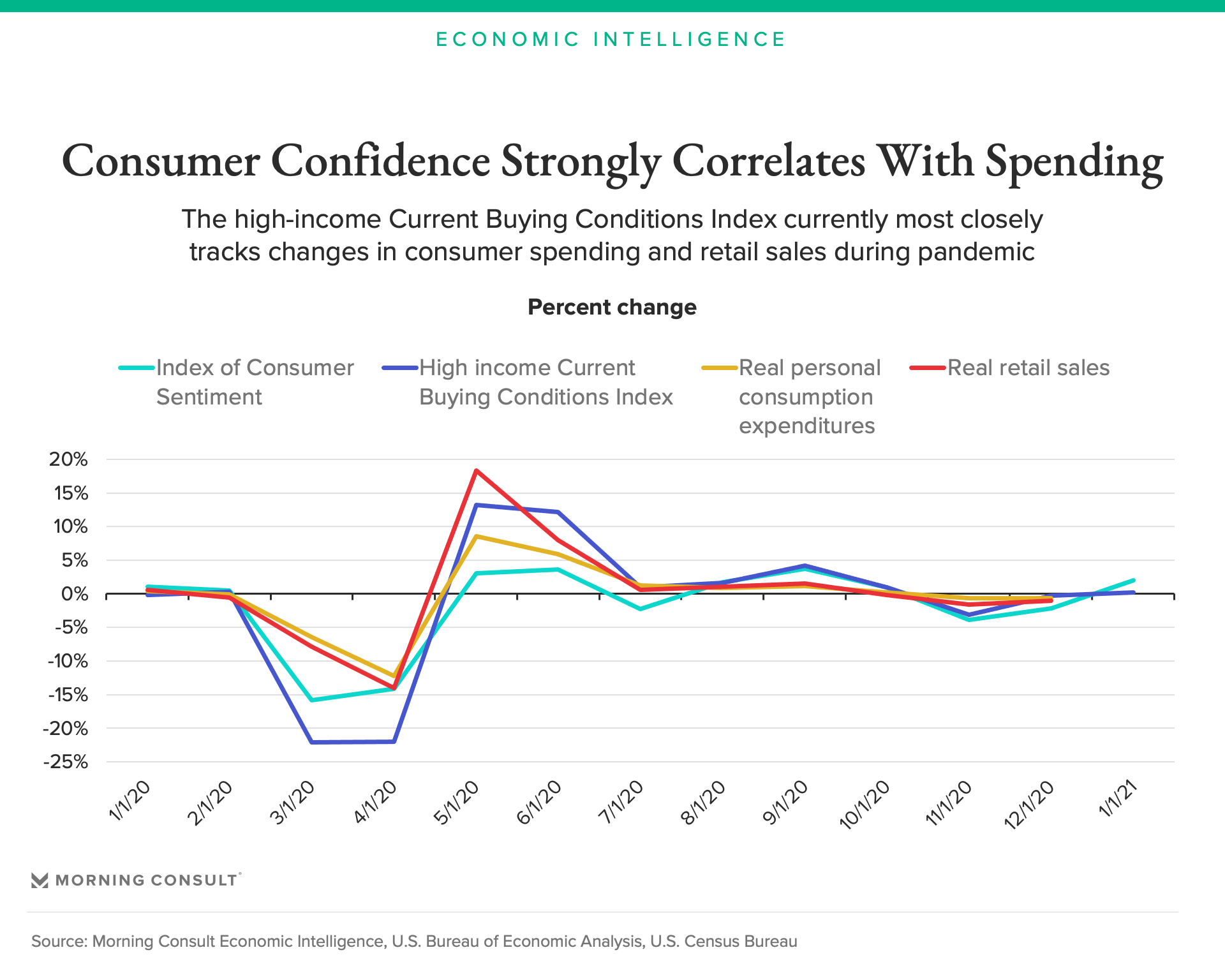

- Over the past 12 months, the CBC Index among high-income consumers ($100,000 or more) has become the strongest indicator of consumer spending, showing a strong positive correlation with real personal consumption expenditure (.96) and real retail sales (.90).

The correlation between the high-income CBC Index and real spending is strong today for two reasons:

- First, high-income Americans are weathering the pandemic at a much better rate than lower-income Americans and are driving much of the consumption. Their financial strength means their spending is driven much more by their willingness to spend than their financial capacity, while for lower-income Americans, their spending has been reserved for essential items and has stayed relatively flat in recent months due to financial constraints.

- Second, spending on consumer durable goods has accounted for an above-average share of total consumer spending during the pandemic due to the restrictions placed on other retail categories such as the restaurant industry. Since the CBC Index directly tracks consumers’ interest in buying these goods, it has closely tracked actual consumer spending patterns.

While Morning Consult’s Index of Consumer Sentiment (ICS), which incorporates five distinct components of consumer confidence, still shows a strong correlation with real expenditure data (.86), the high-income CBC Index is currently the best high-frequency indicator available for understanding consumer spending today. But as governments ease restrictions on the service industry and consumers grow more comfortable engaging in standard activities, the ICS is likely to regain its standing over the CBC Index as the best indicator of consumer spending.

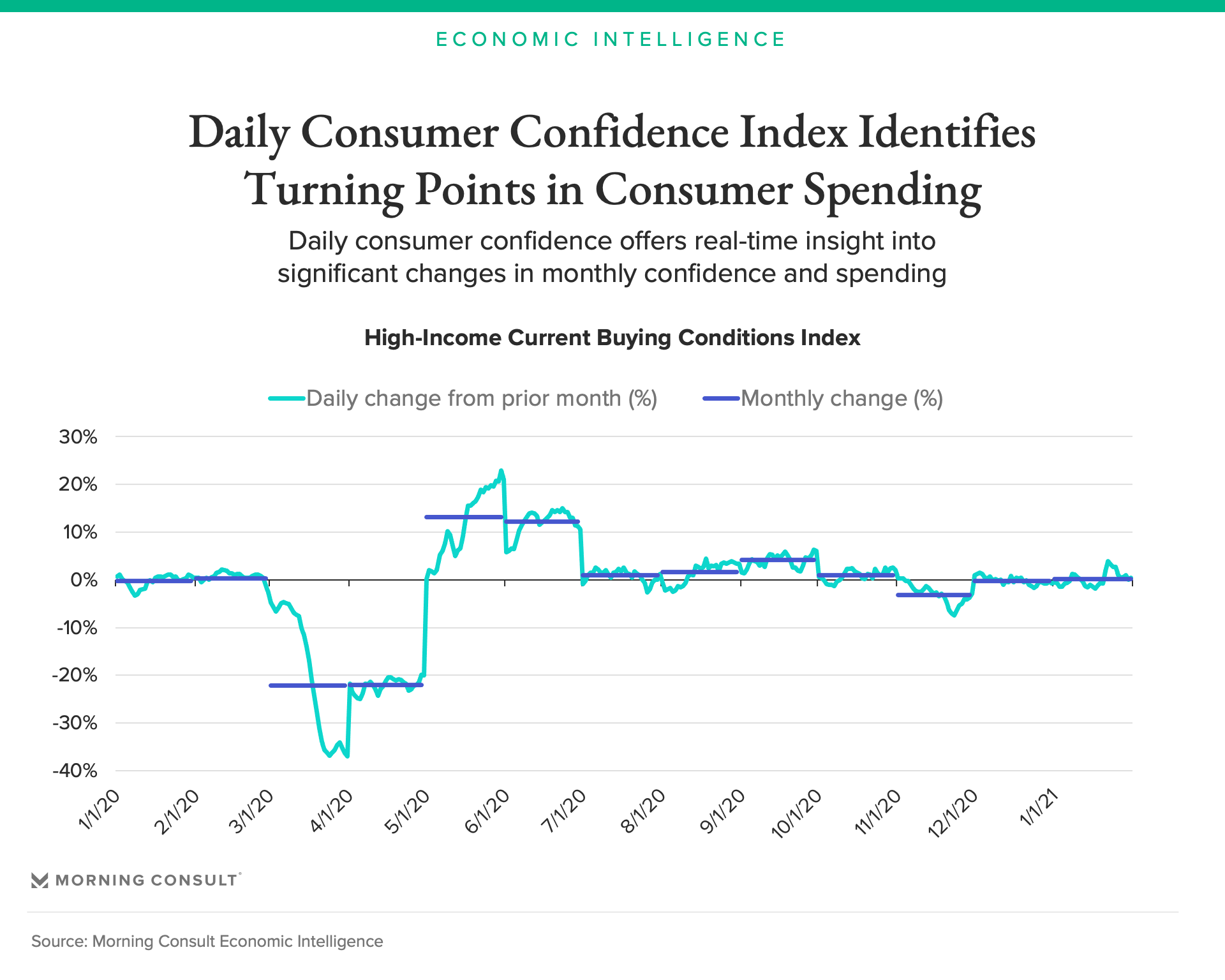

What the CBC Index tells us about what’s next for consumer spending: In January, the high-income Current Buying Conditions Index remained essentially unchanged from December, increasing by 0.18 percent during the month. While the size of the increase is not impressive, it signals that consumer spending and retail sales are turning the corner after two consecutive months of contracting.

- Daily data also shows that the CBC Index among high-income adults rose over the course of January. Thus, even if it just maintains on average its current level for the duration of February, the high-income CBC Index in February will increase by 0.28 percent. This moderate increase in the high-income CBC Index provides a floor or lower bound for consumer spending in February.

- Developments in the fight against the pandemic as well as additional financial support for households suggest that the high-income CBC Index will actually increase by the end of March to 110, driving consumer spending and retail sales higher by 1 to 2 percent over the next two months.

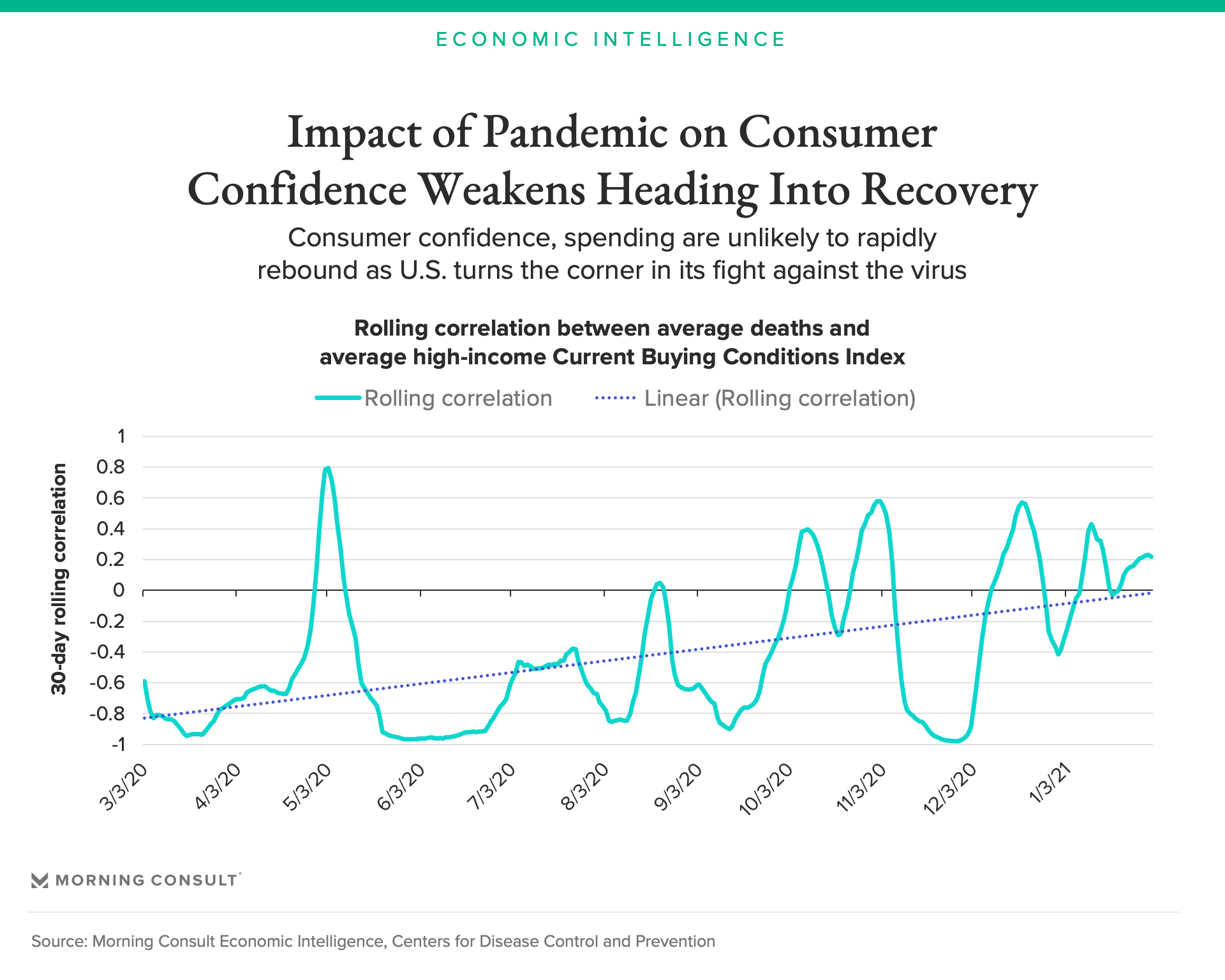

The recovery won’t be as quick as the decline: The relationship between the pandemic and the high-income CBC Index is weaker now than it was at the beginning of the pandemic. As a result, although the decrease in consumer confidence was ignited by the pandemic, defeating the virus in the United States will not on its own fuel a complete and immediate rebound in consumer confidence or consumer spending.

- Over the past year, the high-income CBC Index has grown less correlated with new COVID deaths, as illustrated in the graph below. In other words, the pandemic does not weigh as heavily on high-income consumers as it used to.

- Future increases or decreases in new deaths will exert a weaker influence on the high-income CBC Index and, by extension, on consumer spending. As the United States manages and ultimately defeats the virus, do not expect consumer confidence or spending to increase as rapidly as it decreased in March 2020.

John Leer leads Morning Consult’s global economic research, overseeing the company’s economic data collection, validation and analysis. He is an authority on the effects of consumer preferences, expectations and experiences on purchasing patterns, prices and employment.

John continues to advance scholarship in the field of economics, recently partnering with researchers at the Federal Reserve Bank of Cleveland to design a new approach to measuring consumers’ inflation expectations.

This novel approach, now known as the Indirect Consumer Inflation Expectations measure, leverages Morning Consult’s high-frequency survey data to capture unique insights into consumers’ expectations for future inflation.

Prior to Morning Consult, John worked for Promontory Financial Group, offering strategic solutions to financial services firms on matters including credit risk modeling and management, corporate governance, and compliance risk management.

He earned a bachelor’s degree in economics and philosophy with honors from Georgetown University and a master’s degree in economics and management studies (MEMS) from Humboldt University in Berlin.

His analysis has been cited in The New York Times, The Wall Street Journal, Reuters, The Washington Post, The Economist and more.

Follow him on Twitter @JohnCLeer. For speaking opportunities and booking requests, please email [email protected]