Why Biden Isn’t Getting Much Credit for Improving Consumer Sentiment, and What It Means for 2024

Key Takeaways

Although consumer sentiment is still below pre-pandemic levels, confidence about the economy is at a two-year high as wage growth outpaces inflation and Americans hear more good news about the economy.

Despite that upward trend, perceptions of Biden’s handling of the economy have seen only marginal gains.

Consumer sentiment is hovering around the same level as it was right before the 2020 election. If the economy continues on its current trajectory, it could keep climbing higher.

The economy’s salience is an open question hanging over 2024 elections and continued economic progress could render it a secondary issue.

Sign up to get the latest global brand, economics, media and marketing news and analysis delivered to your inbox every morning.

The White House’s “Bidenomics” push last year rested on a calculated bet that a slowing inflation would improve U.S. consumer sentiment and boost perceptions of President Joe Biden’s handling of America’s economy. And while the first assumption has proven prescient, the second is yet to come to fruition.

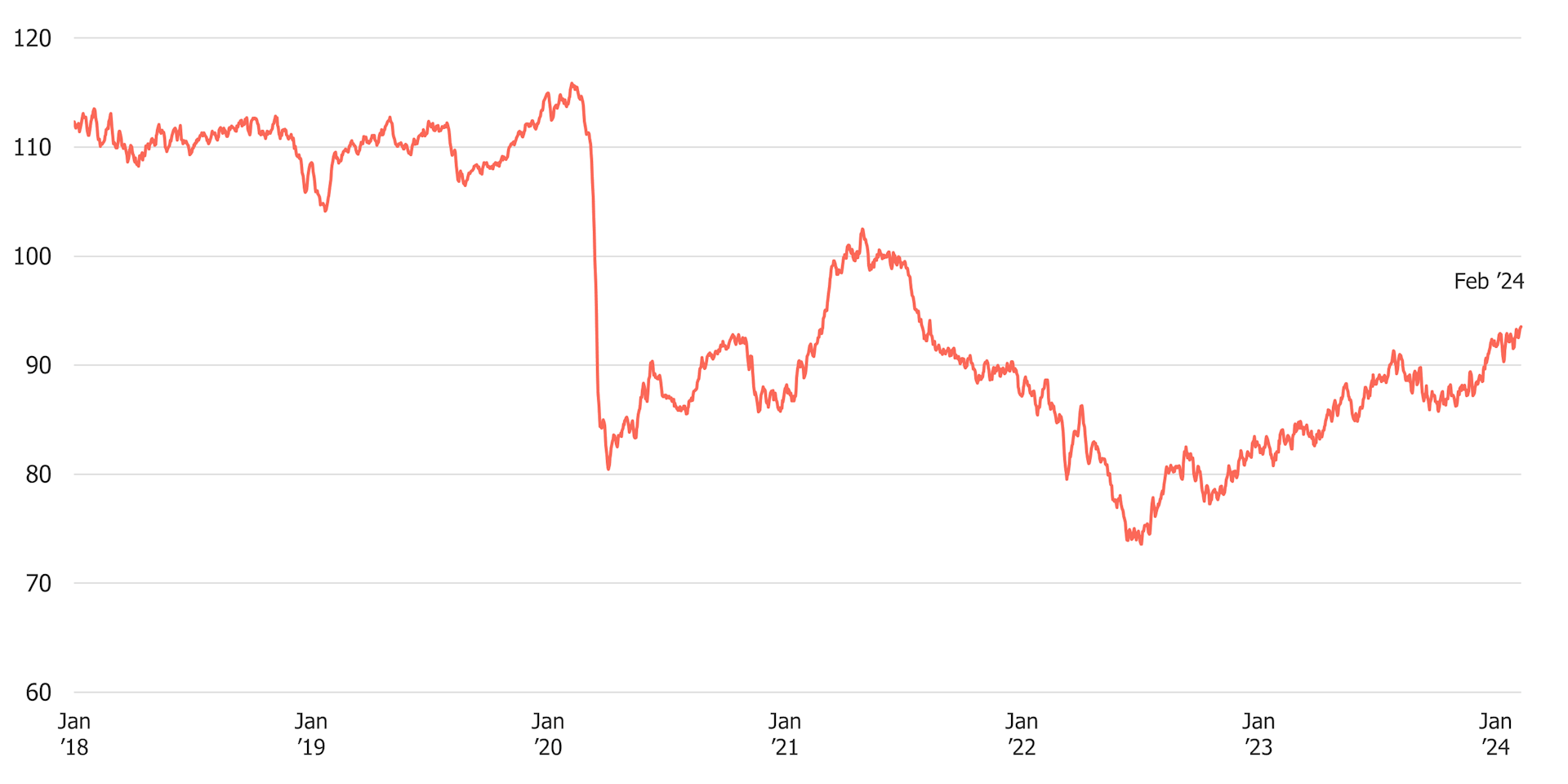

Consumer Sentiment Is at a More Than 2-Year High

Despite many economists’ predictions of a recession in 2023, the labor market remained tight with strong wage growth and an unemployment rate below 4%. In addition, consumers continued to spend, propping up real GDP to 2.5%, even higher than 2022’s 1.9% growth rate.

At the same time, Personal Consumption Expenditures (PCE), the Federal Reserve’s preferred measure of inflation, has come down to 3.1%, moving closer to the Fed’s 2% target with each passing month. As it became apparent there was no recession coming at the end of 2023, economists wrestled with the divergence between consumer sentiment and the surprising success of the economy. Although consumer sentiment remains well below its pre-pandemic levels from February 2020 (19%), it has grown 27% since its low point in July 2022.

A Morning Consult survey from November 2023 found that consumers' unhappiness about the economy was largely due to concerns about inflation and prices. In fact, sticker shock was so severe that consumers said they’d rather see prices go down than their own wages go up.

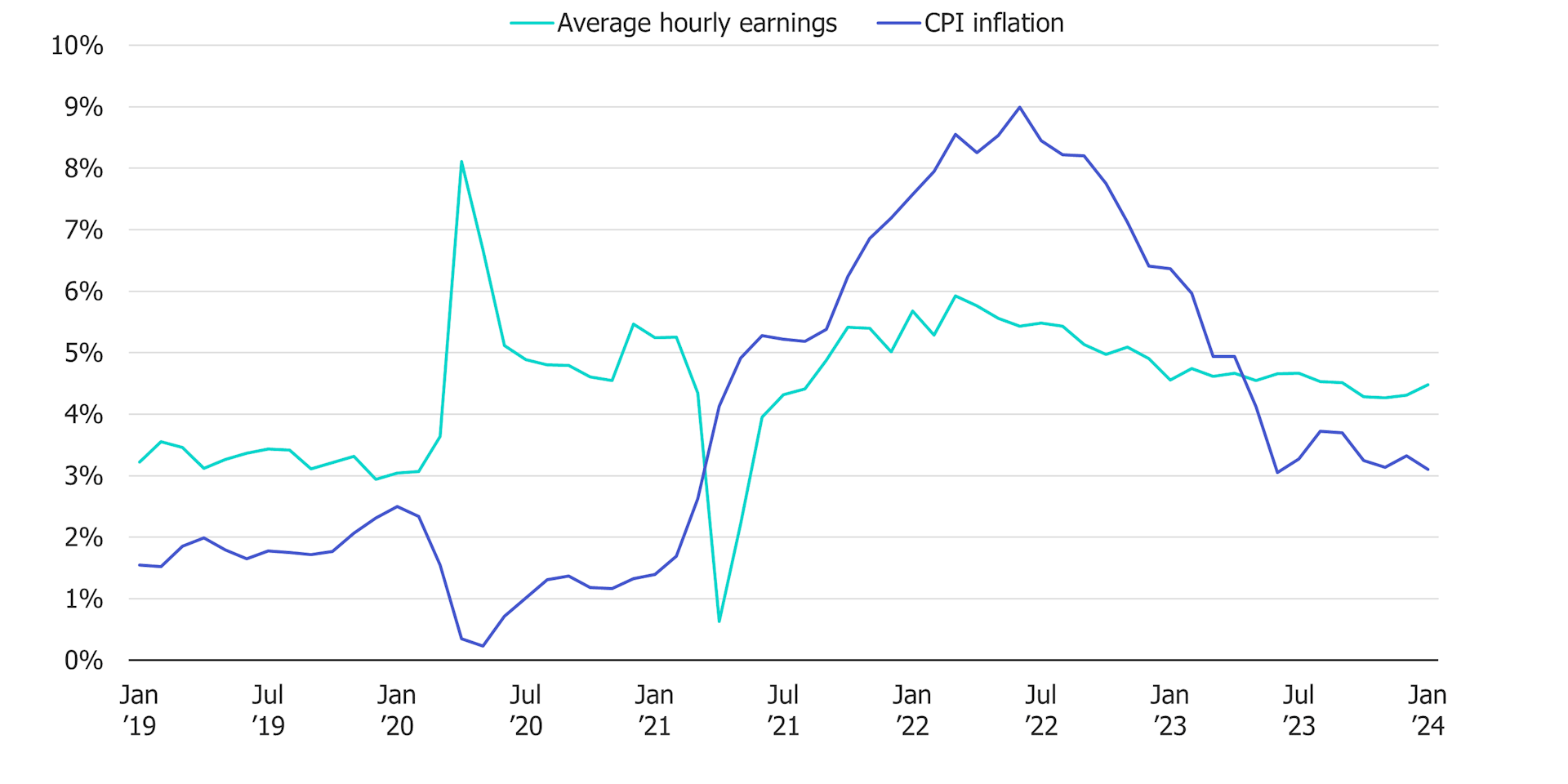

This somewhat counterintuitive preference was a consequence of a sustained erosion in purchasing power. From early 2021 onwards, inflation was higher than wage growth for two full years, which meant that consumers’ dollars weren’t going as far and they couldn’t afford to buy as much as before, coinciding closely with the backslide in consumer sentiment that began mid-2021.

Wages Have Grown Faster Than Inflation for the Past Nine Months

Fortunately, for consumers and the Biden campaign, January marked the ninth straight month in which U.S. wage growth outpaced inflation, likely a significant factor in improvements to consumer sentiment.

And as inflation has cooled and positive data on jobs and unemployment has continued in recent months, news coverage of these developments is filtering down to U.S. voters, according to Morning Consult Political Intelligence survey tracking of so-called issue buzz.

Voters Are Hearing More Good Economic News

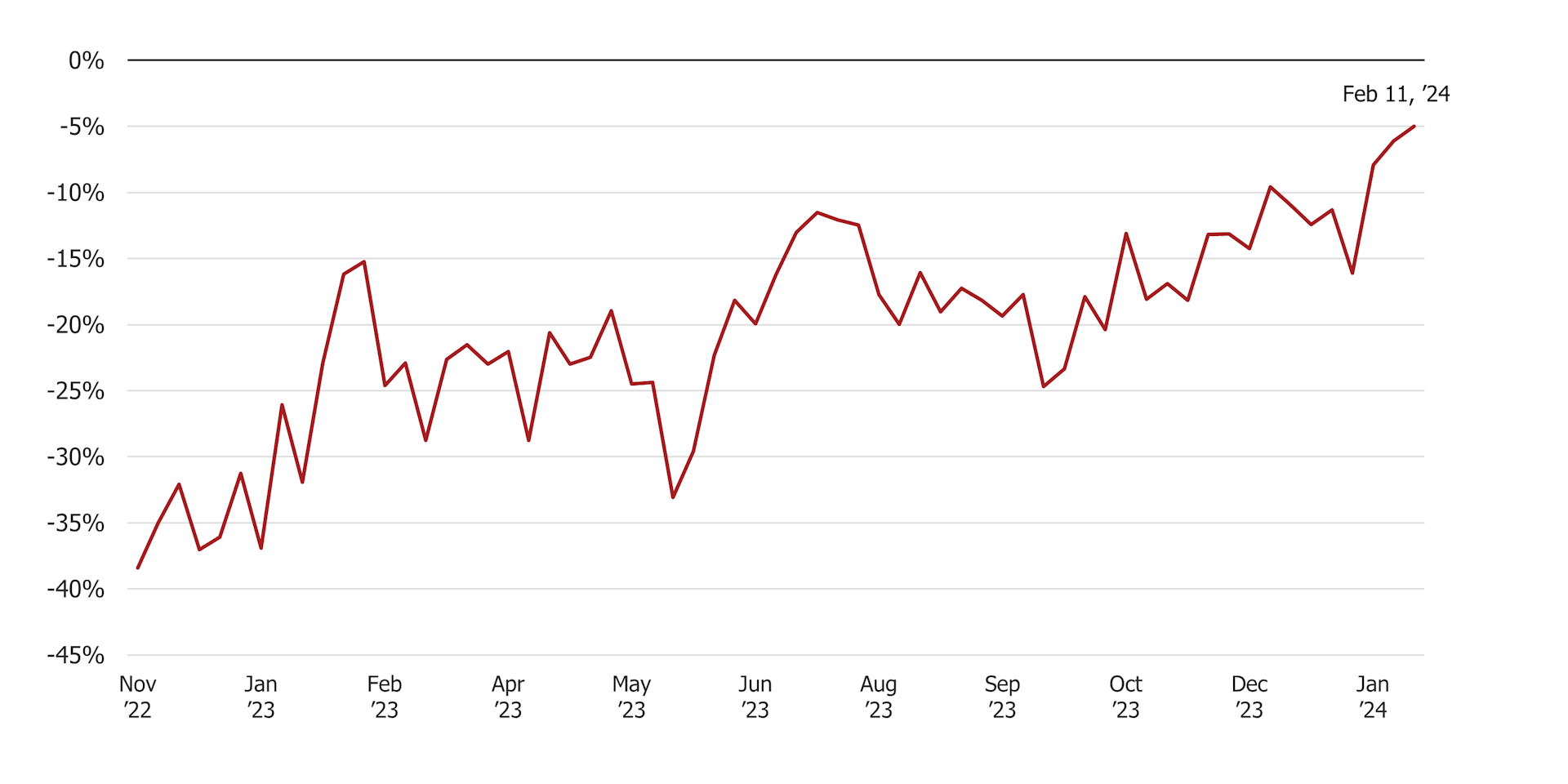

The latest survey finds voters are slightly more likely to report recently seeing, reading or hearing something negative about the economy than positive (33% to 28%). But that still represents a stark improvement from the beginning of 2023, when voters were 37 percentage points more likely to report hearing something negative about the economy than positive. One popular argument for the recent gloomy sentiment of U.S. consumers by historical standards is that it is caused in part by negative news coverage on the economy, spread widely by social media.

But while consumer sentiment and the tenor of media coverage on the U.S. economy are moving in a positive direction, President Joe Biden is only seeing marginal improvements in his own numbers on the topic.

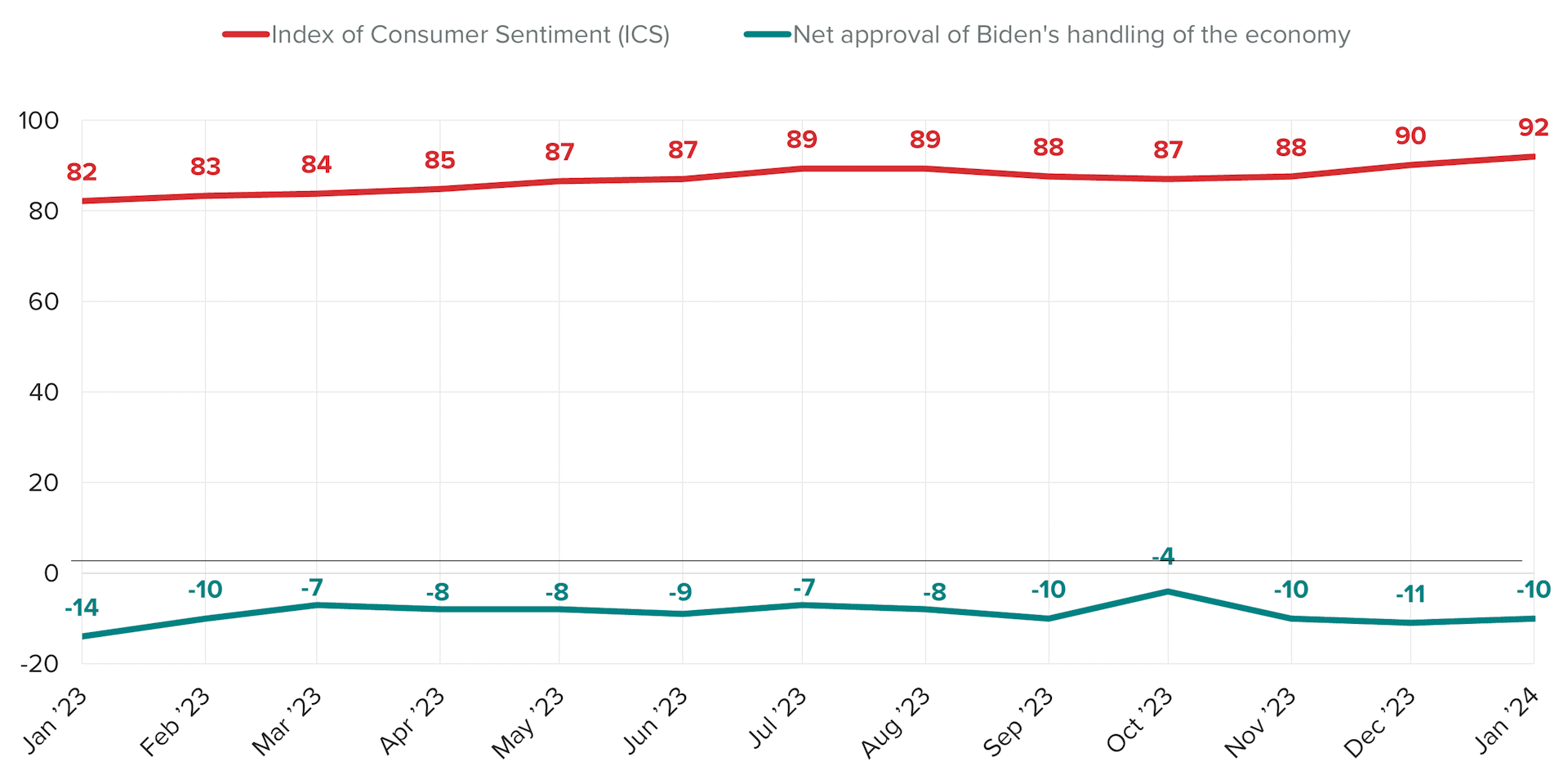

Despite Uptick in Consumer Sentiment, Perceptions of Biden’s Handling of the Economy Haven't Improved Much

In Morning Consult Political Intelligence surveys conducted last month, voters were 10 points more likely to disapprove than approve of Biden’s handling of the topic. Though that’s up ever so slightly from January 2023, when Biden’s economic approval was 14 points underwater, perceptions of his handling of the economy have actually worsened since October despite gains in consumer sentiment.

Political scientists have documented a weakening in the relationship between consumer sentiment and a president’s overall approval rating in recent years. It’s plausible that — due to increasing polarization and hyperpartisanship — we could be seeing a similarly weakening relationship between consumer sentiment and views of the president’s economic approval rating. But there are other possible reasons why voters don’t want to give Biden credit for economic gains.

One explanation is that prices remain elevated since early 2021, which coincides neatly with the beginning of Biden’s presidency. That makes it easier for Republicans to pin on the president.

Another is loss aversion, or negativity bias, which causes people to internalize negative events more than positive events. Though wages have consistently outpaced inflation for the past nine months, that wasn’t the case for the preceding two years. Because purchasing power was weak for so long, consumers may not be prepared to give Biden credit for improving economic fortunes at this time.

Additionally, consumers may see high inflation as something that is inflicted onto them, whereas they may view increases in wages as something they earned out of their own merit. In other words, although both the high inflationary period and increased wages occurred under Biden, the average American may place blame on the president for the higher prices while not attributing increased earnings to him.

Consumer Sentiment Still Has Room To Grow and It Likely Will if the Economy Remains on Its Current Trajectory

The average consumer sentiment score in January 2024 was 92, the same value as in October 2020, right before the last presidential election. From January to November, there is quite a bit of time for consumer sentiment to continue to grow, and if the economy continues on its current trajectory, it will likely reach closer to pre-pandemic levels. That could boost perceptions of Biden’s handling of the economy.

If inflation continues cooling while remaining below wage growth, as expected, that would give consumers more time to feel the benefits of increased purchasing power. In that scenario, consumers are likely to feel better about higher prices relative to the pre-pandemic period, and as a result, about the economy overall. As more time passes, 2019 prices will move further into consumers’ rearview mirrors, making it less of a mile-marker for them on where prices should be.

In addition, the Fed has hinted at rate cuts later this year, which would alleviate certain pain points for consumers, such as financing costs for housing among others. Finally, if continually easing inflation, a strong labor market, and less restrictive monetary policy all do come to fruition, there will also likely be more positive economic news, which could lift consumer sentiment even further and boost perceptions of Biden’s stewardship of the economy.

There are some downside risks however, which could break the streak of growth for consumer sentiment. The Consumer Price Index (CPI) in January came in hotter than expected, with housing and services inflation continuing to be sticking too high in order to fully bring inflation down the Fed’s target. If inflation does prove harder to bring down, the Fed could leave rates higher for longer. So far, high rates appear to have had little impact on consumer demand, but cracks are beginning to form: some delinquency rates for credit cards and autos are above pre-pandemic levels, a sign of percolating financial stress.

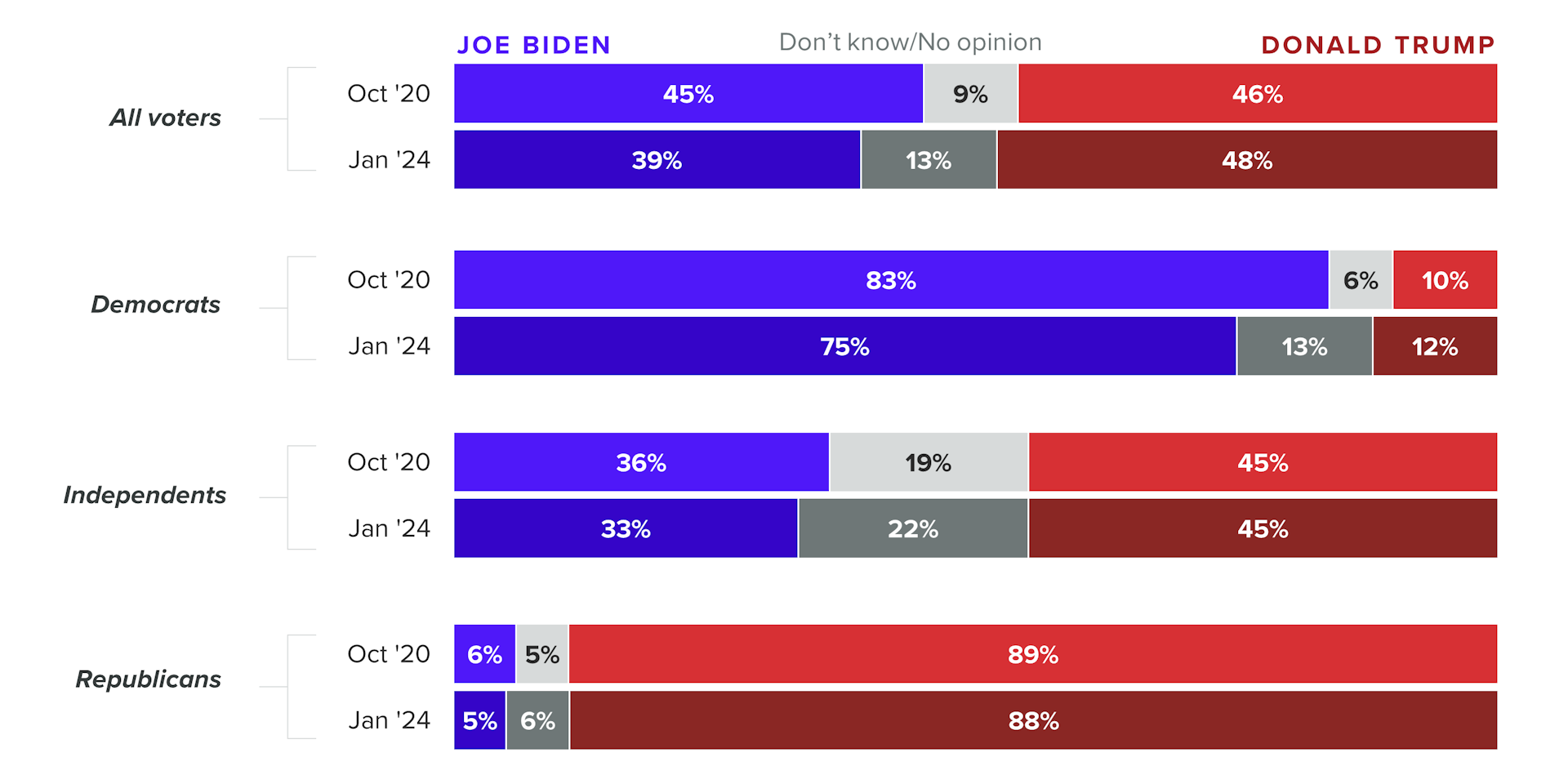

As the Biden campaign ramps up for what’s looking like a 2020 rematch given former President Donald Trump’s runaway performance in the Republican nomination race, it’s worth comparing the trends in voter trust of both candidates on the economy.

Fewer Voters Now Trust Biden More Than Trump to Handle the Economy Than in 2020

Just like on many other topics, fewer voters now trust Biden more than Trump to handle the economy, which is once again the U.S. electorate’s top issue for the presidential election.

As our recent tracking data suggests, the Biden campaign will likely need to see consumer sentiment continue to improve to a point that begins to translate into political tailwinds for the president. While he may not be able to win the economic argument against Trump, he could narrow the trust gap to a point where it lowers the economy’s salience in the election, just as Democrats did in the midterm elections of 2022, when consumer sentiment was significantly lower.

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]

Cameron Easley is Morning Consult’s head of political and economic analysis. He has led Morning Consult's coverage of politics and elections since 2016, and his work has appeared in The New York Times, The Wall Street Journal, The Washington Post, Politico, Axios, FiveThirtyEight and on Fox News, CNN and MSNBC. Cameron joined Morning Consult from Roll Call, where he was managing editor. He graduated from the University of North Carolina at Chapel Hill. Follow him on Twitter @cameron_easley. Interested in connecting with Cameron to discuss his analysis or for a media engagement or speaking opportunity? Email [email protected].