Middle- and High-Income Consumers Pulled Back on Spending in July

Key Takeaways

Morning Consult’s inflation-adjusted consumer spending metric decreased in July following two months of strong growth. Retail categories remained strong, with Gen Z and millennial consumers driving increased spending in apparel and home furnishing.

Inflation remained relatively stable, with core services continuing to prop up price growth. Consumers are more likely than they were a year ago to walk away from goods and services with higher-than-expected prices.

Home price growth in the South and West limits consumers’ ability to trade down to cheaper alternatives.

Sign up to get our data on the economy, including trends in consumer spending and consumer confidence.

Following two months of strong growth, Morning Consult’s measure of consumer spending declined slightly in July. Total average consumer spending fell by a modest 1.2% month over month after growing 7.1% in June and 6.1% in May. The reduction was driven by middle-income and high-income earners, who pulled back on services purchases after propping up spending in the previous two months.

Annual spending increased for most goods and services

Although consumer spending decreased from the previous month, spending for most goods and services increased compared with last year. Consumers continue to spend more on “fun” categories like recreation, airfare, apparel and home furnishing as spending remains surprisingly resilient for discretionary categories this summer.

What we do that’s different: We survey thousands of U.S. consumers monthly to measure their spending patterns and habits, asking questions on topics including household income, spending, savings, debt, housing payments and more.

Why it matters: Morning Consult’s consumer and spending data provides a detailed assessment of U.S. adults’ self-reported household financial conditions and spending, as well as consumers’ perception of inflation and supply chain disruptions and the impact of both on purchasing decisions.

On the other hand, spending on housing and groceries, the two largest components of spending in the average consumer’s budget, has declined from the previous year. Although inflation for groceries has cooled recently, prices remain elevated, putting strain on households. This is especially true for low-income households, which continue to limit their spending on groceries in Morning Consult’s data after pandemic-era Supplemental Nutrition Assistance Program benefits expired in March.

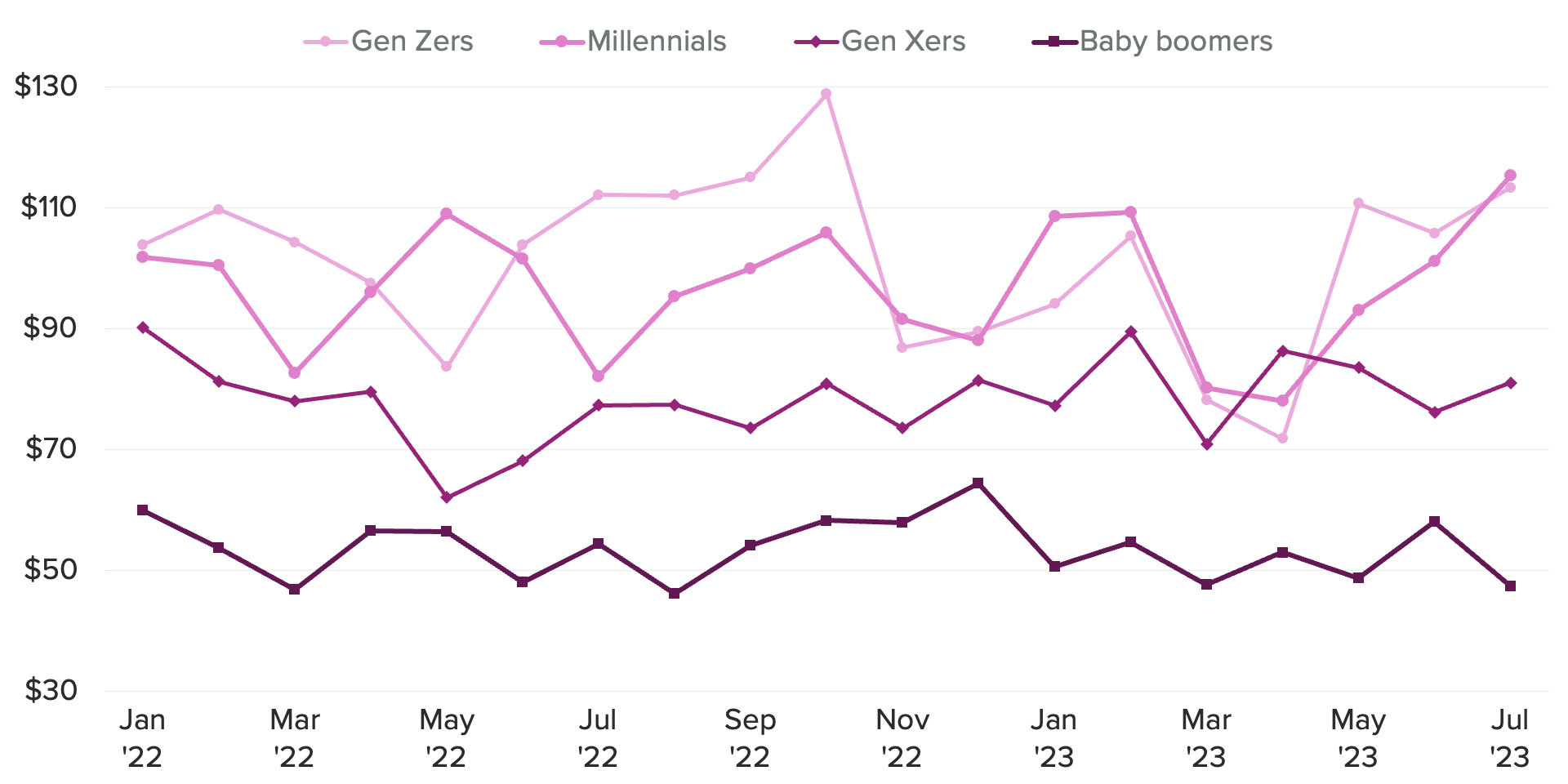

Gen-Z and millennials pull ahead on spending for clothing

Among 20 different categories that make up Morning Consult’s total spending, different dynamics played out. The decline in spending was driven by services categories, while goods purchases increased. In particular, Gen Z and millennial consumers continued to increase their apparel purchases. Baby boomers tend to spend less on clothing and apparel than their younger counterparts, but since March Gen Z and millennial consumers have pulled away from even Gen Xers, increasing their average spending by 45% and 44%, respectively. Increased spending in July could be in part due to Amazon Prime day shopping: Nearly half of all U.S. adults said they shopped during Amazon’s Prime Day (July 11-12), with an even greater share of Gen Zers and millennials participating in the sales.

Generational Divide in Apparel Spending

Monthly inflation in July was relatively steady from June

Annual top-line inflation picked up to 3.3% from 3.0% after 12 consecutive months of declines. Core inflation, which strips out volatile food and energy categories, continued its annual decline to 4.7%, its lowest level since October 2021. Although inflation has come down substantially from its highs last years, the fight against it is not yet over, as both core and top-line inflation are still running hotter than the Fed’s 2% target.

Core goods exerted negative pressure on inflation, driven in large part by prices for used cars, which declined a substantial 1.3% from the previous month. Core services excluding housing, or “supercore services,” increased in July relative to June. Given the Fed’s close monitoring of supercore services, stubbornness in this category could signal that future rate hikes are not out of the question.

Recent home price growth in the South and West limits consumers’ ability to trade down

In the past few years, Southern and Western population centers have been growing faster than the rest of the country, according to the U.S. Census Bureau. The pandemic accelerated trends such as remote work and triggered a spate of early retirements, leading more U.S. consumers to seek more living space and pleasant climates.

The influx of new residents puts additional pressure on supply-constrained housing markets in these areas. Inventory tightness has been exacerbated over the past year as rising interest rates discouraged prospective sellers that had previously locked in comparatively low mortgage payments. New construction, particularly for multifamily residences, is helping to fill this gap in supply — but building new housing units takes time. As a result, housing prices have risen more in the South and West as the market strains to accommodate growing populations.

Higher price growth in recent years has, in turn, reduced consumers’ ability to trade down to more affordable housing options. The South and West had large declines in Substitutability Index scores over the past year, indicating that as prices continue climbing and inventory remains exceedingly tight, consumers have become less able to trade down to more affordable homes.

This memo offers a preview of Morning Consult’s August U.S. Consumer Spending & Inflation Report. Morning Consult Economic Intelligence subscribers can access the full report here.

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]