Higher Debt Burdens Could Be Driving Up Price Sensitivity

Key Takeaways

High living costs and elevated interest rates are contributing to rising debt burdens among U.S. consumers.

Many of the same consumers reporting higher monthly debt-to-income ratios are more likely to walk away from prospective purchases due to sticker shock.

Apparel and telecom services registered the highest price sensitivity scores last month, implying these categories are among the most vulnerable to lost demand due to budgetary pressures.

Consumers’ finances began 2024 on substantially more solid footing than many expected a year ago as inflation moderates and the job market remains resilient. Real incomes eked up 2.1% from a year ago, according to Bureau of Economic Analysis data, and Morning Consult’s index of consumer sentiment has trended higher for the past four months.

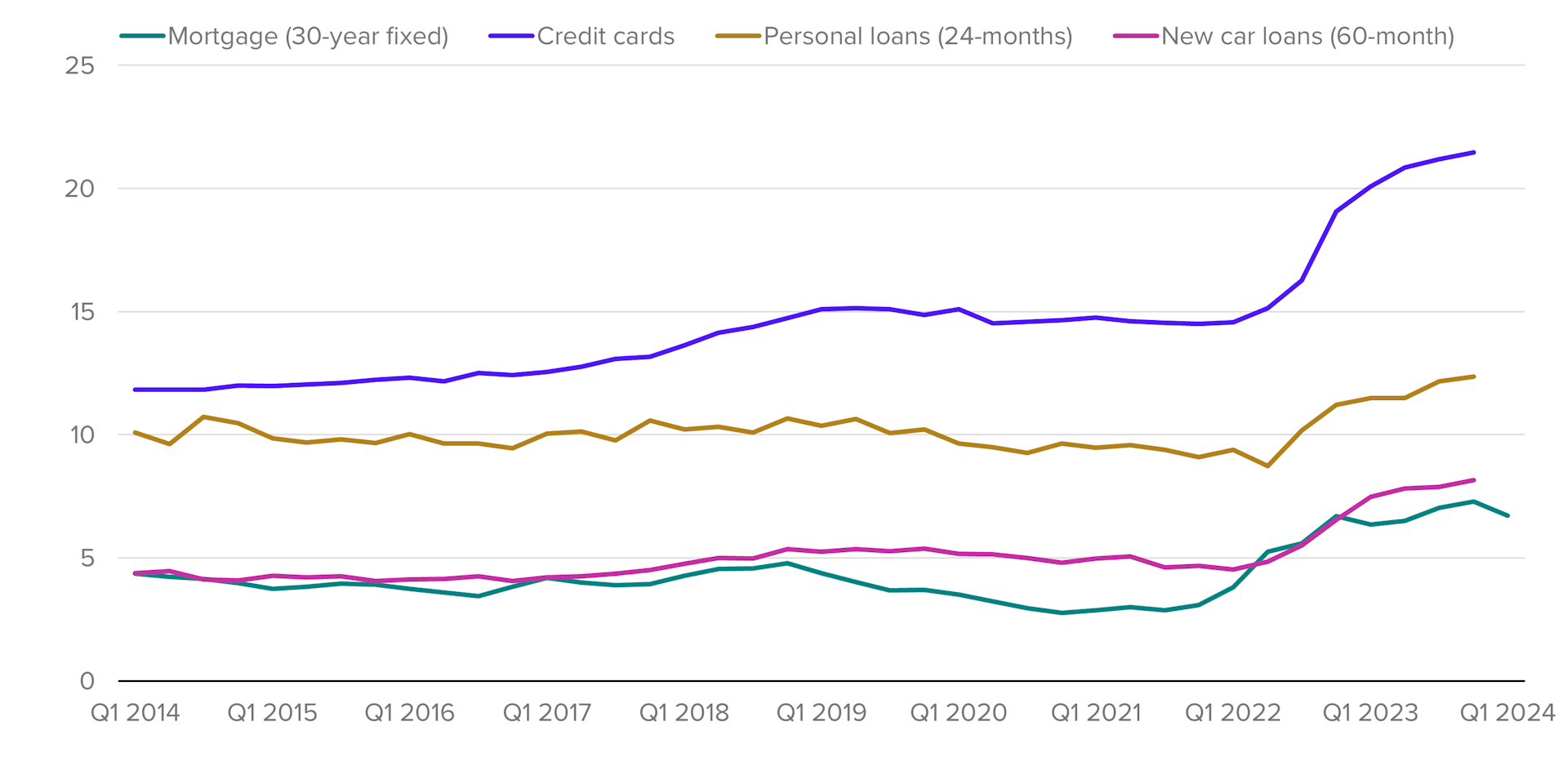

However, as the Federal Reserve’s Federal Open Market Committee (FOMC) mulls over its next move, interest rates remain elevated. Borrowing is significantly more expensive than it was a few years ago, impacting consumers’ ability to afford purchases that are typically financed, like homes and autos, as well as raising the cost of carrying credit card debt. Even as consumers start to feel price relief from cooling inflation, the pinch of rising debt burdens is adding to budgetary pressures, contributing to persistent price sensitivity as consumers forgo purchases due to cost constraints.

Interest Rates Jumped and Have Stayed High

Consumers face a growing debt burden

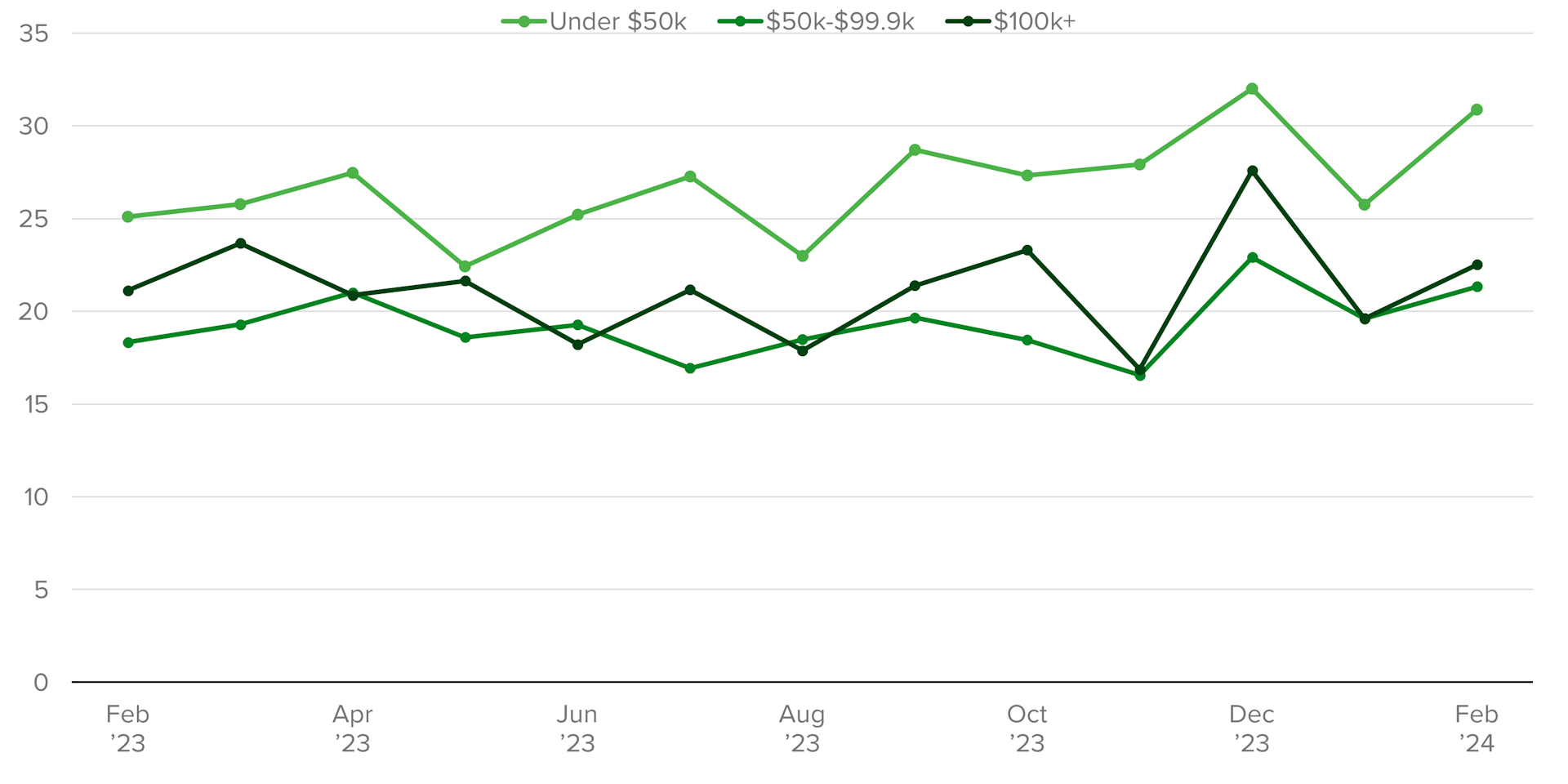

Despite higher interest rates discouraging some consumers from taking on and carrying debt, the high cost of living means some–particularly the most financially vulnerable–have little choice. Many consumers are still adjusting to current price levels after several years of historically high inflation. Morning Consult tracks consumers’ debt burdens through monthly financial obligations ratio, calculating monthly debt flows as a share of monthly income: From February 2023 to February 2024, this measure increased across all income groups, but especially for those from households earning less than $50,000 per year.

Debt Burdens Are Rising, Especially For Lower Earners

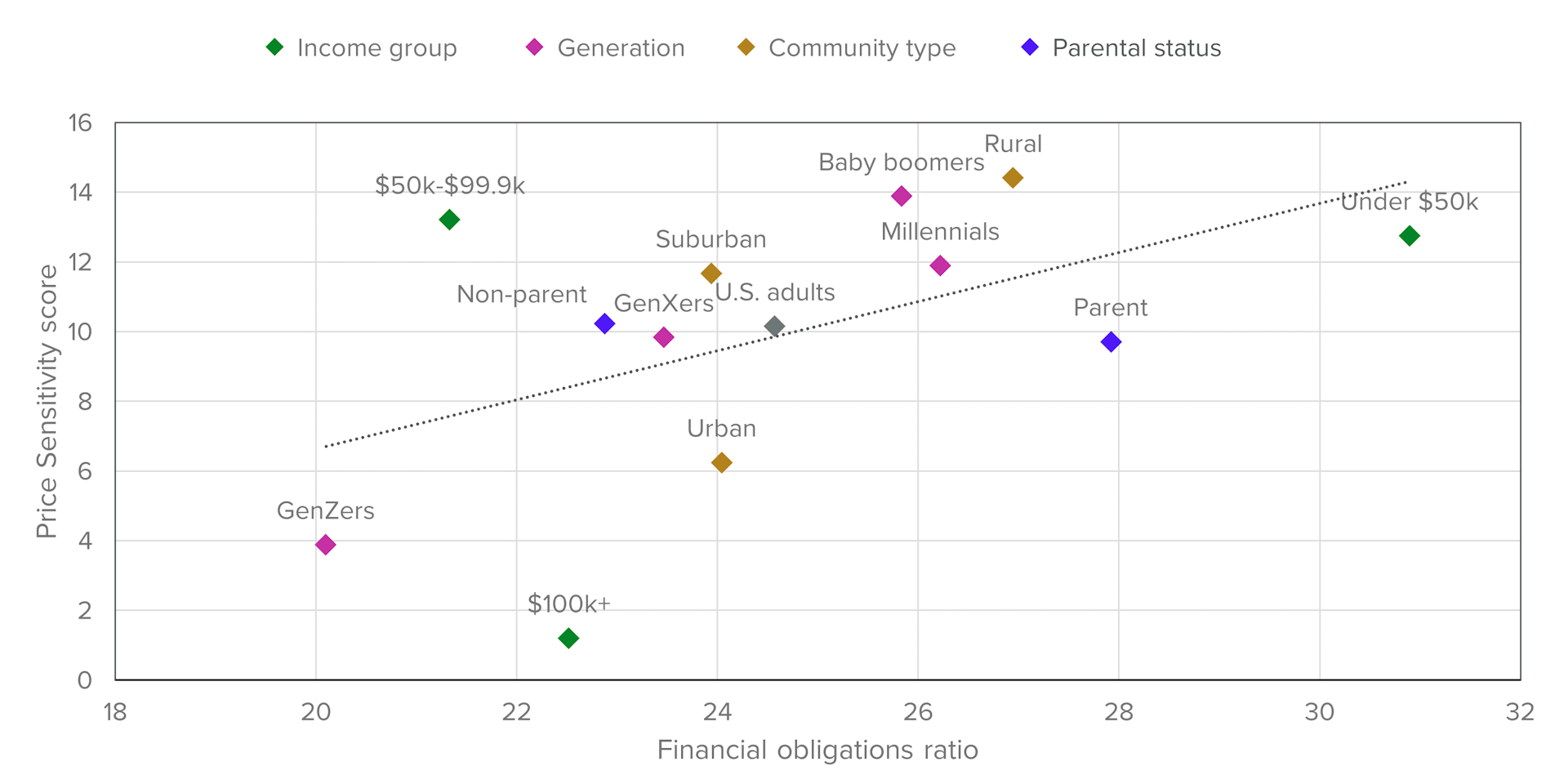

Financial obligations linked to higher price sensitivity

Many of the same groups reporting larger monthly debt burdens are also more likely to be walking away from prospective purchases due to high prices. As of February 2024, lower earning adults, those living in rural areas, baby boomers and Millennials all had relatively high scores for Price Sensitivity, Morning Consult’s proprietary index tracking the prevalence of sticker shock among consumers. These same groups were also among the most debt-burdened, with higher financial obligations ratios than adults overall. This finding suggests that the financial pinch of carrying larger debt burdens could play a role in dampening purchasing demand.

Debt-Squeezed Consumers More Likely to be Struggling With Sticker Shock

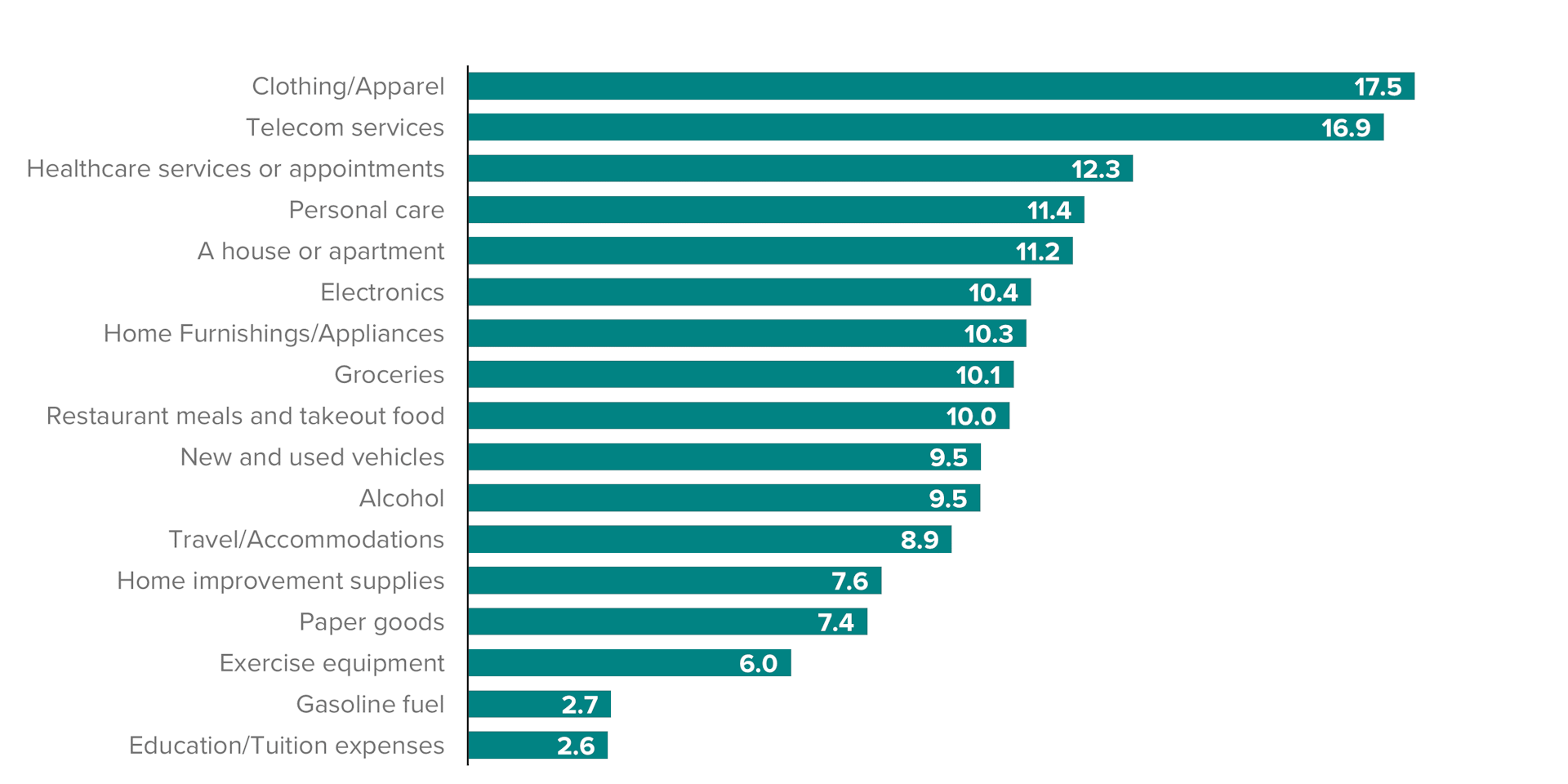

Purchases of apparel and streaming services among the first to be cut from budgets

As budgetary constraints lead some consumers to forgo purchases, certain categories are more vulnerable to being casualties of sticker shock than others. As of February, clothing and apparel had the highest Price Sensitivity score for U.S. adults. While certain clothing purchases, like winter coats for growing children, fall farther toward the household necessity end of the spectrum, many contemplated apparel purchases are more discretionary - and thus more vulnerable to be walked away from when budget-conscious shoppers see a higher-than-hoped-for price tag.

Price-Conscious Consumers Are Forgoing Clothing, Home Entertainment Purchases

Telecom services are facing a similar scenario: internet and cell phone services are more or less essential purchases, but entertainment-related add-ons, like streaming services or TV, tend to be less critical. New purchases within this category are therefore similarly on the chopping block for U.S. adults. Should budgetary pressures escalate further, these categories could be some of the most at risk of seeing diminishing demand.

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]