Frequent Returners Are Unbothered by Rising E-Commerce Return Fees

Key Takeaways

Around one-third (36%) of U.S. consumers have noticed that retailers have been introducing return fees recently, which many brands see as necessary in the face of the rising return rates that come with e-commerce growth.

Positive mail-in return experiences increasingly include reducing friction for the customer, like by eliminating the need for shoppers to repackage items and print mailing labels, but paying for the return maximizes dissatisfaction.

Those who make returns more frequently tend to order multiple items or sizes to try at home, only keeping what works best. They’re also less likely to be put off by return fees, and are essentially willing to pay for the convenience of bringing the store to them.

Sign up to get the latest global brand, media and marketing news and analysis delivered to your inbox every morning.

Returns are a pain point for consumers and retailers alike. What’s often a rather boring logistical morass is popping up as the subject of morning show segments and think pieces due to shifting return policies. To offset costs, retailers and consumer brands are tightening the reins on return policies in myriad ways: shipping charges and restocking fees, making the return window shorter, offering store credit instead of a refund or no longer refunding used merchandise.

Consumers have noticed these changes. When asked how much they’ve seen, read or heard about return policy changes, 36% of U.S. adults said they’ve heard at least something about brands’ introducing return fees (a number that rises to 58% among frequent returners), and 43% have noticed a shift toward store credit.

According to shoppers, these policies are fairly common. Most consumers (59%) said stores they shop from have time limits on returns, and 51% said they shop at stores that offer store credit in lieu of a refund. But just 24% said they shop at stores that charge for returns — a number that’s likely to increase soon.

E-commerce growth has been eroding retailers’ margins, as online purchases have higher return rates than in-store purchases. Still, these recent changes are happening at a time when consumers are more price sensitive than ever because of inflation: In a recent survey, around half (49%) of consumers said they’re avoiding purchases with return fees to try to save money.

Frequent returners buy multiple options and return what doesn’t work

Bad return experiences are a common consumer gripe, so it’s surprising that about half of consumers report never making returns of electronics, home furnishings or beauty and personal care products — but most of these purchases happen in person, and there’s a fairly objective set of evaluation criteria for items in these categories. Apparel, however, is a different story, since fit introduces an enormous amount of complexity to a purchase: Just 30% of consumers said they’ve never returned an apparel purchase.

In particular, retailers should note the behaviors of frequent returners, defined as those who make a return at least once every three months — they’re an expensive cohort for retailers to serve when so many of their purchases are sent back. They comprise about 29% of the U.S. population, and they make apparel and beauty or personal care returns most frequently. Millennials, men, urban dwellers and high-income individuals are all more likely to fit the frequent returner profile.

Men, Millennials, High-Income Consumers and Urban Dwellers Return Products More Frequently

Frequent returners often make returns for different reasons than the average consumer. The general public was most likely to say they make returns because the product didn’t fit or otherwise work the way they’d hoped, or that the item they received was defective. Just 10% said they buy multiple options to try at home and return whatever doesn’t work, compared with 20% of high-frequency returners.

This habit has grown out of the challenge of evaluating products online and has been enabled by free shipping and return policies. If retailers want to reduce this expensive and inefficient shopping behavior, introducing return fees is one effective stick. But it should be paired with a carrot: offering shoppers more robust tools to evaluate products online to build confidence that they’ll get the order right the first time. That could take the form of improving product detail page descriptions and imagery, augmented reality try-ons that actually work or thorough reviews from verified users.

Most shoppers pay nothing for their e-commerce returns, but repeat returners are surprisingly OK with fees

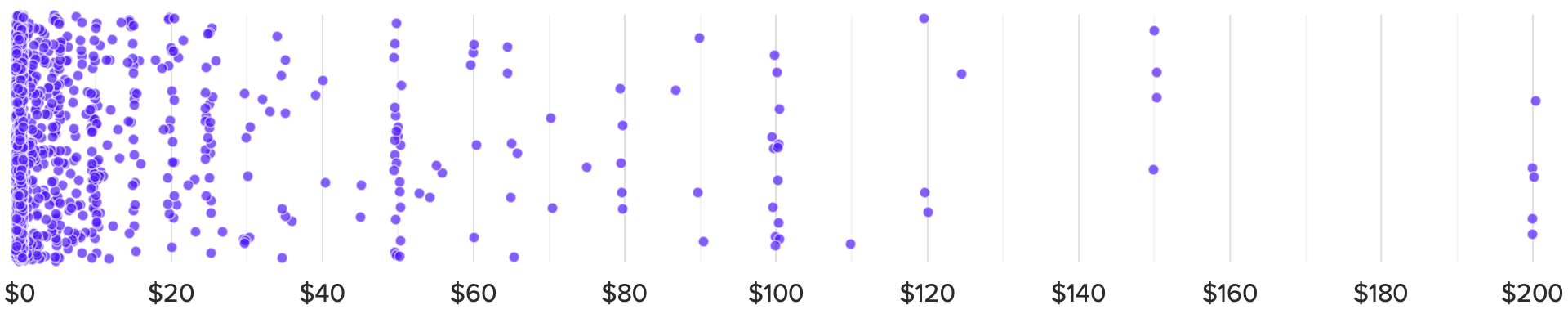

When asked how much they paid for their most recent return, 60% of shoppers said $0; for those who did pay, the median fee was $9.99.

Frequent returners, on the other hand, were less likely to report that their last return was free (just 39% said they did not pay), indicating that people who order and return as a means of creating a fitting room at home are willing to pay for the service. In fact, when asked about the impact of shipping and restocking fees on their satisfaction with the return experience, frequent returners were much less likely to report dissatisfaction: 57% of all respondents said paying would be unsatisfactory, but just 36% of frequent returners shared that sentiment.

Most E-Commerce Returns Are Still Free

Return fees are a conundrum. It makes sense for retailers to eat the cost of return logistics when free returns reduce risk for consumers and encourage them to try products they might not otherwise order. But as e-commerce takes up a larger share of sales, increasing the rate of costly mail-in returns, the free return equation no longer tips the scales in favor of the retailer.

For brands introducing return fees, there are ways to soften the blow. In a recent shipping study conducted by Morning Consult, we found that while cost is paramount in consumers’ decisions, brands can make paid shipping more palatable by increasing the speed of the shipment or offering rewards points. We can extrapolate that return considerations would be similar — if brands are asking shoppers to pay a return fee, they should consider crediting shopper accounts more quickly or offering a sufficient rewards program benefit.

Maintaining customer satisfaction while raising return fees

Mail-in returns are the real culprit driving up costs for e-commerce brands, and 35% of returners reported using that option in the last month. The good news is that the rate of mail-in returns has stayed fairly steady since we began tracking this behavior in 2021. Most returners (65%) bring products into stores when making a return, the most cost-effective solution for retailers. Half as many returners (32%) are making returns at third-party drop-off points (e.g., returning an Amazon order at Kohl’s), though these options tend to have higher consumer satisfaction.

Examining the options brands are experimenting with to rein in return costs, introducing fees is by far the most unpopular. Offering store credit rather than a refund is far behind, nearly tied with waiting four weeks for a refund. Strict time limits, such as requiring a return to be completed within 30 days, are more acceptable for most. Frequent returners just don’t find any part of the returns process as painful as the general population does, so for retailers, being less generous with return policies unfortunately might have the least impact on the most frequent returners.

Of All Return Requirements, Fees Introduce the Most Pain

When asked to describe the best experience they’ve had returning an online order, more than 100 people mentioned Amazon’s return service via Whole Foods, The UPS Store and Kohl’s, where shoppers typically can make a return without repackaging the item and printing a label.

Respondents’ return horror stories often include items lost en route back to the warehouse or challenging customer service experiences. For less expensive items, particularly if the item can’t be resold or the cost of the return can’t be recouped, some retailers will just credit the customer for the cost and let them keep the item to avoid the pain of return logistics and lengthy customer service interactions while maintaining positive customer sentiment.

Related content

The Subscription Divide: Millennials Love Them. Baby Boomers Are Dubious

Retailers Need to Rebuild Consumer Trust and Bring Fun Back to Stores as Inflation Persists