Economic Concerns Are Softening the Blended Travel Boom

Travel companies bemoaning the end of business travel had shifted some focus to blended business-and-leisure occasions to fill the gaps. But consumers’ early interest in blended travel has waned as economic worries have deterred potential travelers and their employers alike.

As Americans settled in to pandemic-driven hybrid working models, many sought to blend business travel with leisure travel as a way to make trips more accessible, enjoyable or affordable. But since the spring, it appears that the challenging reality of combining work with play, exacerbated by growing economic concerns, has sunk in for many of these travelers.

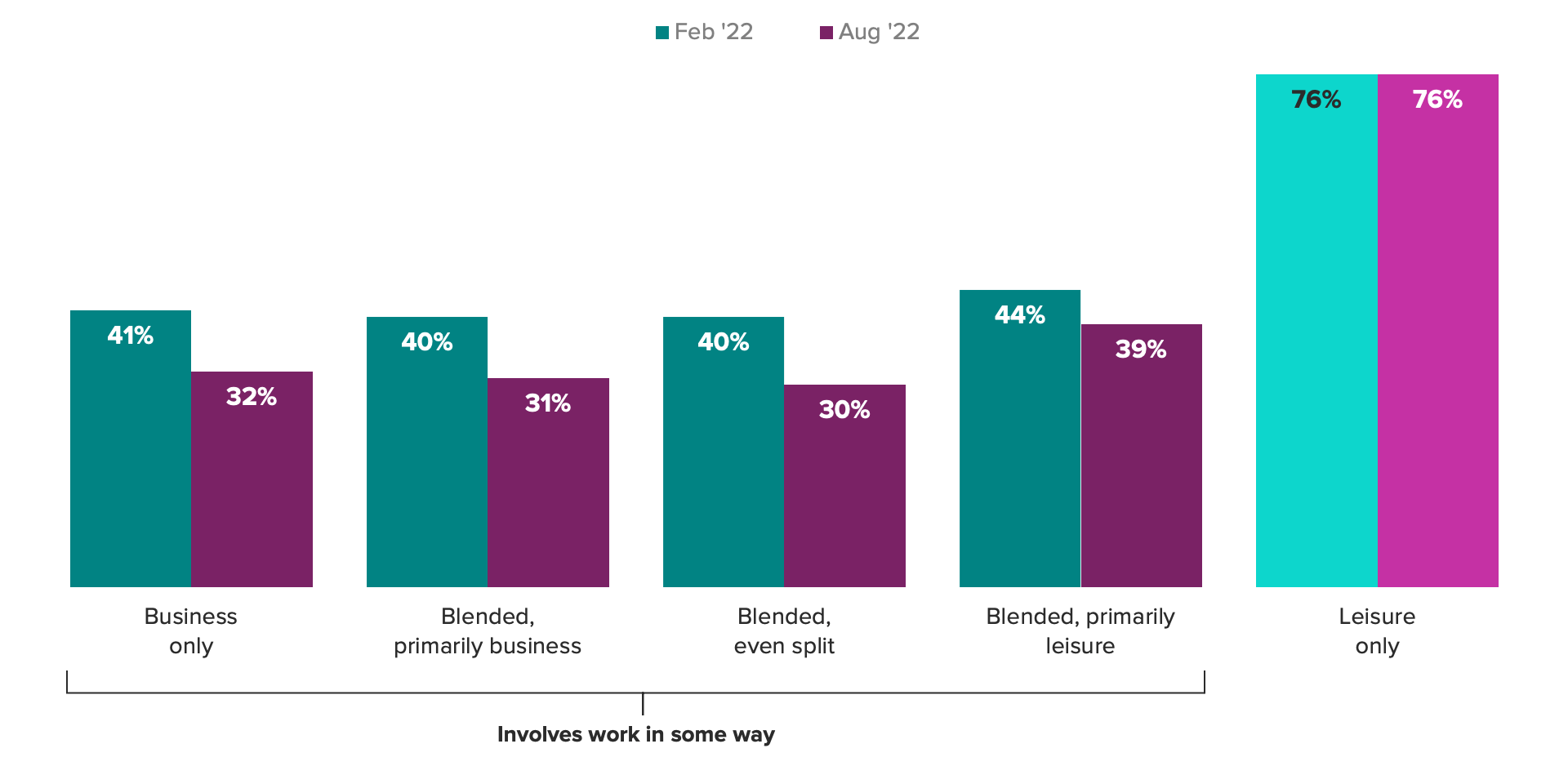

The share of adults saying they’d take a trip that involves work in some way dropped several percentage points across all occasions between February and August, while the share saying they’d travel just for leisure stayed the same.

The best predictor of whether someone plans to engage in blended travel now is their pre-pandemic behavior. More than half of those who took “bleisure” trips before COVID-19 shutdowns say they’ll take a trip that equally combines business and leisure in the next year, compared with just 5% of those who didn’t take bleisure trips before the pandemic. This suggests that, contrary to expectations, the category has not seen an influx of new entrants — at least, not yet.

To best capitalize on the blended market, travel companies should focus on targeting previous blended travelers to re-engage them, and defer efforts to bring in new blended travelers until economic concerns recede.

Touting cost savings likely won’t bolster blended travel plans

When travel occasions are combined, it can be difficult to identify the primary decision-maker. But likely due to the skew toward the leisure side of blended travel, workers report covering more costs out of pocket, as opposed to these expenses being paid by their employers.

This behavior is particularly true when it comes to meals and entertainment. More than half of blended travelers report being primarily or solely responsible for funding these categories. Accommodation costs, meanwhile, are the most likely to be fully covered by the employer.

With economic concerns dampening leisure travel expectations, it may seem like a sound strategy to emphasize the potential cost savings of combining leisure with business travel to attract more customers. But when travelers choose to take a blended trip, savings isn’t their primary motivator.

Just over 1 in 5 travelers with blended plans cite the ability to save on costs as a reason to combine business and leisure trips. But even more important to these travelers are experiences and enjoyment. Around a quarter of travelers with blended plans (26%) say they are motivated to combine their business and leisure trips if doing so would make their trip more enjoyable or if it would give them a chance to travel to places they otherwise wouldn’t. Connecting with friends and family who live far away is also more important to these travelers than savings. Nearly 1 in 4 travelers with blended plans say the ability to visit friends or family who live far away more often or for longer periods would encourage them to combine business and leisure trips.

For brands, this means there’s an opportunity to tap in to a wide variety of messaging approaches and highlight the various benefits of blended travel without alienating those who aren’t driven by savings alone.

Businesses continue to rein in travel spending

There is one final and crucial hurdle to blended travel, however: employer budgets. Even if employees have the interest and the personal finances to engage in blended travel, many are still stymied by a lack of opportunities to do so due to extended travel budget reductions at their companies. While COVID-19 restrictions have eased and many companies have reopened their offices, they haven’t returned to a pre-pandemic approach to travel. In July, a J.D. Power study found that half of executives said their companies still had business travel restrictions in place, including fewer trips overall and fewer employees sent on each trip. These restrictions will likely remain in place through the remainder of the year and possibly longer as companies guard against a potential economic downturn.

For travel companies hoping to attract bookings for conferences, airfare and accommodation, that means competition is fierce. For this reason, it’s more crucial than ever to identify the most durable business travel occasions and get in front of key decision-makers.

For more insights on business travel, download Morning Consult’s semiannual report The State of Travel & Hospitality, which tracks evolving consumer trends in the travel & hospitality sector and analyzes what they mean for the future of the industry.

Lindsey Roeschke is an analyst whose work focuses on behavior and expectations of consumers in the travel & hospitality and food & beverage categories, particularly through a generational and cultural lens. Prior to joining Morning Consult, she served as a director of consumer and culture analysis at Gartner. In addition to her research and advisory background, Lindsey has more than a decade of experience in the advertising world. She has lived and worked in seven cities across four continents.