The Financial Goals of Underbanked and Unbanked Americans

This analyst note is part of a new series exploring unbanked and underbanked Americans, two groups that are difficult to identify but have been at the forefront of financial services leaders’ minds as they seek to better serve consumers and compete with fintechs. Read the other stories in the series, including how the two groups' demographic profiles differ and why these populations aren’t banked.

Key Takeaways

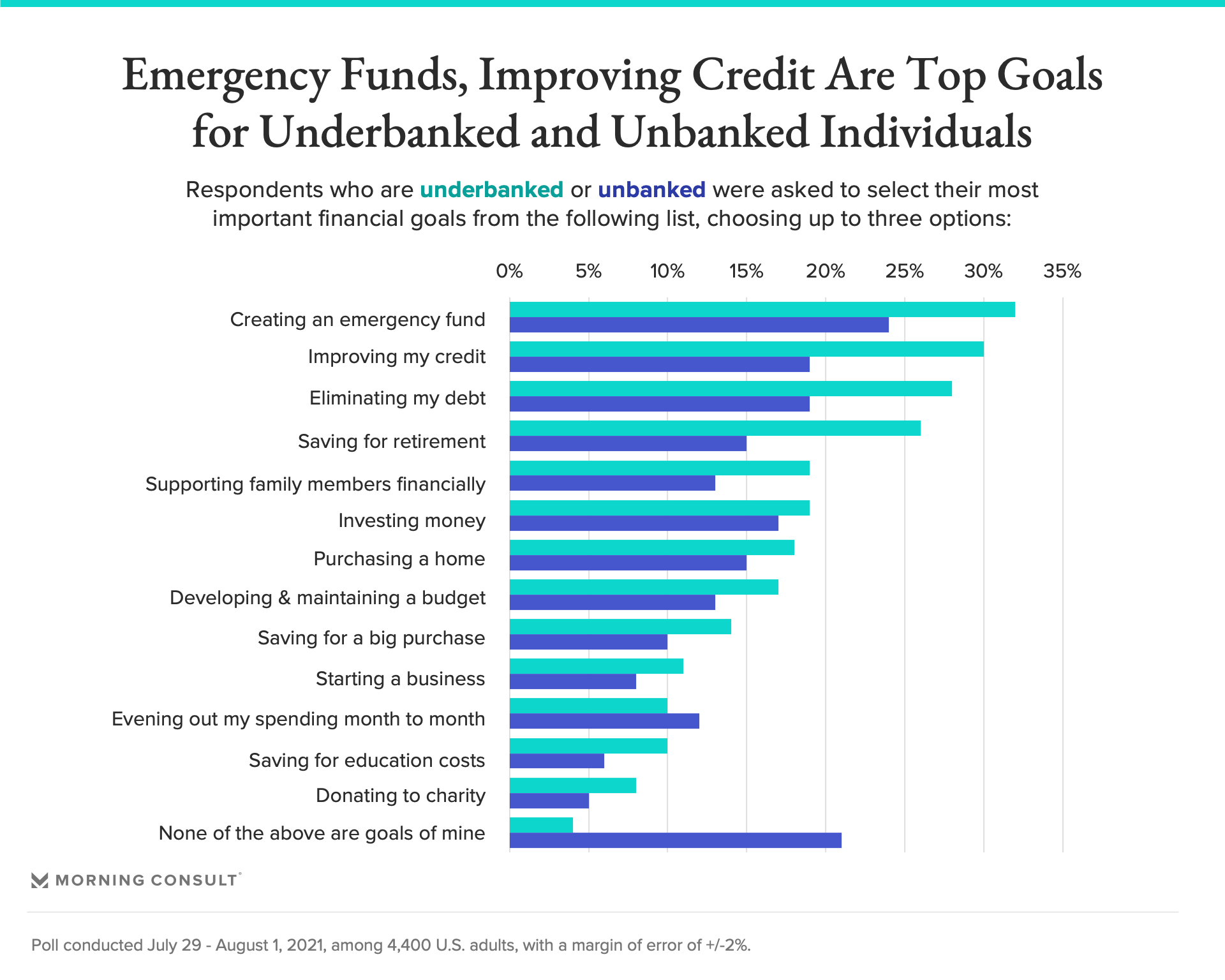

A plurality of both unbanked and underbanked adults cite creating an emergency fund as an important financial goal to them.

One in 5 unbanked adults, when presented with a list of financial goals, said none were important to them.

Underbanked and unbanked individuals are often studied together, but new analysis shows just how distinct the groups’ financial goals and usage of alternative financial services are — important information for financial services leaders seeking to serve these communities.

Although creating an emergency fund was the top financial goal for individuals in both groups, underbanked adults are more likely in general to have financial goals than unbanked adults -- and to actively be working towards those goals. Twenty-one percent of unbanked adults said they’re not aiming to accomplish any of the 13 financial objectives listed in the survey, compared to 4 percent of underbanked adults.

What’s driving this: Many unbanked adults report feeling disenfranchised (only 38% of unbanked adults believe banks are interested in having them as a customer) or are less involved in decision making (roughly 3 in 4 unbanked adults say they participate a lot or some in their household’s financial decisions, compared to 96 percent of underbanked adults that say the same).

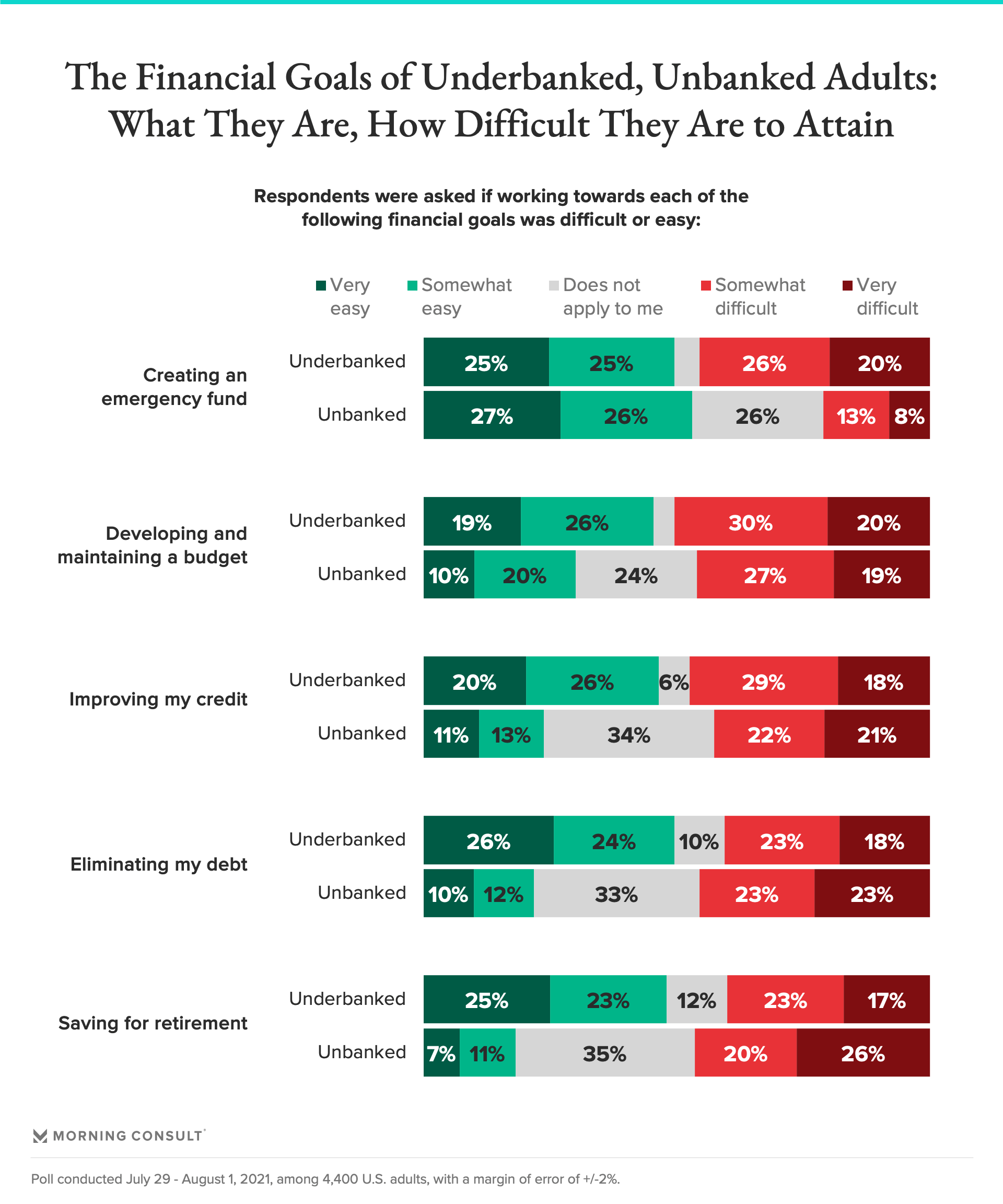

Both groups, however, report struggling with the goals that are important to them, such as creating an emergency fund, developing a budget, improving their credit and eliminating debt.

Income volatility is likely preventing members of both groups from planning ahead. Underbanked and unbanked adults are about equally as likely to say their household’s income fluctuates a lot or some from month to month: 59 percent for underbanked individuals and 55 percent for unbanked individuals.

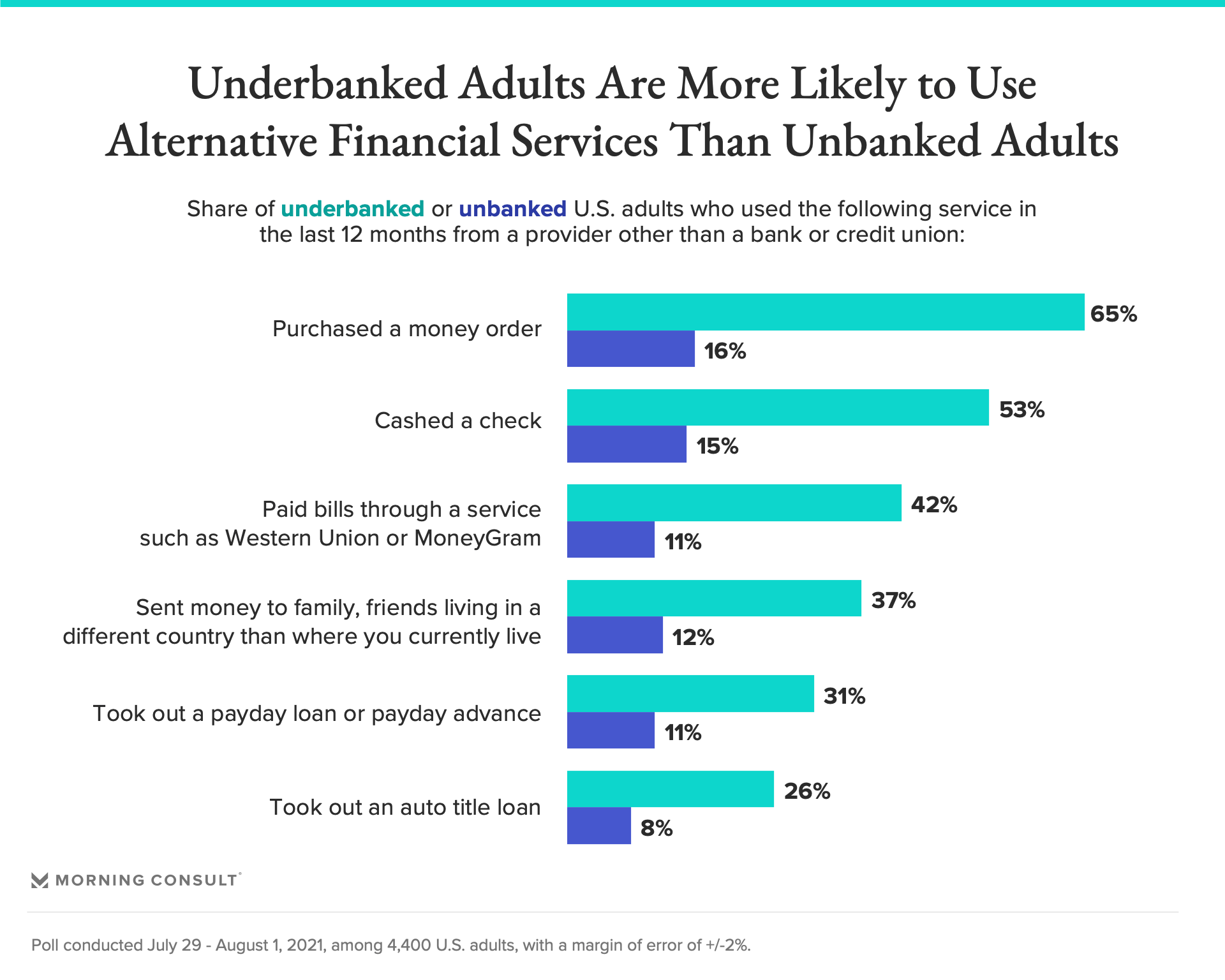

However, underbanked adults are more likely to use alternative financial services to attempt to manage their finances and achieve goals. Roughly two-thirds of underbanked adults report purchasing a money order in the past 12 months, and just over half (53 percent) report cashing a check using a provider other than a bank or credit union, compared to 16 percent and 15 percent, respectively, for unbanked adults.

This openness to using financial services in general is another reason why underbanked adults represent the stronger opportunity for fintechs and banks to serve them.

Charlotte Principato previously worked at Morning Consult as a lead financial services analyst covering trends in the industry.