How the Roughly One-Quarter of Underbanked U.S. Adults Differ From Fully Banked Individuals

This analyst note is part of a new series exploring unbanked and underbanked Americans, two groups that are difficult to identify but have been at the forefront of financial services leaders’ minds as they seek to better serve consumers and compete with fintechs. Read the other stories in the series, including the reasons why these populations aren’t banked and their financial goals.

Key Takeaways

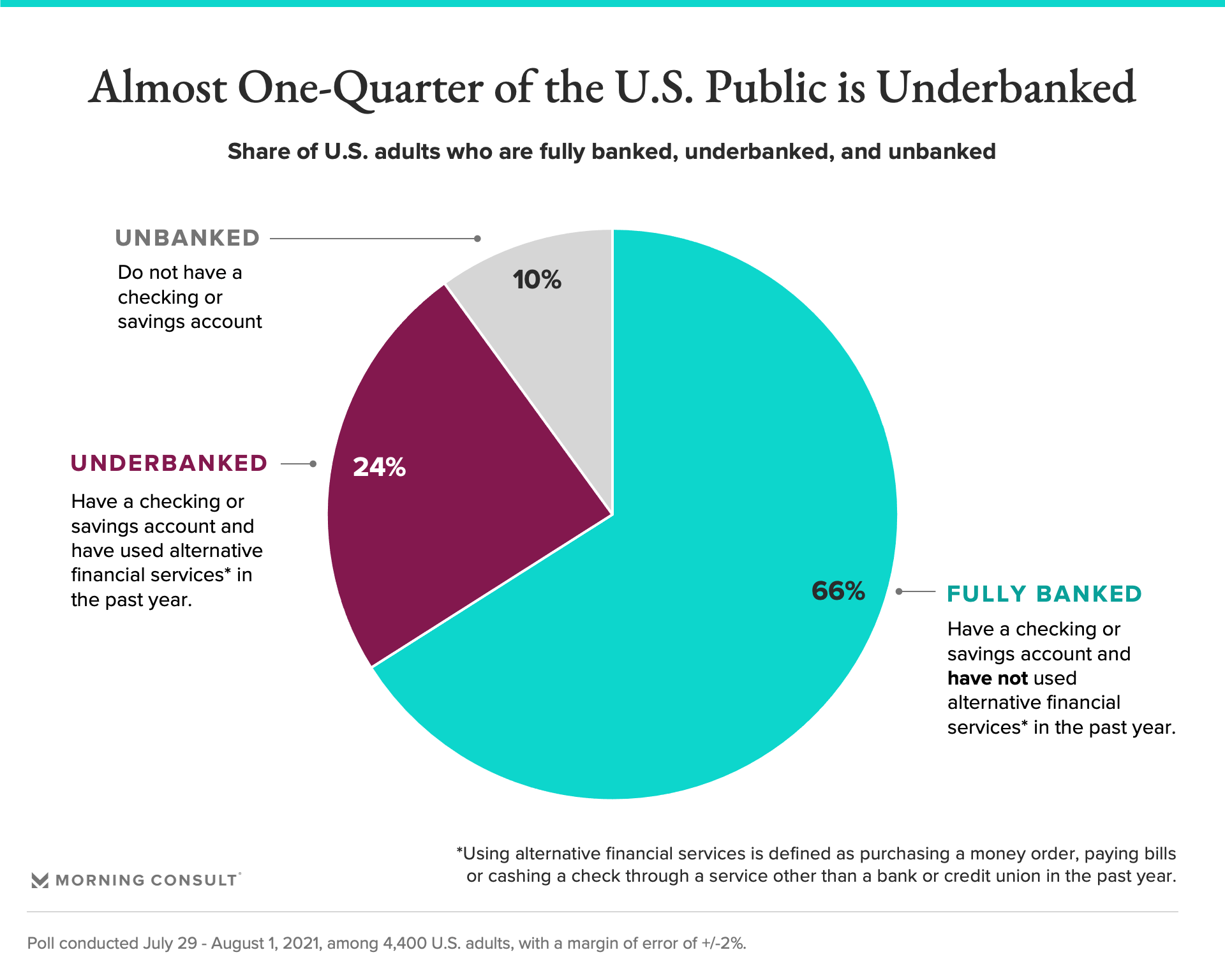

One in 10 adults says they do not have a checking or savings account.

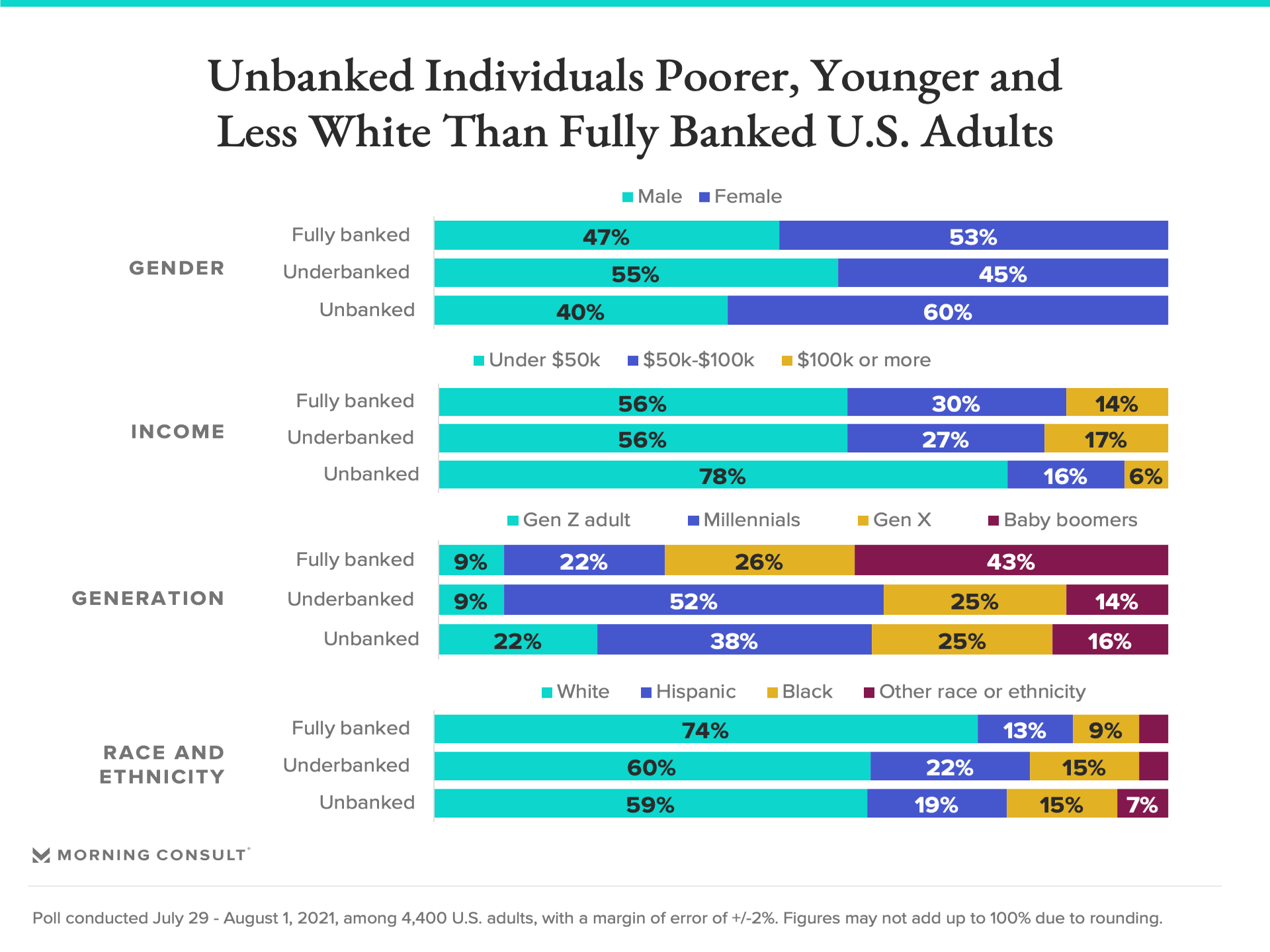

Underbanked consumers are more likely to be men, while unbanked consumers are more likely to be women.

Ten percent of U.S. adults are unbanked and roughly one-quarter are underbanked, according to recent Morning Consult analysis aimed at exploring how these two often-overlooked groups differ from those who are “fully banked.”

The results highlight how many banks and credit unions have fallen short in serving the needs of their customers, as the coronavirus pandemic continues to deepen the country’s income inequality.

Unbanked adults are defined as those without a checking or savings account. Of those, half report that someone in their household does have a checking or savings account, and half --- or 5 percent of all U.S. adults -- report that no one in their household has either a checking or savings account.

Another important, but harder to define, group is underbanked individuals. These are individuals who have a checking or savings account but who also report accessing alternative financial services outside of a bank or credit union. Specifically, underbanked individuals in Morning Consult’s survey were defined as having done at least 1 of 3 activities with a provider other than a bank or credit union in the past year: purchased a money order, paid bills or cashed a check.

Compared to fully banked consumers, or those who have a checking or savings account and have not done any of the three activities listed above with a provider other than a bank, unbanked and underbanked adults are younger, poorer and less likely to identify as white. One notable difference between unbanked and underbanked consumers, however, is gender: Underbanked adults are more likely to be male, while unbanked adults are more likely to be female. Women are less likely than men to say that they participate “a lot” in the financial decisions of their household, and are more likely to cite someone else in their household having a bank account as a reason for their not having one, suggesting that they are not the primary financial decision maker in their household and use the bank account of whomever lives with them.

As banks create financial inclusion initiatives for the unbanked and work to better serve their underbanked customers, they will need to understand not only who these consumers are demographically, but also their financial goals and how they are currently working towards them, to best create solutions that best meet their needs.

Charlotte Principato previously worked at Morning Consult as a lead financial services analyst covering trends in the industry.