Gen Z, Millennial Travelers Seek Rewards Programs, but Vacation Rentals Aren’t Delivering

Key Takeaways

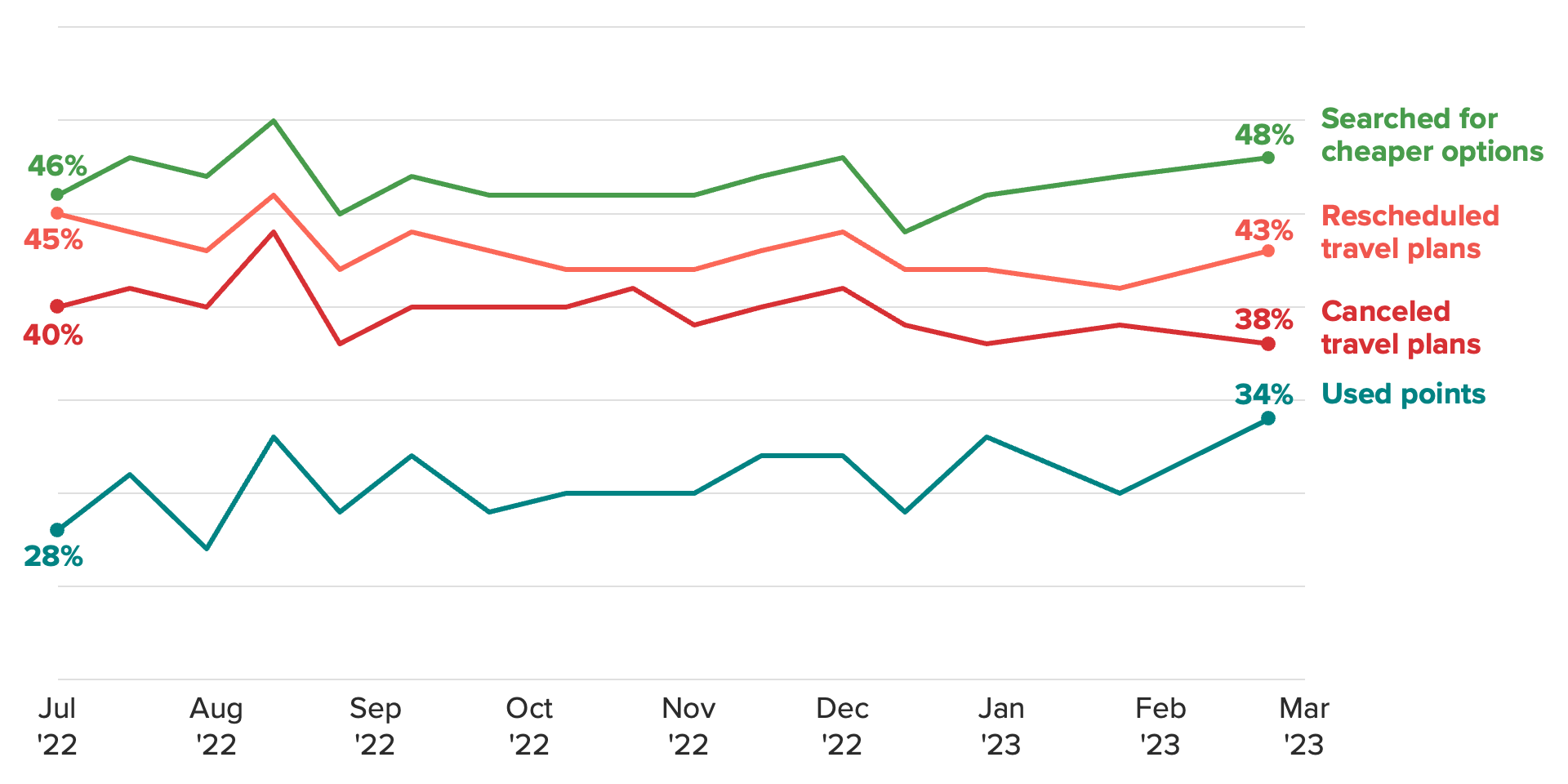

- 34% of U.S. adults said they used points or rewards on travel purchases to save money, a 6 percentage point increase since last summer.

- Gen Z adults and millennials are more likely than older generations to book with points and rewards, and they also overindex in booking vacation rentals.

- As financial worries persist, short-term vacation rentals may lose these key customers to traditional hotels with strong loyalty programs.

For more insights on leisure travel, download Morning Consult’s semiannual report The State of Travel & Hospitality, which tracks evolving consumer trends in the travel & hospitality sector and analyzes what they mean for the future of the industry.

Summer is vacation rental season, but when travelers book their beach houses this year, the inability to use points to cover their reservations may make them think twice. With economic concerns looming, more travelers are using points and rewards to cover bookings, especially Gen Z adults and millennials, both crucial demographics for short-term rental brands. As a result, these travelers may shift their business to accommodations where they can leverage alternatives to cash and credit payments — in other words, traditional hotels with loyalty programs.

Travel loyalty programs were initially created to attract and retain the business of the highest-spending travelers. But a lot has changed in the years since, including the recent pandemic-driven downturn in business travel and the resultant shrinking volume of the group those loyalty programs initially served. As financial concerns loom in an uncertain economy, loyalty points and rewards should now be thought of less as a mechanism to reward high spenders and more as a tool to keep cash-concerned travelers on the road. Vacation rental companies without loyalty programs are at risk of losing customers as financial worries persist.

Millennial and Gen Z travelers are more likely to utilize points and rewards to save money

Economic concerns are casting a cloud over travelers’ plans, but after multiple years of travel restrictions and regulations, people don’t want high prices to be yet another barrier keeping them at home. As a result, travelers are more likely to reschedule or search for cheaper options than cancel their trips entirely to help save money.

While not yet surpassing cancellations, another behavior is on the rise: utilizing points. The most notable shift over the past eight months is among those who are leveraging points or rewards to book travel. Over a third of U.S. adults (34%) said they used points to save money on an upcoming trip, a 6 percentage point increase since last summer. This is especially true for Gen Z adults and millennials, who are 2 and 8 points, respectively, more likely than the general population to take this approach.

Younger generations are also more likely to be active users of travel rewards credit cards. Gen Z and millennial cardholders say they plan to book travel using rewards at a higher rate than older generations, with nearly 2 in 5 millennials saying they plan to do so within the next three months.

This behavior aligns with generational truths: Millennials and Gen Z adults value and prioritize travel, but they have also experienced significant financial hardships and are less likely to have as much savings and disposable income as older generations, driving them to look for alternative approaches to financing their trips.

Simply put, points and rewards are tools that can keep younger generations traveling.

Vacation rental brands are missing an opportunity with millennial and Gen Z points users

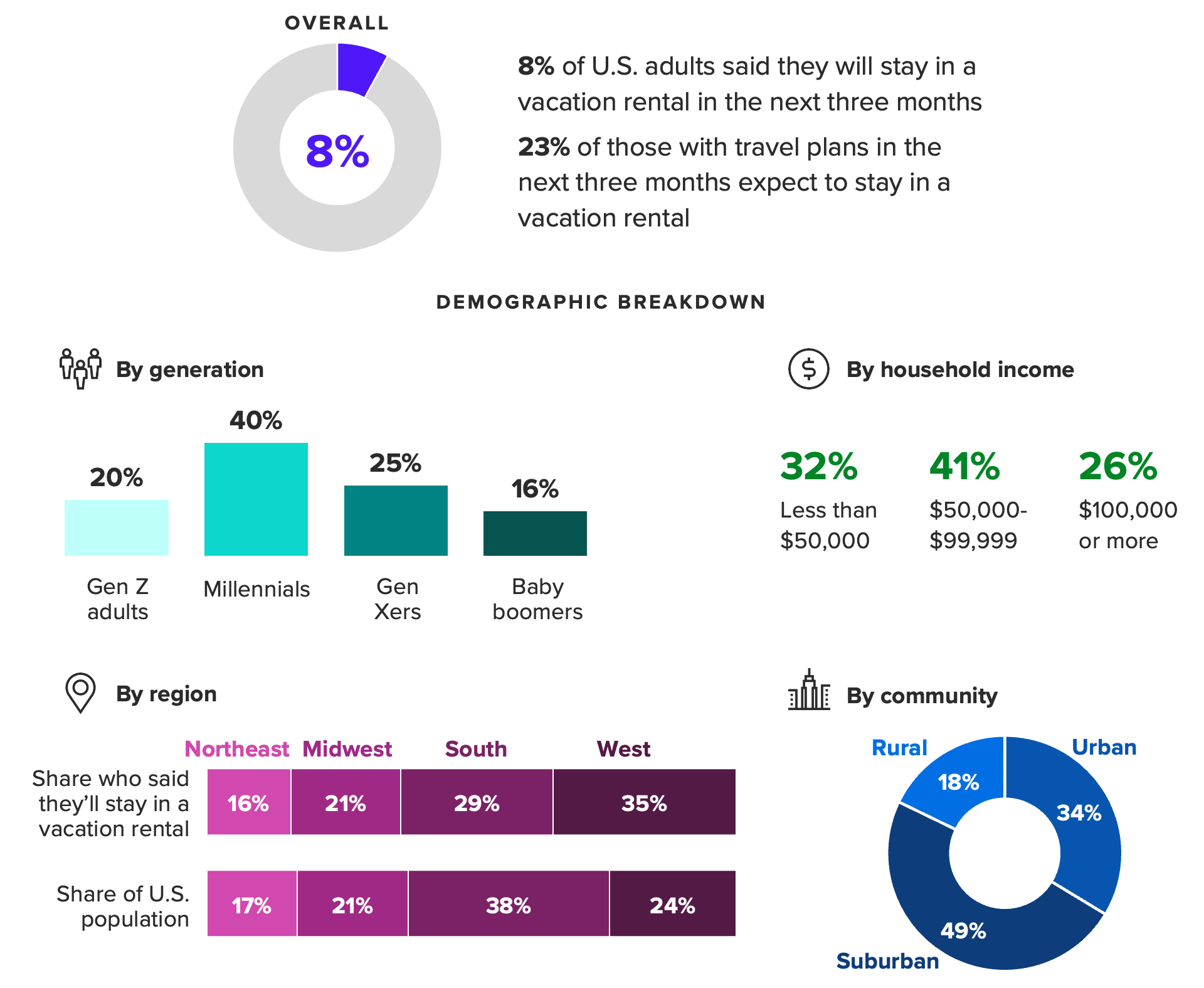

The demographic profile of points and rewards users aligns closely with that of travelers who use vacation rentals. Three in 5 of those who say they plan to stay in a short-term rental in the next three months are Gen Z adults or millennials. In comparison, these generations account for around 2 in 5 of those who intend to stay at a chain hotel.

Summer is a crucial time for vacation rental companies, and summer 2023 will see even higher shares of travelers staying in such properties. Compared with this time last year, the share of adults with travel plans in the next three months who intend to rent a house or apartment is up 4 points.

But while vacation rental brands are doing well among these younger demographics, they’re also leaving business on the table. The inability to leverage reward program earnings to cover a stay threatens to drive would-be short-term rental users to hotels, where they can avoid paying out of pocket for accommodation. Economic worries show no signs of abating, and while the summer months are driving bookings, a slower shoulder season looms if consumers shift their business to brands that allow them to leverage points.

Vrbo’s loyalty program can capture travelers who want to earn and spend points on vacation rentals

The two major players in the vacation rental space are taking very different approaches to this challenge. The imminent launch of Expedia Group’s One Key rewards program will allow travelers to earn and spend points on bookings with Vrbo as well as Expedia and Hotels.com, a move that will be attractive to travelers who are considering vacation rentals. Airbnb, on the other hand, introduced alternative payment methods including buy now, pay later and bank payments with its most recent platform update, but it appears to have no plans to enter the loyalty game. Savvy travelers may circumvent this by utilizing travel rewards credit cards for booking, but the lack of a brand-specific program leaves travelers’ long-term loyalty up for grabs.

Beyond the big two short-term rental brands, all companies in the travel industry must pay attention to consumers’ attitudes toward points and rewards. Brands with a strong presence in the space should leverage their programs to woo cost-conscious travelers, especially in the face of ongoing economic instability.

Lindsey Roeschke is an analyst whose work focuses on behavior and expectations of consumers in the travel & hospitality and food & beverage categories, particularly through a generational and cultural lens. Prior to joining Morning Consult, she served as a director of consumer and culture analysis at Gartner. In addition to her research and advisory background, Lindsey has more than a decade of experience in the advertising world. She has lived and worked in seven cities across four continents.