Gen Z Shopping Habits: Why They Love New Brands

Key Takeaways

Gen Zers are more open to trying new brands than most adults: 77% of Gen Z adults say they make an effort to try new brands, the highest share of any generation.

This lack of loyalty is a double-edged sword: It means they are easier to acquire as new customers, but brands must work to retain Gen Z shoppers.

Gen Z spends a lot of time and money on new purchases, giving brands ample opportunity to capture their attention and earn the power of their influence across other generations.

For more insights on Gen Z — about their social media preferences, favorite celebrities and more — read our recent coverage of this trend-setting generation.

Gen Zers: They’re fascinating but confounding, influential yet fickle. It’s no wonder consumer brands are trying to understand them and earn their attention. Gen Z adults are hard to win over, but trying to do so is worth the effort: Morning Consult’s Fastest Growing Brands research shows that brands break through with Gen Z first, then trickle up to older generations. So capturing young adults’ attention yields returns not just in the near term, but also down the road as they influence the zeitgeist.

For retailers, the important thing to note is that Gen Z shops differently than older generations. They’re more open to new brands, they’re high-frequency shoppers and they spend extra time considering their purchases. These habits present opportunities for consumer brands to win the cohort’s attention and, hopefully, their loyalty.

Gen Zers are open to trying new brands — except in personal electronics

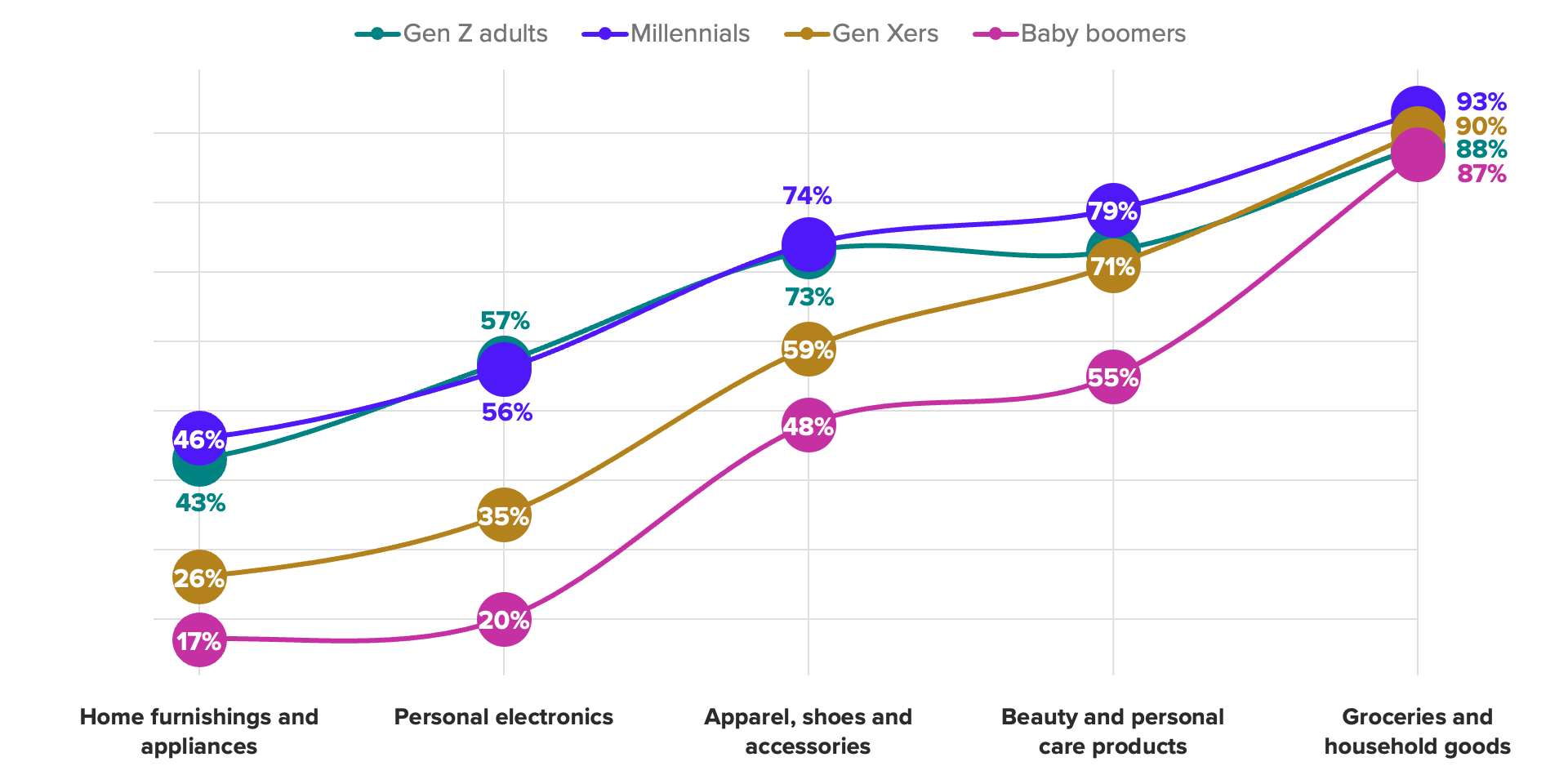

More than three-quarters of Gen Z adults (77%) are open to trying new brands, particularly when purchasing groceries, apparel (among Gen Z women in particular), or beauty and personal care products. The biggest difference in interest between Gen Z shoppers and the general population is in beauty and personal care: 36% of Gen Z adults said they tried a new brand in that category, compared with 28% of U.S. adults.

Gen Z’s openness to new brands is great news for almost every category — except one. For personal electronics, Gen Z’s brand loyalty is firm, and particularly so with Apple. According to data from Morning Consult Brand Intelligence, Gen Z’s preferences for phones and computers point clearly to Apple products: iPhone favorability among Gen Z is 71%, versus 59% for the general population, with near-inverse numbers for Samsung at 63% and 74%, respectively. Gen Z also lags behind Gen Xers and millennials in terms of openness to new brands in home furnishings and appliances, but this shouldn’t be too concerning since members of the youngest cohort haven’t aged into the core consumer group for this sector yet.

Openness to new brands is driven in part by inflationary pressure over the last year, particularly in the grocery category, as consumers sought out less expensive replacements for their preferred brands, but Gen Z remains the most consistently open to novelty of all generations. Youth culture is fickle and trend-driven, so the ability to cement Gen Z’s brand loyalty with young shoppers is rare, but still a worthy goal given their influence on older consumers.

Gen Zers are high-volume shoppers, spending $104.50 per month on apparel in the last year

Gen Zers, as well as millennials, are more likely than Gen Xers and baby boomers to say they’ve made at least one purchase from the apparel, personal electronics, and home furnishings and appliances categories in the last month.

With apparel in particular, Gen Z adults report spending more than other generations do, with an average monthly spend of $104.50 over the last 12 months (versus $77.15 for all respondents). Fashion consumption is a big part of youth culture — a confounding fact for a generation known for prioritizing sustainability. At the same time, we know that Gen Zers are less concerned about fast fashion’s environmental impact than older adults are.

While Gen Z women are more open to new apparel, footwear and accessories brands than their male counterparts, both genders are equally likely to be monthly purchasers in these categories. Gen Z men, on the other hand, buy personal electronics more frequently than Gen Z women do.

Despite just being at the start of their careers, Gen Zers outpace millennials and Gen Xers in financial well-being. They have fewer financial responsibilities like mortgages and children, and are more optimistic about their financial futures.

How TikTok influences Gen Z shopping habits

Gen Zers spend a lot of time on social media, and the app with the most influence on how they shop is TikTok. Half of daily TikTok users are 18 to 29 years old, per MCBI data, and TikTok is the brand that’s most popular with Gen Z relative to the general public. The “TikTok made me buy it” hashtag has over 8 billion views, and trending products on the platform regularly sell out. MCBI data also shows that daily TikTok users tend to be heavier Amazon and Walmart shoppers, and are much more likely to make purchases through social media (60% of daily TikTok users do this, versus 36% of the general population).

The Gen Z purchase process

When social media browsing is inextricably linked to product discovery, you get a generation that is constantly bombarded with interesting products to try. This does not, however, mean that Gen Z’s purchases are all impulsive; rather, they spend more time thinking about their purchases than older generations do. Across the categories we evaluated, Gen Z is less likely than older adults to make a purchase decision in a week or less, and more likely to take a month or more to consider it.

Surveys conducted from November 2022 to January 2023 among 766 Gen Z adults and 5,657 adults from other generations, with unweighted margins of error of up to +/-4 percentage points.

Given Gen Z’s propensity for trying new brands, this makes a ton of sense. The cohort is less likely to make habitual purchases over and over, and instead shops with consideration and intent more often. This is more work for the consumer, but it also gives brands more time and opportunities to intervene and steal their mindshare from competitors. Of course, Gen Zers’ brand openness is a double-edged sword because it’s also harder to keep their loyalty. Brands will need to reinforce product features and benefits post-purchase, potentially with styling or usage advice, to help retain Gen Z shoppers the next time they need a product in the same category.