Coronavirus Clouds Shopper Comfort, Holiday Spirit and Channel Consumption This Year

Key Takeaways

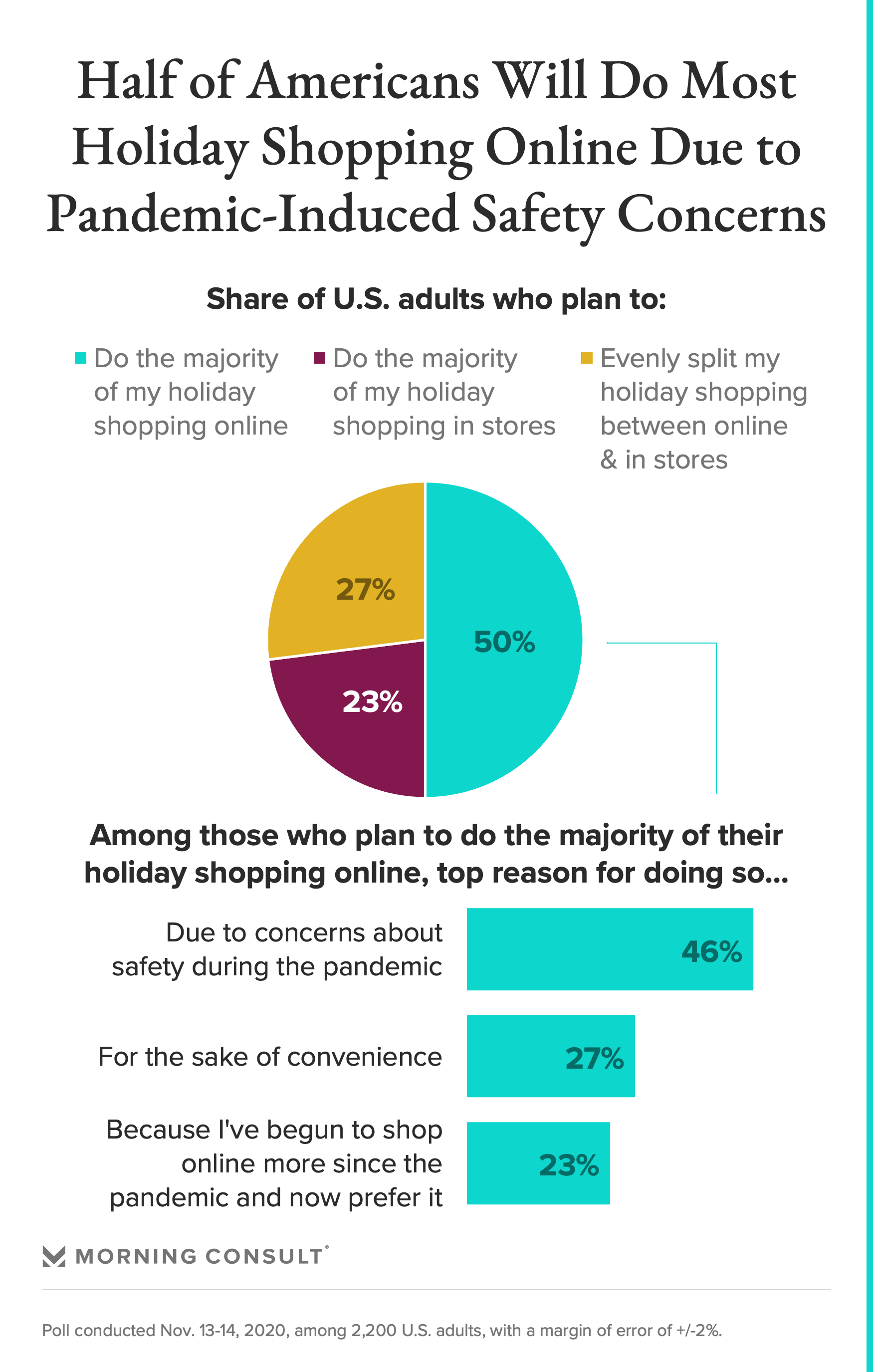

50% of shoppers plan to do most of their holiday shopping online, with pandemic-related safety concerns as the top-cited reason. Roughly half as many (23%) plan to stay offline and instead shop predominantly in stores -- similar shares as in early September.

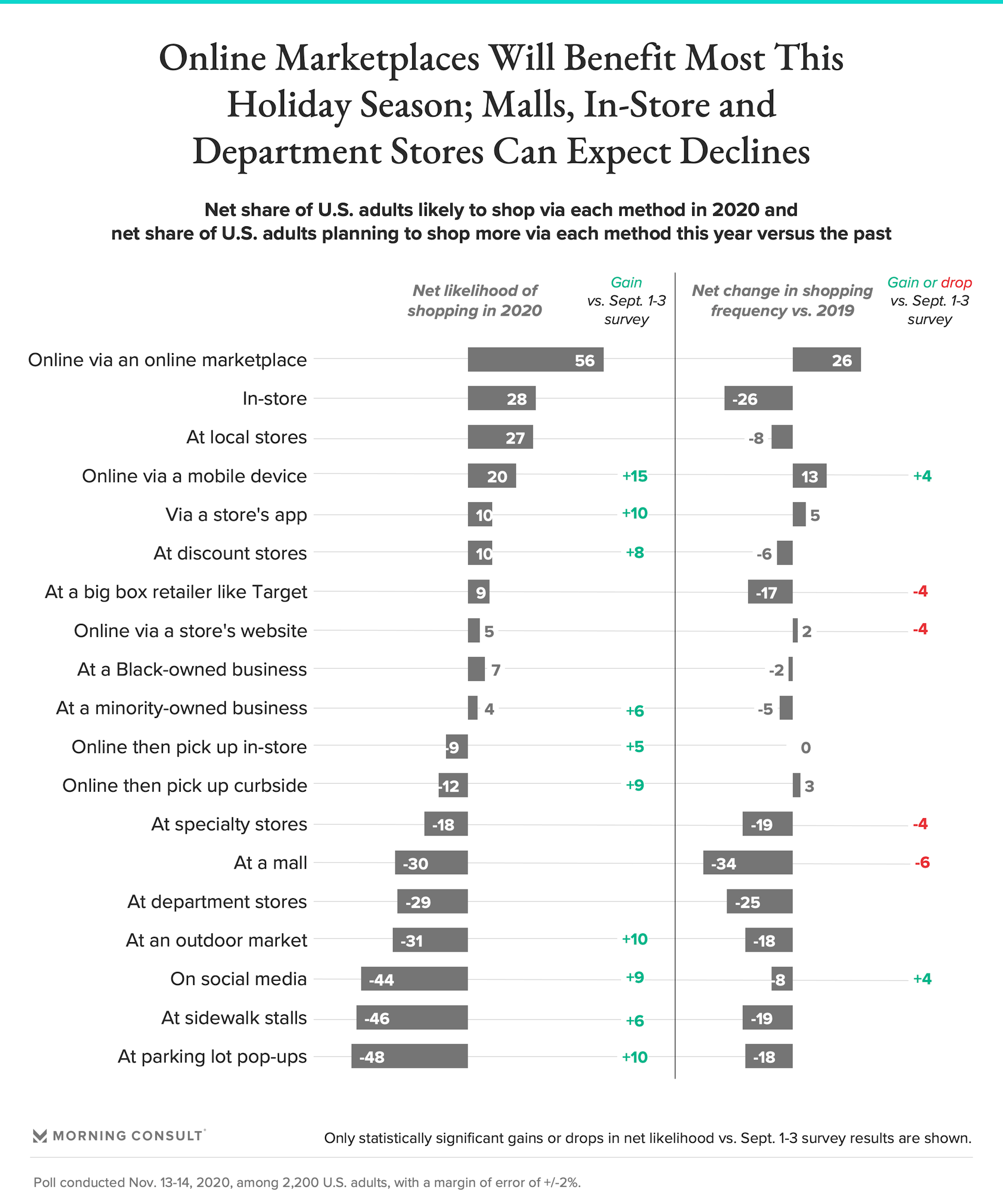

Online marketplaces, local stores and other in-store methods remain the channels U.S. shoppers are most likely to shop at for gifts this holiday season, but mobile commerce, store apps and discount stores have gained momentum since tracking began. E-commerce options featuring either in-store or curbside pick-up have also seen gains in likelihood of use in recent weeks.

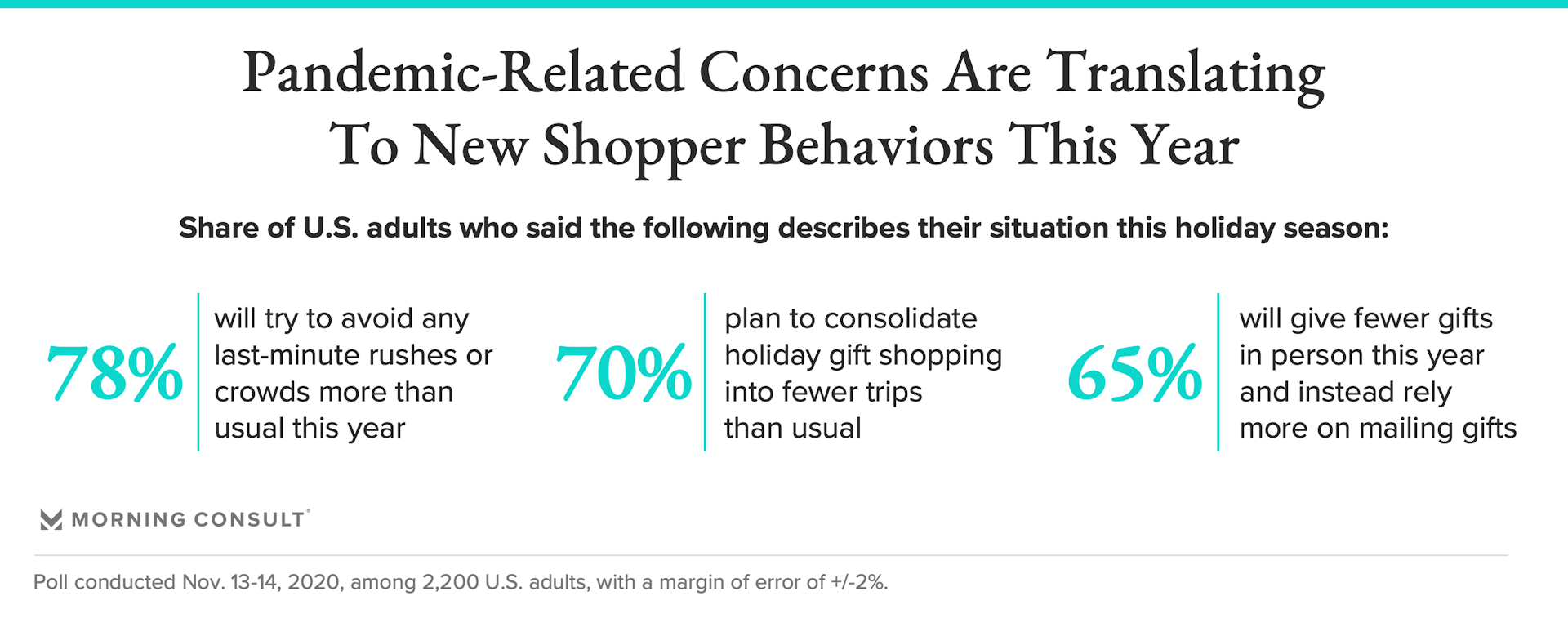

65% of Americans plan to mail holiday gifts this year instead of relying on in-person giving, but concerns around delivery delays are rampant: 54% are worried about delivery speed and/or delays this holiday season, and a similar share (52%) expresses concern around gifts they mail being delivered on time.

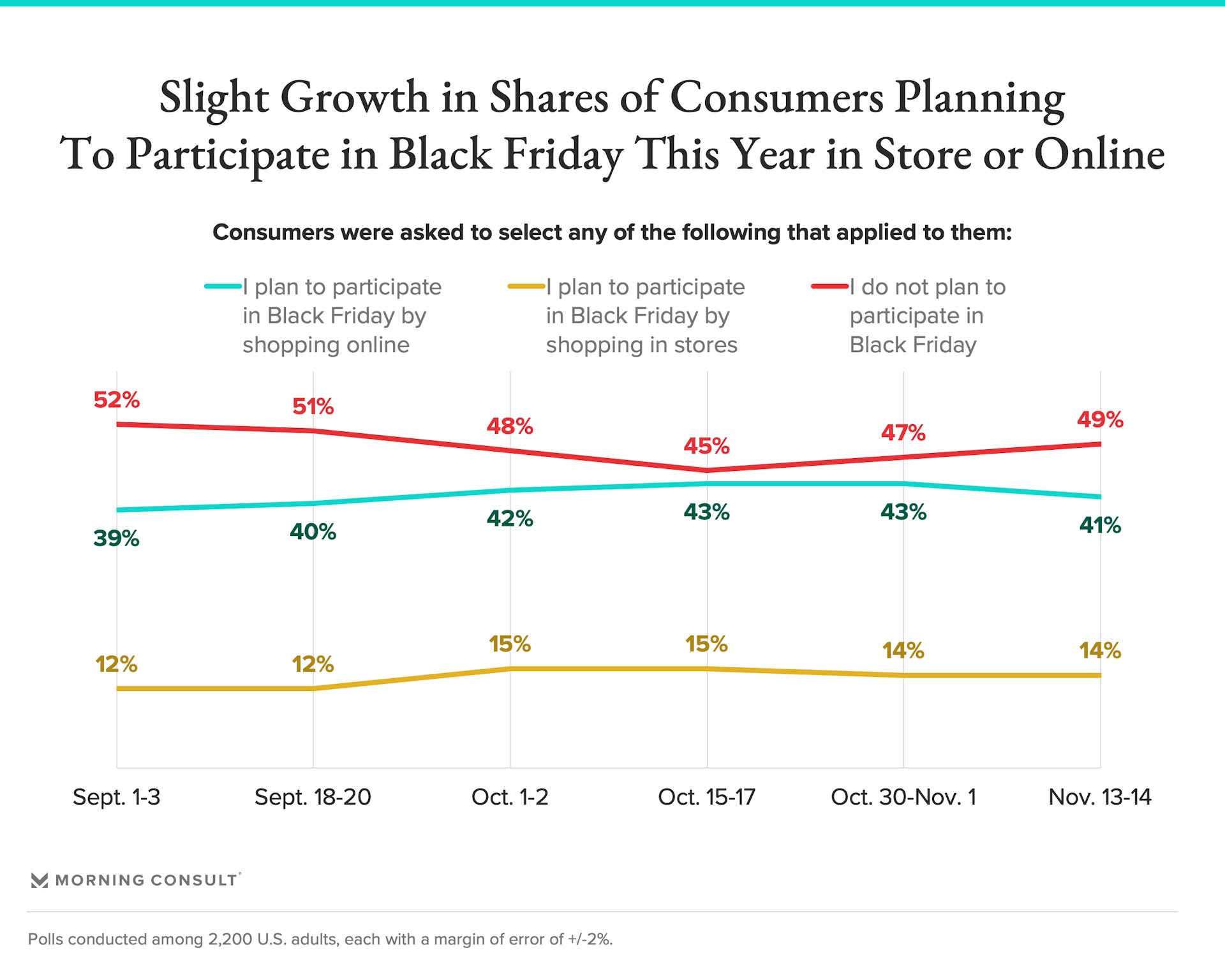

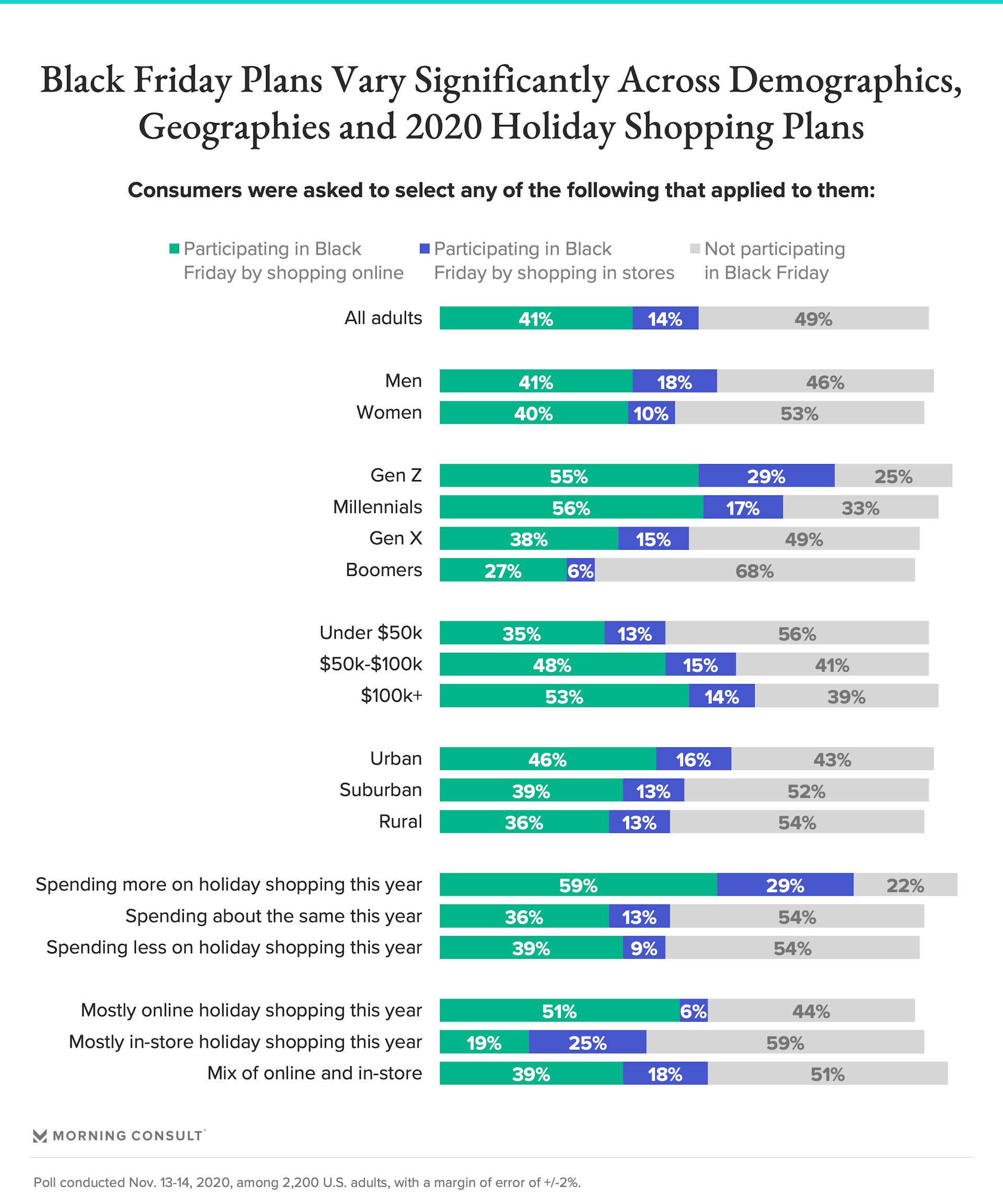

The share planning to sit out Black Friday this year has held steady since tracking began in early September, but the near-half of Americans who do plan to take part are increasingly likely to shop via both online and in-store methods than was the case earlier this season. Men, higher incomes, urbanites, Gen Zers and those planning to spend more this holiday season are significantly more likely to participate in Black Friday this year.

From the way consumers will celebrate and travel to how they’ll shop and spend, Morning Consult has been closely monitoring how consumer spending, channel preferences and shopping needs, preferences and habits are changing this holiday season, and what brands can do to navigate this landscape as it evolves.

As Black Friday, Cyber Monday, and other defining tentpoles of the shopping season rapidly approach, pandemic-related concerns and shifts in shopping behavior continue to influence where and how Americans will shop this year.

Building on our earlier analysis of how these shifts will affect storied holiday traditions like Black Friday, we explore key changes in how and where consumers will shop since tracking began in early September, what hasn’t changed and how differing attitudes across a divided America are translating to nuanced implications for spending, purchasing preferences and the success of certain shopping channels this holiday season.

Hyperlocalized targeting is of course hypercritical to the relevance of retailers’ sales, messaging and communications among diverse and divided Americans this holiday season. But more granular insight into highly nuanced consumer audiences who have diverse comfort levels, preferences and needs in this unique year is critical for retailers to better anticipate and meet those needs, build stronger and more personalized consumer relationships and attempt to close out the year with more successful retail strategies.

While nearly half of Americans (49 percent) have begun their holiday shopping, 41 percent have yet to start -- and despite retailers’ best efforts to pull demand and spending earlier this year, it seems shoppers are instead increasingly likely to procrastinate their gift-buying.

How the coronavirus is affecting holiday consumption this year

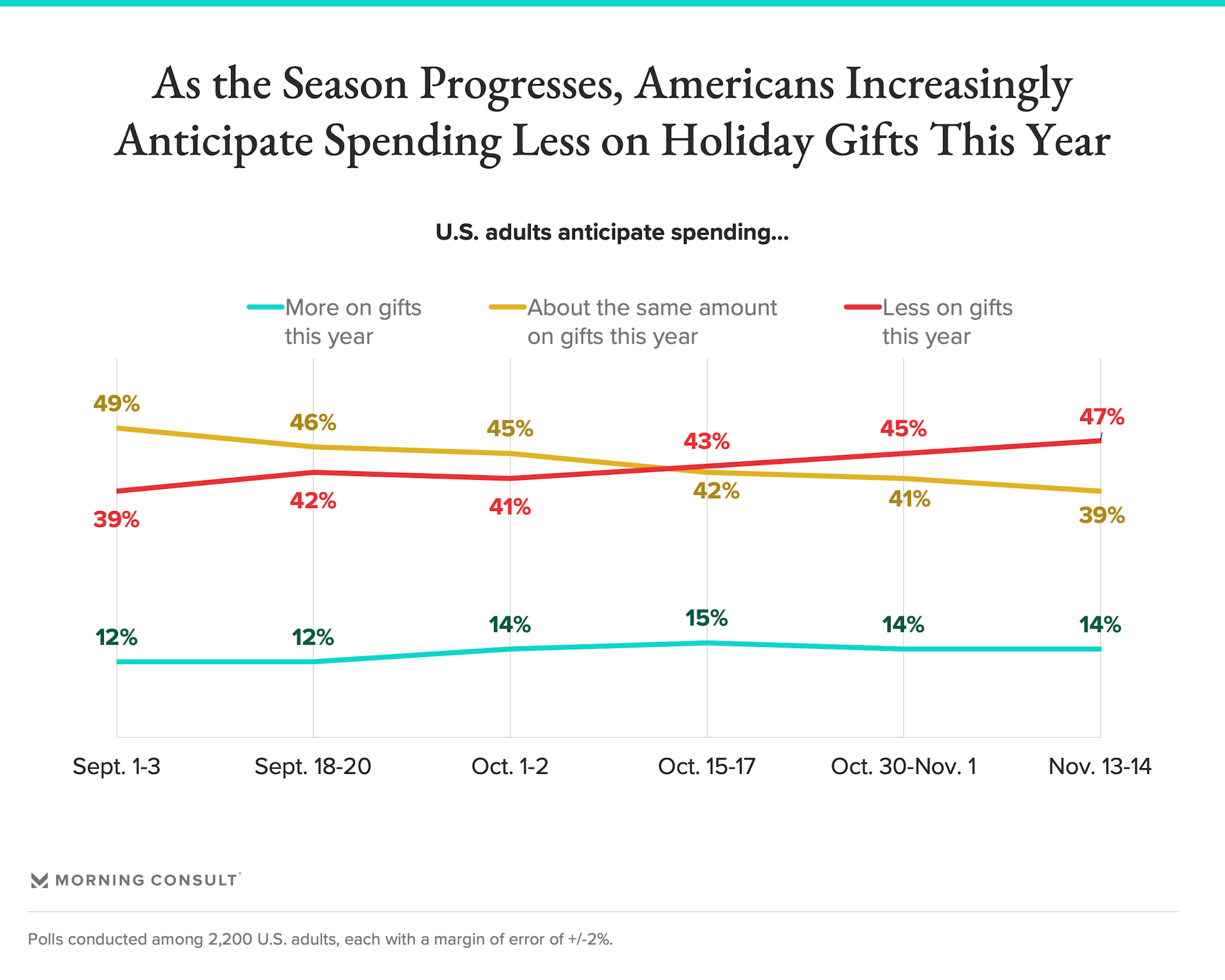

Particularly worrying for retailers is the strengthening trend around spending levels this holiday season, likely exacerbated by ongoing economic uncertainties and lack of a refreshed consumer stimulus package causing wavering consumer confidence: As the season progresses, Americans increasingly anticipate spending less on holiday gifts this year.

This is particularly true for consumers planning to shop mostly online this holiday season, about half of which, (51 percent) anticipate spending less on gifts in 2020 compared to only 40 percent of those planning to shop predominantly in stores. This suggests that while e-commerce channels will enjoy greater traffic and shopper volume this holiday season, retailers shouldn’t necessarily expect that this more convenient and contactless experience will translate to increased consumption on a per-customer basis.

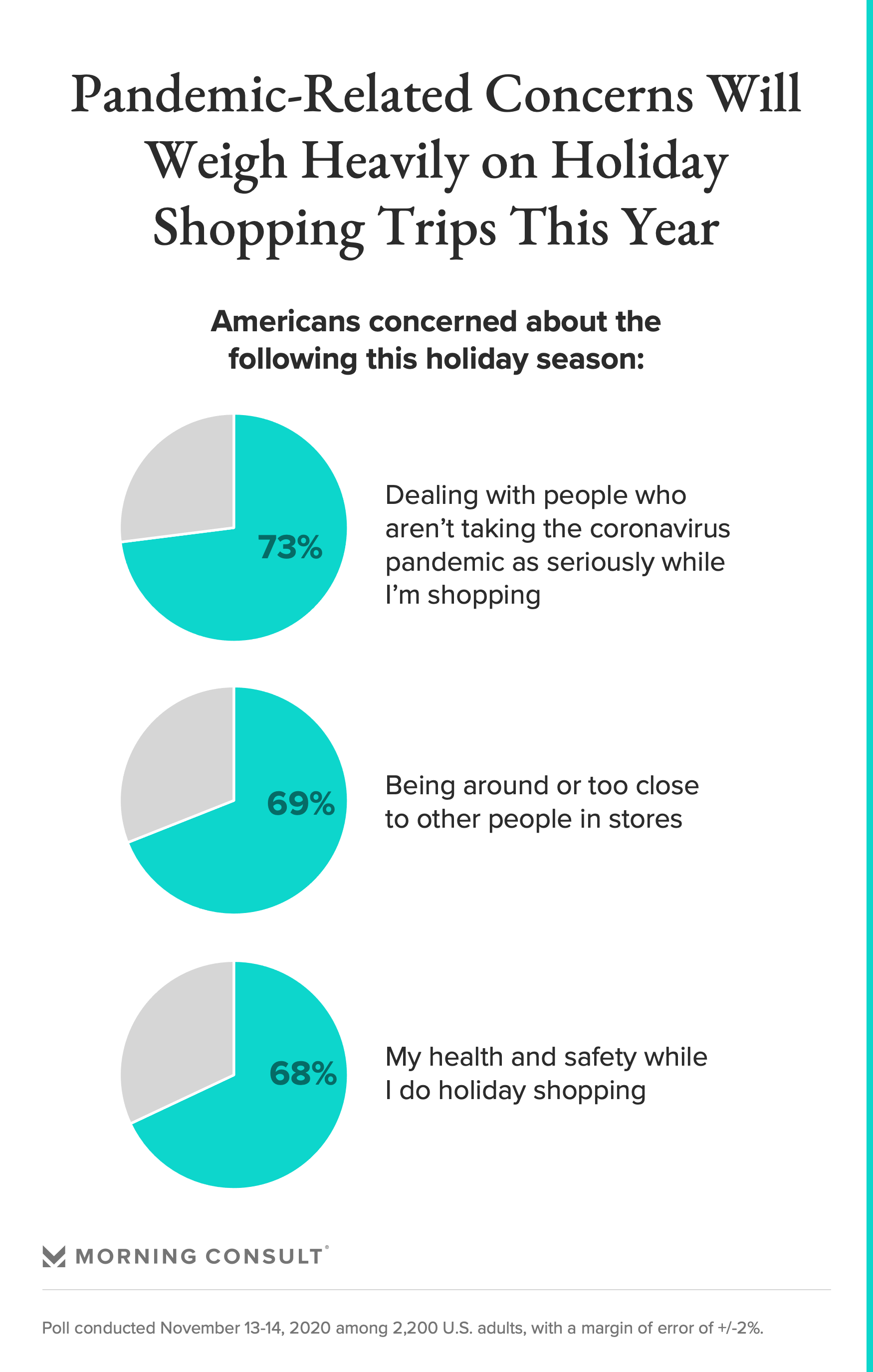

Economy-driven financial strains are undoubtedly affecting shoppers’ ability to spend and are therefore playing a role in this procrastination and expected drop in spending. But with the vast majority of Americans expressing pandemic-related concerns and discomfort around holiday shopping this year, shoppers’ desire to holiday shop has also been impacted.

This has implications for where Americans will do their holiday shopping: Shoppers are most comfortable frequenting local stores or outdoor markets while the majority are uncomfortable going to shopping malls or department stores, sentiments that have largely held steady since tracking began in September.

However, distinct differences in comfort levels exist along party, generation, gender, income, geographic and even employment status lines. Nuances also exist based on expected spend levels this holiday season, and shoppers’ preferences for online versus offline shopping.

Indeed, 67 percent of Americans agree that COVID-19 will significantly impact their holiday shopping decisions this year, with 7 in 10 explicitly adjusting their approach to shopping itself and 65 percent shifting their approach to gift-giving.

Though a clear majority plans to mail holiday gifts this year instead of in-person giving, concerns around delivery delays are rampant for most: 54 percent say they are worried about delivery speed and/or delays this holiday season, and a similar share (52 percent) express concern around ensuring gifts they mail are delivered on time.

Half of Americans plan to do the majority of their holiday shopping online, citing pandemic-related safety concerns as the primary reason why, while roughly half as many (23 percent) plan to stay offline and shop predominantly in stores -- similar shares as in early September.

However, critical nuances in attitudes and subsequent behavioral shifts are clear across income and generational lines:

- Higher-income Americans are significantly more likely to be shifting their holiday shopping online and away from in-store; they, along with Gen X, cite pandemic-induced safety concerns as the primary reason behind online-first holiday shopping.

- Lower incomes, meanwhile, are notably more likely than their higher-income peers to indicate that their online-first preference stems from a newfound preference for this method stemming from increased usage during the pandemic.

- Online-first Boomers also cite safety concerns as the primary reason for this preference, though a greater share indicates convenience as a top reason than is the case across any other generation.

Checking in on channel consumption

While online marketplaces, local stores, and other in-store methods remain the channels Americans are most likely to shop at for gifts this holiday season, mobile commerce, store apps, and discount stores have gained momentum since early September. E-commerce options featuring either in-store or curbside pick-up have also seen gains in likelihood of use in recent weeks. Malls, specialty stores and big-box retailers, on the other hand, continue to face an uphill battle as likelihood to shop at these, especially relative to 2019, remains weak.

Black Friday implications

The share planning to participate in Black Friday this year has held steady since tracking began in early September: 49 percent currently indicate that they do not plan to participate (52 percent said this in early September). But those who do plan to participate in Black Friday are increasingly likely to shop via both online and in-store sales than was the case earlier this season.

But again, more granular insight into key audiences reveals important nuances around Americans’ 2020 Black Friday plans. Men, higher incomes, urbanites, Gen Zers and those planning to spend more this holiday season are significantly more likely to participate in Black Friday this year; the latter two consumer groups are also among the most likely to participate in Black Friday via in store shopping options.

Still, the share planning to rely more on Cyber Monday than Black Friday this year has been on the rise since early September. This is due to both pandemic-related discomfort shopping in stores, with a 27 percent increase in the share of Americans citing this as the reason for their increased reliance on Cyber Monday, as well as pandemic-induced increases in comfort with shopping online (up 29 percent since September).

The share expecting to participate in Small Business Saturday, 12 percent, has also remained consistent since early September.

A cookie-cutter approach won’t cut it this holiday season

The holidays are usually about coming together, but as marketers have navigated the many challenges 2020 presented -- as well as an election that left the nation more divided than ever -- it has become abundantly clear that Americans’ attitudes, needs and priorities are far from united.

From comfort with and ensuing preferences around online and offline shopping methods, to attitudes around holiday shopping and expectations around holiday spending, different (and sometimes polarizing) sentiments across consumer groups reveal numerous fault lines -- meaning historically one-size-fits-all approaches to communicating with, appealing to and crafting experiences for the 2020 holiday shopper now require critical nuance.

This multifaceted consumer landscape creates an especially complex environment for brands to resonate -- let alone succeed -- in. Just as hyperlocalized targeting was instrumental for more relevant and therefore more effective media strategies, hypergranular insight into key consumer groups is now more critical than ever for retailers to better anticipate and meet diverse consumer needs, build stronger and more personalized shopper relationships, and craft more successful retail strategies to end this and every year strongly.

Victoria Sakal previously worked at Morning Consult as a brands analyst.