How COVID-19 Is Changing Everything From How Europeans Celebrate to Where They’ll Shop This Holiday Season

Key Takeaways

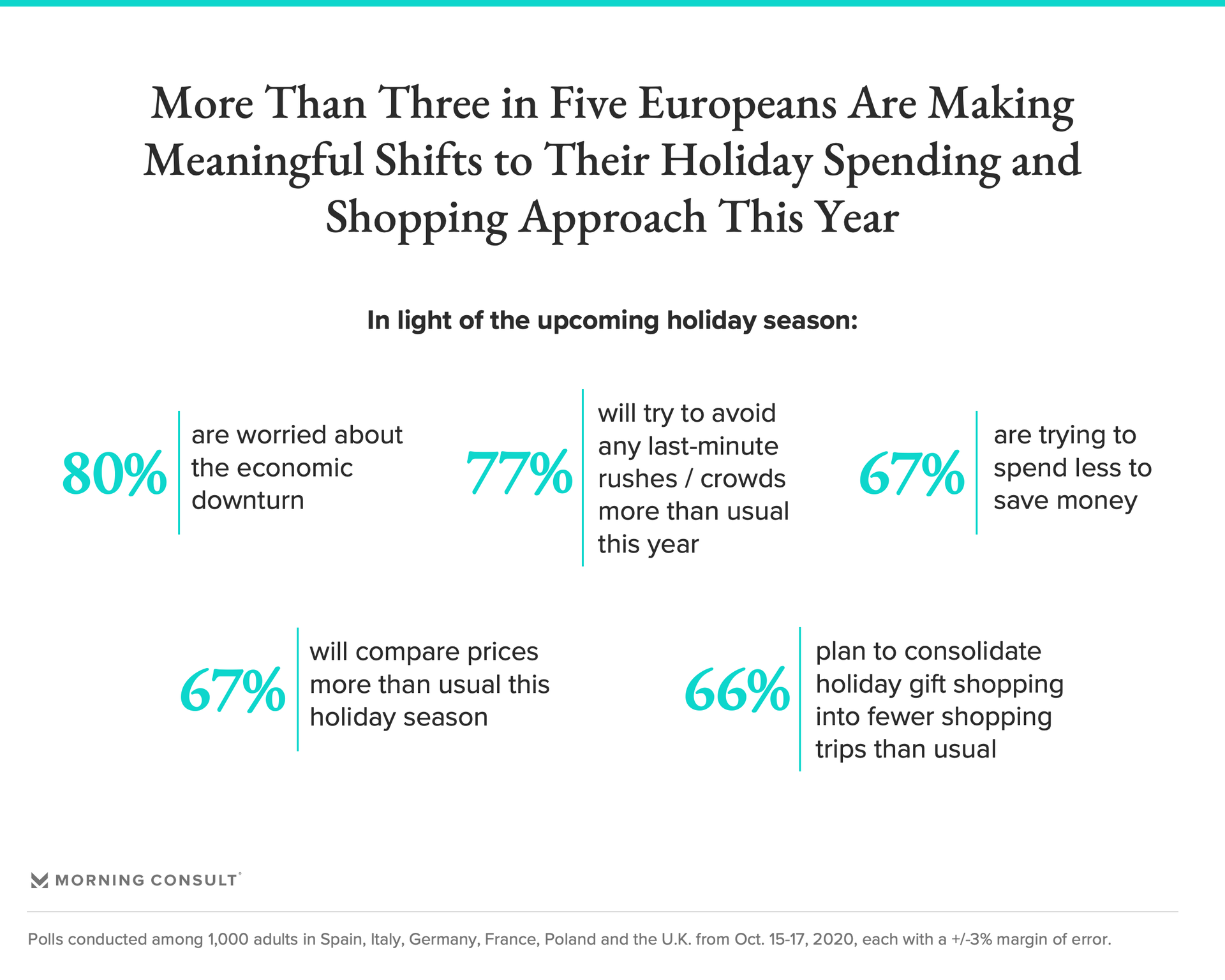

71% of European shoppers say COVID-19 will significantly impact their 2020 holiday season, though this excludes Germans, 43% of which consider this to be the case, and 80% of Europeans are worried about the economy. More than half of Spanish, French and Polish residents are worried about their job security in the pre-holiday months.

This has led more than six in ten to make meaningful shifts in their approaches to holiday spending and shopping: Two-thirds of Europeans on average plan to spend less, compare prices more and make fewer holiday gift shopping trips this holiday season.

Only 38% of Europeans on average are looking forward to this year’s holiday season, perhaps in part related to stifled travel plans. Only 24% of Europeans plan to travel over the winter holidays this year.

In nearly every market, three in four Europeans will rely most heavily on online marketplaces for gift purchases this year. Online via either online marketplaces, store websites or mobile devices will see the greatest upticks year-over-year, with an average of one in five consumers across EU markets planning to use these more in 2020.

Like the United States, several European nations are preparing for a “dark winter” as the pandemic enters an increasingly threatening phase across the continent.

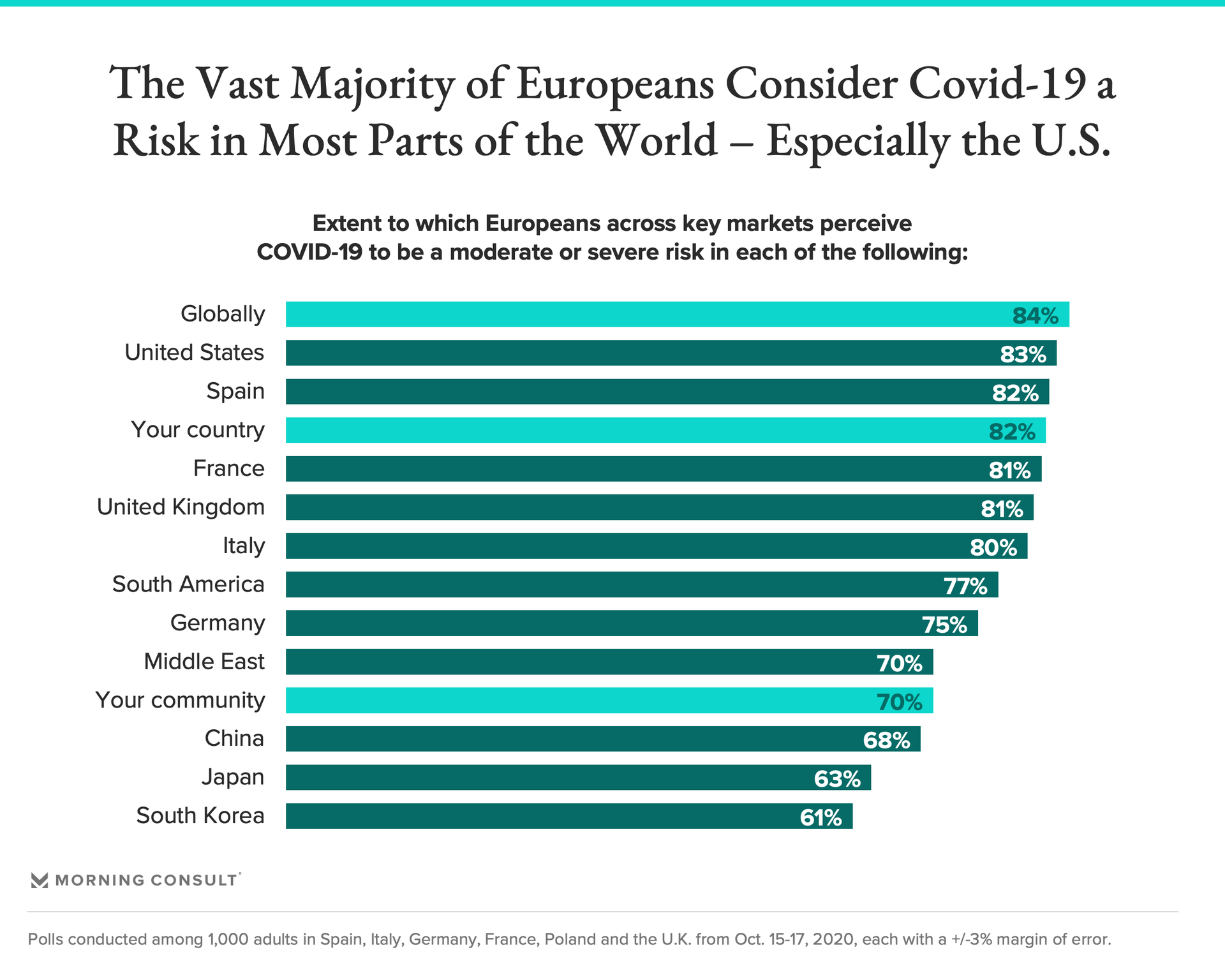

As coronavirus outbreaks reach new highs, the vast majority of Europeans on average recognize COVID-19 to be a risk globally and in most parts of the world -- particularly in the United States and in their own country.

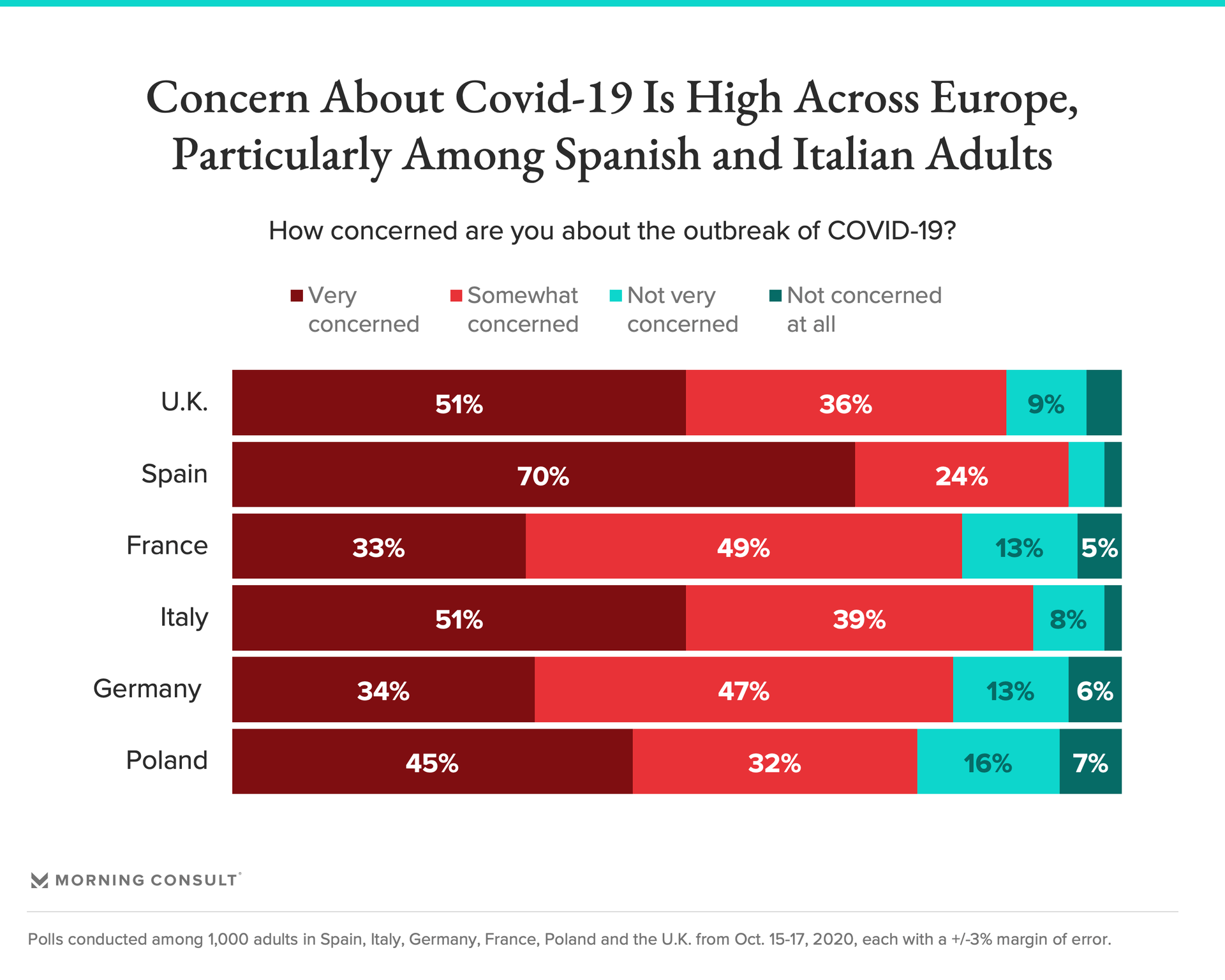

More locally, recent resurgences have left an overwhelming majority of Europeans concerned about the COVID-19 outbreak, though Polish and German adults are relatively less worried. As the outbreak rises, the share of concerned Italians has most noticeably jumped, up 11 points since late June.

Importantly, the recent acceleration in COVID-19’s spread across Europe has led to negative reactions as European consumers feel the economic effects of rising cases. As has been the case stateside, the pandemic has threatened consumer confidence and hamstrung spending as consumers prioritize essential purchases and living expenses.

Ongoing consumer confidence tracking by Morning Consult Economist John Leer finds that since July 1, the ICS has fallen 5.3 percent in the United Kingdom, 3.7 percent in Spain and 0.4 percent in France, three countries experiencing high numbers of new daily cases. This dampened confidence is also seen in other markets experiencing high caseloads, and is highly likely to impact holiday spending across affected markets, from purchases of larger ticket items or more premium gifts to the size of holiday gatherings and overall spend levels.

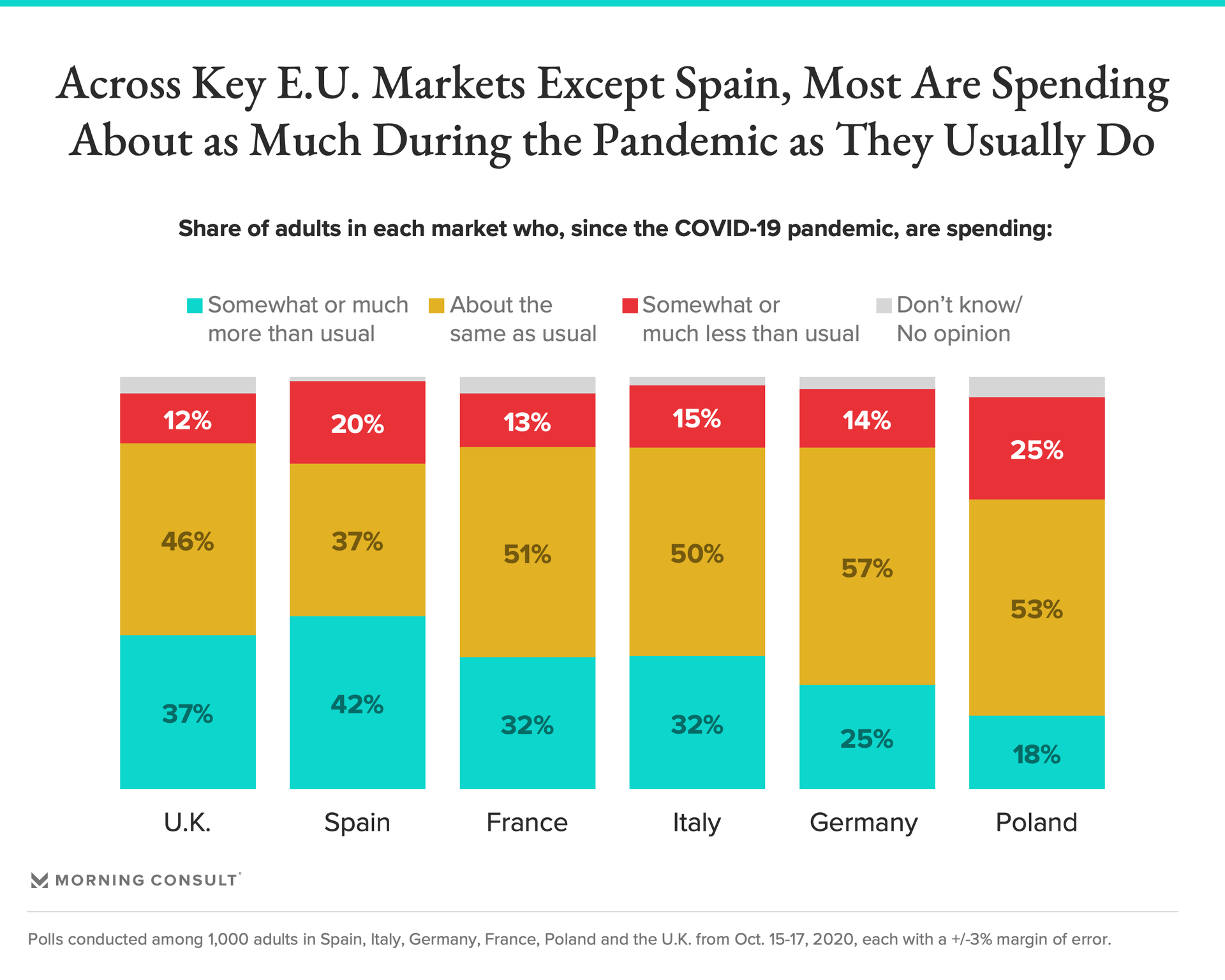

Still, with the exception of Spain, most consumers in each E.U. market surveyed report spending about as much during the pandemic as they usually do (42 percent of Spanish report spending somewhat or much more than in non-pandemic times vs. 20 percent spending somewhat or much less). Conversely, 25 percent of Polish respondents are spending somewhat or much less and just 18 percent of consumers in that market are currently spending more.

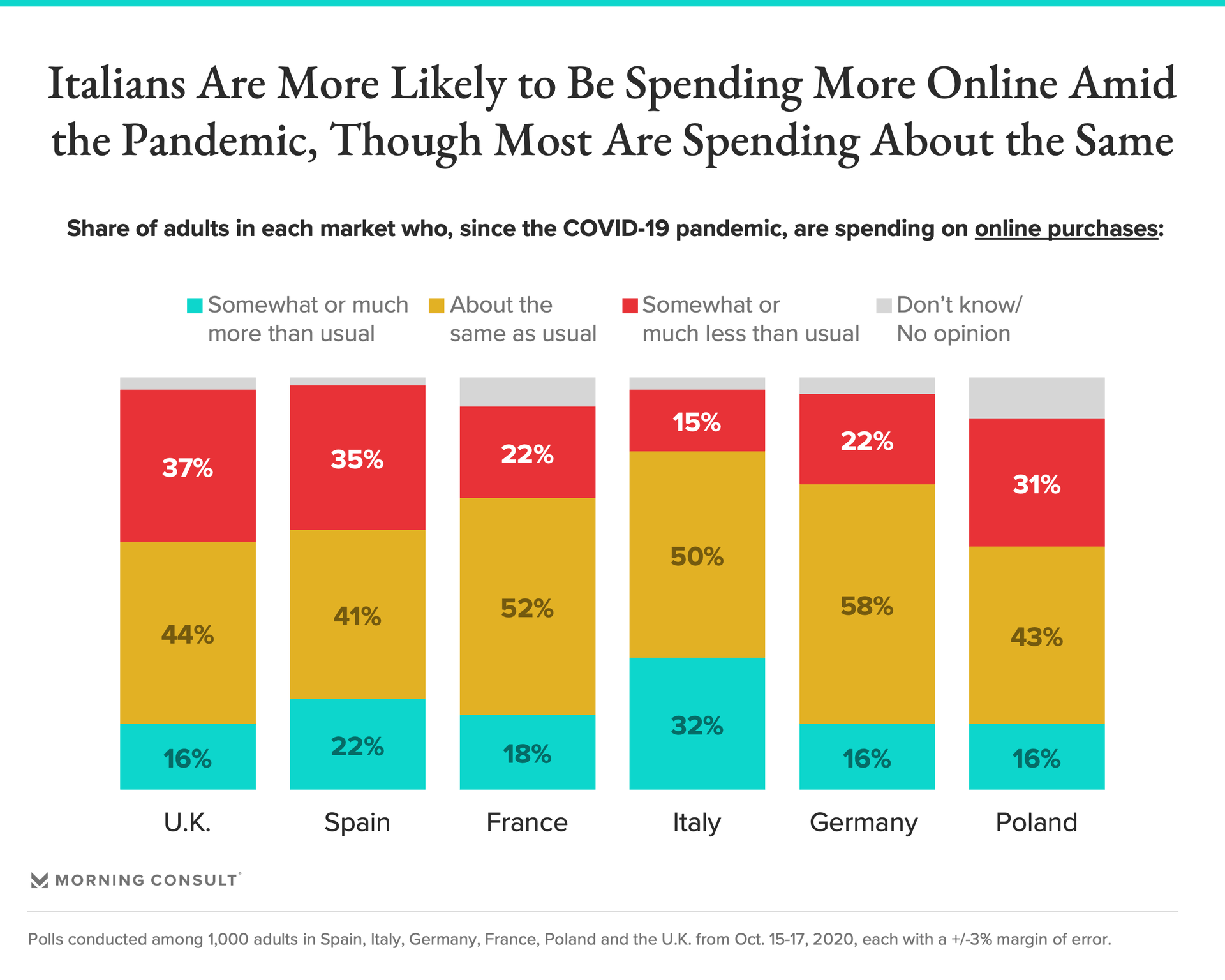

When it comes to online purchases specifically, French, Italian and German consumers are largely spending about as much as they were pre-pandemic, while sizable shares of consumers in the UK, Spain and Poland are now spending less online than they were before the pandemic. Roughly a third of Italians, 32 percent, report spending more online at this time than they usually did, the largest share doing so across the EU markets surveyed.

With many European countries shattering daily infection records, national leaders reinstating lockdowns, and uncertainty mounting around how to rein in growing outbreaks — in addition to mounting financial challenges as economies struggle and employment wavers — how will Europeans’ holiday shopping, spending and consumption be impacted?

New research conducted Oct. 15-17 in the United Kingdom, Spain, France, Italy, Germany and Poland among 1,000 adults in each market aims to shed light on how the convergence of ongoing concern around the coronavirus, increased anxiety stemming from recent resurgences, and potential nostalgia, joy or relief associated with the holidays will translate for brands this season across key European markets.

COVID-19 will significantly impact the 2020 holiday season for 71 percent of European shoppers and their families. This excludes Germans, only 43 percent of which consider this to be the case. And 67 percent of Europeans say that COVID-19 will significantly impact their holiday shopping decisions this year, again with the exception of Germans (only 41 percent of which find this true).

Indeed, the combination of a global pandemic stirring health concerns and economic pressures leading to financial challenges means that 80 percent of Europeans on average are worried about the economy, and that more than 6 in 10 are making meaningful shifts to their holiday spending and shopping approaches.

How -- and if -- they’ll celebrate

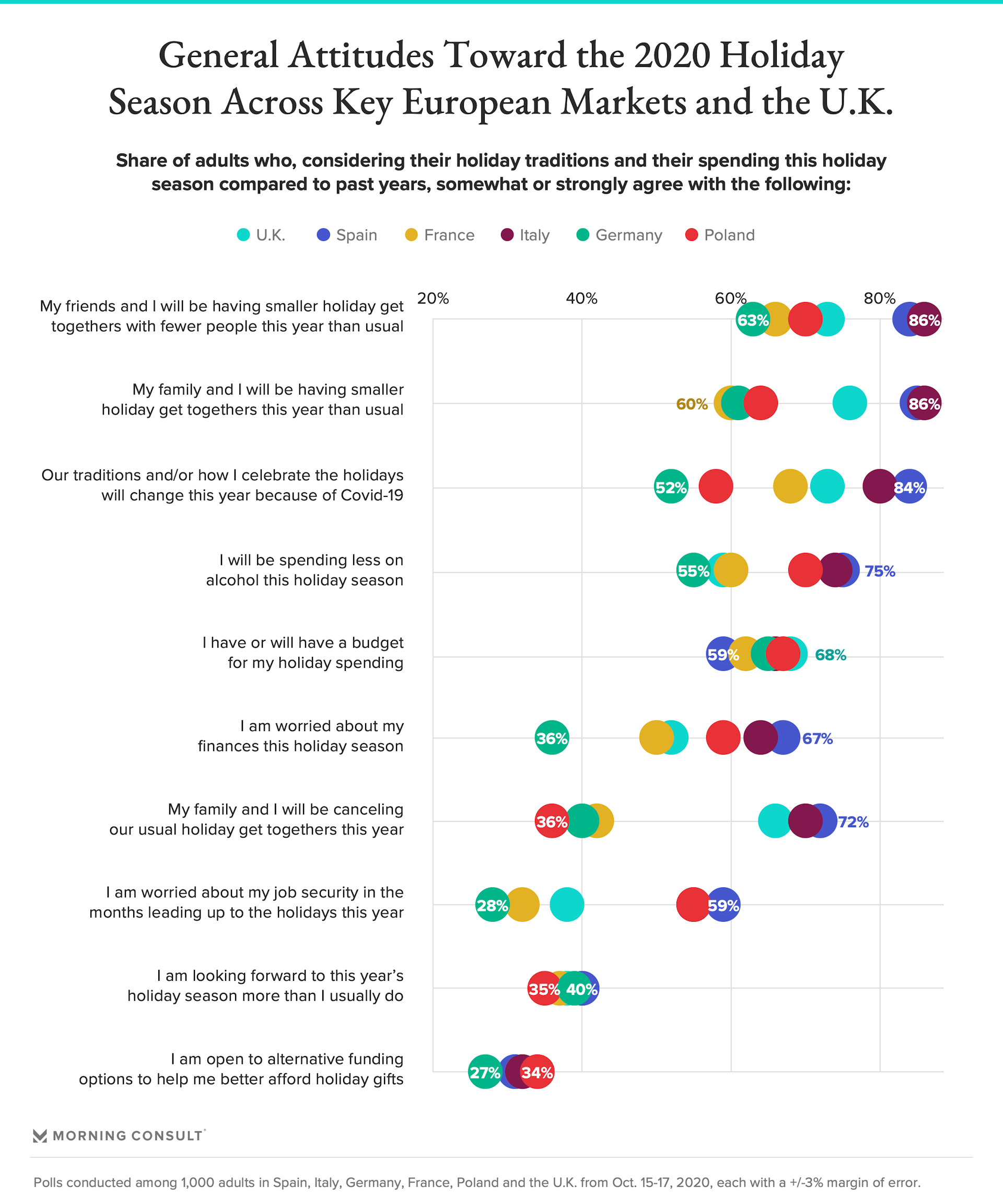

Across markets, the vast majority of Europeans acknowledge that their friends and family will be having smaller holiday get-togethers than usual this year and that their traditions and how they celebrate the holidays will change this year because of the pandemic, though these sentiments are weaker among the French, Germans and Polish.

The Spanish and French in particular, as well as many in the United Kingdom, are notably more likely to say that their families are altogether canceling their usual holiday get-togethers this year. More than half of Spanish, French and Polish residents are worried about their job security in the months preceding the holidays, while this is distinctly less true for Germans (only 28 percent are worried about this).

Where markets tend to agree is in their disinterest in alternative funding options to help with financing this holiday season, and in the extent to which they’re looking forward to the holiday season -- which is to say, not much.

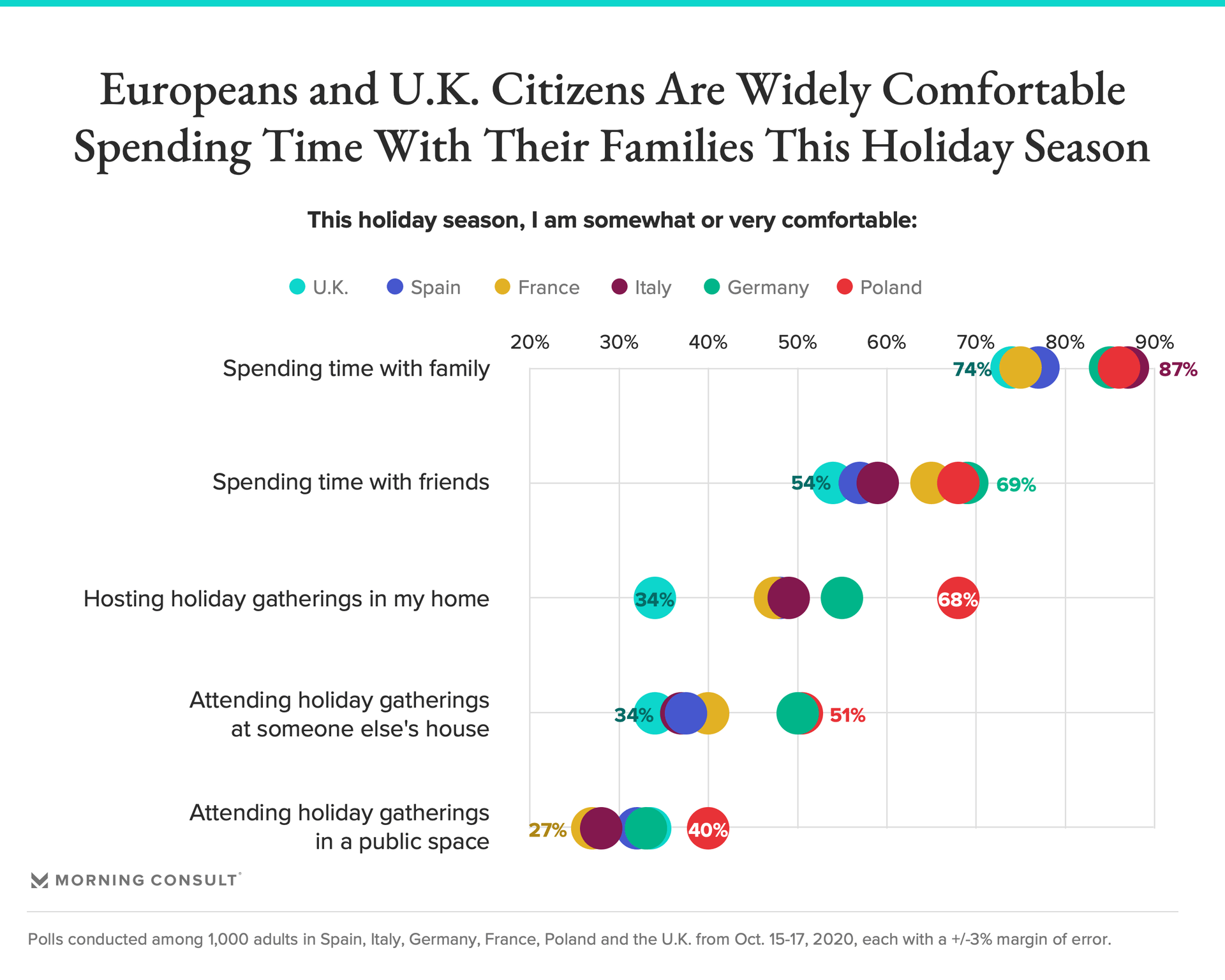

Across markets, citizens are widely comfortable spending time with their family this holiday season, though comfort levels start to differ around spending time with friends (just over half of those in the United Kingdom, Spain and Italy are somewhat or very comfortable with this, while more than 6 in 10 are in other markets).

Significant differences also exist in comfort with hosting holiday gatherings in one’s home, with only a slim majority of Germans and a clear majority of Polish shoppers comfortable doing so, as well as attending holiday gatherings at someone else’s home, which 50 percent of both Germans and the Polish are comfortable with, but clear minorities in other markets are comfortable with.

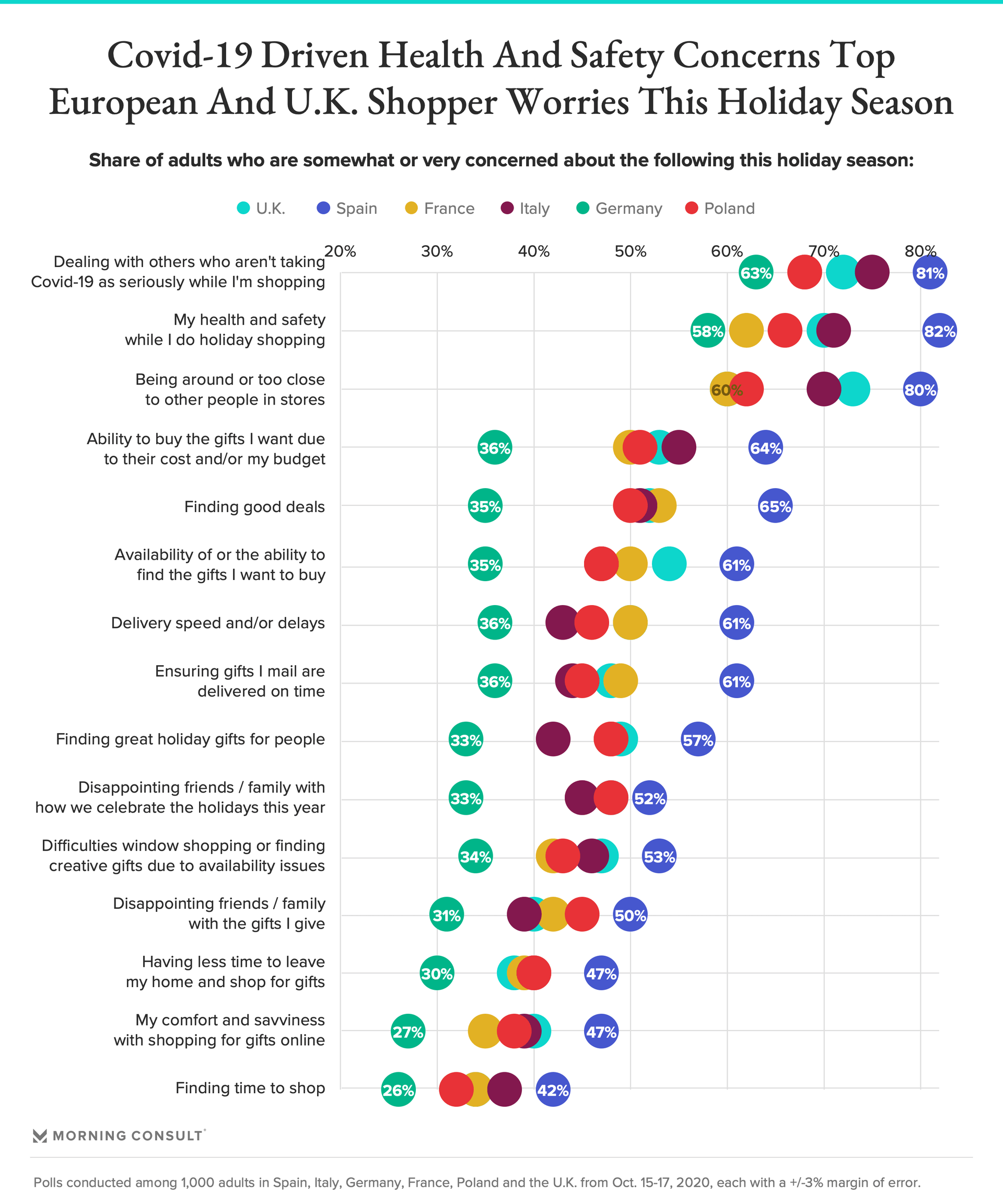

These comfort levels reflect concerns expressed about this holiday season, some of which seem to be universal across key European markets. These include dealing with others who aren’t taking COVID-19 as seriously, being around or too close to others in stores and -- related -- their health and safety while doing holiday shopping. Other concerns, however, are more market-specific:

- In general, Spanish shoppers express significantly higher levels of concern across a number of elements of the coming holiday season than other markets; Germans are notably less concerned.

- Beyond that, most Italians (55 percent) are worried about their ability to buy desired gifts due to cost or budget concerns, the majority of UK shoppers (54 percent) are concerned about availability of gifts they’re planning to buy and most French (53 percent) are concerned about finding good deals

Though a sizable share of Spanish shoppers express concern around finding or having less time to shop, comfort and savviness with online gift shopping, or disappointing recipients with gifts, these are less concerning for the majority of consumers across other key markets.

And when it comes to traditional holiday activities, while most Europeans anticipate cooking and baking at home this holiday season the same amount as they did pre-pandemic, nearly a third in each market (and notably more Italians) plan to do these more than usual.

Spotlight on travel

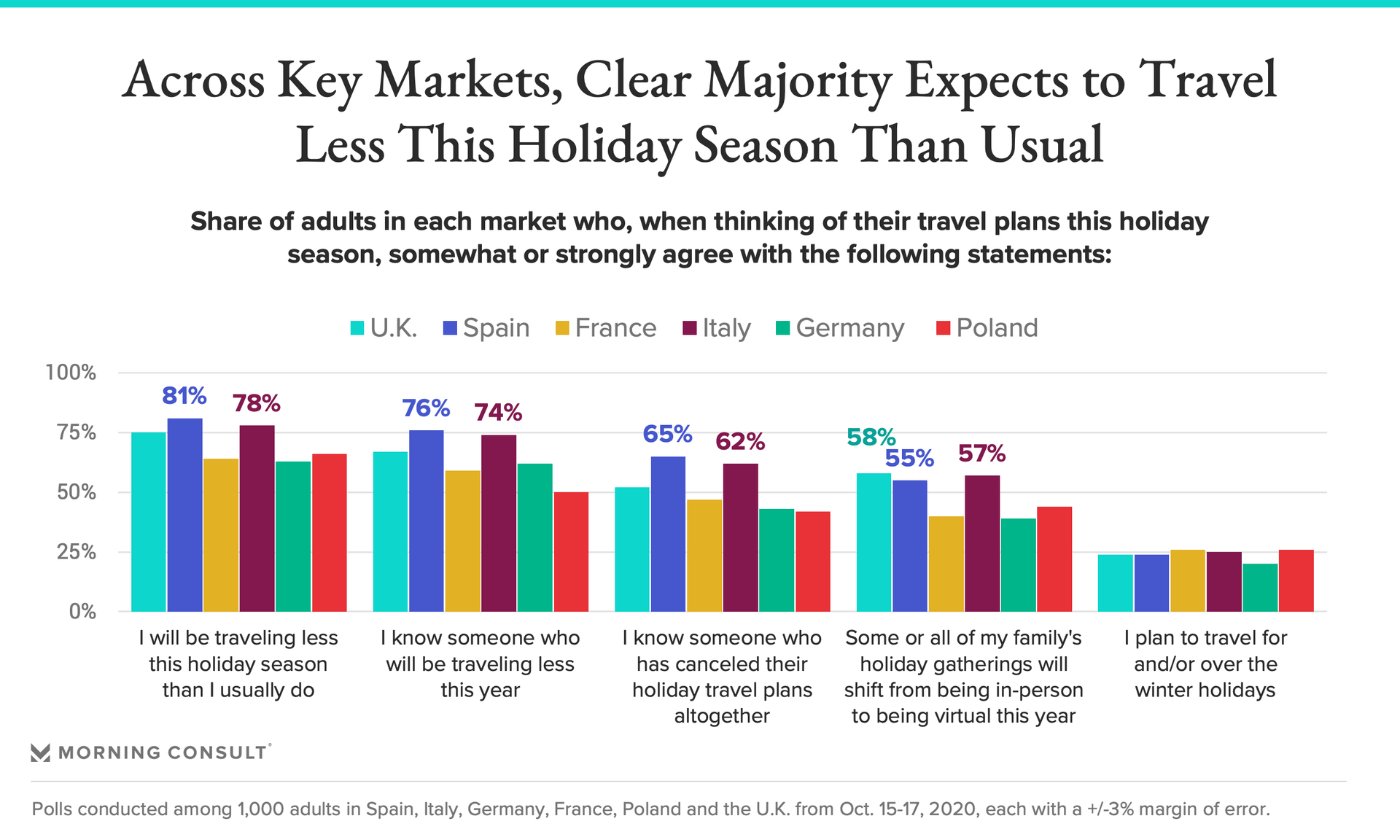

Across markets, a clear majority expects to travel less than usual this holiday season, and knows someone who will be traveling less this year, reinforcing hesitations toward and the unpopularity of doing so. Indeed, with minimal variance across markets, only around a quarter of Europeans (24 percent on average) plan to travel over the winter holidays this year. While Spanish and Italians are more likely to know someone who has entirely canceled their holiday travel plans and are also more likely to say that their family’s holiday gatherings are going virtual this year, these are also true for a sizable share across all markets.

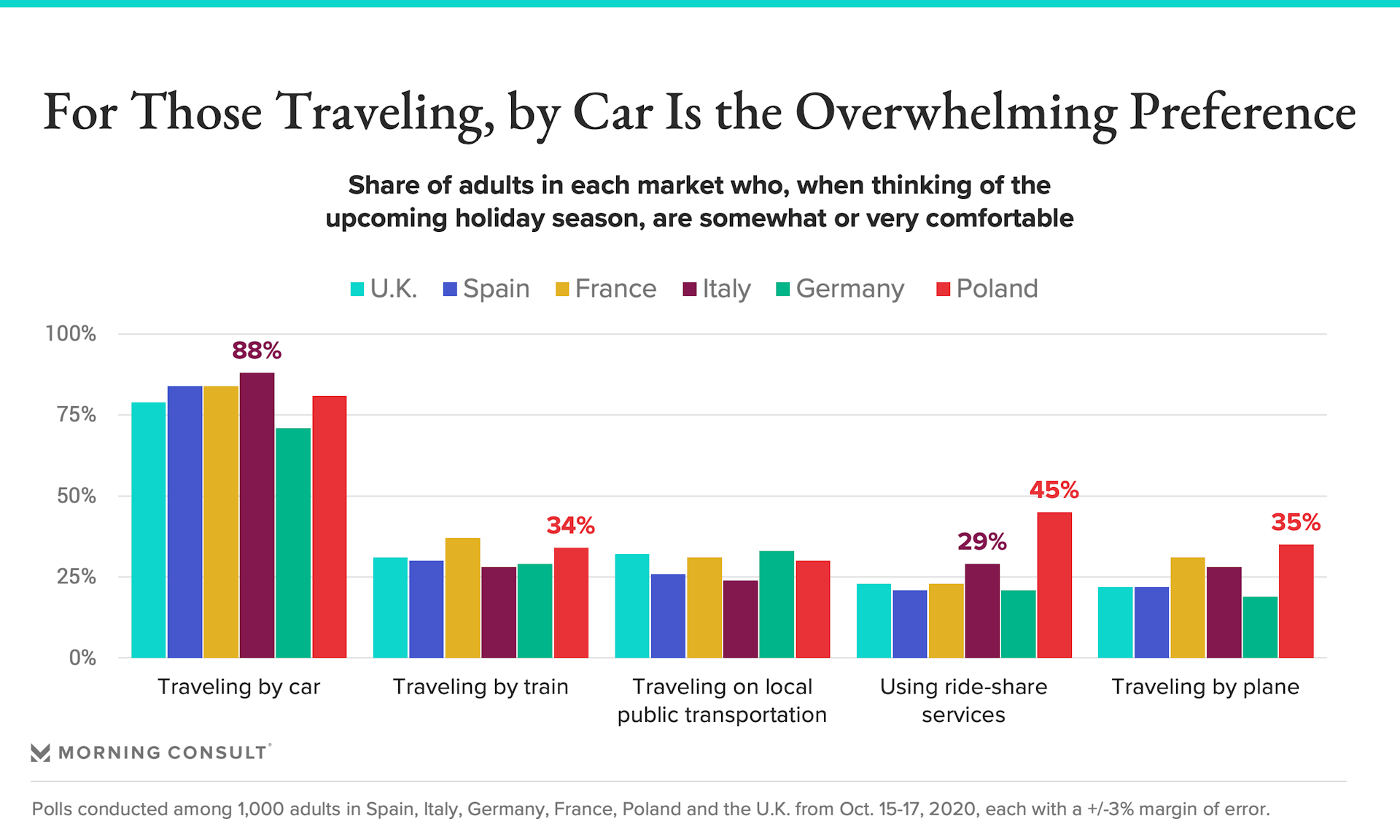

For those who are traveling, doing so by car is the universal preference, with 8 in 10 consumers in each market except Germany expressing comfort traveling via this method (71 percent of Germans are comfortable). 45 percent of Polish consumers are comfortable using ride-sharing services this holiday season and 35 percent are comfortable traveling by plane, while closer to one in five are comfortable doing so in each other market.

How -- and if -- they’ll spend

Two-thirds of Europeans on average plan to spend less, compare prices more and make fewer holiday gift shopping trips this holiday season. But beyond these consistencies, financial struggles and concerns stemming from the economic downturn will translate to different holiday shopping behaviors across European markets:

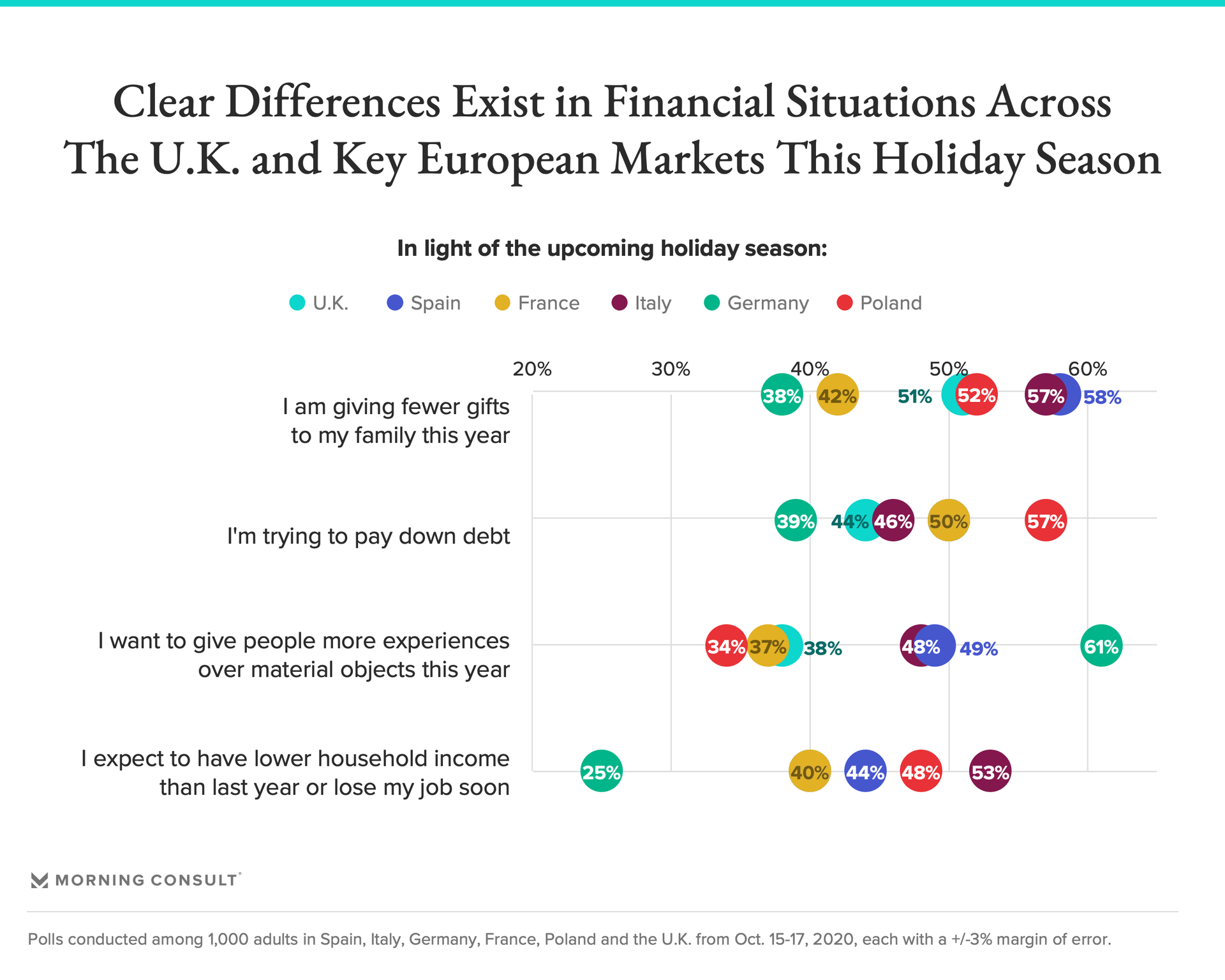

- Spanish and Italian shoppers are most likely to say they are giving fewer gifts this holiday season.

- While Italians are notably more likely to expect to have lower incomes this year compared to last, Germans are much less likely to expect lower incomes or job losses this year; this divergence most likely reflects differences in these nations’ respective approaches to handling COVID-19.

- Polish consumers are significantly more likely to be planning to gift experiences instead of material goods this year while also aiming to reduce their personal debt; Germans are again least likely to be doing each of these.

Coupled with new realities imposed by the coronavirus, this financial landscape translates to the 2020 holiday season in a few ways, in terms of not only anticipated spending levels, but also where consumers across key EU markets plan to spend.

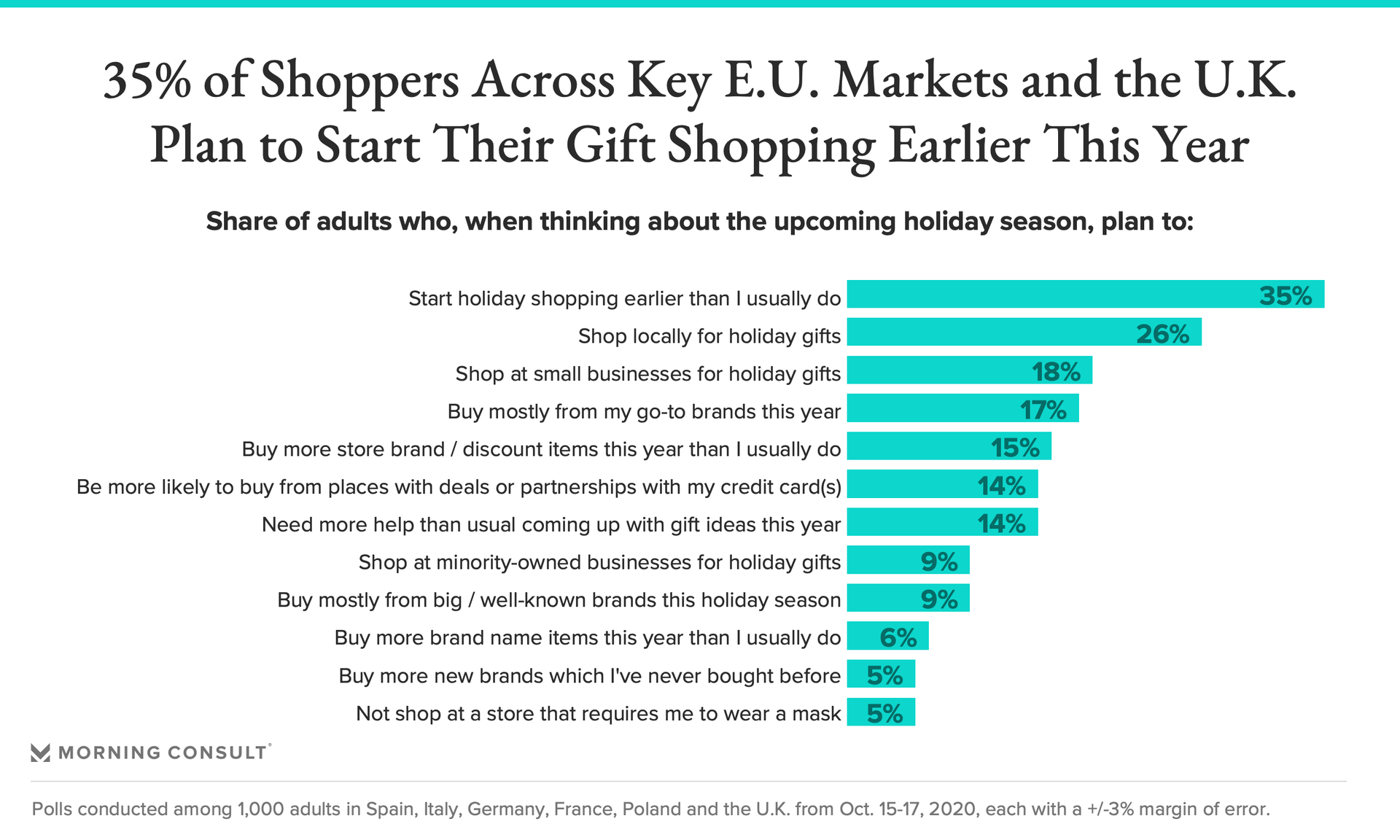

An average of 35 percent of consumers across EU markets plan to start gift shopping earlier this year, and more than a quarter on average anticipate shopping locally for holiday gifts, though the French are less likely to do so (only 19 percent plan to). Polish shoppers are most notably motivated by credit card deals or partnerships, with 27 percent indicating these would make them more likely to buy from a store or site.

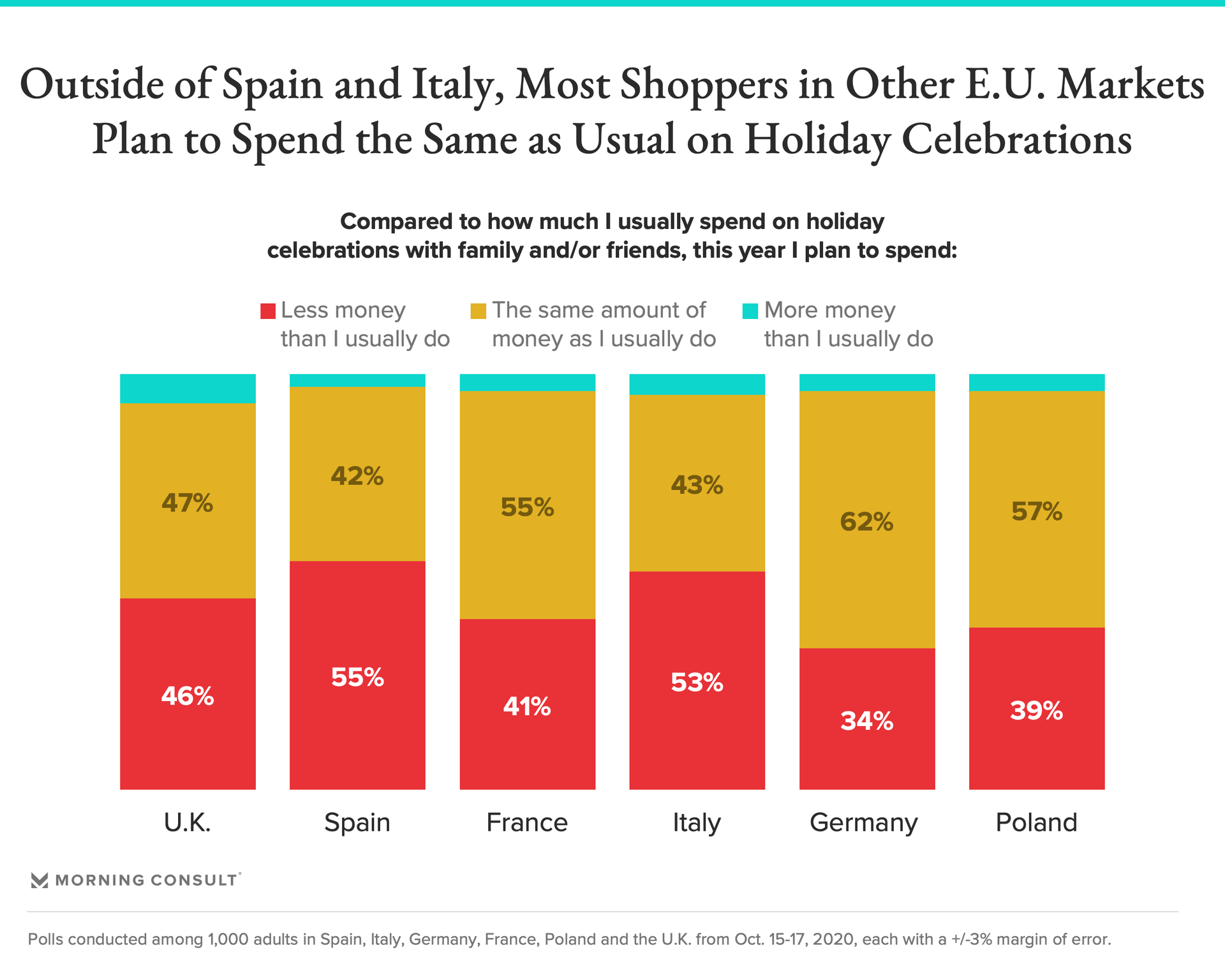

With the exception of Spanish and Italian consumers, the majority of which both plan to spend less than usual on holiday celebrations this year, most consumers in other markets expect to spend the same as they usually do.

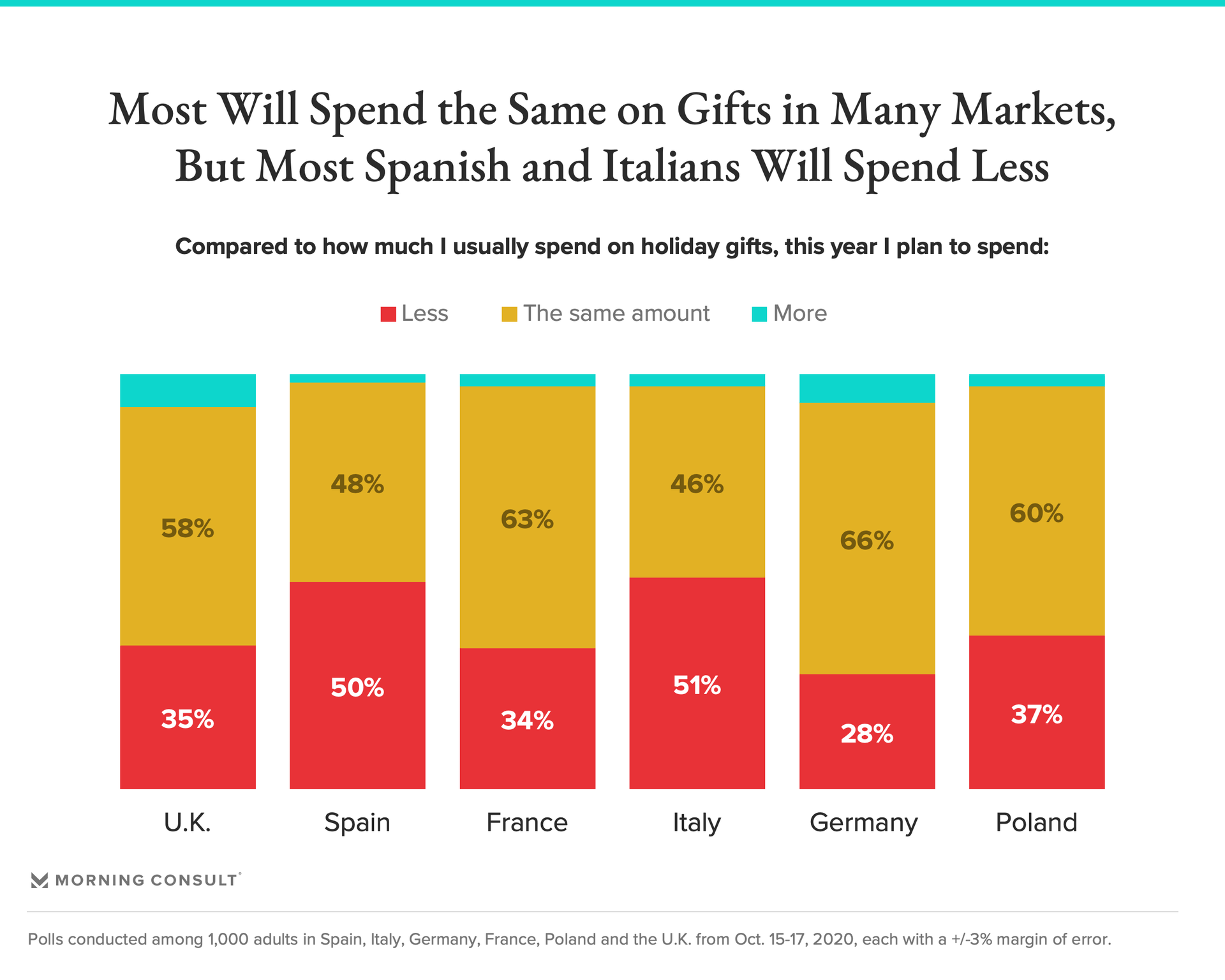

Anticipated spending on holiday celebrations largely parallels anticipated spending on gifts this year: Again, the majority of Spanish and Italian consumers plan to spend less than usual on holiday gifts this year, while a clear majority in other markets expect to spend about the same as they usually do.

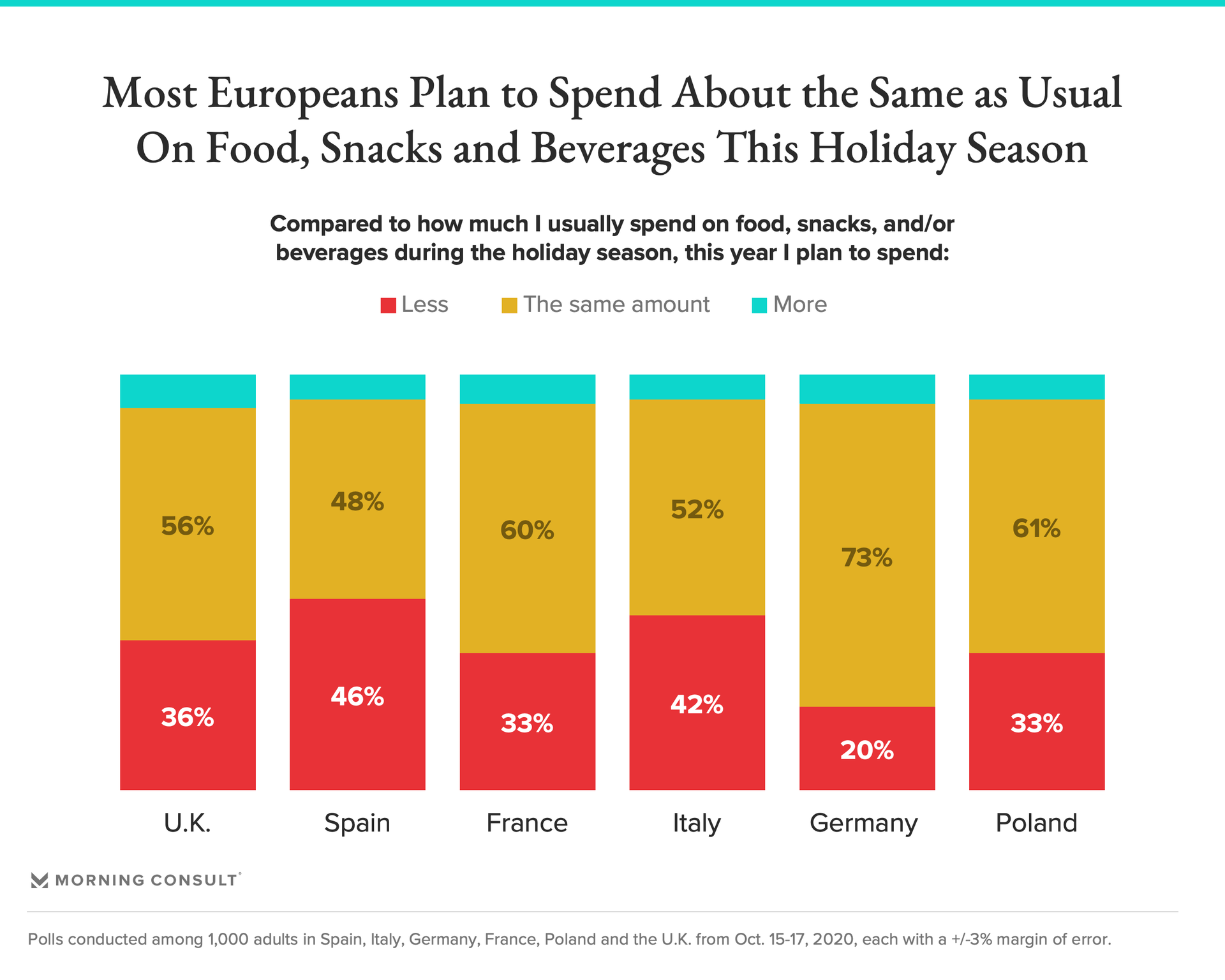

Most shoppers across markets also plan to spend about the same on food, snacks and beverages this holiday season, though this is again a slim majority of Italians (52 percent) and just under the majority of Spanish (48 percent). It’s also worth noting that 42 percent and 46 percent of Italians and Spanish respectively plan to spend less on food, snacks and beverages this holiday season, and that anywhere from 6 percent to 8 percent of each market plans to spend more.

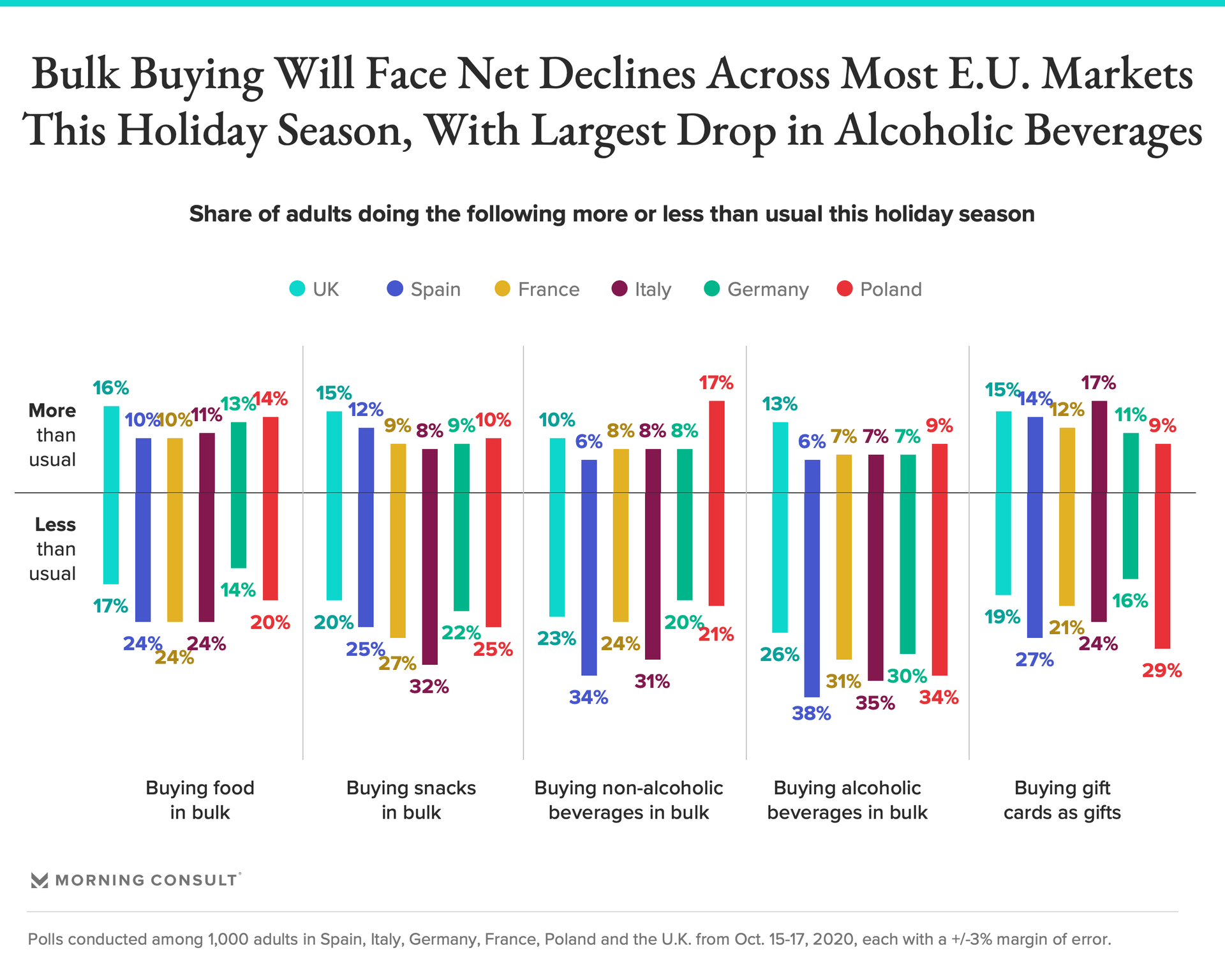

Compared to years past, roughly a third of consumers in each market plan to buy alcoholic beverages in bulk less — though nearly twice as many UK shoppers plan to buy these more this year than is the case in other markets. Beyond that, significant differences exist between markets’ expected changes in consumption this year:

- The Spanish, French and Italians are notably more likely to buy less food in bulk this holiday season; Italians are also significantly more likely to buy fewer snacks in bulk this year.

- While the Spanish and Italians are notably more likely to buy fewer non-alcoholic beverages in bulk this year, the Polish are nearly twice as likely as other markets to buy these more.

- The Polish and Spanish are notably more likely to buy fewer gift cards this year, while Italians are most likely to buy more.

As relates to luxury and premium goods specifically, outside of the United Kingdom, most consumers in key European markets say they have never bought these items and report no plans to buy them as gifts this year. A fifth of shoppers in France, Germany and Poland and 25 percent of UK shoppers plan to buy about as many of these goods as they have in the past.

Where they’ll shop

While UK shoppers are significantly more likely to do the majority of their holiday shopping online this year (49 percent plan to do so) and the Polish plan to rely mostly on in-store shopping (47 percent), a preference for online vs. offline holiday shopping is less clear-cut in other EU markets.

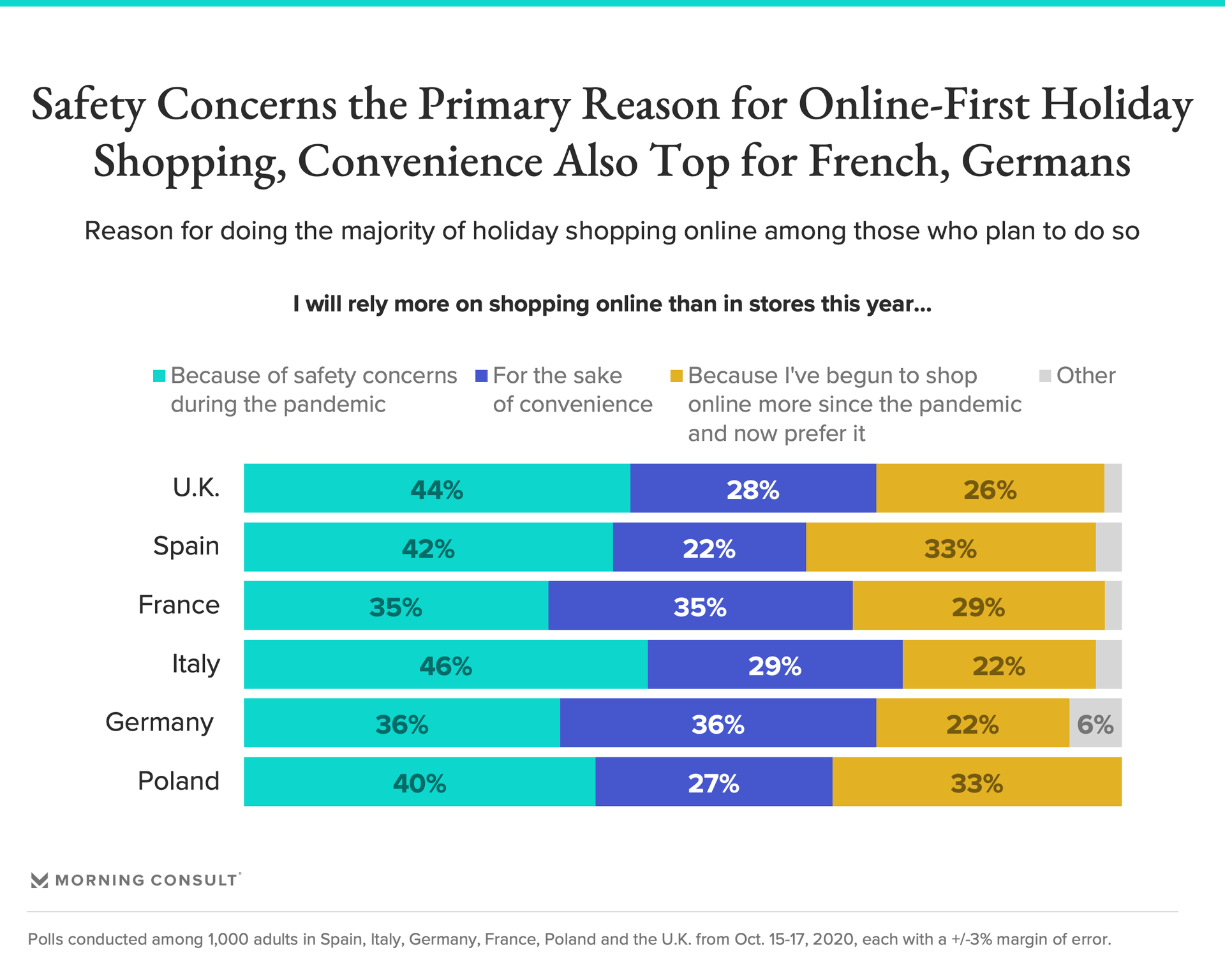

But across markets, those planning to do the majority of their shopping online this year cite pandemic-induced safety concerns as the primary reason why — though convenience is an equally strong driver of online shopping for French and German consumers. Still, a genuine preference for online shopping driven by increased comfort with this method due to COVID-19 is the main reason behind online-first holiday shopping for a third of Spanish and Polish shoppers.

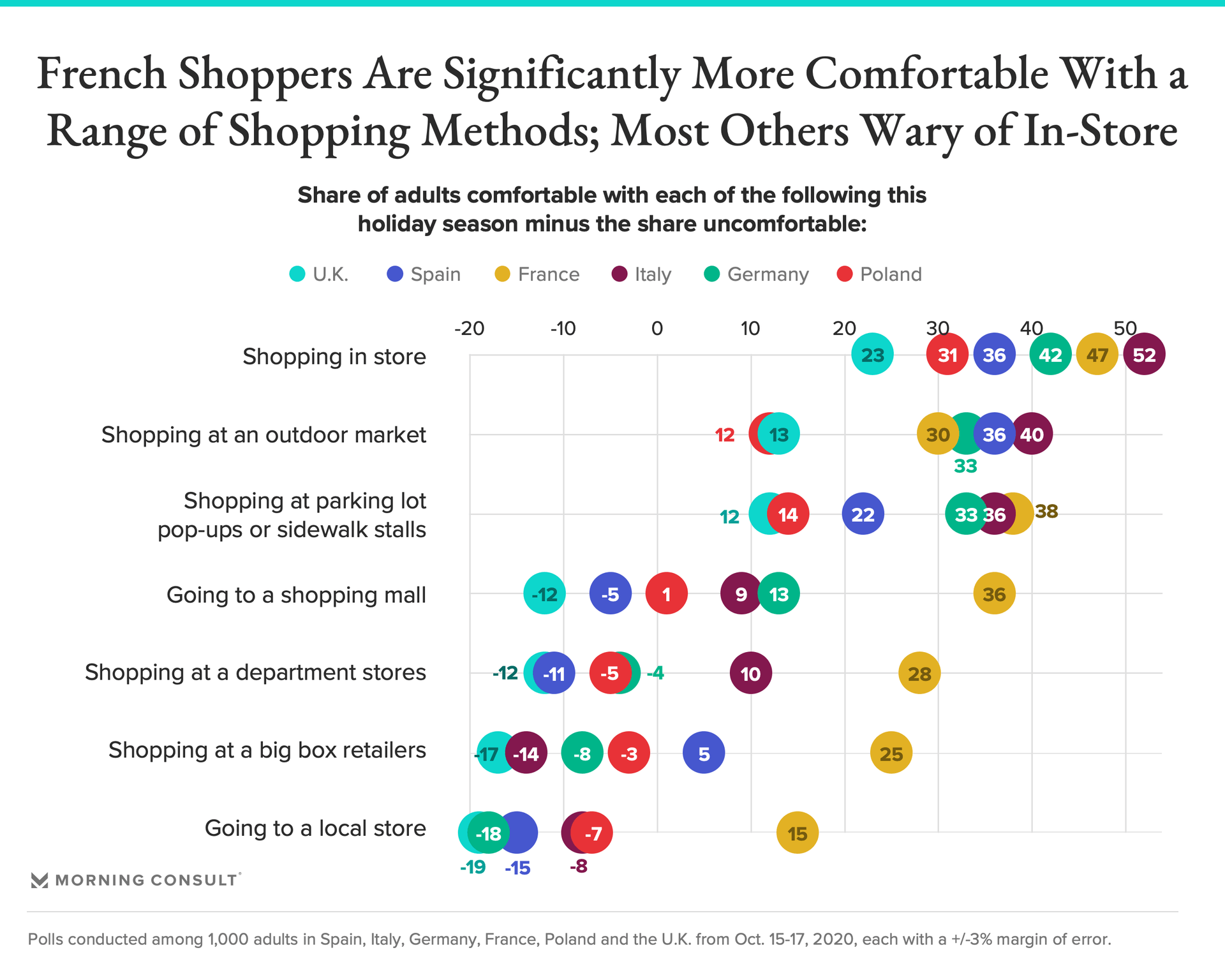

Related to those concerns, with the exception of the French, only a small net share of shoppers across markets is comfortable shopping in-store or at outdoor markets, parking lot pop-ups or sidewalk stalls. And in many markets, decidedly more shoppers are uncomfortable shopping at department stores, big box retailers or local stores this year than the share that says they are comfortable doing so.

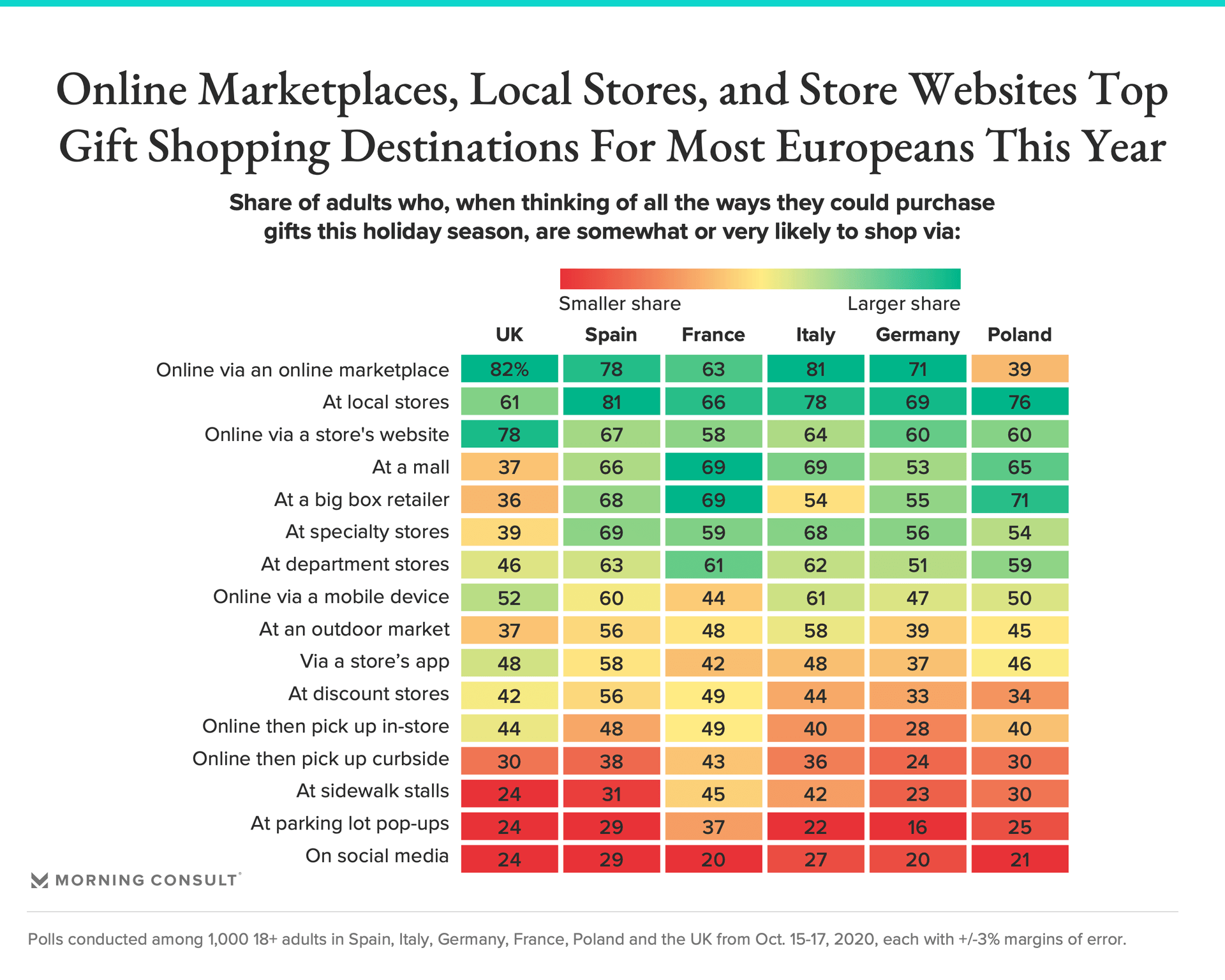

Given this context, Europeans in nearly every market plan to rely most heavily on online marketplaces for gift purchases, though Polish consumers are the notable exception (only 39 percent are likely to use this method versus an average of 75 percent likelihood across all other markets surveyed). Shoppers across markets are also highly likely to shop online via a store’s website, but local stores can expect significant traffic as well: An average of 72 percent of consumers across key markets likely to shop at these for gifts this year. Other offline channels are also among the most popular, from malls and big box retailers to specialty and department stores.

Conversely, social commerce as well as parking lot pop ups and sidewalk stalls are least popular this year: Less than a third of consumers in any market likely to shop these methods, outside of the 45 percent and 37 percent of French shoppers who say they are likely to shop at sidewalk stalls and parking lot pop-ups, respectively.

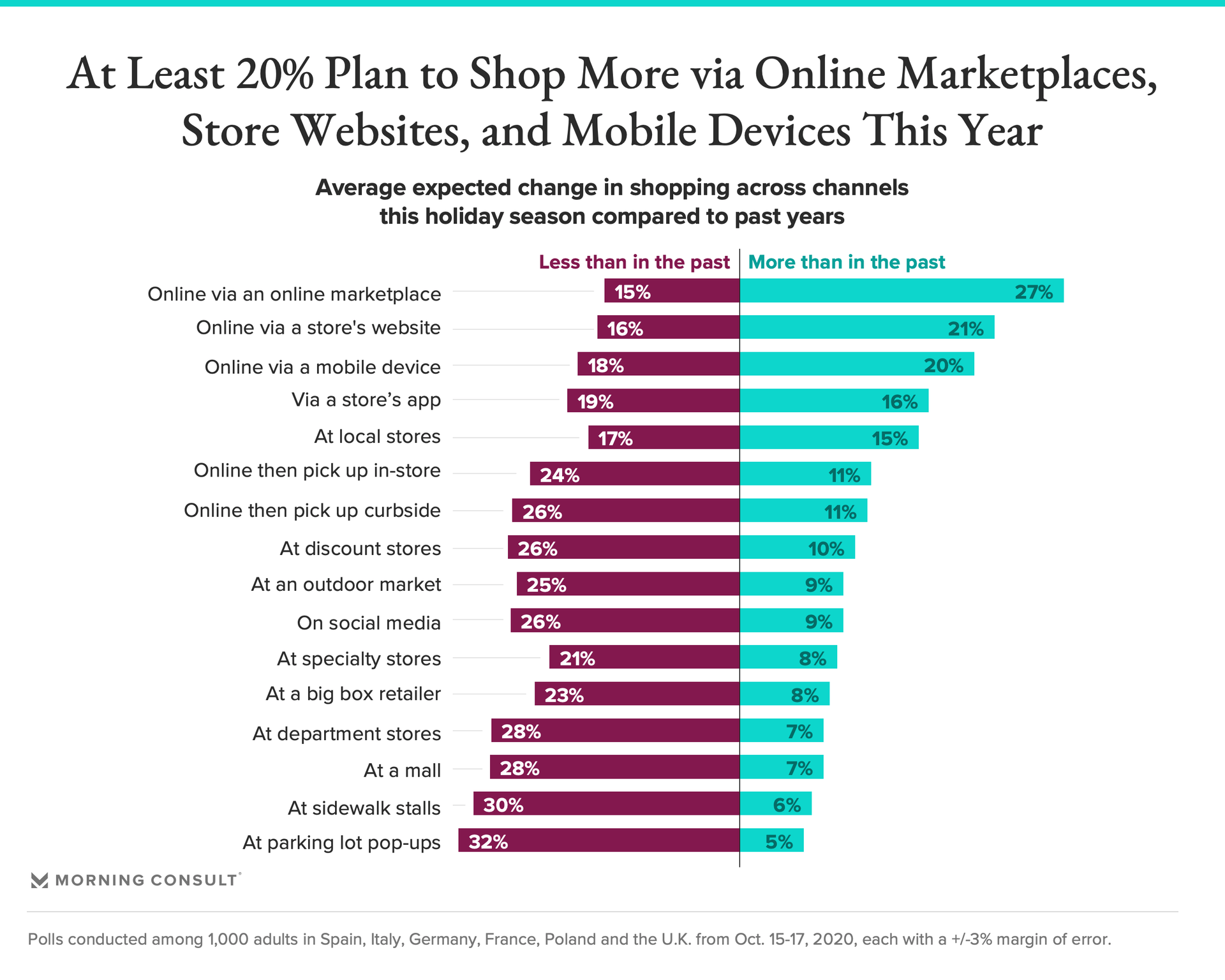

These likelihoods reflect expected changes in shopping across channels this holiday season relative to years past. Online via either online marketplaces, store websites or mobile devices will see the greatest upticks, with an average of one in five consumers across EU markets planning to use these more. Parking lot pop-ups and sidewalk stalls can expect the greatest declines in usage year-over-year — but so too can other traditional offline channels, with an average of anywhere from 21 percent to 28 percent of EU consumers expecting to shop these less in 2020.

What they’ll be buying and gifting

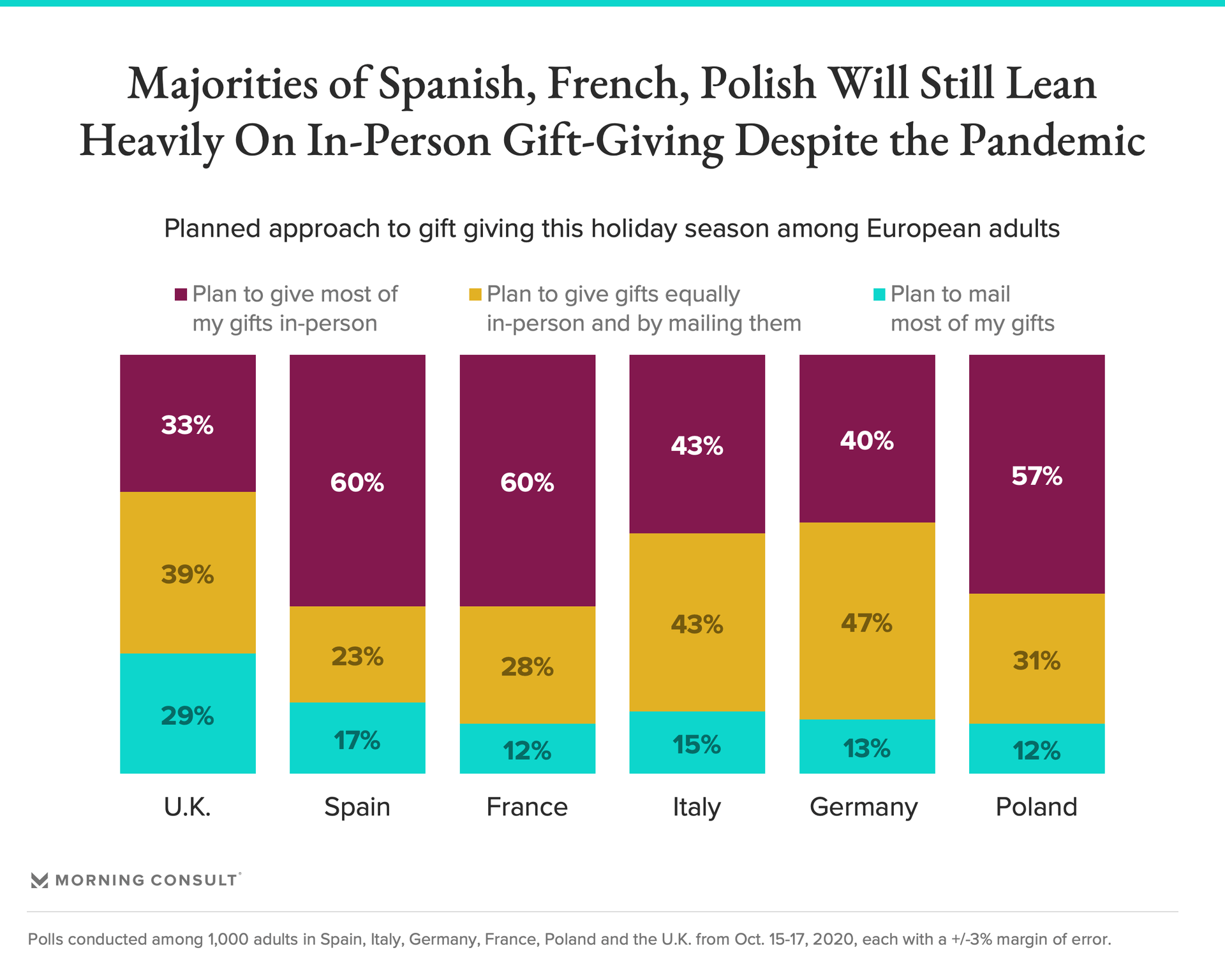

European markets and the United Kingdom are divided as to whether they will switch to mailing their gifts instead of giving them in-person: while the majority of Spanish, French, and Polish consumers plan to give most of their gifts in-person, more Germans and UK citizens plan to give their gifts via a mix of in-person and mailing. The UK is most likely to shift to mailing gifts, though under a third (29 percent) plan to do so.

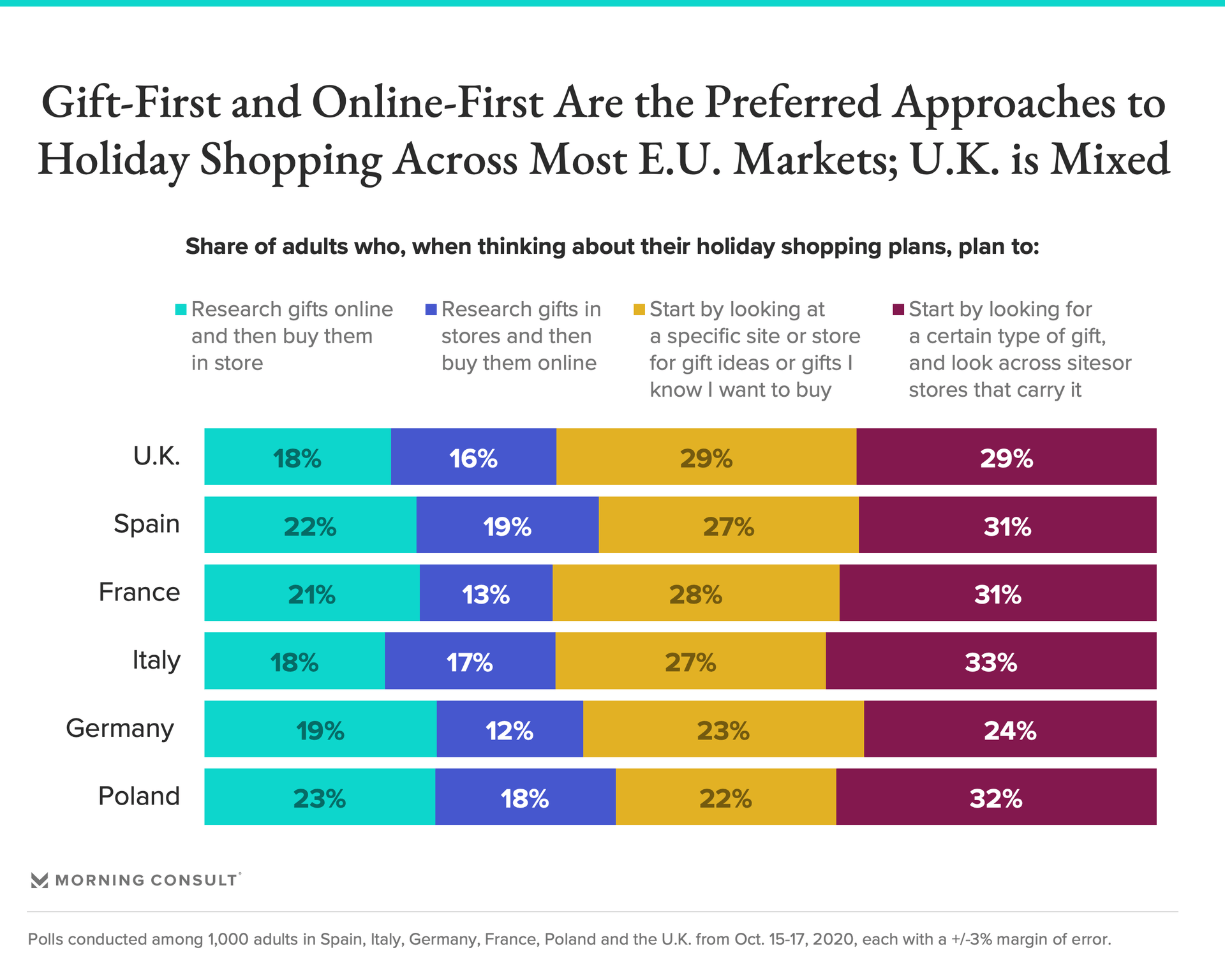

The approaches European shoppers plan to employ for gift shopping perhaps unsurprisingly vary by market. UK shoppers are most likely to do a mix of pre-planning and on-the-go discovery, while the majority of Germans and Polish shoppers plan to pre-plan. Spanish, French and Italian shoppers are also most likely to pre-plan but a sizable share -- nearly 3 in 10 -- still plan to do both equally in each of these markets.

In terms of gift planning and research, the most common approaches across markets are to either start by looking for a certain type of gift and then exploring sites or stores carrying it, or starting with specific sites or stores and from there identifying gifts of interest. The least popular strategy across all markets is researching gifts in store and then purchasing them online, likely a symptom of the COVID-19 related availability and health concerns expressed by shoppers in each market.

When it comes to finding gift ideas this holiday season, searching the internet is the top approach across markets, with two in five planning to do this. Window shopping is next most popular for Italians, with 31 percent planning to do this, while products seen on sites shopped on is next most likely for UK shoppers (30 percent plan to source gift ideas this way). A fair share of Spanish shoppers (30 percent) also plan to get gift ideas from the products they see on sites on which they shop, as are recommendations from friends (28 percent) or ads on TV (26 percent). Magazines will be a source of ideas for nearly a quarter of French and Spanish shoppers (24 percent and 23 percent, respectively). Notably fewer French say they will use ads seen on either TV or the internet for gift ideas (only 16 percent and 12 percent, respectively, plan to use these).

Products seen in the stores in which consumers in each market shop as well as recommendations from parents or family are also reasonably likely to play a role for around 3 in 10 in each market.

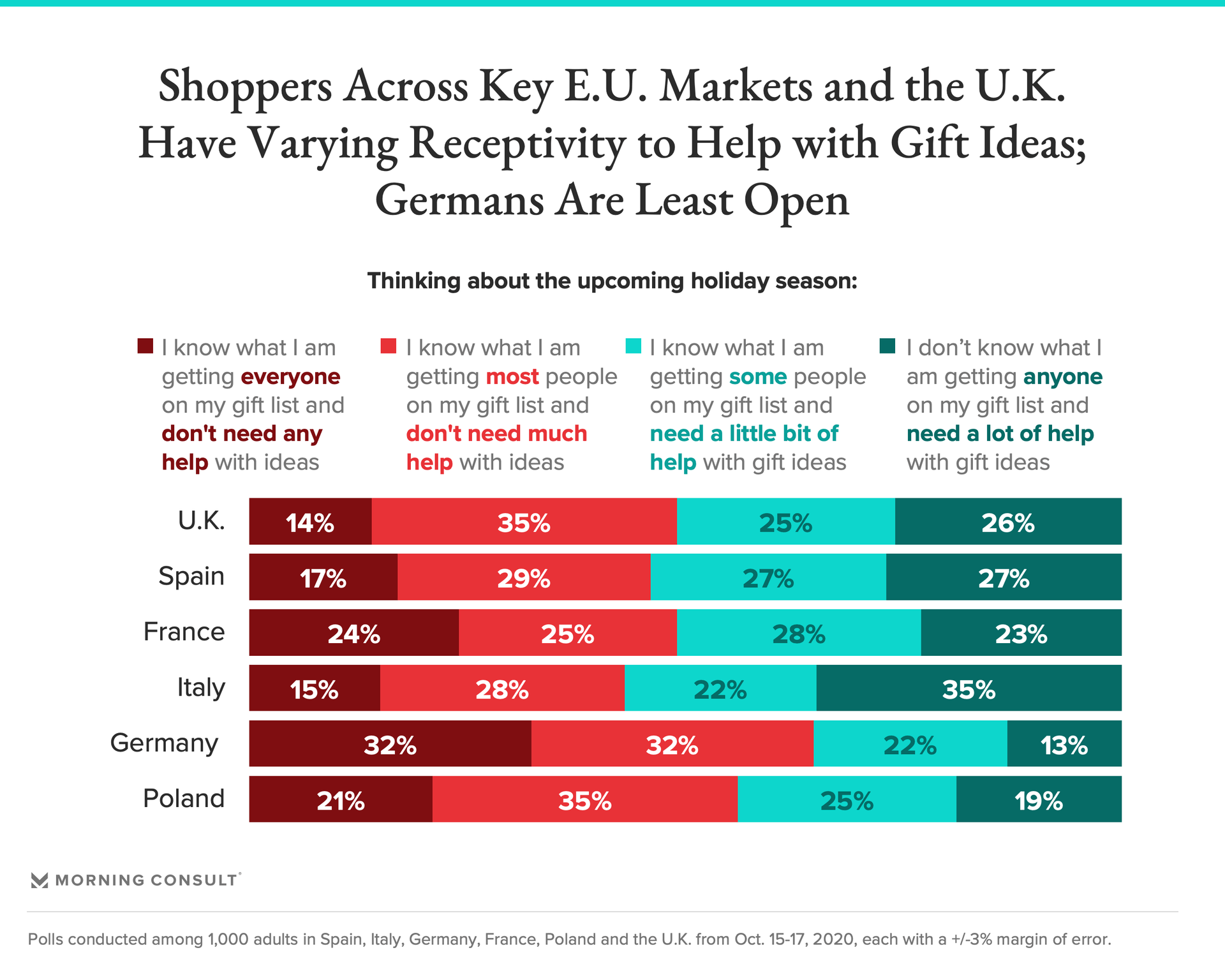

That said, it seems shoppers in some markets are more open to help with gift ideas than others. While roughly a third of Germans (32 percent) say they know what they are getting everyone on their list and don’t need any help with ideas, a slightly greater share of Italians (35 percent) doesn’t know what they’re getting anyone and could use a lot of help with ideas. Another near-third (32 percent) of Germans as well as 35 percent of both UK and Polish shoppers are mostly set with their gift lists, and don’t need much help.

In terms of specific gift types shoppers across markets plan to give, those that are either meant to be used, enjoyed or consumed at home or practical gifts are the most popular, though UK shoppers are notably more likely than those in other markets to give fun or entertaining gifts. Experiential and prestigious gifts as well as those that are spiritual or related to the holiday season are distinctly less popular across all markets, with very few consumers intending to give these.

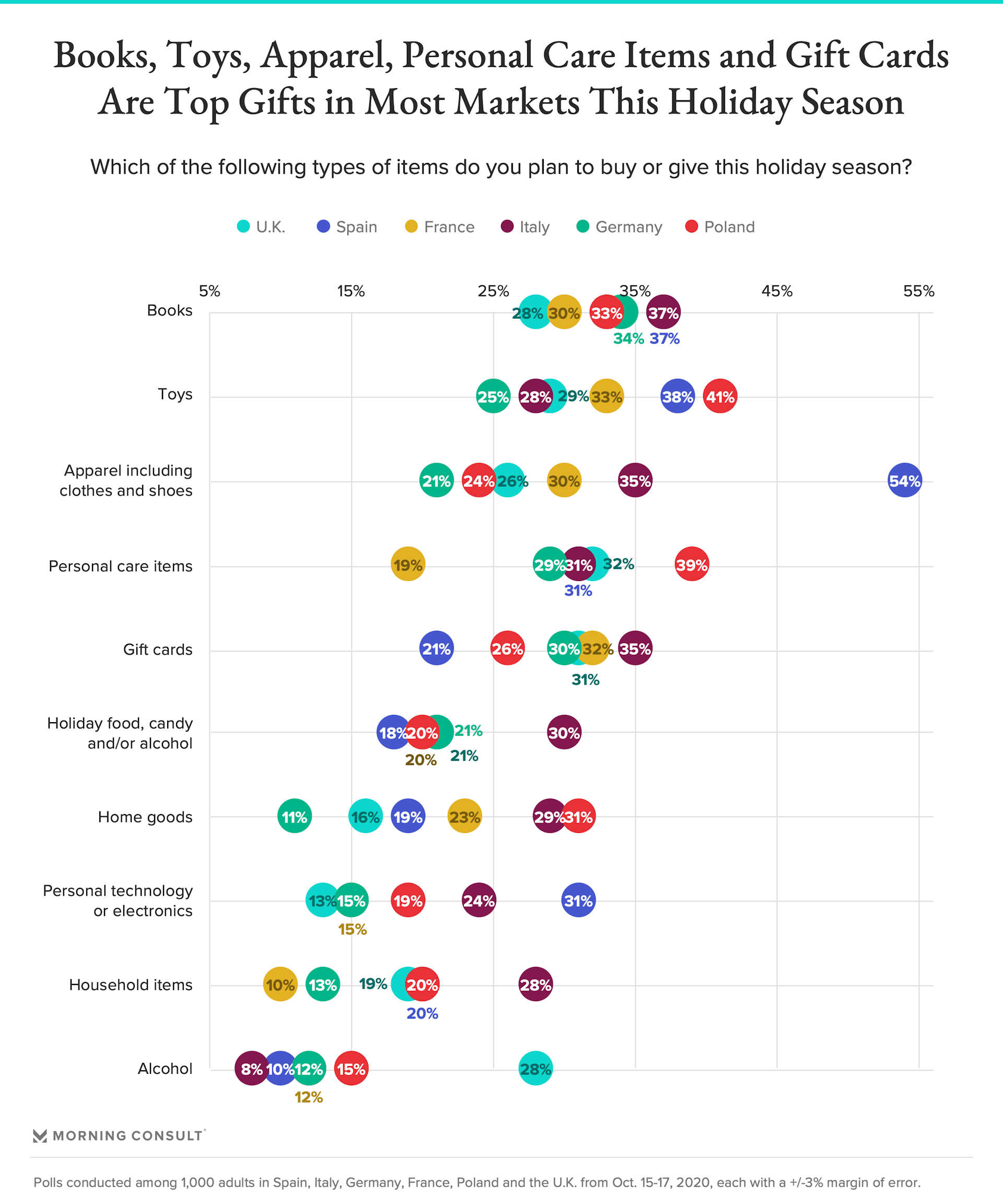

Books, toys, apparel, personal care items and gift cards are the top gift categories across most markets this holiday season, though some nuances exist on a market level:

- Apparel will be popular among the majority of shoppers in Spain (54 percent), and personal technology or electronics are also more likely to be popular among Spanish (31 percent) than in other markets.

- Toys (41 percent) and personal care items (39 percent) are of notably greater interest in Poland than in other markets.

- Home goods are of interest to notably more Polish (31 percent) and Italians (29 percent) than other markets’ shoppers.

- Italians are also notably more likely to gift holiday food, candy or alcohol (30 percent) and household items (28 percent) than others.

- Those in the UK are the most likely to give alcohol this year as a present, with nearly a third (28 percent) planning to do so.

Fewer than one in 10 in every market expects to buy gifts from certain categories— namely experiences, activities, at-home fitness equipment, furniture and subscription services — this year.

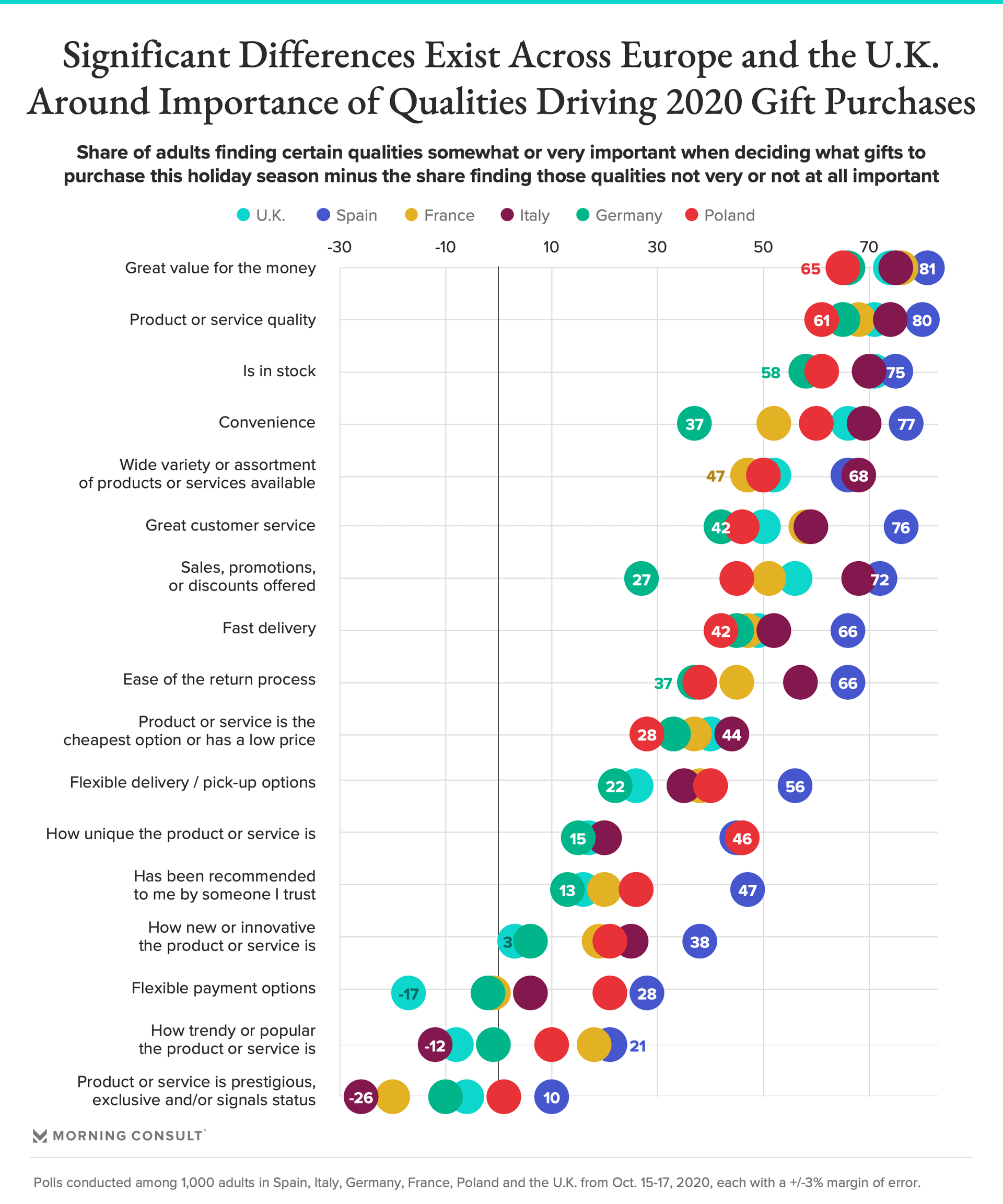

Spanish shoppers are more likely to find product or service qualities important to their gift purchasing decisions this year while Germans are notably less likely to, but a few qualities rise to the top in importance across all markets. Great value for the money is the most important trait to consumers in all markets, followed closely by the product or service’s quality and the item being in stock or readily available. Convenience is also generally important, though Germans are much less likely than other markets to prioritize this. A gift’s prestige or exclusivity, trendiness or popularity are less important qualities (though, again, relatively more important to Spanish consumers). Also worth noting:

- Spanish shoppers are notably more likely to consider flexible delivery or pick-up options, the item’s uniqueness, recommendations from someone trusted and flexible payment options important to their gift purchasing decisions.

- Polish shoppers are also more likely to find the item’s uniqueness and flexible payment options important.

- The variety of options available is notably important to German shoppers.

When it comes to features shoppers consider when deciding which brands or companies to purchase gifts from this holiday season, having an easy and seamless shopping experience, respecting and protecting customers' privacy and security, and having a good reputation are consistently top priorities across markets.

However, not far behind in overall importance are three qualities related to a company’s role within society: Whether taking care of and treating employees well, being environmentally-conscious or being socially responsible, clear majorities of consumers in each market say these will be important to decisions around which companies to buy from this holiday season.

Conclusion

As in the United States, COVID-19 and other events defining 2020 more broadly are dramatically reshaping the way Europeans will celebrate and shop during this year’s holiday season. With travel substantially stifled, certain types of spending reduced, and health and safety concerns rampant, certain strategic shifts will be critical for brands to win in any European market. But it’s also clear that differentiated messaging, channel, and even gift discovery strategies will be essential for international brands seeking to ensure relevance and build relationships within these highly nuanced markets.

For more on Morning Consult's full coverage of the 2020 holiday shopping season, check out our collection of insights and analysis here.

Victoria Sakal previously worked at Morning Consult as a brands analyst.