Even as Inflation Cools, Consumers Continue to Cost Cut

Key Takeaways

71% of consumers said they looked for deals, coupons or other discounts to help save money in December 2023, a 7-percentage point decrease compared with a year ago.

Smaller shares of consumers report using a variety of savings tactics while shopping, but majorities are still employing them, especially deal hunting.

Some savings tactics that consumers employed during periods of high inflation may stick around even as prices normalize.

Sign up to get the latest global brand, media and marketing news and analysis delivered to your inbox every morning.

Even with a small uptick in December, inflation looks to be headed in the right direction after reaching 40-year highs in June 2022. And though consumers’ concerns about inflation are cooling, the recent historic price growth appears to have left them with a mindset that could shape behavior for years to come.

Concerns about inflation are waning, but remain elevated

Consumers are less likely to report hearing about inflation than they were a year ago. The share of U.S. adults who said they have heard “a lot” about inflation fell 13 percentage points from 56% in December 2022 to 43% in December 2023.

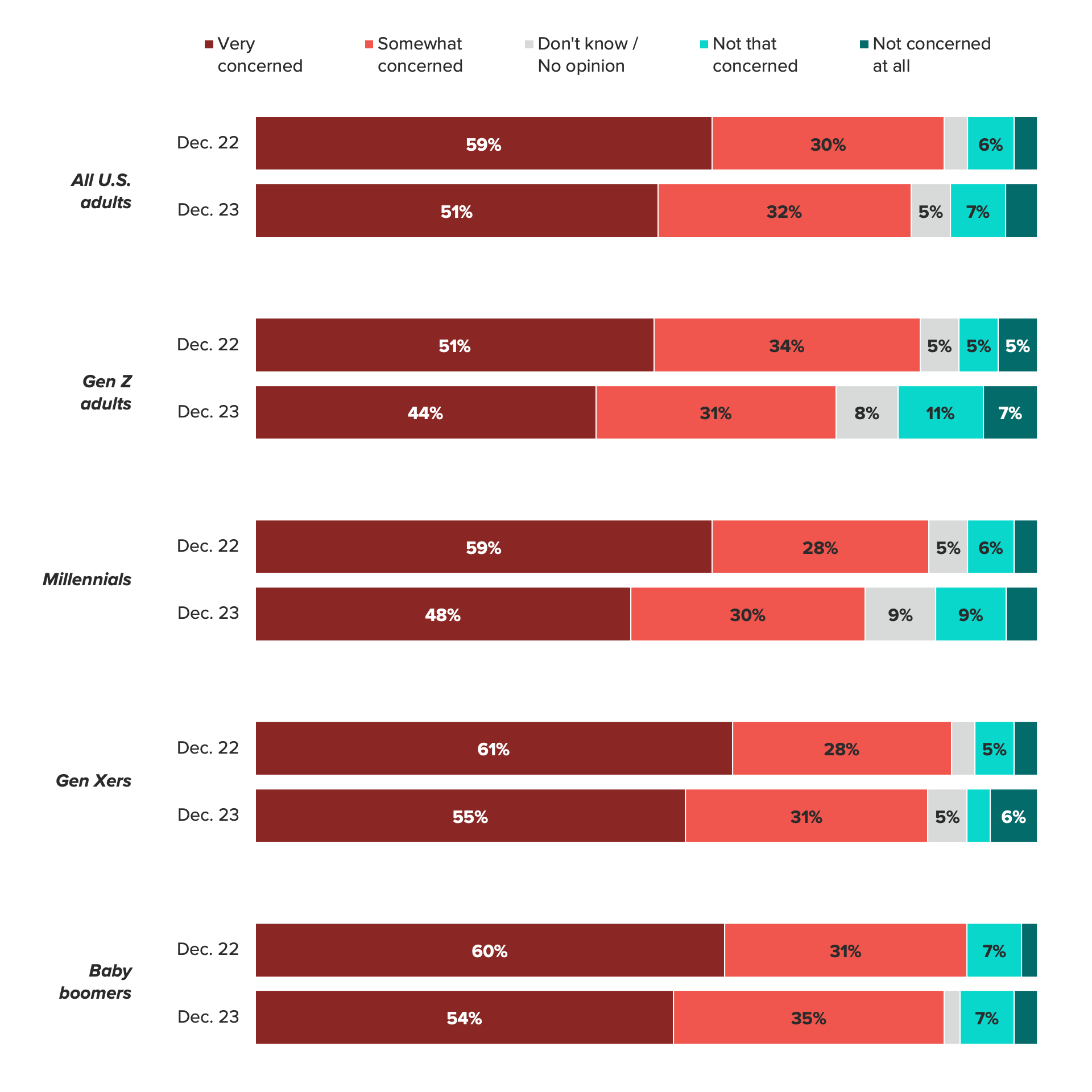

This decline in intensity is translating to slightly less worries. When asked how concerned they are about inflation, about half (51%) of U.S. adults reported being “very concerned,” an 8-point drop from the year prior.

Inflation Worries Remain High but Are Declining

Compared with a year ago, Gen Zers and millennials are less concerned about inflation compared to their older counterparts. Concerns among those groups dropped 11 and 9 points, respectively, while Gen Xers’ and baby boomers’ concerns only saw a 3-point decline. (Baby boomers’ financial well-being has consistently tracked higher than other generations.)

The larger shift from younger consumers could be for a number of reasons, including a relatively strong job market, rising wages and that they are less likely to be on a fixed income. Plus, inflation has been slowing for months, so it’s possible this is starting to be recognized by these consumers. But there’s still a lot more room for improvement, even among those who are the least likely to be concerned.

A gloomy mindset may stick with consumers, even if inflation continues to improve. And it wouldn’t be the first time. Even after the 2008 recession ended and there were positive signs of economic improvement, polling showed that many Americans still believed the country was in a recession.

Consumers are less likely to be taking cost-cutting actions, but some behaviors look to be sticking

There are similarly positive signs in how consumers are shopping. But similar to inflation concerns, large shares of consumers still report employing cost cutting measures. Looking for deals, coupons and other discounts remains the most cited action to help save money. Roughly 7 in 10 consumers said they did this in December, a 7-point decrease from the year prior.

Cost Cutting Remains a Priority for Consumers Even as Inflation Cools

The shopping behaviors which saw the largest changes were shopping less overall and delaying minor purchases. These saw 11- and 12-point drops, respectively. Shopping at discount stores and delaying major purchases were the savings behaviors that saw the smallest changes compared with a year ago, a sign that these behaviors might be becoming more entrenched.

The cost-cutting behaviors most utilized by Gen Zers and millennials in December 2023 were dealing hunting, shopping less overall and shopping at discount stores. Shopping at discount stores is particularly interesting because it is a savings tactic that doesn’t necessarily require consumers to give something up, but allows them to still shop for what they want and need, just at a different store.

New audiences, like Gen Z, turning to discount stores even helped Dollar General land a coveted spot on our Fastest Growing Brands list. The retailer earned the No. 15 spot in our Gen Z ranking after seeing an 11-point jump in purchasing consideration from the beginning of 2023.

Nicki Zink is deputy head of Industry Analysis. Her team identifies trends affecting key demographics across food & beverage, travel & hospitality and financial services. Prior to joining Morning Consult, Nicki served as the head of digital intelligence at Purple Strategies, a corporate reputation and strategy firm. She graduated from Miami University with a bachelor’s degree in mass communication. For speaking opportunities and booking requests, please email [email protected].