Brands

Fastest Growing Brands Report 2023

Report summary

Morning Consult’s Fastest Growing Brands 2023 is the definitive measure of brand growth for both emerging and established brands, showcasing a wide range of companies and products that have accelerated their consumer appeal and awareness in 2023.

In this report, we rank the top 20 brands that have seen the biggest rise in purchasing consideration this year, explore how that is playing out across generations and reveal which brands have seen a lift in purchasing consideration, even if it didn’t translate to an immediate or direct increase in buying.

Morning Consult’s Fastest Growing Brands rankings are determined by measuring growth in the share of consumers who say they would consider purchasing from a brand over the course of the year. Morning Consult Brand Intelligence tracks consumer perceptions on thousands of brands on a daily basis, forming the foundation of this report.

Want brand tracking built uniquely for your brand? Learn more and get in touch.

Key Takeaways

- 2023 was generative AI’s breakout year: ChatGPT is our No. 1 fastest growing brand.

- It’s social media’s world; we’re just living in it: Facebook, Instagram, Instagram Reels and YouTube Shorts all made the list.

- Go viral — but then make the most of it: Brands such as Starry and Clinique turned buzz into lasting purchasing consideration.

- Gen Z gets thrifty with Dollar General: Economic uncertainty and social media virality pushed more young shoppers to the discount brand.

- Messi boosted Major League Soccer: Millennials especially loved Messi’s splashy arrival stateside.

Highlights from this report

Generative artificial intelligence made a splash in 2023, even as its skeptics amassed.

The beginning of this year felt a bit like we were living in the future. Consumers had unprecedented access to developing generative artificial intelligence models via applications such as ChatGPT and DALL·E. AI dominated the headlines, and even after a fair amount of bad press about the unintended consequences of the technology, GAI brands garnered enough purchasing consideration to earn high spots on our Fastest Growing Brands® list.

We also see social media’s impact on this year’s list like never before. Not only are there four social media brands on our main list, but many of the other top-ranked brands can attribute their strong social media acumen or utility to a growing community of digital creators.

Our country’s continuing economic uncertainty also played a role in shaping this year’s rankings. Read on for our case studies on these brands and more.

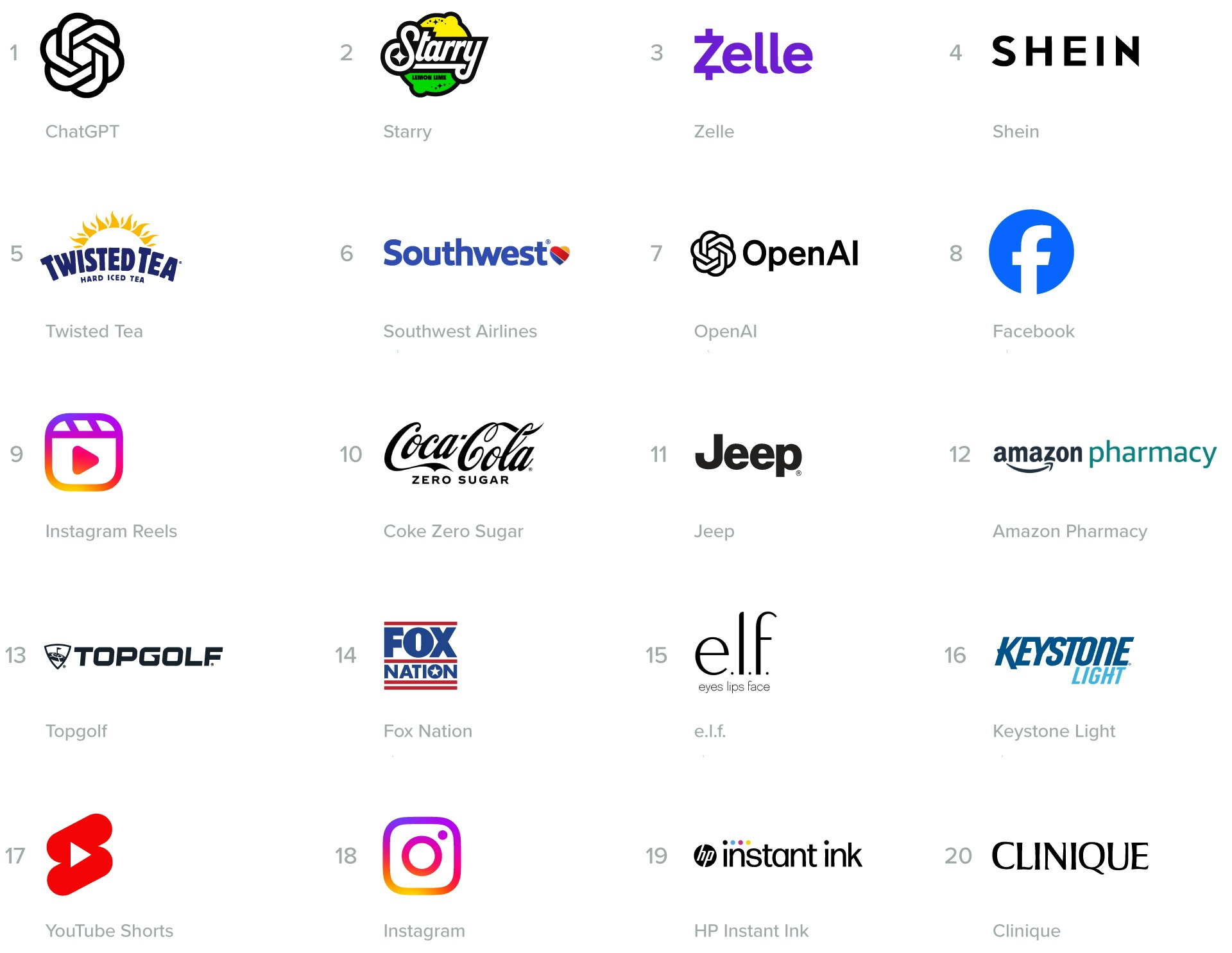

Fastest Growing Brands 2023: All U.S. adults

Methodology

Morning Consult’s Fastest Growing Brands rankings are determined by measuring growth in the share of consumers who say they would consider purchasing from a brand over the course of the year. Morning Consult Brand Intelligence tracks consumer perceptions on thousands of brands on a daily basis, forming the foundation of this report.

Growth was determined by taking the share of consumers who said they were considering purchasing from the brand from Oct. 1-24, 2023, and subtracting the share who said the same from Jan. 1-31, 2023. The Fastest Growing Brands 2023 analysis was conducted among 1,586 brands. Sample sizes ranged from 1,069 to 17,661 responses collected among U.S. adults, with respective margins of error ranging from +/-3 to +/-1 percentage points.

Military brands, higher education institutions, brands that had not gathered a comparable sample size and brands that no longer existed (excluding rebrands) as of Oct. 31, 2023, were removed from eligibility for the public-facing ranking.

Editor's note: This report has been updated to reflect that Pure Life Water is no longer part of the Nestle brand in North America.

About the authors

Joanna Piacenza leads Industry Analysis at Morning Consult. Prior to joining Morning Consult, she was an editor at the Public Religion Research Institute, conducting research at the intersection of religion, culture and public policy. Joanna graduated from the University of Wisconsin-Madison with a bachelor’s degree in journalism and mass communications and holds a master’s degree in religious studies from the University of Colorado Boulder. For speaking opportunities and booking requests, please email [email protected].

Amy He leads Industry Analysis at Morning Consult. Prior to joining Morning Consult, Amy served as the executive editor at eMarketer, and was a China reporter for many years. She graduated from New York University with a bachelor’s degree in journalism and East Asian studies. For speaking opportunities and booking requests, please email [email protected].

Nicki Zink is deputy head of Industry Analysis. Her team identifies trends affecting key demographics across food & beverage, travel & hospitality and financial services. Prior to joining Morning Consult, Nicki served as the head of digital intelligence at Purple Strategies, a corporate reputation and strategy firm. She graduated from Miami University with a bachelor’s degree in mass communication. For speaking opportunities and booking requests, please email [email protected].

Jordan Marlatt previously worked at Morning Consult as a lead tech analyst.

Lindsey Roeschke is an analyst whose work focuses on behavior and expectations of consumers in the travel & hospitality and food & beverage categories, particularly through a generational and cultural lens. Prior to joining Morning Consult, she served as a director of consumer and culture analysis at Gartner. In addition to her research and advisory background, Lindsey has more than a decade of experience in the advertising world. She has lived and worked in seven cities across four continents.

Jaime Toplin previously worked at Morning Consult as a senior financial services analyst.

Ellyn Briggs is a brands analyst on the Industry Intelligence team, where she conducts research, authors analyst notes and advises brand and marketing leaders on how to apply insights to make better business decisions. Prior to joining Morning Consult, Ellyn worked as a market researcher and brand strategist in both agency and in-house settings. She graduated from American University with a bachelor’s degree in finance. For speaking opportunities and booking requests, please email [email protected].

Mark J. Burns previously worked at Morning Consult as a sports analyst.

Kevin Tran previously worked at Morning Consult as the senior media & entertainment analyst.

Wesley Case is a research editor on the Industry Intelligence team, focusing on coverage of entertainment, brands and sports. Prior to joining Morning Consult, he was an editor at The Athletic and a features reporter and critic at The Baltimore Sun. Wesley graduated from the University of Delaware with a bachelor’s degree in English and a concentration in journalism.

Brian Yermal previously worked at Morning Consult as a research editor on the Industry Intelligence team.