Consumers Are Still Looking for Cheaper Alternatives to Essentials

Key Takeaways

Slowing inflation, along with ample supply for most goods, is helping to support consumer purchases ahead of the holidays, but consumers remain highly price-conscious.

Trading down is less of a factor for most goods and services than it was a year ago as more retailers promote discounts. However, consumers’ willingness to seek out cheaper alternatives and their strategies for doing so vary by category.

Inflation expectations have fallen this year as price growth has slowed, but they have recently begun to level off as prices in major categories like food and housing remain stubbornly elevated.

This memo offers a preview of Morning Consult’s December Inflation & Price Pressures Report. Morning Consult Economic Intelligence subscribers can access the full report here.

Following a reprieve from price growth in October, more U.S. adults experienced higher-than-expected prices on purchases last month. Prices continue to impact purchasing decisions this holiday season: Consumers showed higher price sensitivity on discretionary purchases compared with a year ago and continued trading down for high-priced essentials. Plentiful supply and modest demand growth for categories like durables could help cool prices further, but factors like still-elevated housing costs suggest the inflation trajectory may be bumpy.

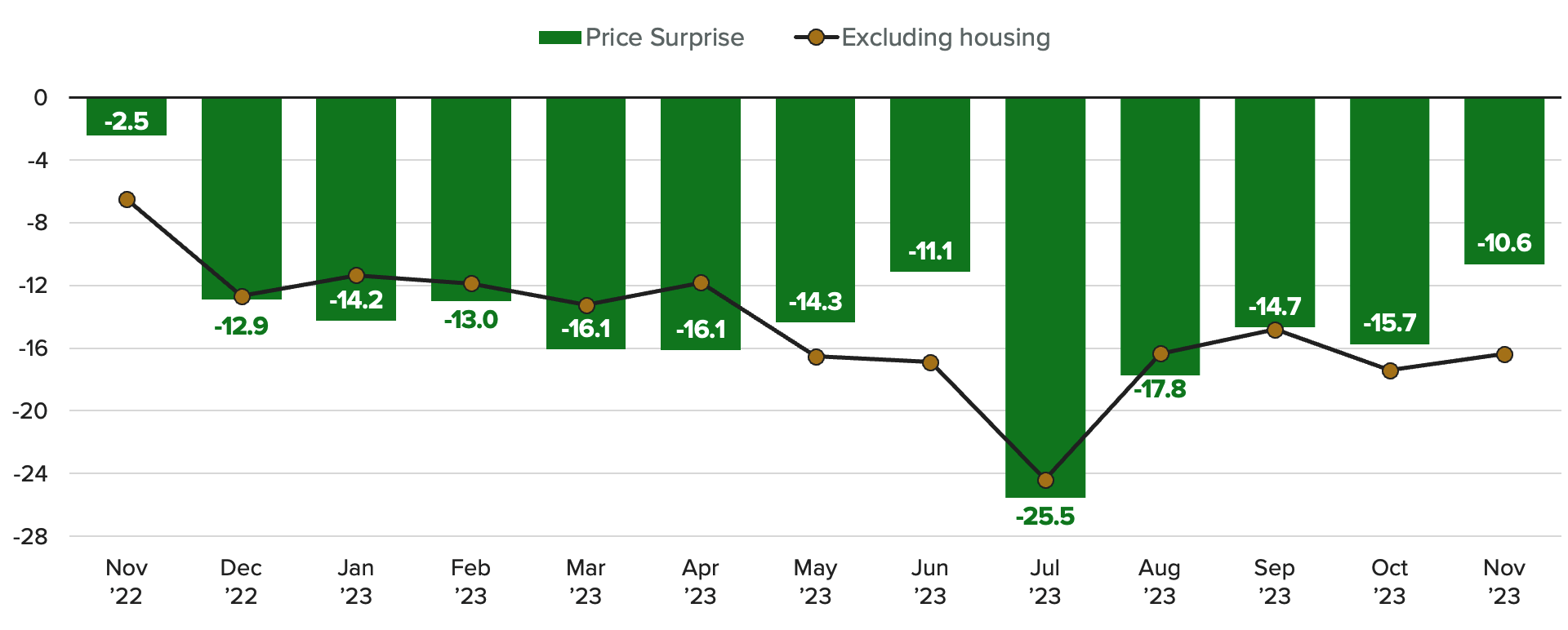

Inflation May Have Picked Up Again for Some Categories in November as Consumers Reported More Upside Price Surprises

Morning Consult’s Price Surprise Index tracks the prevalence of consumers’ reporting higher-than-expected prices when purchasing various goods and services. The measure tracks closely with top-line inflation, registering a 0.90 correlation with the annual rate over the past year. Overall, price surprise tends to be a negative score, as consumers are more likely than not to have a sense of what goods and services cost.

However, month-over-month increases in the Price Surprise Index have tended to be indicative of a pickup in inflation. In January, April and August 2023, monthly increases in the index coincided with a month-over-month increase in the rate of inflation, suggesting price growth may have escalated in November from last month’s flat reading.

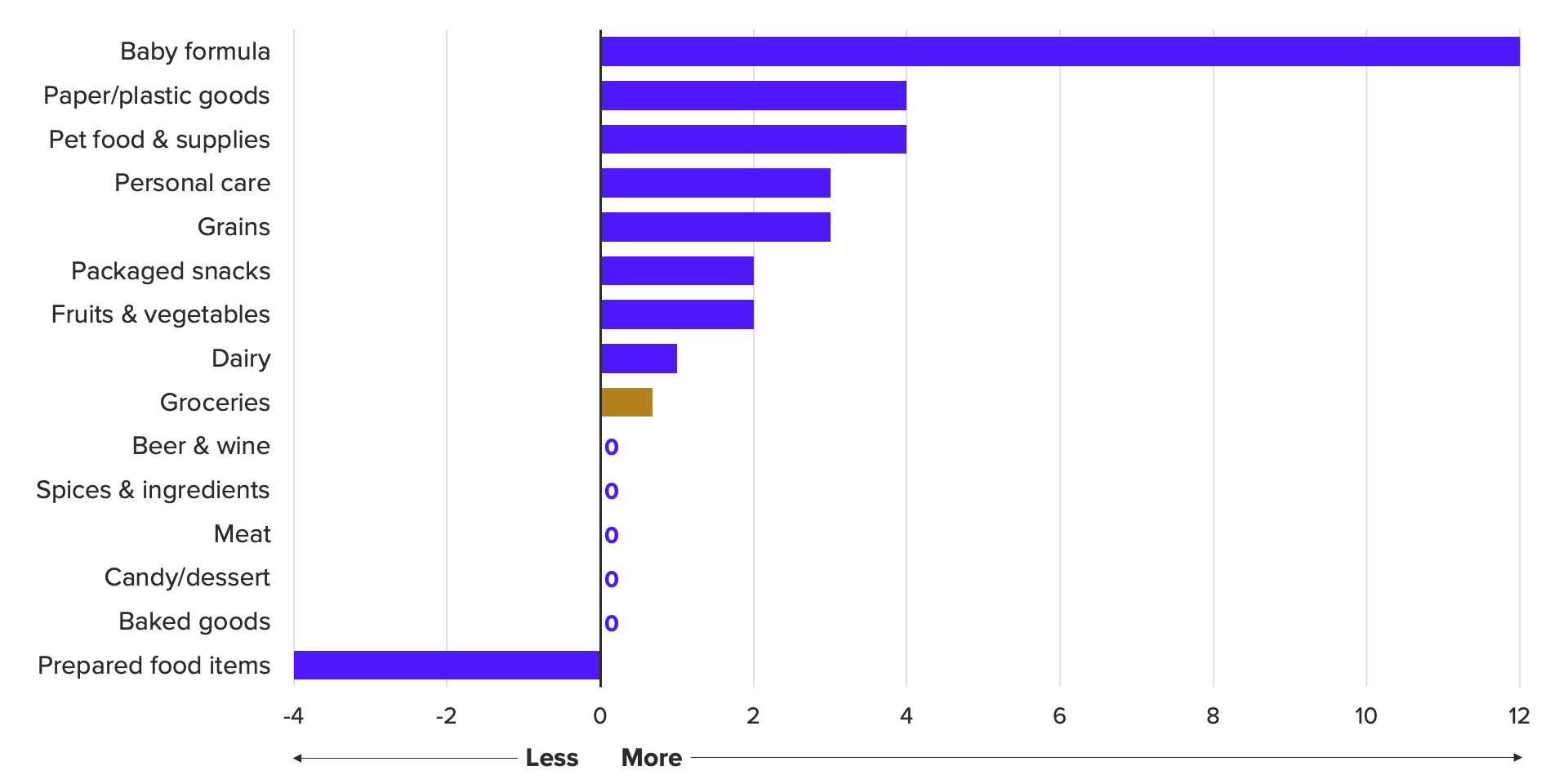

Sticker Shock Won’t Stop Consumers From Buying Essentials, but Packaged Snacks and Baked Goods Are More Readily Cut From Budgets

The grocery category is contributing to higher price sensitivity for nondurables compared with a year ago. However, not all grocery products are treated equally by consumers. In fact, many of the categories eliciting the most surprise about high prices are the same ones for which consumers are least price sensitive. Baby formula stands out with the highest level of price surprise, but given the critical nature of this product, consumers are unlikely to walk away from buying it. More discretionary categories, like packaged snacks or baked goods, are being left out of grocery carts to save on costs, even though prices for these items aren’t causing as much surprise.

Those who simply can’t afford the higher-than-expected prices for staple categories are seeking out alternatives rather than walking away from these purchases. Since trading down requires additional effort, this behavior is most concentrated among staple categories. Consumers have been less inclined to apply this extra effort to track down affordable alternatives for discretionary items like meat, candy or prepared food. These items are more of a nice-to-have than a need-to-have, so sticker shock more often results in walking away from a purchase rather than making a cheaper purchase within the same category.

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]