Beauty Shoppers Turn to Mass Brands For Savings

Key Takeaways

Purchasing consideration for mass beauty brands is accelerating faster than that of prestige brands. Budget-friendly brands’ purchasing consideration rose 4.7 points since Q2 of 2022.

Younger consumers are more likely to use prestige brands, mixing high-end and budget-friendly products in their routines.

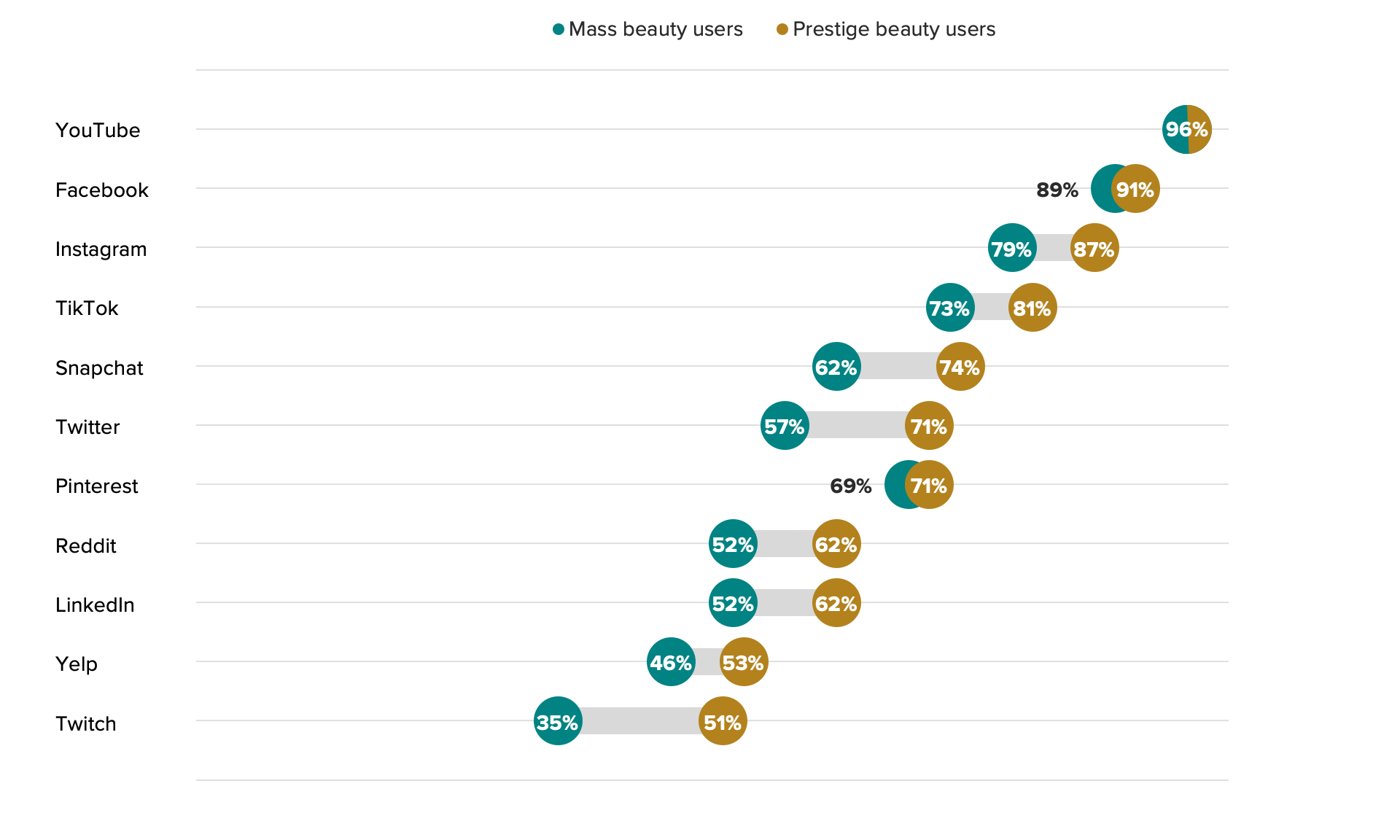

These prestige beauty shoppers tend to use social media more than mass brand shoppers. Spending more time on platforms where cosmetic content is prevalent helps to reinforce shoppers’ inclination towards splurging on premium brands.

Download our new report, the State of Beauty and Personal Care, for a deep dive into industry trends and consumer behavior.

Last year was a bumpy one for the beauty industry, but retailers and brands were seeing positive momentum as the page turned to 2025. Ulta raised their 2024 outlook, Sephora performed "remarkably well” per LVMH, but beauty brands have still seen their share of stumbling blocks.

Cost pressures mean consumers need to be discerning about their purchases. They’re willing to spend, but brands charging high prices have to justify their worth. The good news is purchasing consideration for both mass and prestige beauty brands is rising, but mass brands have seen more of a boost recently, helped along by shoppers seeking to save costs and the trend of posting dupes, or lower cost alternative products on social media. Prestige brands are still very attractive to younger consumers who spend time on social media, and are particularly attuned to the category.

Purchasing consideration is rising for beauty, with a recent boost for mass brands

Mass beauty brand purchasing consideration has seen a stronger growth trend than that of prestige brands in recent months as more shoppers have traded down to mitigate the impact of the rising cost of living on their budgets. Mass brands have been introducing more premium versions of products in this time with stronger efficacy claims, which contributes to this boost. While both brand groups saw growth in their purchasing consideration scores over the last two years, the budget-friendly brands rose 4.7 points, as compared to 2.4 points for prestige brands.

Purchasing consideration for mass beauty brands is accelerating

The rising popularity of drugstore brands like NYX Professional Makeup and e.l.f. Cosmetics have helped this trend along, as these brands are often cited as offering great dupes for prestige brand products. E.l.f. Cosmetics Super Bowl ads featuring stars like Jennifer Coolidge have also spurred this growth in awareness and purchasing consideration.

Both budget and prestige brands are benefiting from prevalent “get ready with me” videos on social media platforms like Instagram and TikTok, where users watch influencers apply their makeup products. These videos typically feature a mix of budget-friendly and high-end makeup products.

Young consumers are more likely to use prestige beauty brands

The audiences for mass and prestige beauty brands are not mutually exclusive — many cosmetics users blend high and low-cost products in their routines. However, there are some notable gaps between who tends to use high end brands, and who favors the budget-friendly options.

First, high-end beauty brand users are younger, with higher representations among Gen Zers and millennials. They’re also naturally wealthier, as anyone who is going to pay $45 for one tube of lipstick has to have discretionary income. Gen Zers may not have the wealth of older adults (yet), but they’re also less likely to have financial responsibilities like children and tend to prioritize this category in their discretionary spending.

Prestige beauty users tend to be younger, and seek social validation

Prestige beauty shoppers are also trend driven and status conscious. Similar to those who shop from luxury fashion brands, having the latest trendy products in beautiful, weighty packaging is both a status symbol and self assurance for this particular consumer cohort.

Prestige beauty shoppers are extremely online

Cosmetics users who buy prestige brands are more likely to use all social media channels in this analysis, except for YouTube, which is equally popular across all beauty consumers. Their keen sense of social status explains some of this behavior, but many of these platforms also have unique benefits and communities for beauty brands to tap into.

Prestige beauty brand users are heavy social media users

Platforms like YouTube, Instagram and TikTok see a lot of influencer activity relevant to the sector, with tutorials and “get ready with me” content where creators recommend and demonstrate beauty and skincare products. Here, shoppers find community and advice. Reddit has several active forums for beauty and skincare (the subreddit r/SkincareAddiction has 4.2 million members) where users can ask questions, post pictures, and evangelize products.

Partnering with beauty influencers is a necessity for beauty and personal care brands, but Reddit is less welcoming of sponsored content and brand participation.

Earning the attention of beauty shoppers is one thing, retaining their loyalty long-term is another, especially as financial pressure drives customers to find lower-cost alternatives for their favorite products.

For more on beauty and personal care shopping trends, download our new report, the State of Beauty and Personal Care.

Morning Consult Intelligence customers can access the platform here. If you are interested in learning more about our audience profile data, reach out to your Morning Consult contact or email [email protected].