Money 20/20 Europe: 5 Things to Keep in Mind About Consumer Finances and Relationships

When thousands of fintech professionals gather for this year’s Money 20/20 Europe conference, there will likely be jargon-filled conversations about product ideation, value chains, monetization strategies and distributed ledger technology. But to continue creating products that are truly consumer-oriented, leaders will need to stay grounded in the realities of their customers’ everyday lives — how they’re thinking about and experiencing the rapidly changing financial services sector and, importantly, how they aren’t thinking about it (most consumers still don’t know what “fintech” is, for example).

Here are some things to keep in mind about consumers:

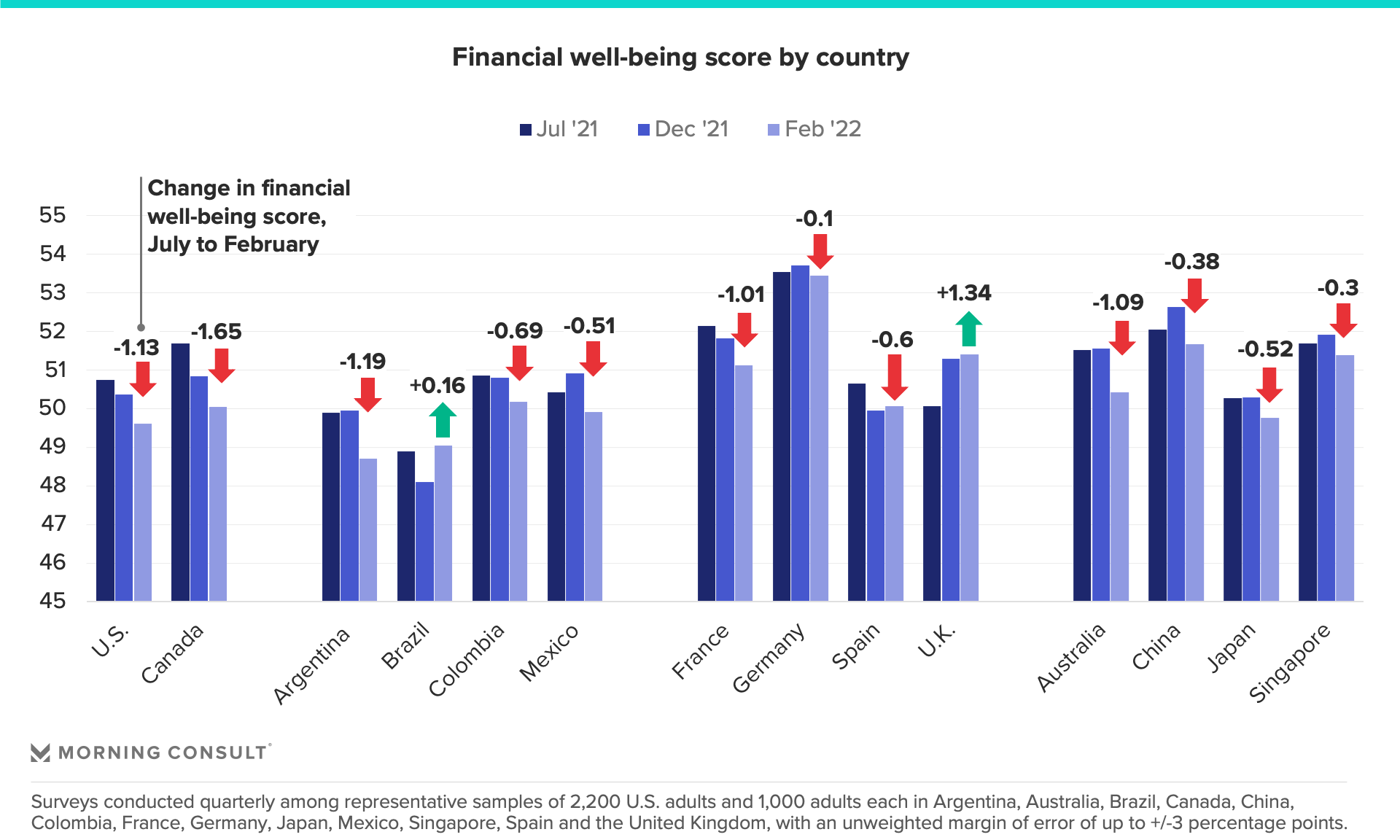

1. Across major economies, consumers have poorer financial health this year

As inflation impacts consumers around the world on the heels of a lingering pandemic, their sense of financial security and well-being has dampened. Morning Consult’s quarterly surveys of consumers in 14 countries show that financial well-being scores — a numerical reflection of how consumers are feeling about their current and future financial situation — have dropped in all but two countries (Brazil and the U.K.) from July 2021 to February 2022.

Across all countries surveyed, a minority of consumers feel well-prepared to handle a major expense, and only between 14% and 39% of consumers feel that they are securing their financial futures. And these sentiments are unlikely to improve over the next few months, as savings dwindle and consumers continue to battle inflation.

What this means for leaders: As traditional and fintech service providers engage in exciting conversations about innovation, it’s important that they not lose sight of consumers’ short- and long-term financial health outlooks. With so many struggling financially, how can leaders deliver financial services that will make an immediate impact?

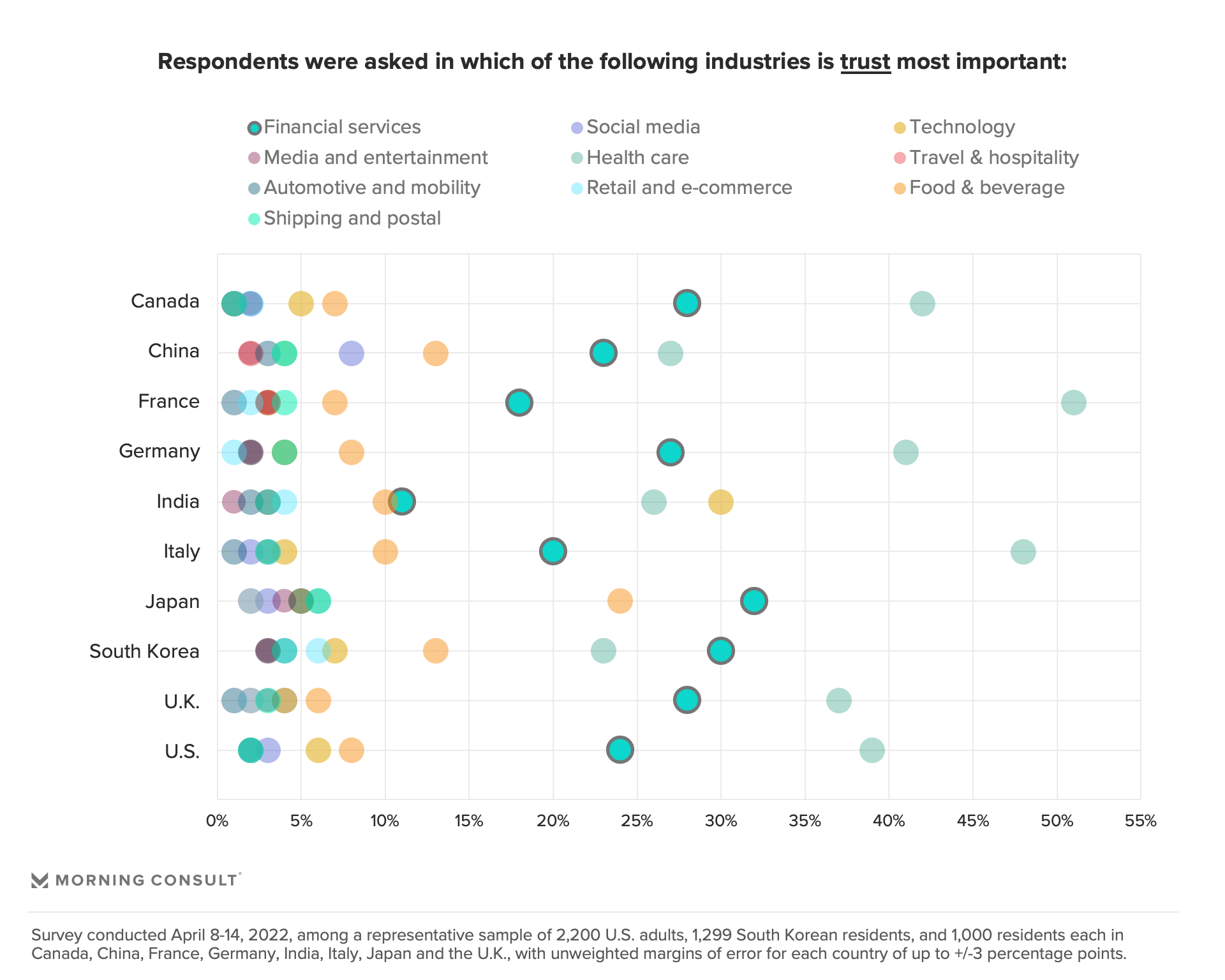

2. On trust and data privacy, financial services providers are held to a higher standard than other industries

The basics still matter: Trust and data privacy remain the cornerstones of financial services relationships, and fairly or unfairly, these attributes matter more for consumers’ relationships with this industry than with others.

Across the world’s 10 largest economies, consumers said trust was more important in financial services than in every other industry except health care. Even more important than trust, however, is data privacy. In eight of the 10 countries surveyed, consumers identified financial services as the industry in which data privacy is most important to them, more so than health care and technology.

What this means for leaders: As ideas like decentralization, open banking and “trustlessness” become more popular with the general public, it’s important to consider whether these principles impact consumers’ broader trust in the financial services industry, and how they influence consumers’ feelings of security about their financial data. From there, providers will need to reassess how they’re building trust and communicating data privacy practices with consumers to ensure that priorities align.

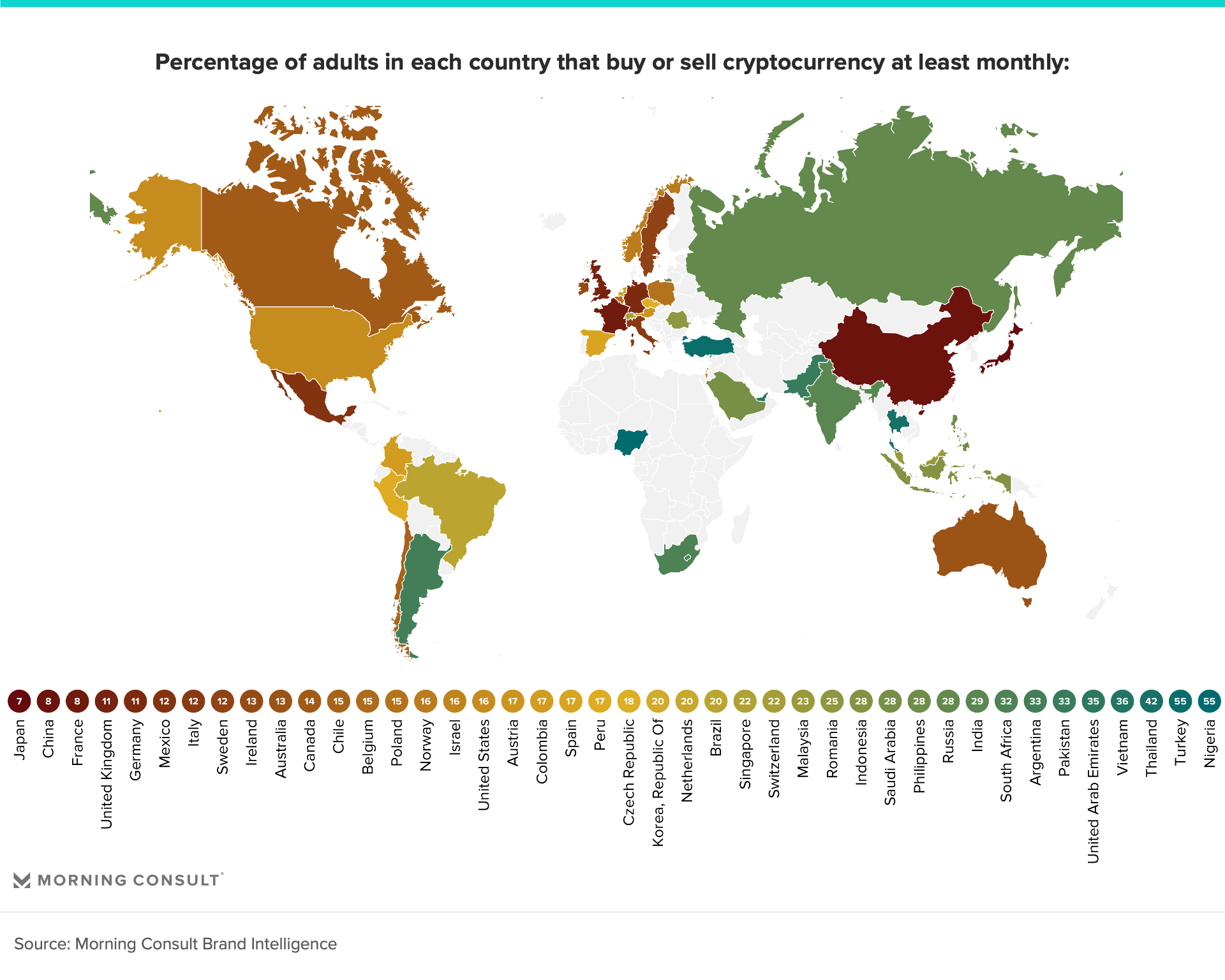

3. Cryptocurrency has evolved from fringe to mainstream

In a relatively short amount of time, cryptocurrency has captured the collective imagination and found its way into the digital wallets and portfolios of consumers around the world. Countries in South America and the Asia-Pacific region have particularly high rates of cryptocurrency usage, while Nigeria currently has the highest rate at 55%, according to Morning Consult Brand Intelligence, which surveys consumers in 44 countries daily on their habits and brand interactions.

Despite the volatility and newness of cryptocurrency, the technology is here to stay. It’s fully entrenched in economies around the world, and more governments are exploring what it means for their own monetary systems and citizens.

What this means for leaders: For many consumers, cryptocurrency is the gateway to a host of innovative financial services. As the technology becomes more popular, consumers are more likely to encounter related concepts such as Web3 and decentralized finance. Consumers will likely be itching to experiment with these concepts, so leaders must stay ahead of — and even embrace — these trends in order to anticipate consumers’ needs and preferences.

4. In many countries, consumers are more likely to use fintech payments and investing than online banking

Consumers are inundated with fintech products, but some fintech innovations are taking hold more quickly than others.

Across a majority of countries surveyed, consumers are more likely to report using peer-to-peer money transfer services at least once a month compared with online banking. Strong shares of consumers around the world have made fintech-enabled purchases through social media, proving that fintech innovations are becoming embedded in many everyday consumption behaviors.

The importance of moving money seamlessly and digitally cannot be understated, particularly for consumers in areas where traditional, in-person access is limited. But beyond payments, consumers still need to be able to store their money securely and digitally, and across many economies, small shares of consumers report using online banking.

What this means for leaders: Payments are still the tip of the spear and the primary way many consumers first experience fintech, but basic online banking fintech can’t be overlooked as an opportunity for improved delivery of services that will meaningfully impact consumers’ everyday lives and financial management.

5. Consumers still aren’t sure what “fintech” is

The sobering truth is that, although consumers use many technologies to conduct their financial lives, most report that they don’t use fintechs, pointing to a disconnect between industry insiders and consumers who use such services.

Fintech is an industry term, not a consumer one. When asked, a majority of consumers say they don’t work with any fintech providers, even though a majority of adults report regularly interacting with fintechs through digital wallets and other apps, for example.

What this means for leaders: Don’t get lost in the jargon. The term “fintech” will become increasingly meaningless: When everything is considered fintech, and as financial apps become more embedded in consumers’ daily lives, leaders will need to describe their innovations using other terms that are directly tied to customers’ own lexicons and financial needs. They should speak in terms of the jobs consumers need done, in language they themselves use, when speaking about products and innovations.

Charlotte Principato previously worked at Morning Consult as a lead financial services analyst covering trends in the industry.