Hollywood’s Franchise Frenzy Won’t Help Streamers Win Nonsubscribers

Key Takeaways

Streaming services must look beyond franchising to expand their domestic market.

Around one-third of current video streaming subscribers (34%) said a selection of shows based on big franchises was a major factor in their decision to sign up for a service, but only half as many nonsubscribers — those with zero subscriptions — said the same.

And more streaming subscribers than nonsubscribers cited movies based on well-known franchises as a major factor in their decision to sign up for a service (33% versus 21%).

Franchises must still anchor overall strategies, especially for international growth, but streamers should retain low-cost ad tiers to maximize subscription revenue domestically.

For the latest entertainment industry news and analysis, sign up for our daily entertainment briefing here.

The notion of franchise fatigue isn’t new, but fresh concerns are arising due to Hollywood’s reinvigorated obsession with universe building. For example, Disney’s Bob Iger in February said the company would “lean more into our franchises,” and Paramount is reorienting its network around spinoffs of key IP like “Billions” and “Dexter.”

These are smart moves because flashy original franchises can help streamers stand tall in a sea of seemingly infinite programming options.

But streamers that fixate too much on franchising won’t maximize their U.S. reach. New Morning Consult data shows that consumers without video streaming subscriptions are much less likely to say that TV series and movies based on well-known franchises drive their decision to sign up for a service than those with subscriptions and all adults in general. Moreover, the share of nonsubscribers saying they’d pay more for a video streaming service that regularly released content based on well-known franchises was significantly lower than that of consumers who are already subscribed to at least one streamer.

The rush to franchise isn’t misinformed, but our data does underscore the importance of a content strategy that balances franchises and lower-budget original ideas, as well as accessibility: Those who don’t pay for streaming uniquely cite price as the biggest factor in deciding whether to sign up for a service.

There’s still room left to grow domestically, but nonsubscribers don’t care as much about franchises

Any customer growth in the industry is welcome after last year’s streaming market correction, but U.S. customers are paramount given that they generate much more revenue than their international counterparts. And within the United States, new growth engines are badly needed: Netflix’s cumulative U.S./Canada subscriber adds in 2022 were lower than in 2021 and 2020, and the same was true for Disney+.

Meaningful growth opportunities can be found among consumers without video streaming subscriptions — that is, those who would grow the overall domestic streaming market. In April, 17% of U.S. adults reported having zero video streaming service subscriptions. But for executives thinking that franchise content will be the catalyst to convert nonpaying consumers into paying ones, the reality is that IP is more of a tool that will help services make inroads with current video streaming subscribers: 34% of streaming subscribers said availability of shows based on well-known franchises was a "major factor" in their decision to sign up for a service, while that figure was just 17% for nonsubscribers. Movies based on well-known franchises were similarly more of a motivator for the former group (33%) than the latter (21%).

Moreover, 46% of those with a video streaming subscription said they’d pay more for a service that released movies and TV shows based on franchises like “Game of Thrones,” while that share was only 13% for respondents without subscriptions.

For those who’ve held out on paying for a video streaming service this long, it’s probably not because of a lack of content. The biggest deterrent for nonsubscribers is the monthly fee: Respondents without subscriptions cited price above all else as a major factor in deciding whether to sign up for a streaming service, unlike those with subscriptions and all adults. This data is consistent with our analysis from August, which found that high prices were by far the biggest deterrent to would-be subscribers.

That’s not to say that flashy programs based on well-known IP can’t help win over those consumers; it’s just that paid streamers that both focus on boosting the accessibility of their content and build out new franchises have the best shot at winning over these consumers. This all could be achieved by leaning on free ad-supported streaming TV — or FAST — services more heavily for content distribution and marketing.

How video streaming services can program content strategy in 2023 and beyond

Despite what traditional creative discourse might convey, there’s really no compelling argument for pivoting away from franchising as long as some original ideas are still being developed. It’s easy to find recent TV and film franchise attempts that didn’t pan out, but the degree to which people discount a piece of content because it’s not an original idea is greatly overstated.

In April, 74% of adults said they had a positive opinion of TV franchises like “Yellowstone” and “Game of Thrones,” while 72% said the same for film franchises like “Star Wars” and “Jurassic Park.” Younger consumers are more likely to have a positive opinion of franchises than their older counterparts, as are video streaming users and moviegoers.

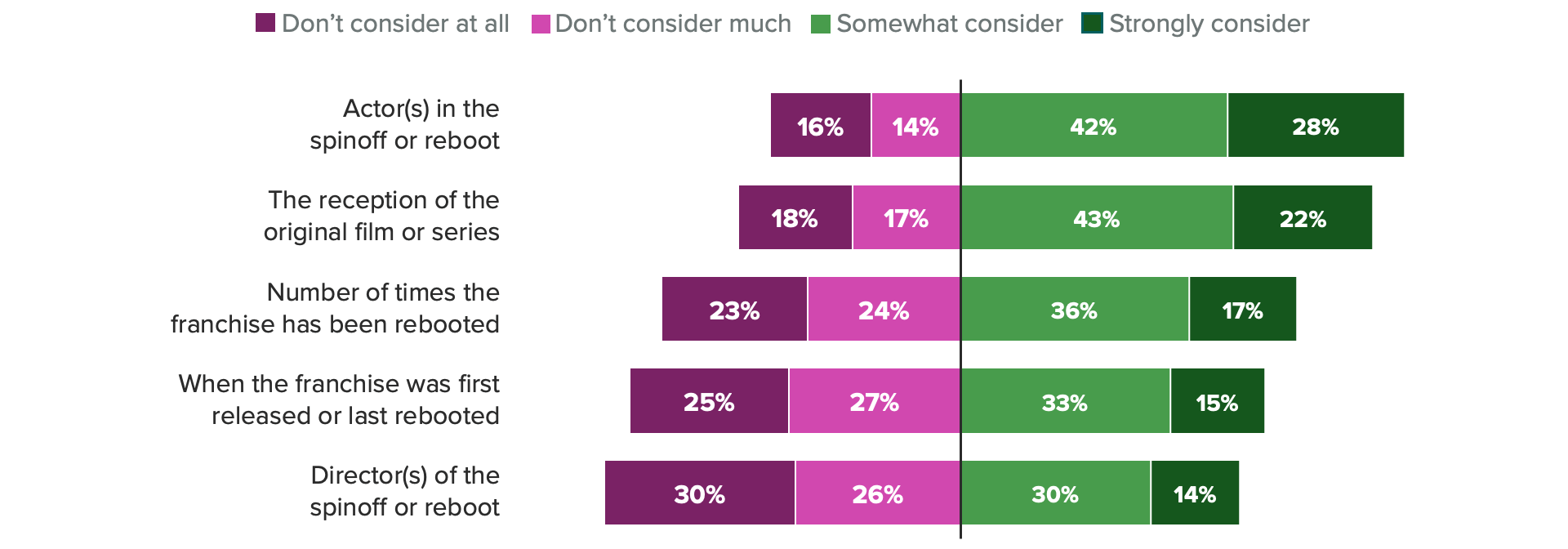

Focusing marketing campaigns around the talent involved in a spinoff or reboot is a key way to maximize the chances of it taking off. In April, 28% of U.S. adults said they strongly consider the actors involved when deciding whether to watch new content that’s connected to a larger franchise, a higher figure than for other factors like the reception of the original film or TV series (22%) or the number of times the IP has been rebooted (17%).

There’s no smoking gun category where streamers should focus their reboot strategies. Large shares of adults said they’re interested in more TV and film offerings based on books (69%) and superheroes (53%), but categories that consumers have less interest in seeing franchises developed around, like brands (31%), could still take off — see Amazon’s “Air,” which is already being viewed as a potential 2024 best picture Oscar contender.

If anything, streamers should look toward their own libraries to develop new non-English titles. While older consumers are less enthusiastic about this strategy, 37% of Gen Z adults and 40% of millennials say they would be more interested in watching an English-language series if it had one or more foreign-language TV spinoffs set in the same universe.

Amazon is taking this approach with its mega-budget spy thriller “Citadel,” which debuted its flagship U.S. show last week but has various foreign-language editions on the way. Other global streamers have the ability to do this too, but Amazon’s approach with “Citadel” still represents a relatively novel way of betting big on an expensive original scripted franchise. Other services should mimic this approach as streaming growth becomes an increasingly international story, and they must maximize global returns on content investment amid economic pressures that make costly franchise flops even bigger setbacks.

Kevin Tran previously worked at Morning Consult as the senior media & entertainment analyst.