Resale Apps Paving the Way: Looking Into eBay’s and Poshmark’s Differentiators

The brand health and audience metrics for eBay and Poshmark reveal strengths in both platforms that stem from innovations that solve buyers’ and sellers’ challenges, as well as differentiators that cater to unique audience preferences.

To better understand the opportunities for retailers and consumer brands in the resale market, Morning Consult conducted surveys that uncovered insights into the behavior and perspectives of resale buyers and sellers. This research is part of a series on who’s buying and selling in the resale economy, and where brands have opportunities to alleviate buyers’ and sellers’ challenges.

The resale industry’s technology-driven growth is being led by platforms that differentiate themselves with attributes like social communities, access to rare products and advanced authentication techniques — and eBay Inc. and Poshmark Inc. are two such brands that exemplify the shifting landscape of peer-to-peer resale platforms.

For U.S. consumers, eBay is synonymous with resale (97% of U.S. adults are currently aware of the brand), while a newer platform like Poshmark has lower awareness (currently 65%, though that’s expanding). EBay’s cross-category assortment, payments and technology investments, and longevity have contributed to strong brand health, while Poshmark’s social media-like interface caters to a younger audience, and its continued expansion outside of apparel and into home and electronics has drawn more consumers.

Morning Consult Brand Intelligence, which tracks thousands of brands in more than a dozen countries, allows us to dive into brand health metrics and audiences for each of these resale platforms to examine what’s changing for the future of the industry.

Poshmark’s quickly growing net promoter score has caught up with eBay’s

Our high-frequency data shows that eBay’s net promoter score has held relatively consistent over the last year, while Poshmark’s NPS is showing a sustained upward trend. EBay also has stronger favorability metrics, though net favorability for both brands has stayed steady over the last year and a half.

EBay’s continued strength reflects a market leader not content to rest on its laurels. The brand has made technology investments geared toward resolving common buyer challenges with resale — namely, authentication and 3D views of preowned merchandise, both of which were implemented to support the growing sneaker resale market. Other brands considering entering the resale market should pay attention to eBay’s robust reviews platform, as reviews contribute to high ratings from online shoppers on brand trust.

Poshmark’s NPS gains mirror its growth, driven in part by its expansion from apparel into new categories like electronics. The resale app’s social media functionality taps into the community element of resale, which is important to younger shoppers. Poshmark also recently introduced “brand closets,” which let brands directly connect with their community members, appealing to brands that want to explore resale without launching a platform of their own.

Gen Z holds the key to resale market growth

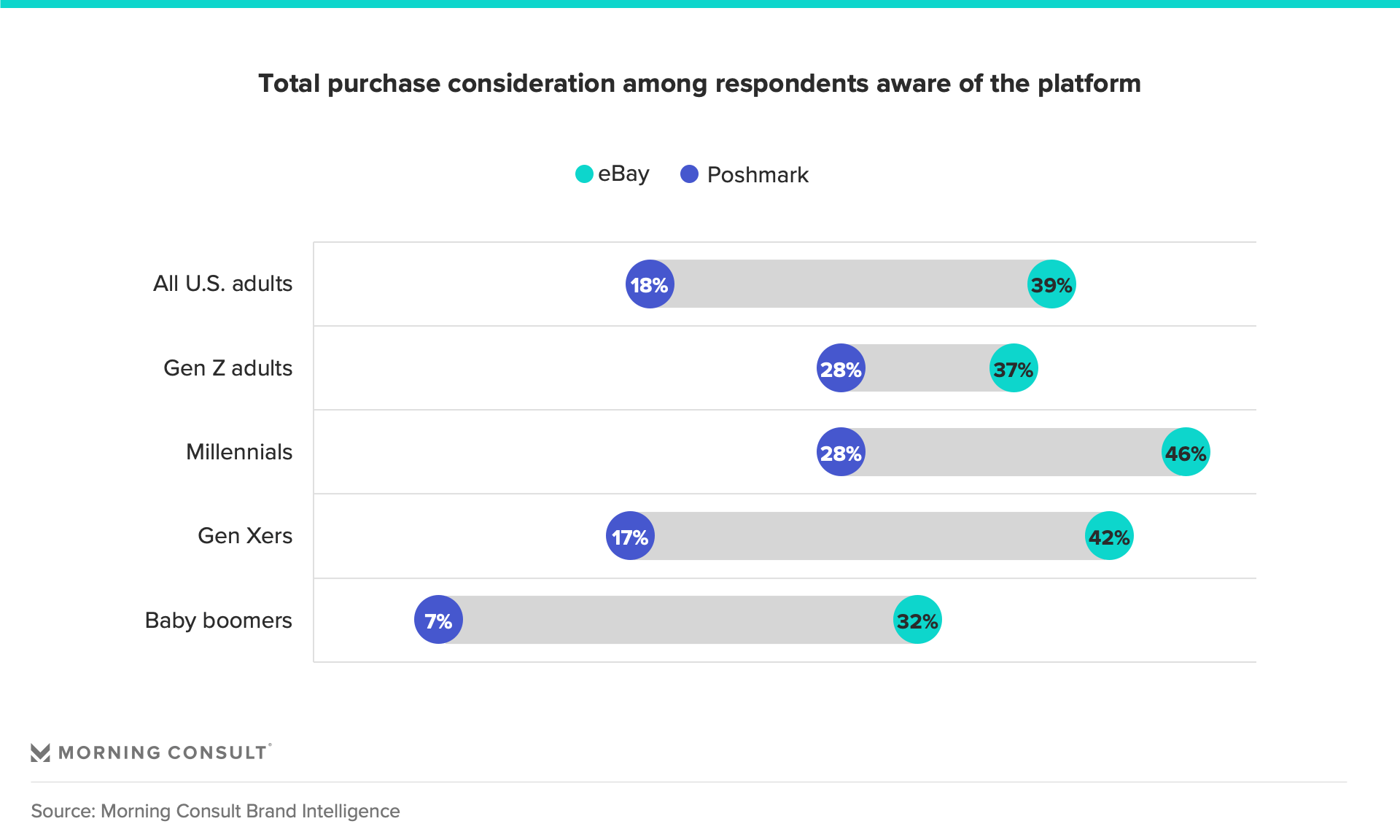

Among U.S. adults who are aware of each platform, eBay wins on purchase consideration with an audience that skews older, per MCBI data, but Poshmark is catching up most quickly with Gen Z adults, given that its platform targets a younger audience.

Millennial and Gen Z men are more likely than their female counterparts to consider purchasing from both platforms. Interestingly, while in-person secondhand shopping is dominated by women, rates of purchasing in the online resale market are equivalent between men and women of all ages, so brands just tapping into this space could see ample growth among both genders.

The resale market shows no signs of slowing down, and there’s plenty of room for competitors to enter the space. Poshmark’s emphasis on community is working, but that isn’t the only way forward. Brands should focus on Gen Z in particular as the cohort flocks to resale, driven by TikTok trends, the promise of a treasure hunt or the desire to shop sustainability. Resale platforms that successfully grab younger consumers’ attention can grow with them by differentiating on a wide range of purchase drivers and experience attributes.