What Retailers Need to Know About Resale’s Buyers and Sellers

To better understand the opportunities for retailers and consumer brands in the resale market, Morning Consult conducted surveys that uncovered insights into the behavior and perspectives of resale buyers and sellers. This memo focuses on why resale brands, retailers and online platforms need to recruit more sellers by tapping into the nuanced motivations that drive people to get into the resale game in the first place.

This research is part of a series. Stay tuned for more.

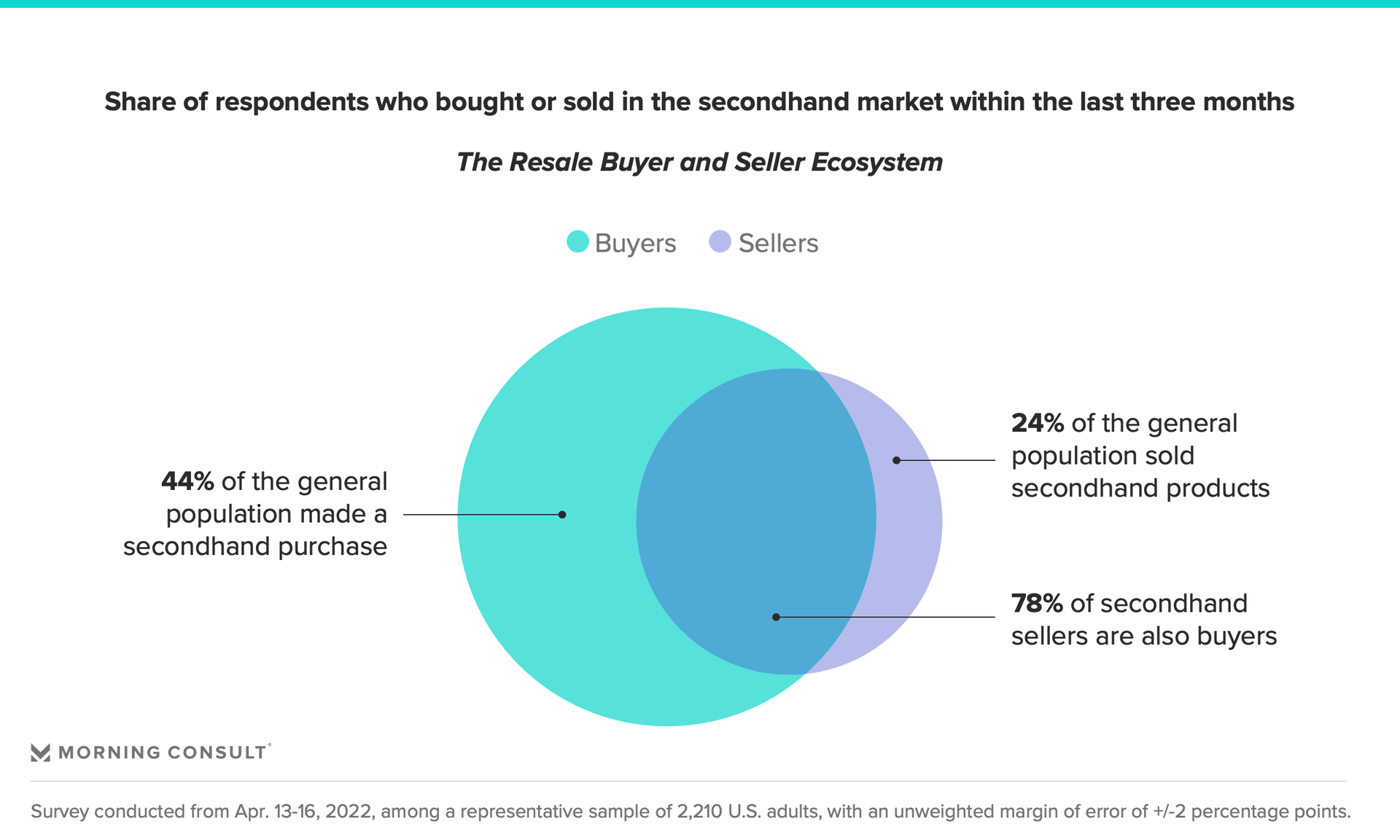

Resale’s explosive growth is reeling in brands and consumers alike, with the latter flocking to the secondhand market for practical reasons such as financial savvy and supply chain constraints, or for more emotional reasons like the desire to shop sustainably and participate in a growing community. Morning Consult surveys show that in just the last three months, 44% of U.S. adults bought a secondhand item and 24% sold one, with clothing, books, games and furniture being the most common resale categories.

This means retailers and brands are assessing if they should reclaim ownership of their products on the secondhand market, which for fashion alone could be worth $67 billion by 2025. This projected growth depends on platforms and, increasingly, on brands recruiting more buyers — and especially sellers — into the market.

Most sellers buy, but fewer buyers sell

There are nearly twice as many buyers as there are sellers in the resale market. Sellers also tend to be buyers: 78% of those who sold a secondhand item in the last three months also bought one over the same period. Brands hoping to reclaim control over how their products are resold or expand their resale businesses should court potential sellers by targeting their most loyal customers as initiates into the resale game. For most brands, this is a new world that will require learning how to buy products back from customers. It also requires breaking down the perceived barriers to selling secondhand, and showing people that it can be easy and even fun.

The demographics of resale economy participants largely mirror the U.S. population in terms of household income levels and community type. Gen Z adults and millennials are disproportionately more likely to participate in both buying and selling, while baby boomers are less likely to participate. One need only scroll through the endless stream of maximalist styling videos on TikTok to see that vintage shopping is trending. Social commerce has allowed for a combination of the influencer economy with secondhand shopping, attracting consumers who might not find treasure hunting in dusty thrift stores appealing.

Resale economy participants are motivated by financial benefits and the prospect of finding rare gems

Earning and saving money are the primary motivations of resellers and buyers, respectively. For consumers, the financial benefits of resale are universal, but the additional motivations are complex. More than half of resale shoppers (56%) say they buy secondhand partly because of the savings, but also for reasons beyond price. And just 23% say they feel compelled to shop secondhand because they can’t afford to buy new.

Notably, those who are unemployed are significantly more likely (at 41%) to say that they shop secondhand because of the affordability, though they would rather buy new. With economists worried about a looming recession, the promise of a good deal may lure more shoppers to the resale market as traditional retail faces continued uncertainty.

Beyond dollars and cents, resale buyers gravitate toward being able to find one-of-a-kind items, like limited edition sneakers or classic ’90s handbags. Sustainability is also a critical motivator for both shopping and selling, particularly among millennials and Gen Z adults (74% and 75%, respectively, versus 66% for all secondhand shoppers). Gen Zers also enjoy discovering classic fashion styles on the secondhand market. Sellers, for their part, find the chance to get rid of their unwanted items just as important as financial gain.

The community aspect of resale — particularly important on platforms like Poshmark and Depop — is much more attractive to younger generations. Retailers and brands exploring adding in-house resale operations by building or buying their own platforms should carefully consider if social media-like elements are beneficial for their target audience, and if the benefits outweigh the challenges that come with social platforms, such as the need for content moderation.

Resale economy participation in the United States lags behind global trends

U.S. consumers buy secondhand at a higher rate than those in other countries, but they lag far behind on the selling side. America’s culture of accumulation and our predilection for large homes with ample closet space might make it harder for brands to nudge their U.S. customers toward parting ways with their things.

Internationally, French consumers lead the charge when it comes to participation in the resale economy, and that goes for both shopping and selling. Most European and some Asian countries surveyed see parity across their buying and selling populations. Countries with more robust resale economy engagement also tend to have greater cultural affinity for quality products that stand the test of time and can be repaired rather than thrown away.