What Consumers Want From Restaurant Rewards Programs

Key Takeaways

Roughly half of U.S. adults belong to at least one restaurant rewards program.

Frequent restaurant goers, younger generations, parents and high-income households are most likely to belong to multiple rewards programs.

Free stuff is table stakes for a rewards program, but targeted offerings, for instance early access to new products for Gen Zers, will help delight customers and win loyalty.

Want to know first when we publish next month’s biannual report on the state of the food & beverage industry? Sign up for our Food & Beverage content alerts here.

With the growth of online ordering, which can create a host of technical and logistical challenges, restaurants have increasingly relied on mobile apps to streamline the ordering process for both employees and customers. Rewards programs, also known as loyalty programs, are a natural fit within these apps as a means to incent repeat purchases, increase check averages, and importantly, provide restaurants with more data about their customers.

For loyalty programs to yield these desired outcomes, two things are crucial: 1) restaurants must target the correct customers, and 2) those customers must see consistent value in participation. To help restaurants meet these objectives, we explore who is most likely to be a loyalty program member and the various elements that contribute to a successful loyalty program from the customer’s perspective.

Who participates in restaurant rewards programs

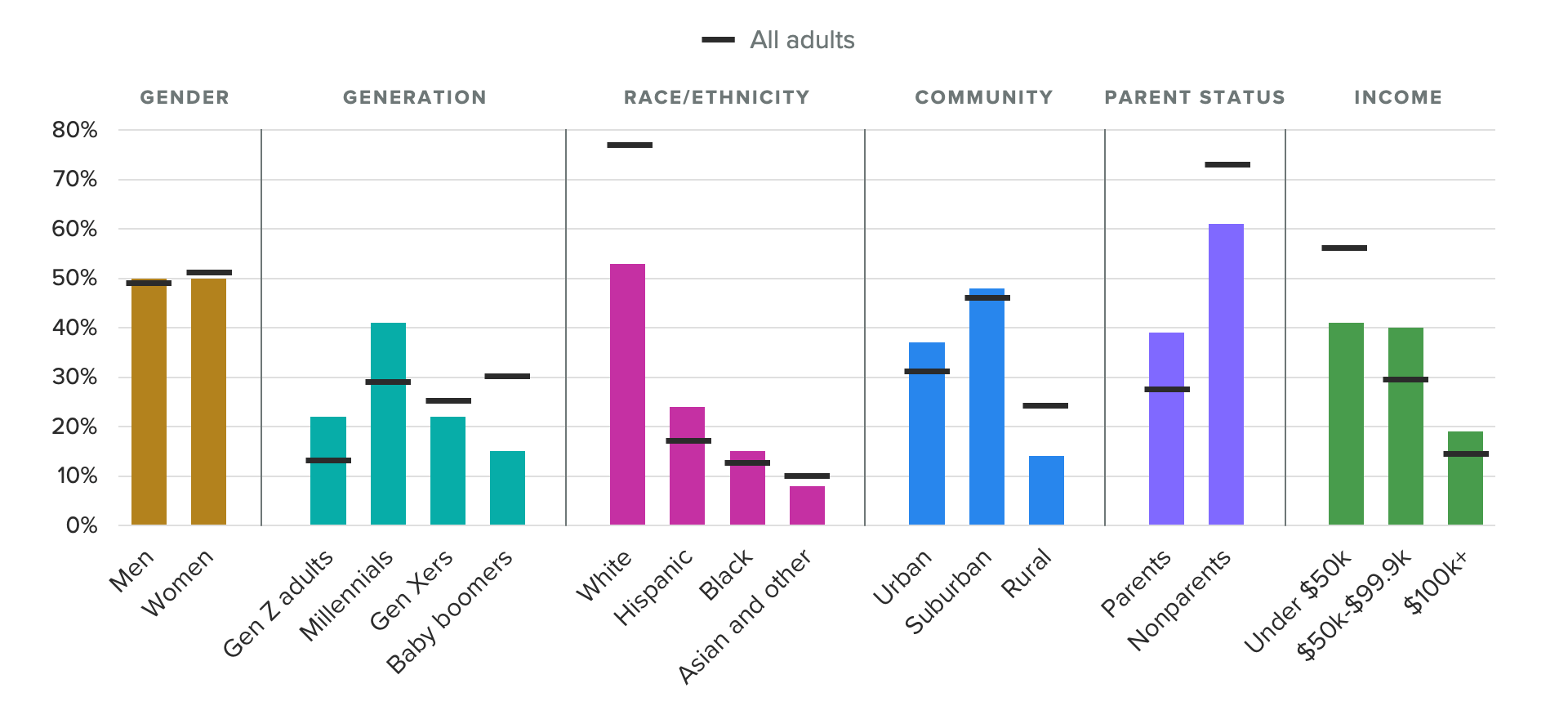

Restaurant rewards programs are common: Roughly half of all U.S. adults said they belong to at least one. Younger generations, parents and high-income households — the groups who tend to frequent restaurants — are also the most likely to belong to more than one loyalty program.

Specific demographics at scale: Surveying thousands of consumers around the world every day powers our ability to examine and analyze perceptions and habits of more specific demographics at scale, like those featured here.

Why it matters: Leaders need a better understanding of their audiences when making key decisions. Our comprehensive approach to understanding audience profiles complements the “who” of demographics and the “what” of behavioral data with critical insights and analysis on the “why.”

Consumers who belong to multiple restaurant rewards programs (at least four) tend to skew younger. With the growth of restaurant-specific apps, Gen Z and millennials, both highly connected and reliant on their smartphones, are the generations that have adopted apps, and related rewards programs, most readily.

Parents also overindex on being members of four or more programs. Not only do families rely on the convenience of food service for many a busy night, but they also spend more per occasion with more mouths to feed. Rewards programs may be a deciding factor if they help ease the price per visit for parents.

Gen Zers, Millennials, Parents and Higher-Earners Are the Most Likely Restaurant Rewards Program Members

Gen Zers go for exclusivity and early access as rewards benefits

Everybody likes free stuff and discounts. They are the top reasons consumers join rewards programs. That is, after all, their basic function: Spend money, earn points, redeem points. But digging deeper into demographic differences can help restaurants tailor their offerings beyond freebies to reach target consumers, like Gen Zers or parents.

Gen Zers, for instance, love to experiment with new-to-them foods. For this digitally-connected generation, there’s social currency in being the one to discover new items. This helps explain why exclusive discounts and early access to new products are attributes that are particularly appealing to Gen Zers in rewards programs. Delivering these special access elements will help restaurants cater to this coveted audience.

Parents, another important demographic group that overindexes on rewards program memberships, also demonstrate differentiated needs. Parents were 5 points more likely to want to earn points for trying new menu items, which has a gamification element that might add some family fun to dining out.

Free Items and Discounts Are Top Rewards Features, but Demographic Differences Also Emerge

Rewards programs give restaurants a competitive edge during time of menu price growth

Rewards programs are not the only way to build customer loyalty, but great programs can add tremendous value for both restaurants and consumers. With food away from home inflation near peak levels, rewards programs can help brands gain a competitive edge on the important metric of perceived value. Restaurants must study their rewards users’ preferences to tailor offerings above and beyond a simple free drink with your next purchase.

Emily Moquin previously worked at Morning Consult as a lead food & beverage analyst.