Russian Consumers Are Feeling Less Confident After Turbulent September

Key Takeaways

Optimism among Russian consumers is finally faltering, with Morning Consult’s Russia Index of Consumer Sentiment falling 1.3 points in September.

Major losses on the battlefield in Ukraine and President Vladimir Putin’s decision to mobilize reserves have shaken confidence at home, souring expectations for future business conditions.

The destruction of human capital, political instability and a potential slowdown in Chinese demand for Russian energy will all further test the resilience of the Russian economy.

This memo relies on data from Morning Consult’s October Global Consumer Confidence report. Morning Consult Economic Intelligence subscribers can access the full report here.

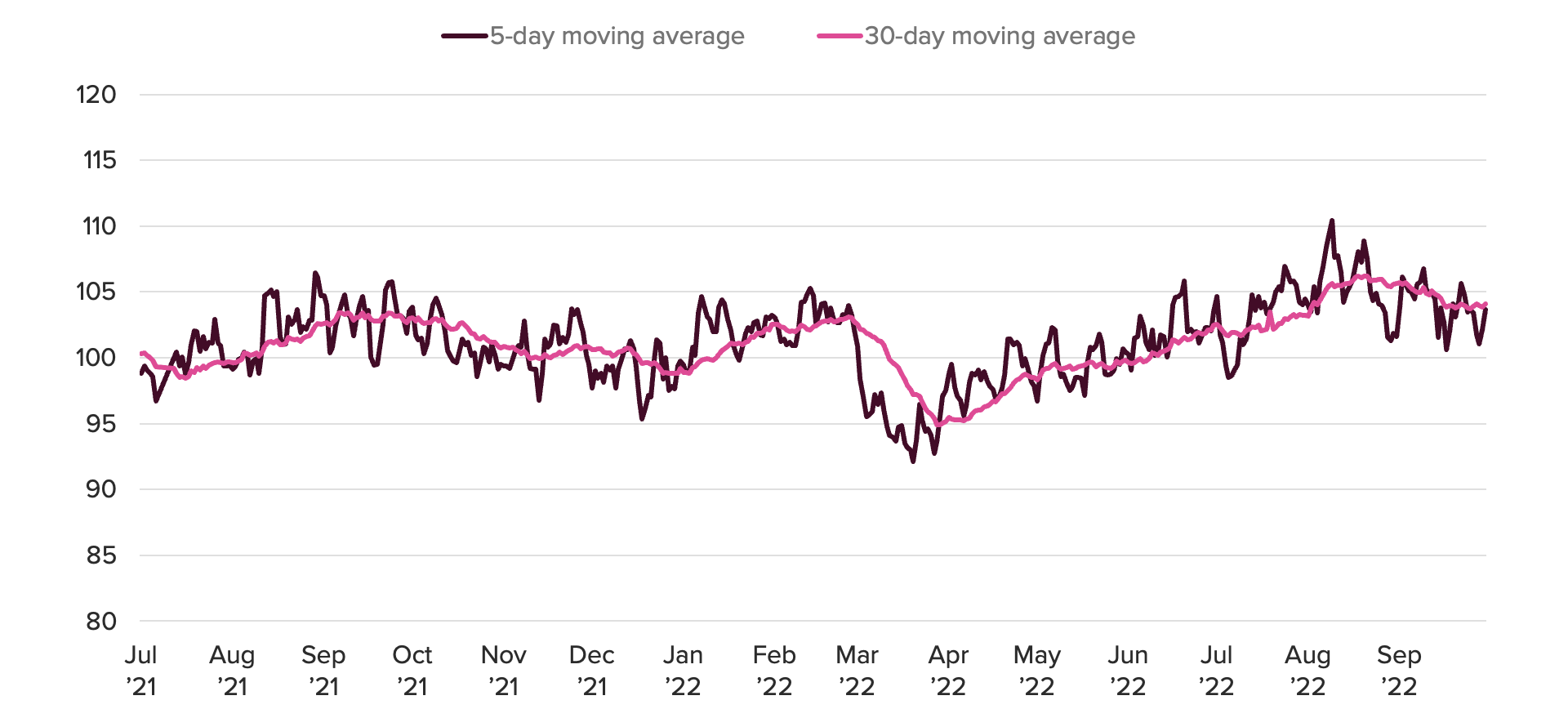

Russian consumer confidence is on the decline. After an initial dip following Russia’s Feb. 24 invasion of Ukraine and the imposition of sanctions on Moscow by major Western powers, consumer sentiment in Russia trended higher from April to August. However, heavy losses on the battlefield and President Vladimir Putin’s mobilization of reservists have shaken the mood within Russia considerably. Morning Consult’s Russia Index of Consumer Sentiment fell 1.3 points in September to 104.1, the first decline in the monthly value since March.

Russian Consumer Confidence on the Decline for First Time Since March

While Western sanctions undermine the long-term prospects for Russian growth, in the near term, the Russian economy has proved surprisingly resilient, as highlighted in our August Global Consumer Confidence report. Elevated global energy prices continue to support the ruble and the Russian worker as China and India provide ample demand for Russia’s energy exports. And while a rapid spike in energy prices threatens to tip Western European economies into recession, the Russian economy had been improving after the initial bite of sanctions.

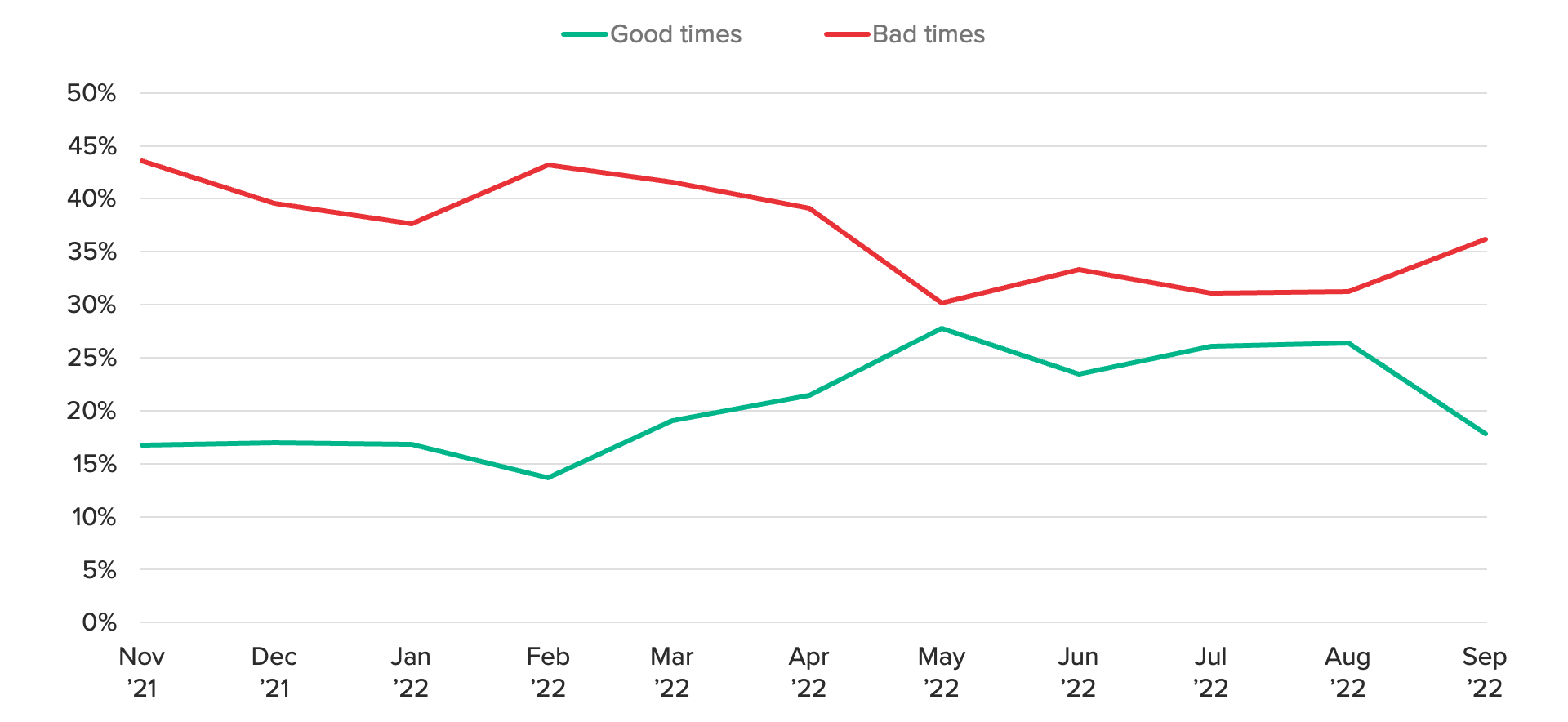

However, economic risks are mounting. President Putin’s decision to call up 300,000 reservists on Sept. 21 was met with protests, a mass exodus of likely conscripts and a mini bank run. While September’s events will not necessarily send Russia’s economy into a downturn, economic sentiment has taken a turn for the worse. Morning Consult data shows that expectations for business conditions have deteriorated, with the share of Russian adults who expect their country will experience bad times financially over the next 12 months increasing from 31.2% in August to 36.2% in September.

Economic Optimism Dented in September

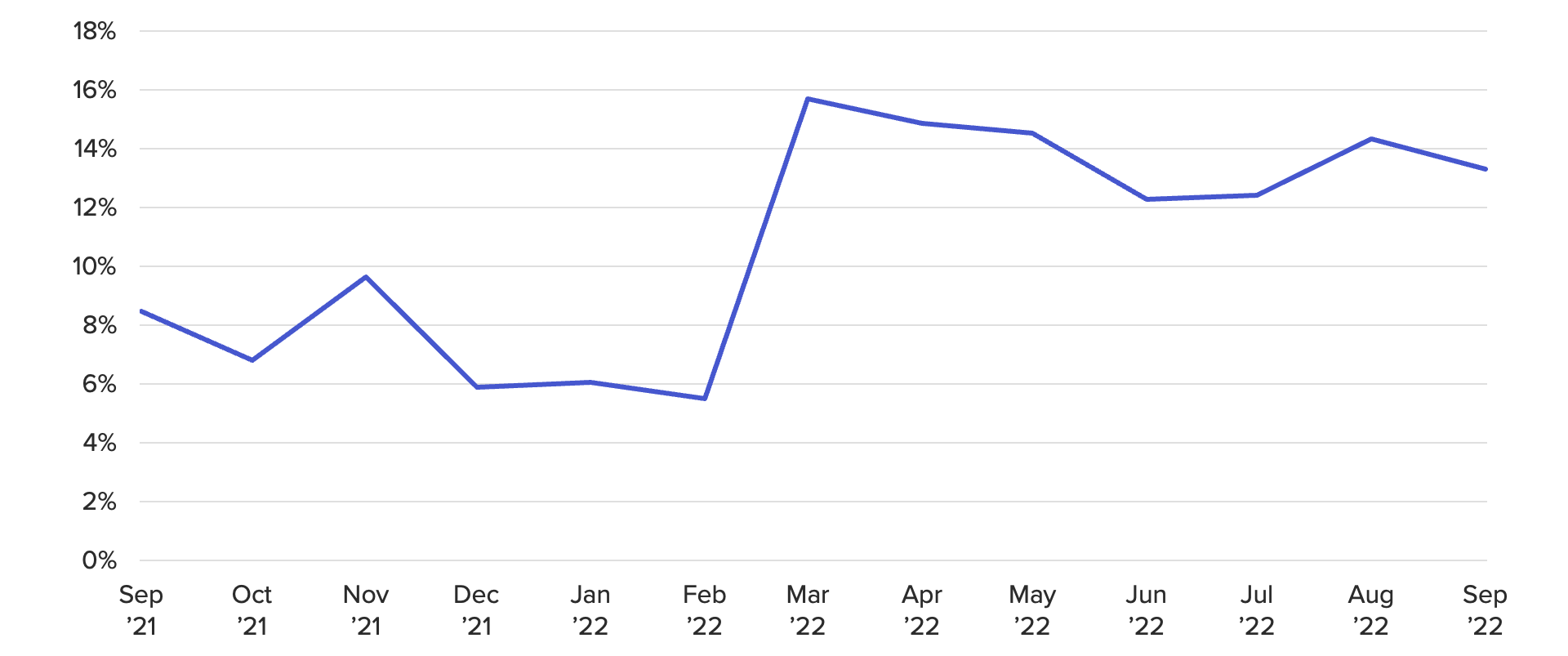

To complicate the picture slightly, we’ve also seen a persistent decrease in inflation expectations in Russia though September as expectations have tracked lower in tandem with headline inflation numbers in recent months. However, Morning Consult data also captured a recent uptick in the share of Russians anticipating price increases on energy and food in the next year. Furthermore, the war in Ukraine has brought an increase in the share of Russian adults who said they have had trouble finding particular food items. In the six months prior to the invasion, 7.1% of Russian adults, on average, said they had trouble finding certain types of groceries, but in the six months after, the average share has been 13.6%.

Sanctions Limiting Availability of Certain Food Items

An economic slowdown in China could also weigh heavily on the Russian economy. As Western Europe has severed its economic ties with Russia, the country has become increasingly dependent on its economic relationship with China. A severe and protracted recession in China would considerably weaken demand for Russian energy exports.

The near- and medium-term outlook is now darkening along with Russia’s longer-term prospects. A slowdown in China and political instability present immediate risks to the Russian economy, and the destruction of human capital and curbs to tech imports will take their toll over the coming years. The widespread adoption of nonfossil fuels, in concert with Western Europe’s decision to wean itself off of Russian energy, will also limit exports and hard currency inflows. While the International Monetary Fund has recently revised up its forecast for the Russian economy — now expected to contract by only 3.4% in 2022 — risks are weighted to the downside, and the Russian consumer is becoming increasingly aware.

Jesse Wheeler previously worked at Morning Consult as a senior economist.