What’s Driving Threads’ Early Success — And Why Twitter Is in Trouble

Key Takeaways

Twitter users’ favorability of the platform is in decline (from net favorability of 49 in April to 42 in June), making now a particularly good time for an alternative like Threads to surface.

The positioning of Instagram’s Threads as more positive, less political and more moderated than Twitter makes Twitter users think more positively about Threads, indicating that its value propositions are resonating.

Instagram’s brand power — and gigantic universe of monthly active users — are huge advantages as it takes on Twitter.

For the latest global tech news and analysis delivered to your inbox every morning, sign up for our daily tech news brief.

Just over a week since the new conversation-based app Threads launched, Meta’s newest social media entry is already making waves. It’s the fastest growing app ever in terms of downloads, and many are already calling it Twitter’s death knell. A new Morning Consult survey, in conjunction with brand tracking data, shows that Threads’ early success is a result of a few key factors: timing, purpose and who’s backing it.

Threads dropped at the right time

Elon Musk’s October takeover of Twitter was characterized by immense uncertainty both within Twitter HQ and on the platform itself. More than eight months later, only 17 of the 60 major advertisers that paused advertising on the platform have reportedly come back.

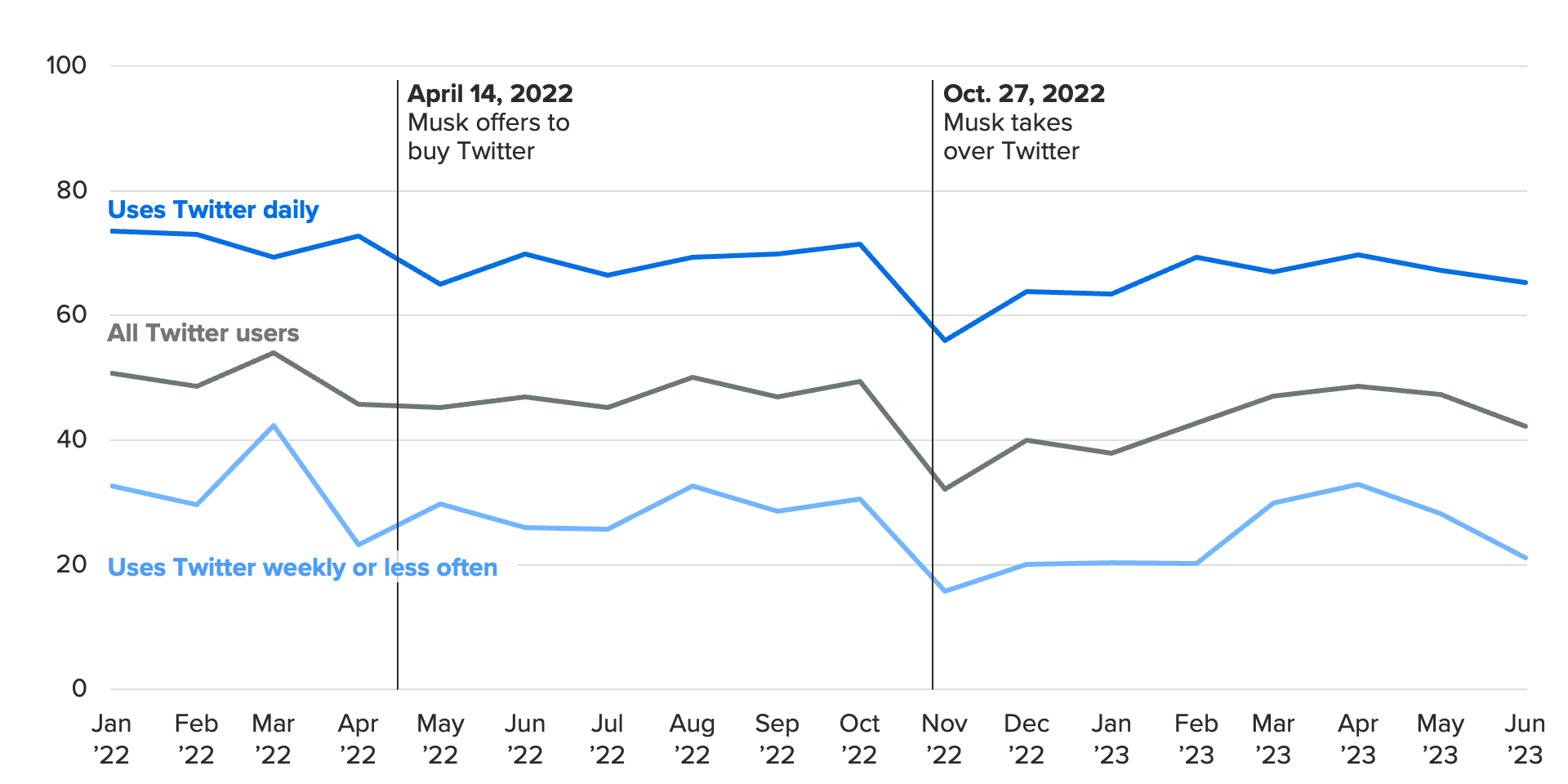

Enter Instagram’s new Twitter look-alike Threads. The app’s launch comes at a time when confidence in Twitter has been in decline, even among its own users. Net favorability toward Twitter, or the share who are favorable minus those who are unfavorable, dropped substantially among Twitter users after Musk took over as CEO last year, according to Morning Consult Brand Intelligence. It recovered somewhat, until plateauing in April at 49 and then declining to 42 in June. By comparison, net favorability of Instagram in June was 71 among its own users. This waning impression of Twitter among its user base marks a good time for an alternative to surface.

Twitter Net Favorability Is Declining Among Its Users

Not too surprisingly, daily Twitter users tend to have a more positive outlook of the brand than infrequent ones, defined as those who log on a few times a week or less. But those infrequent users make up a larger share of the overall market than daily users, and that may be enough for Threads to succeed, if the product can capture this increasingly disaffected Twitter audience while also funneling Instagram users to the platform. Wooing key brands, celebrities and influencers over would make a strong impact, too.

At the end of the day, Threads doesn’t need to be perfect. It just needs to be a good alternative to Twitter.

More positivity, less politics and more moderation resonate with users

Threads isn’t just positioning itself as a Twitter replacement, but more so a positive, less political and better moderated alternative. Twitter, on the other hand, has typically considered itself to be the internet’s “digital town square.” This advantageously positioned Twitter as a place where news breaks quickly and politicians can find an audience of millions on the cheap, which drove engagement among users.

What we do that’s different: Brand data used in this analysis is available exclusively in Morning Consult Intelligence, an exclusive online platform tracking consumer attitudes daily on key indicators for nearly 4,000 brands in 40+ markets.

What Morning Consult Intelligence tracks: Globally, we ask consumers daily about awareness, trust, purchasing behaviors, favorability, net promoter score and buzz. This depth and frequency offers an exclusive, real-time pulse identifying changes in consumer opinion.

But Twitter’s approach of fostering controversy is not for all: Threads’ value proposition of being less controversial is resonating among Twitter’s users. They are more likely than not to say that Threads’ aim to be more positive, less political and have the same moderation guidelines as Instagram gives them a more positive impression of the platform.

Positivity, Less Politics and More Moderation Work in Threads’ Favor

Since the platform’s launch on July 5, 23% of users of both Threads and Twitter say they already primarily use Threads, and 38% say they use both about equally, according to a recent Morning Consult survey. These bi-platform users also tend to say content on Threads is as fun and interesting as that on Twitter, albeit more exciting (though it’s entirely likely this feeling of excitement will dull with time).

Content on Threads Is Considered More Exciting Than Twitter Content

While still early, these trends bode well for Threads, as its differentiator seems to be meeting a demand among many Twitter users right now. It remains to be seen, however, if the same hypercurated and moderated approach that governs Instagram will be successful for a text-based platform in the long term, or if Twitter users’ appetite for more positivity is a short-lived hangover from Twitter’s anarchic environment.

Twitter is competing with Meta and Instagram, not Threads

On an app level, users are presented with the choice of Twitter, Threads or smaller conversation-based, “micro-blogging” apps such as Bluesky or Mastodon. But as a business, Twitter isn’t facing down Threads, so much as Instagram’s brand and its developer, Meta, along with the latter’s social media empire. With 2.35 billion monthly active users, Instagram alone is a tremendous funnel of potential users for Threads, especially when compared with Twitter’s estimated 535 million “monetizable” monthly active users.

Instagram’s brand power is another consideration, as Twitter’s users tend to have a more favorable impression of the former, even predating Musk’s bid and eventual takeover of Twitter. Meta’s brand, meanwhile, is less favored, indicating that tying Threads to Instagram instead of Meta is more likely to pay dividends from a brand perspective.

Twitter Users Have a More Favorable Impression of Instagram

Meta has had its fair share of missteps, from calamitous data privacy violations to ventures into the metaverse that have not yet paid off (or won over investors). Despite those errors, social media is the company’s bread and butter, and Threads is a product that lives squarely in Meta’s area of expertise.

In the fight between Musk and Meta’s Mark Zuckerberg, Zuckerberg has made his name in this space, and consumers seem to agree. While more people tend to have a favorable opinion of Musk than Zuckerberg — 38% of adults have a favorable view of Musk and 30% of Zuckerberg, per the July survey — people are more likely to say Zuckerberg can more effectively run a social media platform (34%) than Musk (23%).

Where Threads goes from here

Many might recall Google’s foray into social media with Google+, or Apple’s via iTunes Ping. The comparisons to Threads are easy to make as these apps were similarly received by new users who seemed content with simply having an alternative to the incumbent.

What sets Threads apart is its business model and place in the market.

Threads has the potential to make decentralization one of its differentiators. Meta revealed that, while it was not an initial feature, Threads is working on supporting ActivityPub, a decentralized social networking protocol that would potentially allow users to interact with Threads content on different apps that support it. Decentralized services have had a rough road to mainstream adoption, and consumers are split on interest in social media decentralization — 37% are interested and 38% are not — but a company as big as Meta could make it more mainstream.

Advertisers fled Twitter in droves, and there is a desire to put that now-idle money to work on a platform where brands don’t need to worry about their content being shown alongside hate speech. Threads doesn’t need to be perfect to be successful. If it can be the safer and more interesting alternative to Twitter to users and maybe more importantly, advertisers, it has the potential to win out as the default conversation-based social media app.

Jordan Marlatt previously worked at Morning Consult as a lead tech analyst.

Related content

Twitter Is Gaining Trust With Republicans, but Losing It With Democrats in the Musk Era

Why Americans Keep Giving Social Media Platforms Their Data — Even if They Don’t Trust Them With It