A Significant Uptick in Holiday Gift Card Giving Reflects Shopper Practicality

Holiday shoppers’ gifting plans reveal a practical bent in the face of inflation, as intent to give gift cards, money and inexpensive books is up significantly from 2021. Maintaining holiday magic will present challenges to household budgets, but the good news for retail and e-commerce brands is that celebrants are prioritizing gifts.

This is part of Morning Consult’s First Look: Consumers’ 2022 Holiday Plans report, which provides an early analysis into the consumer trends that brands should anticipate ahead of the holiday season across the finance, retail, travel and food industries.

Consumers’ financial constraints are apparent in this year’s holiday gifting plans. With 90% of U.S. adults “very” or “somewhat” concerned about inflation, consumers and retail leaders alike are understandably wary about upcoming holiday shopping trends. But there’s still hope for retailers, because we know that shoppers are prioritizing gifting, even though they plan to shift to more practical and budget-friendly product categories.

Almost half (45%) of shoppers said they anticipate spending the same amount on gifts this year as they did last year (38% plan to spend less), but doing so will require trade-offs. One option is to pull those dollars from regular budgets: 67% of shoppers plan to spend more conservatively on their everyday needs leading up to the holidays (a share that rises to 75% among financially anxious shoppers), but keeping holiday spending in check will be a challenge.

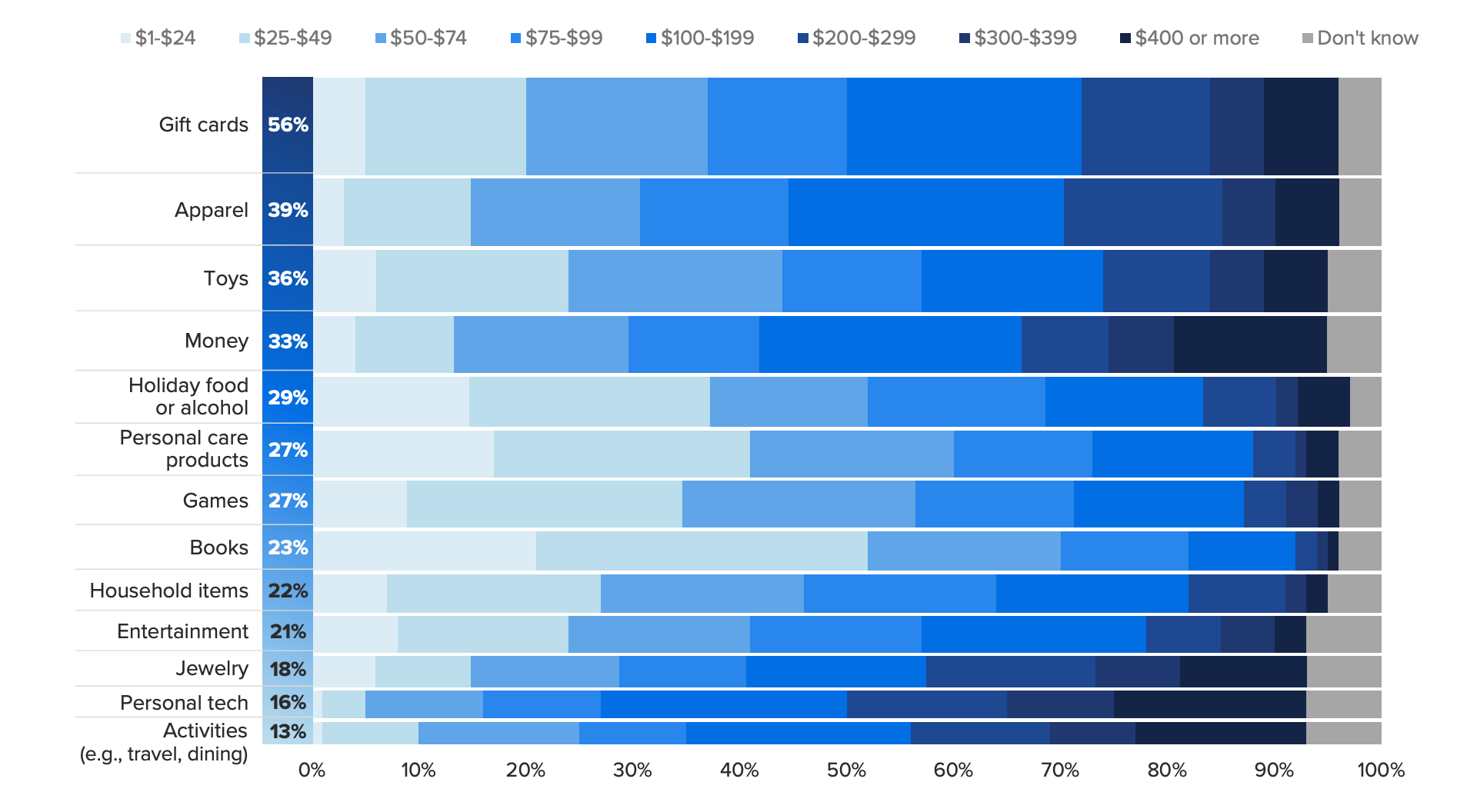

The other option is to give cheaper presents: Gift cards and cash gifts, up 7 and 6 percentage points in purchase intent year over year, respectively, aren’t subject to inflation the same way goods are and allow gifters to have more control over their spending. Shoppers hoping to stay in control of budgets and not overpay for gifts can purchase gift cards for fixed dollar amounts, rather than increasing their holiday sweater budgets.

Gen Xers’ intent to give gift cards is up 11 points from 2021, and men are right behind with a 10-point increase. This should all be good news, as gift cards are an easy upsell at the register or in a digital cart as an add-on to physical gifts, and digital versions are great options for last-minute shoppers.

Meanwhile, intent to gift apparel and holiday food is also up from last year (4 and 5 points, respectively), with women and millennials leaning into the former — intent to give clothing is up 6 points among women and 11 points among millennials. People have heightened concerns about inflationary pressures in both categories, so these gifts might be more practical or feel more special. Intent to give books, the category in which people plan to spend the least, is also up 3 points from 2021.

Consumers prioritize in-stock status and discounts when choosing gifts amid inflationary pressures

Beyond value and quality — shoppers’ perennial priorities — discounting is important given inflation’s strain on household budgets, creating a difficult competitive environment for retailers who are already offering deep discounts to unload excess inventory. The critical question remains: Will all this aggressive discounting be enough to woo shoppers amid waning demand signals?

In-stock status is also important, which is no surprise given ongoing supply chain constraints. The good news is that shoppers are experiencing fewer out-of-stocks and other inventory concerns. The share of shoppers reporting no issues finding items in stores grew 9 points from 2021, with an 8-point gain in the share reporting no out-of-stock issues online. The share of shoppers reporting no instances of back orders grew 11 points from this time last year.

Prestigious gifts or status symbols are not only shoppers’ lowest priority, but this holiday shopping category also dropped 4 points in importance from 2021. While prestige and quality are often linked in people’s minds, that clearly is not the case here, as quality remains a high priority for shoppers. As inflation rages on, we can expect shoppers to carefully examine the value and quality of their purchases, especially when they’re paying more and getting less. This spells trouble for status symbols that don’t have the quality to justify the price tag.

While access to flexible payment options like “buy now, pay later” is a lower priority for shoppers, it’s much more important to Gen Z adults (61%), millennials (64%) and those in households with annual incomes under $50,000 (51%) — the latter two of which are among the most likely to express financial anxiety about the upcoming holiday season. BNPL offers shoppers a controlled means to stretch their cash flow with defined payments over a fixed period of time, often with no interest, which is appealing to those averse to financial risk in this environment.