Why We Buy When the Going Gets Tough

Key Takeaways

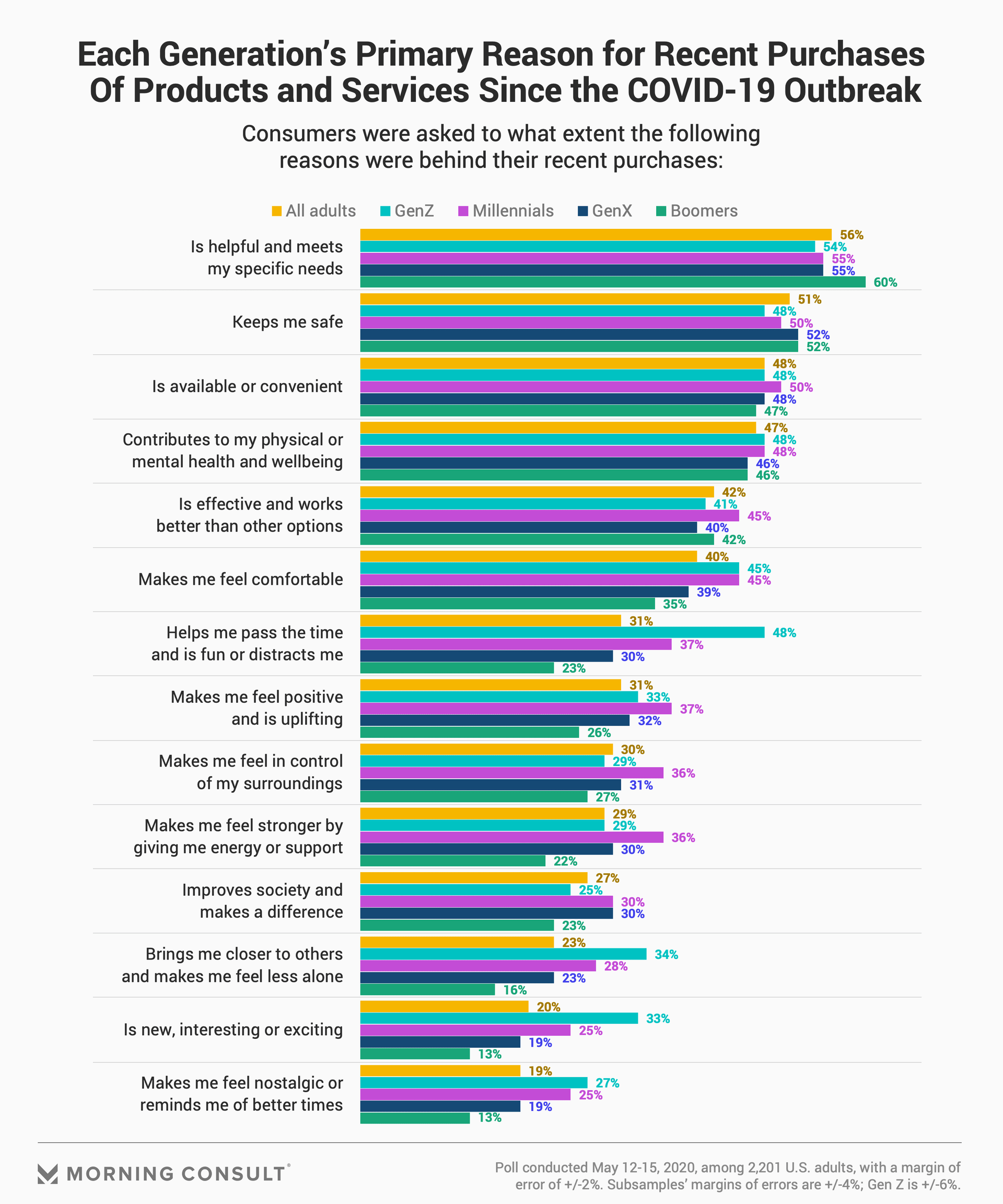

Function (helpfulness, safety, availability) currently drives purchase for most U.S. shoppers, but generational nuances exist. These reveal important implications around the emotions driving expenditures, and how brands can best resonate with different audiences.

The main reasons older generations are buying brands and products during the pandemic are especially functional: items are helpful, meet specific needs and keep them safe.

But younger generations are notably more interested in comfort and entertainment. Gen Z purchases reflect a desire to pass the time, have some fun and get back to life as they knew it, while millennials are more likely to cite desire for positivity, control and strength as top reasons behind recent purchases.

This analysis was authored by Victoria Sakal, Morning Consult’s managing director of Brand Intelligence.

Since the coronavirus outbreak, marketers, decision makers and researchers have been closely studying if and how consumption has changed, whether across categories, channels, occasions or otherwise. But there’s been little exploration of the why behind those changes.

Emotional buying

New Morning Consult research conducted on May 12-15 and on May 19-21 among 2,200 U.S. adults each (with a 2 percentage-point margin of error) finds that though the top reasons for recent purchases relate to functional needs for most shoppers, distinct generational nuances exist. These insights on emotions driving expenditures reveal important implications for brands and businesses striving to strike everything from the right tone in messaging to the most appropriate product positioning during this unique time.

- Gen Z wants to pass the time, have some fun and get back to life as they knew it -- their buying is more driven by a desire for fun, connecting with others, novelty and even nostalgia than is the case with other generations

- Millennials are more likely to cite desire for positivity, control and strength as top reasons behind recent purchases than are their generational peers

- Boomers in particular are not buying things for entertainment, novelty and certainly not for nostalgia as compared to other generations

- 44 percent say that "helps me pass the time and is fun or distracts me" is not at all a reason for their purchasing decisions at this time,

- 58 percent say "is new, interesting or exciting" is not at all a reason, and

- 62 percent say "makes me feel nostalgic or reminds me of better times" is not at all a reason.

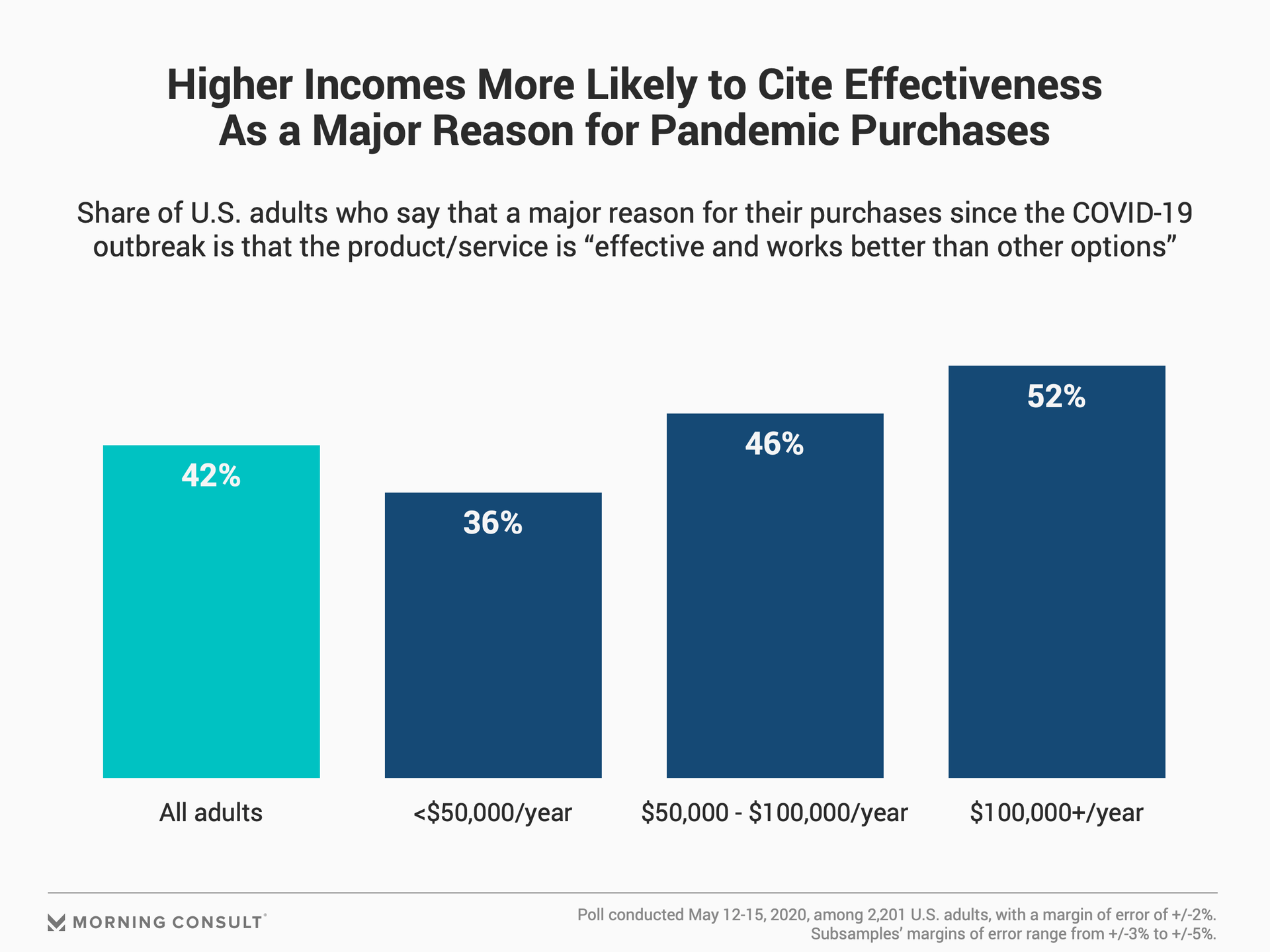

In addition to these generational differences in emotions behind recent purchases, a few other notable demographic nuances exist. Higher incomes are significantly more likely to say that a main reason behind their recent product or service choices is that the item was more effective and worked better. Lower incomes are 14% less likely than the average consumer to cite this as a main reason for a recent purchase, exposing a clear income gap, especially in the context of health and/or safety items these consumers may be purchasing. While higher incomes have the means to afford best-in-class in terms of efficacy and effectiveness, lower incomes may not have access or means to afford those options, and are therefore settling for inferior alternatives.

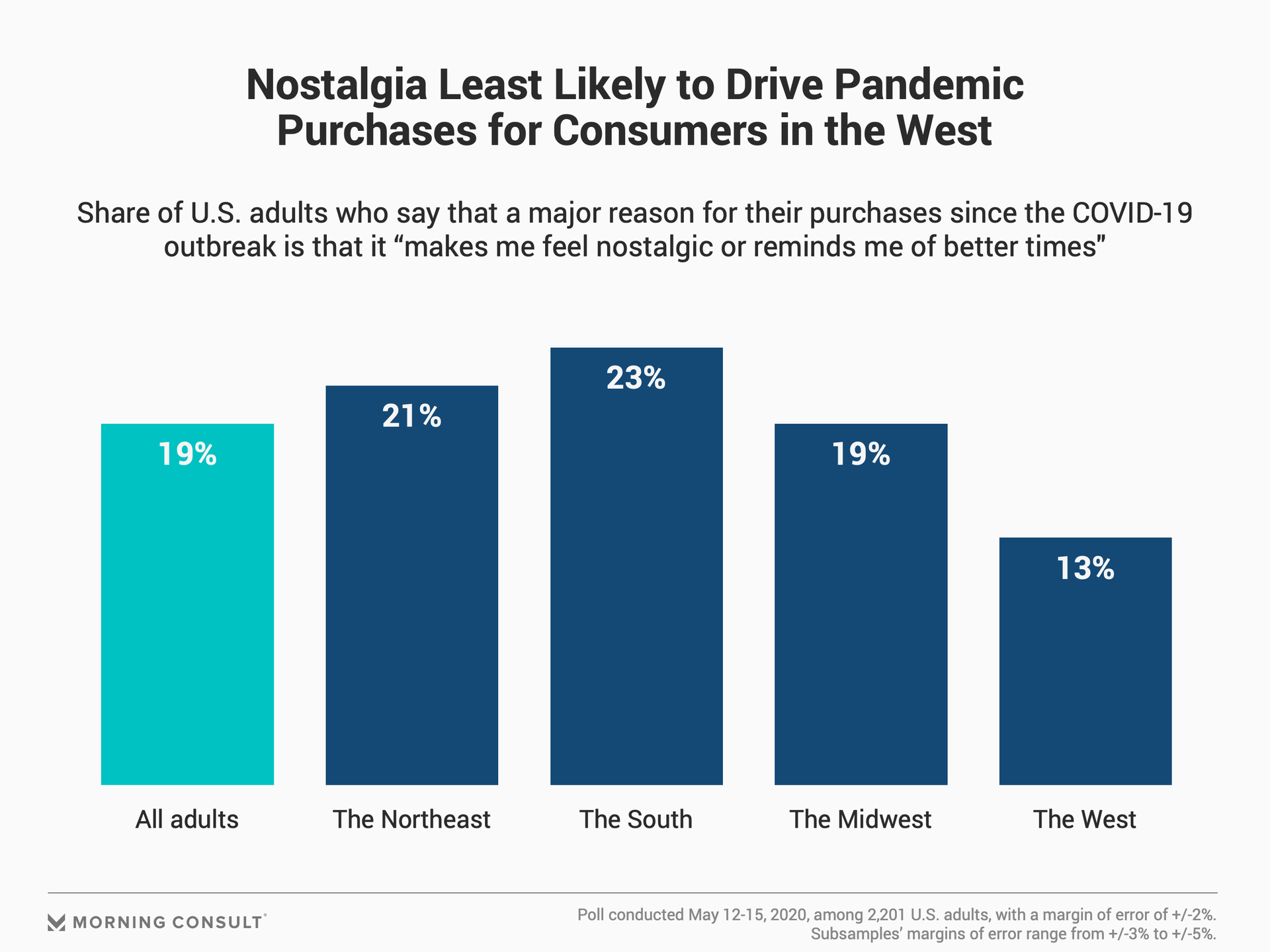

A few regional differences show up in the data as well. The West in particular is less nostalgic for better times than its Northeastern, Midwestern and Southern peers, perhaps because despite shelter-in-place and work-from-home mandates, their lifestyles have been less drastically impacted than their Eastern peers.

Those in the Northeast are more likely to cite products making them feel in control of their surroundings as a top driver of purchase than their peers in other regions. Potentially reflective of psychographic tendencies of Northeasterners in combination with the strict stay-at-home measures enacted in cities in this region, brands active in this corner of the country would be wise to celebrate this desire as constraints begin to lift and residents have greater freedom to make brand, activity and consumption choices again.

Product discovery and abandonment in a pandemic

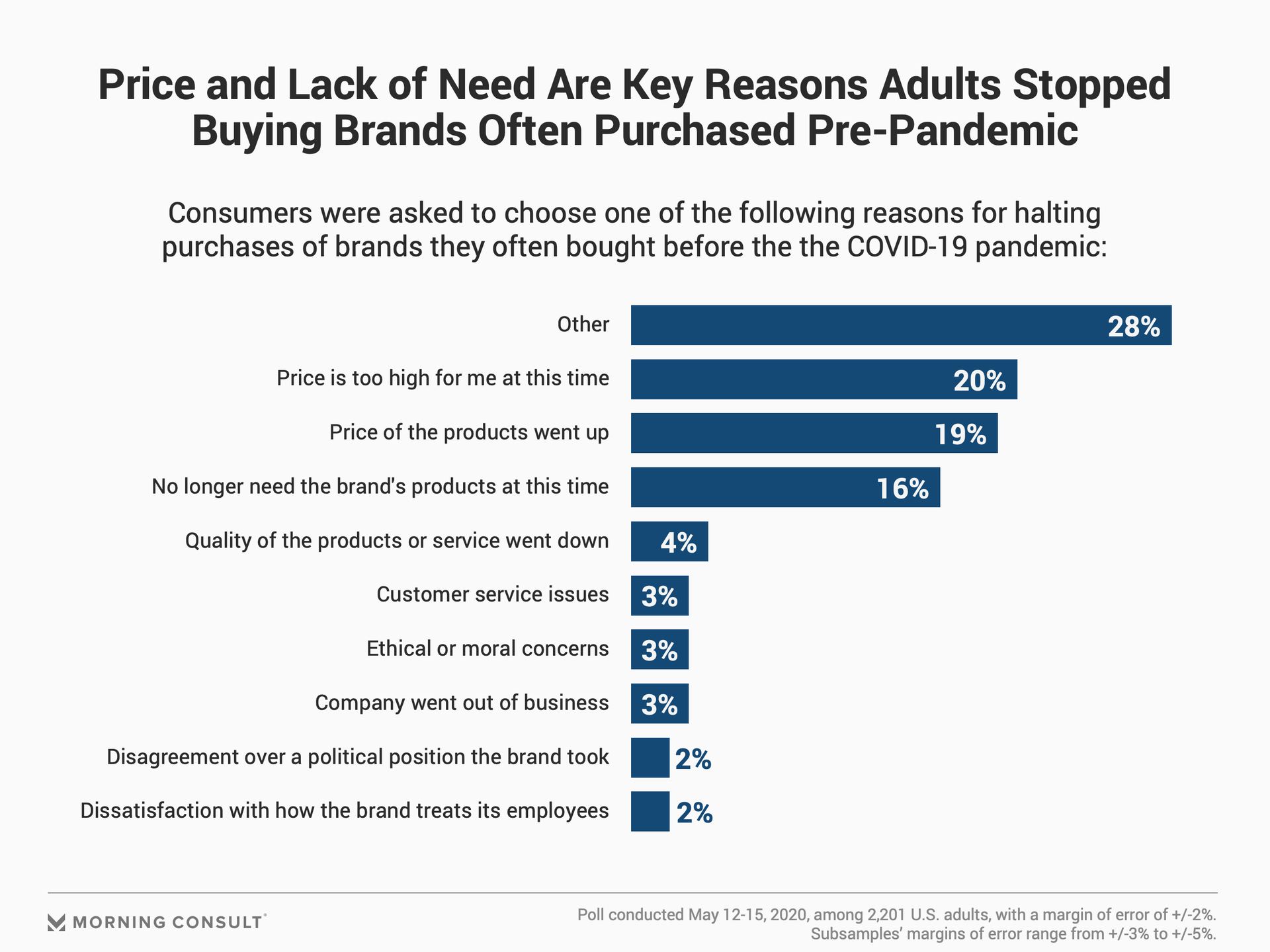

The functional nature of the main reasons consumers cite for recent purchases -- considered in combination with financial pressures from a struggling economy, significant unemployment and concerns about job instability -- also partially explains why U.S. adults are no longer buying brands they used to purchase often before the crisis. Top reasons consumers are discontinuing purchase of brands at this time relate to financial pressures (goods are priced higher or less affordable at this time) as well as lack of need.

However, what doesn't seem to be causing consumers to stop buying from brands are values- or morals-based concerns: treatment of talent, misalignment of political positions, values and/or ethics have led only a small handful of shoppers to stop purchasing from otherwise commonly purchased brands. Morning Consult will continue to track this sentiment as more brands take stances on important political and societal issues coming to a head in recent days, but this suggests that when consumers have the financial means, a clear need and the ability to choose which brands to buy, brand still matters, even during a crisis. Many brands are now navigating supply chain complications, forced closures, safety concerns and potentially even problematic PR, but it seems that brand loyalty still pays off: It creates a stickiness and inertia-powered momentum that only financial pressures and reduced need can cut through.

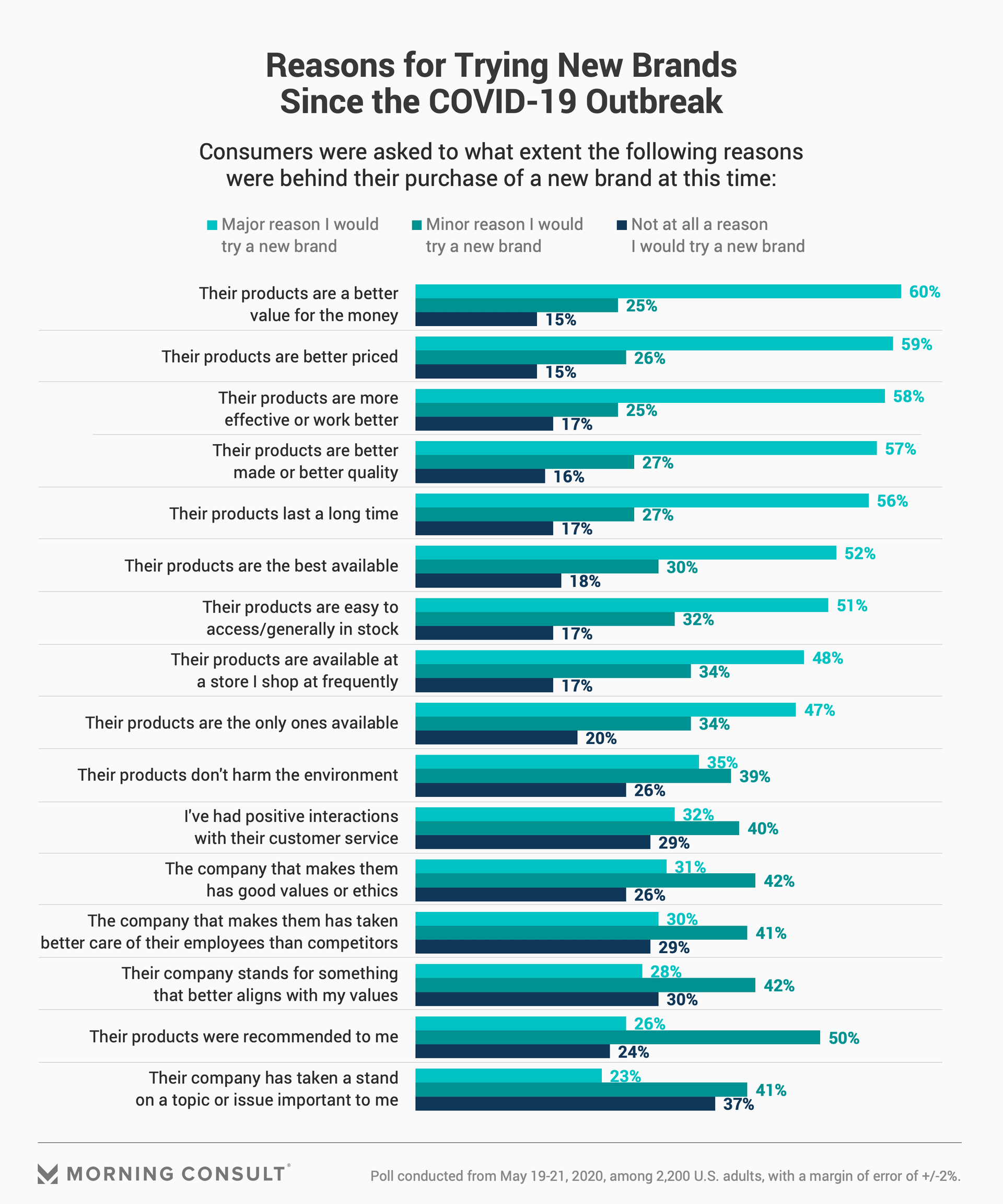

When it comes to trying a new brand at this time, functionality also trumps morality: more than 50 percent of Americans cite better value, price, effectiveness, quality or accessibility as a major reason to try a new brand. Interestingly, strong or aligned values, taking care of employees, and taking a stand on important issues are less important at this time: A third or less of Americans cite these as major reasons for trying a new brand.

Outside of Gen Z being significantly more likely to cite "their products don't harm the environment" as a major reason they'd try a new brand -- and Gen X being significantly less likely to cite this as a major reason -- no other notable demographic nuances exist.

Additionally, 50 percent also say that new products being recommended to them -- though not a major reason for trying something new -- is still a minor reason they'd consider doing so, suggesting the power of a personalized recommendation and word of mouth aren’t dead just because in-person interactions have been stifled.

Though some telling generational and demographic nuances exist, it’s clear that functional needs not only drive purchase for most U.S. shoppers at this time, but also explain why they have stopped buying brands they often bought before the coronavirus outbreak -- and why they’re trying new brands despite the health and financial crisis. Financial pressures caused by a struggling economy, significant unemployment and concerns about job instability play a role, but this finding reveals that when consumers’ wallets regain strength, when pre-pandemic needs become relevant again, and when the ability to choose which brands to buy is restored, brands will still matter.

What’s critical to monitor, however, is the extent to which company values and stakeholder efforts will regain importance to shoppers as Americans slowly reopens, and attention returns to less-functional table stakes.

Victoria Sakal previously worked at Morning Consult as a brands analyst.