Economics

December U.S. Consumer Spending and Household Finances Charts

Report summary

This chart pack provides a curated summary of Morning Consult’s proprietary Economic Intelligence data on U.S. consumer spending and household finances. Morning Consult Economic Intelligence clients can access the complete report here.

Chart pack highlights:

- Following a slight increase in October, consumer spending declined in November, continuing a trend of softening since the height of spending this summer.

- After months of prioritizing spending on experiences, consumers — especially Gen Zers — are pulling back spending on services.

- Real incomes are higher than their year-ago levels, but certain groups, including low-income earners and parents, are becoming more reliant on debt.

Highlights from this report

Consumer spending decreased in November, making it the fourth decline in the last five months. Following a slight increase in October, consumer spending adjusted for inflation declined by 6.0% from the previous month. All income groups reduced their spending, with low-income consumers becoming increasingly likely to trade down to cheaper alternatives.

After prioritizing experiences this summer, consumers have begun pulling back on some discretionary spending. Spending has declined for most discretionary services categories since their peaks in June and July. Gen Zers, who splurged earlier this year, have most sharply reduced their spending, particularly for recreation and apparel categories.

While a tight labor market has led to stronger incomes relative to a year ago, higher debt burdens for some could increase budgetary pressures. Inflation-adjusted incomes are above their year-ago levels for all income groups. At the same time, low earners, Gen Zers and student loan holders report debt rising faster than income. Seasonal trends pushed up credit card balances ahead of the holiday season, while a higher share of consumers, particularly parents and low-income adults, lean on “buy now, pay later” loans.

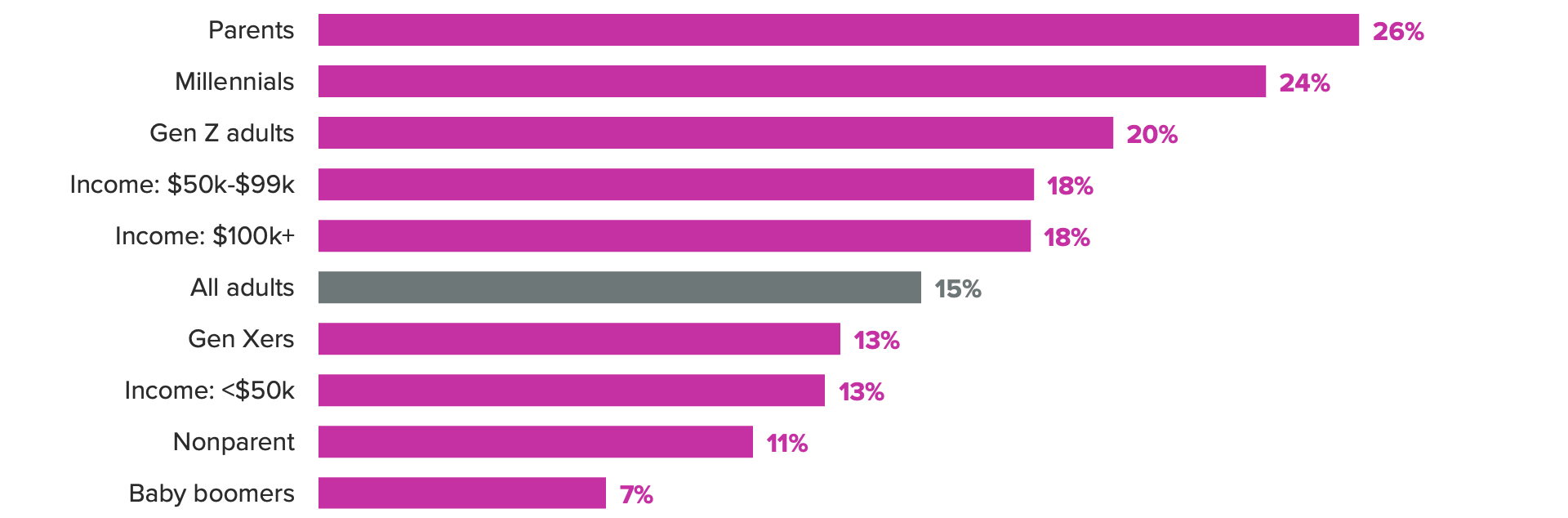

Parents and Millennials Among Those Most Likely to Use Increasingly Popular BNPL Loans

Among those that have a BNPL loan, the average debt payments for those loans have grown in 5 of the past 6 months, increasing from $57 in May to $91 in November. Additionally, the share of adults reporting outstanding BNPL debt has increased from 10.6% in October 2022, when tracking began, to 15% in November 2023. In other words, both the share of consumers using BNPL loans has increased as well as the dollar amount among BNPL users.

The demographics with the largest share reporting outstanding BNPL debt are parents and millennials at 26% and 24% respectively, followed closely by Gen Z adults. Parents in particular are facing increased budgetary pressures ahead of the holiday season, as their debt obligations have increased across all major categories in the previous 3 months. Morning Consult’s spending data also shows that millennials ramped up their spending on clothing/apparel in the past couple of months, so they could be leaning on BNPL loans in part to do so.

About the author

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]