Economics

November U.S. Consumer Spending and Household Finances Charts

Report summary

This chart pack provides a curated summary of Morning Consult’s proprietary Economic Intelligence data on U.S. consumer spending and household finances. Morning Consult Economic Intelligence clients can access the complete report here.

Chart pack highlights:

- Consumer spending increased slightly in October as price relief for certain categories helped to support purchases.

- Discretionary spending is increasingly tilting in favor of experiences outside the home, especially among young adults.

- While residual strength in the labor market continues to support household finances, certain groups — including lower earners, student debt holders and parents — are experiencing growing budgetary pressures.

Highlights from this report

Consumer spending increased 1.0% from September as falling gas prices kept top-line inflation flat in October, improving perceptions of purchasing power. However, spending on many categories remains below its year-ago levels, with even the highest-income households displaying more frugal tendencies this holiday season.

Discretionary spending is increasingly tilting in favor of experiences outside the home. Adults overall are increasingly prioritizing discretionary services over discretionary goods, dampening sales for many retail categories compared with a year ago. Travel categories registered the strongest monthly growth, vastly outpacing spending during the same month in 2022, when many were cowed by airline prices and opted for cheaper holiday travel plans. The reallocation from goods and at-home entertainment to discretionary services and activities outside the home has been particularly visible among young adults as they become choosier about purchasing priorities.

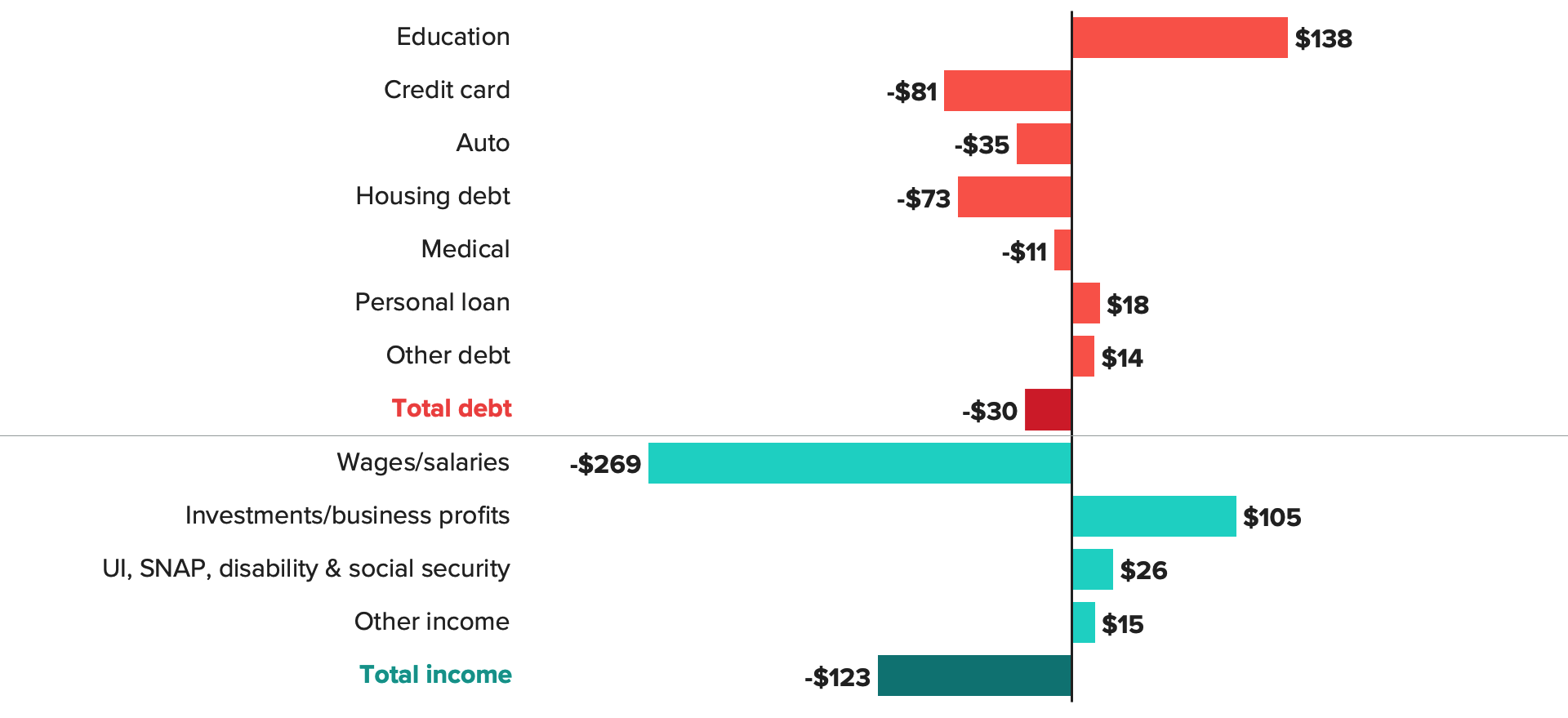

A Higher Share of Adults Are Paying Off Student Debt This Year, Adding To Monthly Cost Burdens

Most households’ finances continue to benefit from a relatively healthy labor market and slowing inflation, but certain groups are experiencing growing budgetary pressures. Despite improvements in spending power this year, for lower-income adults, slower price growth may be little comfort as persistently elevated cost of living challenges affordability. The resumption of student loan payments has contributed to slightly more precarious finances for these debt holders compared with a year ago. Financial strains may also be increasing for parents, who are relying more heavily on BNPL, credit cards and other debt to cover purchases amid the back-to-back cost drivers of back-to-school and holiday shopping.

About the author

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]