What Rising Holiday BNPL Usage Means for Retailers

Key Takeaways

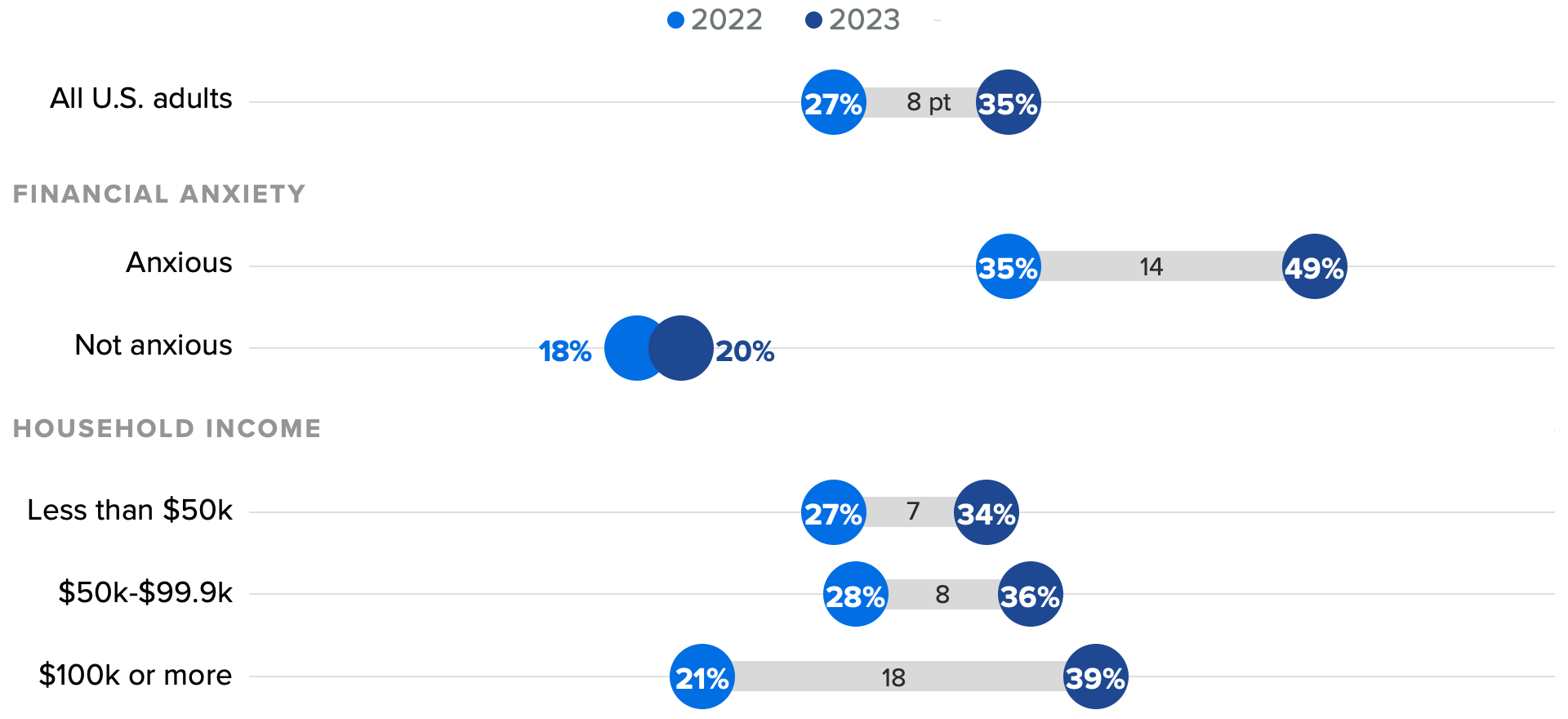

BNPL loans will be more popular than ever this holiday season: Far more high-income (39%) and financially anxious (49%) adults are considering using these loans for their holiday expenses than they were last year (21% and 35%, respectively).

Financially anxious shoppers are especially likely to use BNPL to buy large holiday gifts this year. But this could create problems, since BNPL users are already carrying above-average debt loads and feeling their financial well-being starting to slip.

For BNPL providers and the retailers that use them, the holiday season represents an opportunity for spending growth. But to help limit debt overextension, promotions should be tailored to higher-income consumers, while financial management tools should remain front and center.

Data Downloads

Sign up for our new newsletter on how the trends, habits and behaviors of consumers are impacting the retail industry.

Holiday magic is expensive. While many aspire to spend less this year, gifting, celebrations and travel are significant burdens on household budgets. Just over half (53%) of U.S. adults say they’re anxious about their finances for the upcoming holiday season, and that anxiety is reflected in how they’re thinking about funding all those expenses. It’s tempting to put everything on credit cards and worry about the bill in January, but current interest rates make that plan an expensive proposition.

“Buy now, pay later” loans, on the other hand, are often interest-free and offer defined repayment plans. That certainty can be very appealing to consumers trying to get a handle on their debt, but like credit cards, BNPL can either be a useful tool or a very slippery slope to unwieldy debt. Retailers should be cautious about how they promote these services.

BNPL usage is driven by high earners and the financially anxious

BNPL is an increasingly popular option for financing holiday expenses. This year, people who are feeling anxious about their finances are much more likely to consider using BNPL to fund their holiday expenses than they were last year, as are those with a household income of at least $100,000. The profile of BNPL users is disproportionately high-income and financially insecure, consistent with the groups most keen to use these loans for holiday purchases.

More Consumers Plan to Use ‘Buy Now, Pay Later’ This Year

There are two factors at play here. First, BNPL allows shoppers to spread out their payments over a defined installment plan, so an expensive purchase doesn't feel quite as painful at checkout (or when the credit card bill arrives). Second, BNPL loans often offer a 0% interest rate, which is an incredibly appealing alternative to credit cards.

Specific demographics at scale: Surveying thousands of consumers around the world every day powers our ability to examine and analyze perceptions and habits of more specific demographics at scale, like those featured here.

Why it matters: Leaders need a better understanding of their audiences when making key decisions. Our comprehensive approach to understanding audience profiles complements the “who” of demographics and the “what” of behavioral data with critical insights and analysis on the “why.”

High earners have been paying down credit card debt as interest rates have climbed. At the same time, their monthly BNPL payments are increasing, indicating a shift toward this more attractive interest-free option, especially as BNPL providers are introducing incentives for on-time payments in an effort to compete with precious credit card rewards.

High-Income Households’ BNPL Payments Are Soaring

Monthly BNPL payments have also increased sharply among parents since July, indicating that BNPL was used to finance some back-to-school purchases, as well as gifts for the upcoming holiday season. This suggests that BNPL’s core users are high earners with substantial expenses who are taking advantage of the option to keep up with their normal shopping patterns despite high inflation and interest rates.

BNPL’s ease of use is a double-edged sword because of the potential to put users at risk

Financially anxious adults are twice as likely as their unanxious counterparts to say they use BNPL “most often” to purchase large gifts. Shying away from credit cards for these types of purchases specifically could signify that BNPL is becoming a tool to manage ballooning seasonal expenses, especially if those feel already hard to afford in the current environment. Although this season’s holiday BNPL users are a small sample, 14% have already spent over budget this season, compared with 7% of adults overall.

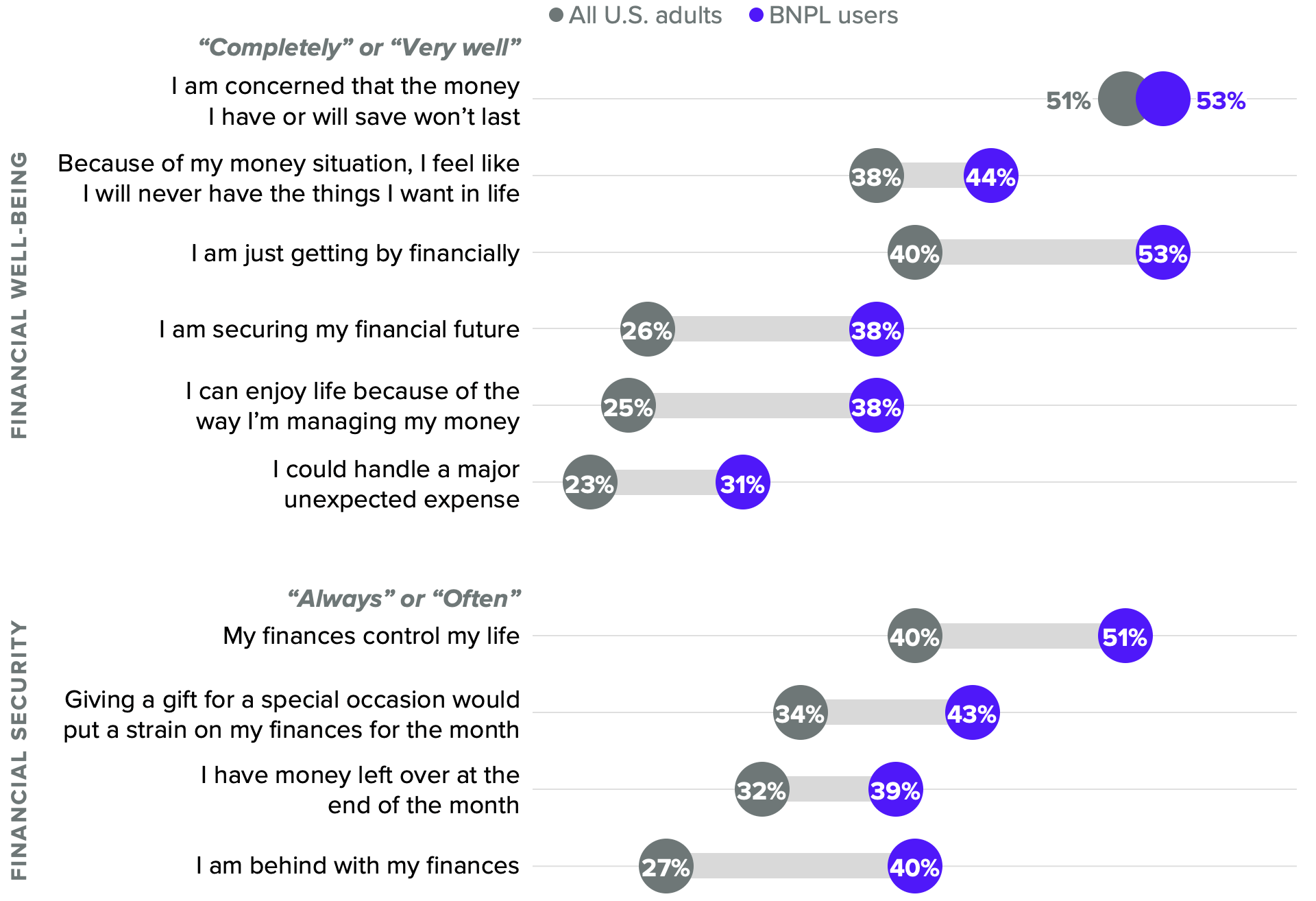

These habits could contribute to an already brewing pattern of financial distress among the typical BNPL user. This demographic is already more likely than the general public to carry every type of household debt, especially in categories like credit cards (55% versus 41%, respectively). And their financial well-being remains in peril, perhaps in response to mounting debt and efforts to manage it.

Our Financial Well-Being Scale, which reflects the extent to which a person’s financial situation provides them with security and freedom of choice, shows a persistent gap between BNPL users and adults overall on several components. In some areas, BNPL users are more worried about their finances: They’re more likely to agree that they’re “just getting by financially” and that their financial situation makes it harder to get what they want in life, for example. But on other measures, this cohort feels more confident than the general public, indicating that their high debt loads and BNPL use could be lulling them into a false sense of security. Using the payment method to facilitate overspending during the holiday season could only exacerbate these problems and push this population even closer to the precipice of financial free-fall.

BNPL Users’ Financial Security Remains Tenuous

For retailers and payment providers, these trends create both a problem and an opportunity

BNPL providers are already tweaking their strategies accordingly. Multiple providers, including Affirm, PayPal and Zip, have found that growth in their BNPL platforms is driven by repeat users. When customers have history with a provider, there’s a greater ability to use past behavior to determine lending standards. Loyalty to one brand can also limit the likelihood of double-dipping on debt between providers. Together, these factors can cut down on risk.

But with the share of those planning to use BNPL this holiday season higher than the share who typically report using BNPL on a monthly basis, the holidays will bring a slew of new users into the fold. Providers should tread with caution:

- With high-income users, it’s likely that they’re using BNPL as an opportunity to find deals, rather than as a lifeline to afford purchases. Targeting this population with BNPL-focused promotions and discounts — similar to the deals that helped fuel Peloton’s boom during the pandemic’s peak years — could help drive use among a potentially lower-risk base with ample appetite for the service.

- But with financially anxious customers, their new large holiday purchases might only add to dangerous debt loads. Retailers that promote programs to help entice safe spending behavior, like on-time payment rewards or other financial management tools, could help mitigate some of these risks as Cyber Weekend approaches.

Jaime Toplin previously worked at Morning Consult as a senior financial services analyst.