Economics

U.S. Consumer Spending & Inflation Report: April 2023

Report summary

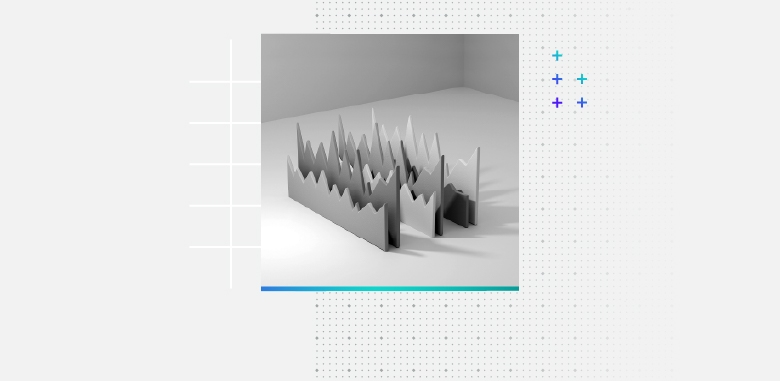

March brought a disappointing close to the first quarter of 2023, with real consumer spending declining by 9.5% month over month. Recent improvements in Americans’ personal finances indicate that consumers may be prioritizing saving and paying down debt over spending amid high prices and economic uncertainty. Inflation softened further in March, bringing welcome relief for consumers, but the persistence of core inflation adds pressure for the Federal Reserve to continue raising rates at its next meeting in early May.

Key Takeaways

- Morning Consult’s real consumer spending decreased dramatically in March, ending the first quarter of 2023 on a sour note.

- Monthly top-line inflation declined more than expected, but core inflation dropped only moderately, offering mixed signals in the fight against inflation.

- Higher prices are pinching the budgets of consumers at all income levels, prompting them to walk away or trade down on high-priced goods and services.

About the author

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]