Amid Unpopular Tax Overhaul, GOP Banking on 2019 Tax Returns

Key Takeaways

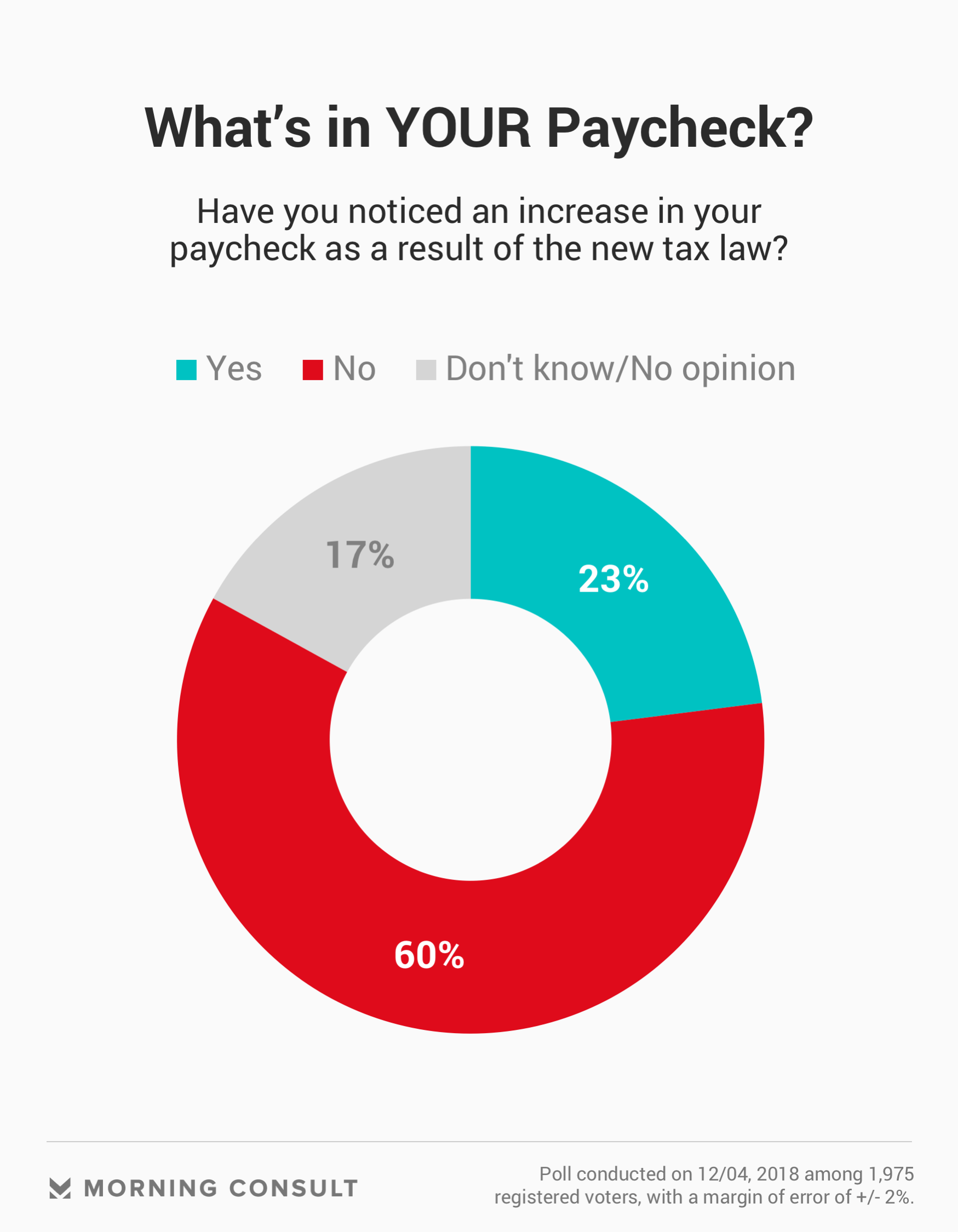

23% of registered voters said they noticed an increase in their paycheck because of the Republican tax overhaul.

Personal benefit driven by politics: 73% of Democrats and 44% of Republicans didn’t notice an increase.

27% anticipate receiving a higher tax refund in 2019.

In 2019, Republicans will get another shot at controlling the narrative around one of their signature legislative achievements: a massive tax overhaul that was supposed to galvanize voters ahead of the midterm elections this year.

The fight may come down to voters’ pocketbooks.

Americans will get their first chance to tally savings and losses from the 2017 Tax Cuts and Jobs Act when they file tax returns in February and receive refunds later in the year. As voters take stock of their own finances, both Republicans and Democrats are gearing up to craft their tax reform messaging ahead of the 2020 presidential election.

So far, few voters have noticed a bump in their take-home pay due to the tax law, according to a Morning Consult/Politico survey.

Twenty-three percent of registered voters said they noticed an increase in their paycheck this year as a result of the law, while 60 percent didn’t, according to a Dec. 4 poll conducted among 1,975 registered voters.

The politics of the law also appeared to affect voters’ perceptions of their personal finances, with 73 percent of Democrats and 61 percent of independents saying they didn’t see any boost on their paystub. Though a 44 percent plurality of Republicans said the same, 37 percent did notice an increase.

Experts said the lack of visible benefit helped Democrats in the midterm elections, and it’s a point the party is likely to stress leading up to 2020.

Congressional Democrats, particularly those bidding for the 2020 presidential ticket, will likely try to introduce bills that roll back the corporate tax cut and breaks for wealthier Americans.

While those bills are not expected to make it through a Republican-controlled Senate and to President Donald Trump’s desk, it will be a key fight to watch for voters who were disappointed by their piece of the tax overhaul, according to several Democratic strategists.

“We had a great deal of success attacking Republicans on the tax issue and showing how their legislation benefits the very wealthy folks,” said Michael Lux, chief executive of campaign strategy firm Progressive Strategies LLC.

“In the next year, Democrats in Congress will be finding ways to set up 2020 election gains on the issue,” said Lux, who served on the Obama transition team and in the Clinton administration as a special assistant to the president in the public liaison office.

But Republicans aren’t about to give up the fight.

It’ll be a defensive rather than an offensive message.

Most voters won’t notice changes stemming from the tax law until they file their 2018 returns next year and when they get their refunds shortly after.

That window gives Republicans a chance to reclaim the narrative on one of the party’s signature pieces of legislation -- and one that has proved far less popular than the party would have hoped, said Rohit Kumar, now a leader for tax policy services at PwC and former deputy chief of staff and senior counsel to Senate Republican Leader Mitch McConnell.

Experts, including Kumar, anticipate Republicans will buckle down on a message around tax reform and a booming economy ahead of 2020, as well as introducing tax cut bills focused on the middle class that they will argue complement the existing legislation.

“So it’ll be a defensive rather than an offensive message,” said Nicole Kaeding, director of federal projects at the Tax Foundation, a tax policy nonprofit.

The Dec. 4 poll found that 41 percent of the registered voters surveyed supported the tax changes, compared to 36 percent who opposed them.

The most recent survey showed fairly consistent results with previous Morning Consult/Politico polling on the tax law. A September survey counted 39 percent in favor of the tax law and 37 percent against, while an April poll found 44 percent for and 39 percent against.

For most of the year, voters have been disappointed by slow-to-appear savings from the tax overhaul, despite assurances from congressional Republicans and Trump that middle-class Americans would benefit from a higher take-home pay, experts said.

“The story of the 2017 tax cut is a familiar story to people who pay attention to public opinion and taxes,” said Howard Gleckman, a senior fellow at the Urban Institute. “Individuals always have a hard time believing when they get a tax cut.”

Individuals always have a hard time believing when they get a tax cut.

Americans don’t appear to be optimistic that the promised savings will come in a larger tax refund, either.

In the December poll, 27 percent of voters said they anticipate receiving a larger tax refund in 2019 than they did this year, while a 48 percent plurality don’t expect it; though an even lower share (17 percent) said they got a bigger refund this year than in 2017.

As with perceptions of their paycheck, party drove people’s attitudes toward their potential refunds. Thirty-seven percent of Republicans said they anticipated a larger refund in 2019, compared to 19 percent of Democrats and 25 percent of independents.

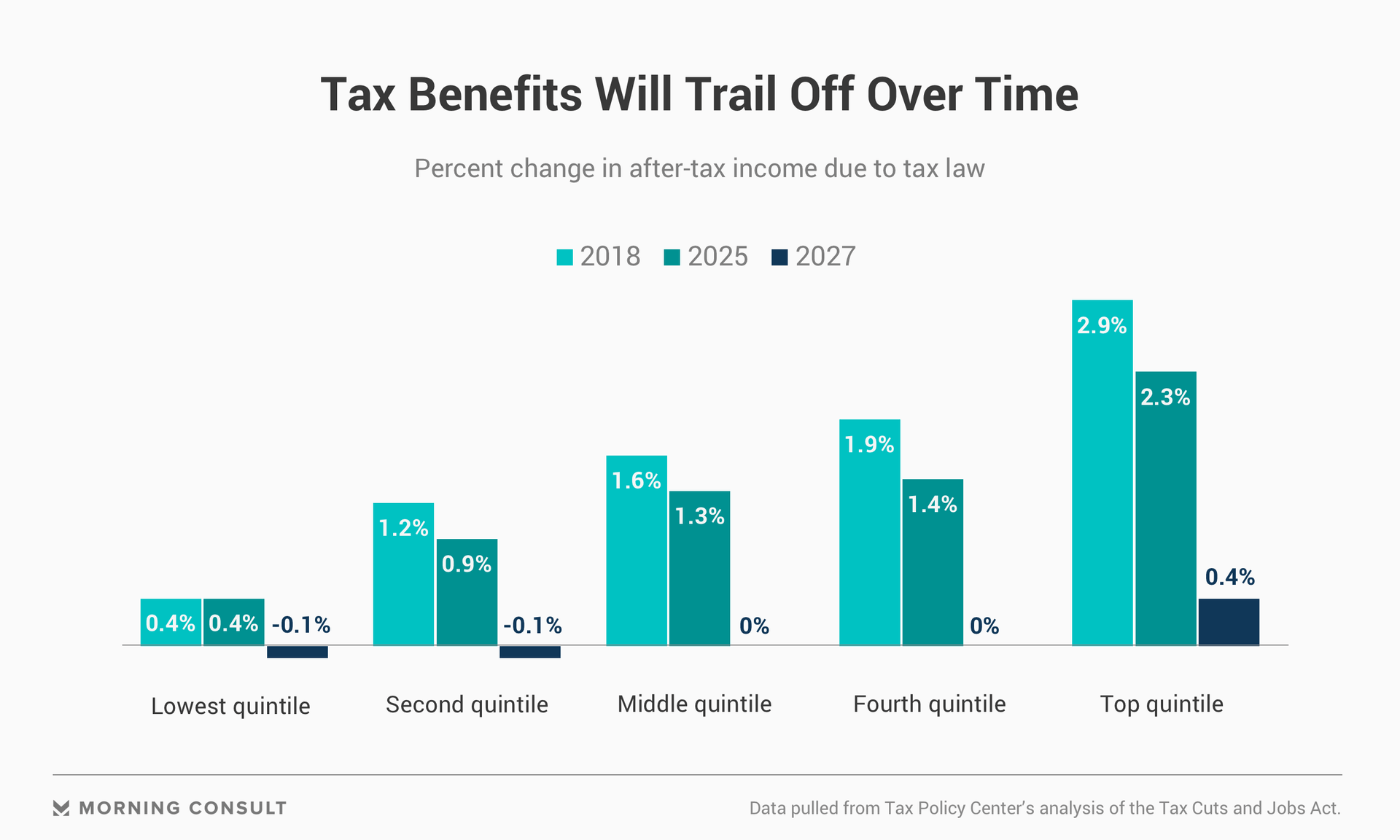

Despite public perception, most Americans will likely get at least a modest benefit once everything is calculated after tax filing season. The size of the benefit varies, but the Tax Policy Center continues to estimate that at least 80 percent of households will see some kind of a tax boost.

The size of the benefit depends on household income, but is unlikely to be substantial for lower earners and will decrease over time. For example, in the upcoming tax season, taxpayers with income less than $25,000 will see an average tax cut of $60, while those making between about $49,000 and $86,000 will see an extra $900, according to an analysis by the Tax Policy Center, a joint project between the Urban Institute and the Brookings Institution.

This round, it could be more difficult for Republicans to convince voters they’re better off with the new tax bill than its has been with previous tax cuts, Gleckman said.

Health care costs are rising, for example, possibly negating any kind of a tax bump, he said.

It’s also possible that people aren’t noticing a pay boost from the tax changes because they’re just not checking their pay stubs.

“People don’t get paychecks or pay envelopes anymore,” Gleckman said. “Whoever looks at their electronic paystub?”

Kumar said he thinks public opinion will eventually swing sway back toward Republicans on tax reform when voters see gains in their tax returns.

But in the meantime, it’ll be “a lot of posturing” from both sides as they build the groundwork for their 2020 bids, even if significant tax policy will be difficult to pass in the gridlocked Congress, Kumar added.

“It doesn’t feel like we’re on a path to lawmaking right now, but you ignore the next year at your own peril.”

Claire Williams previously worked at Morning Consult as a reporter covering finances.