Energy

For Widespread Adoption of Electric Vehicles, Many Roadblocks Ahead

Key Takeaways

62% of consumers said a lack of charging stations would make them less likely to consider an electric vehicle, while 60% named higher upfront car costs as a downside.

The possibility of gas savings is the top perk of electric vehicles: 73% of adults said it would make them more inclined to consider buying or leasing one.

84% of adults said they are unsure whether their state offers incentives to electric vehicle buyers.

With more battery electric vehicles and plug-in hybrids on the road than any country other than China and domestic auto companies like Ford Motor Co. and General Motors Co. investing in new electric models, the United States is a clear leader in the electric vehicle space. But while analysts continue to forecast growth in the U.S. market, electric vehicles still make up just a sliver of overall domestic car sales at 1.2 percent, according to International Energy Agency data.

Expanding that share is likely to prove difficult, according to new polling from Morning Consult, which found that while about 1 in 2 adults say they would be very or somewhat likely to buy or lease a hybrid if shopping for a car in the next decade, just 1 in 3 said the same about all-electric cars, even as battery costs continue to drop and charging infrastructure expands.

The results of the survey of 2,201 U.S. adults, conducted March 15-17, suggest that electric car makers not only have to overcome consumers’ perceptions of the vehicles’ infrastructure-related disadvantages; they must also figure out how to educate potential buyers on the government incentives available to them.

In the poll, people received descriptions of several types of electric vehicles -- all-electric, hybrid electric and plug-in hybrid electric -- and were asked about specific factors that could influence their decision to buy them. The key roadblocks to potential increased sales include concern over the potential unavailability of or distance to charging stations (62 percent said this would make them less likely to consider an electric vehicle) and high upfront costs (60 percent). The poll’s margin of error is 2 percentage points.

Obstacles and benefits of electric vehicles

Range anxiety, or concern among drivers that an electric vehicle might run out of power before they reach their destination, is a well-researched worry, though studies have indicated that most car trips can be completed with an electric vehicle.

The proportion of adults concerned about charging is even greater among the 733 adults who said they were likely to consider buying or leasing an electric vehicle and the 1,117 people who would consider a hybrid vehicle, with 66 percent and 73 percent of those subgroups, respectively, identifying the charging issue as a downside. The margins of error for likely electric vehicle and hybrid buyers are 4 and 3 points, respectively.

Americans do not uniformly have the ability to charge these cars at home. According to the Energy Department, plug-in electric vehicle drivers perform over 80 percent of their charging at their home. Not all homeowners have a garage, and those who have one might use it for purposes other than storing a car. For those individuals, there is “a difficult operating case for owning an electric vehicle,” said Scott Shepard, a senior research analyst at Navigant Research. Those consumers likely would have to rely on public charging that is not universally available and is usually more expensive, Shepard noted.

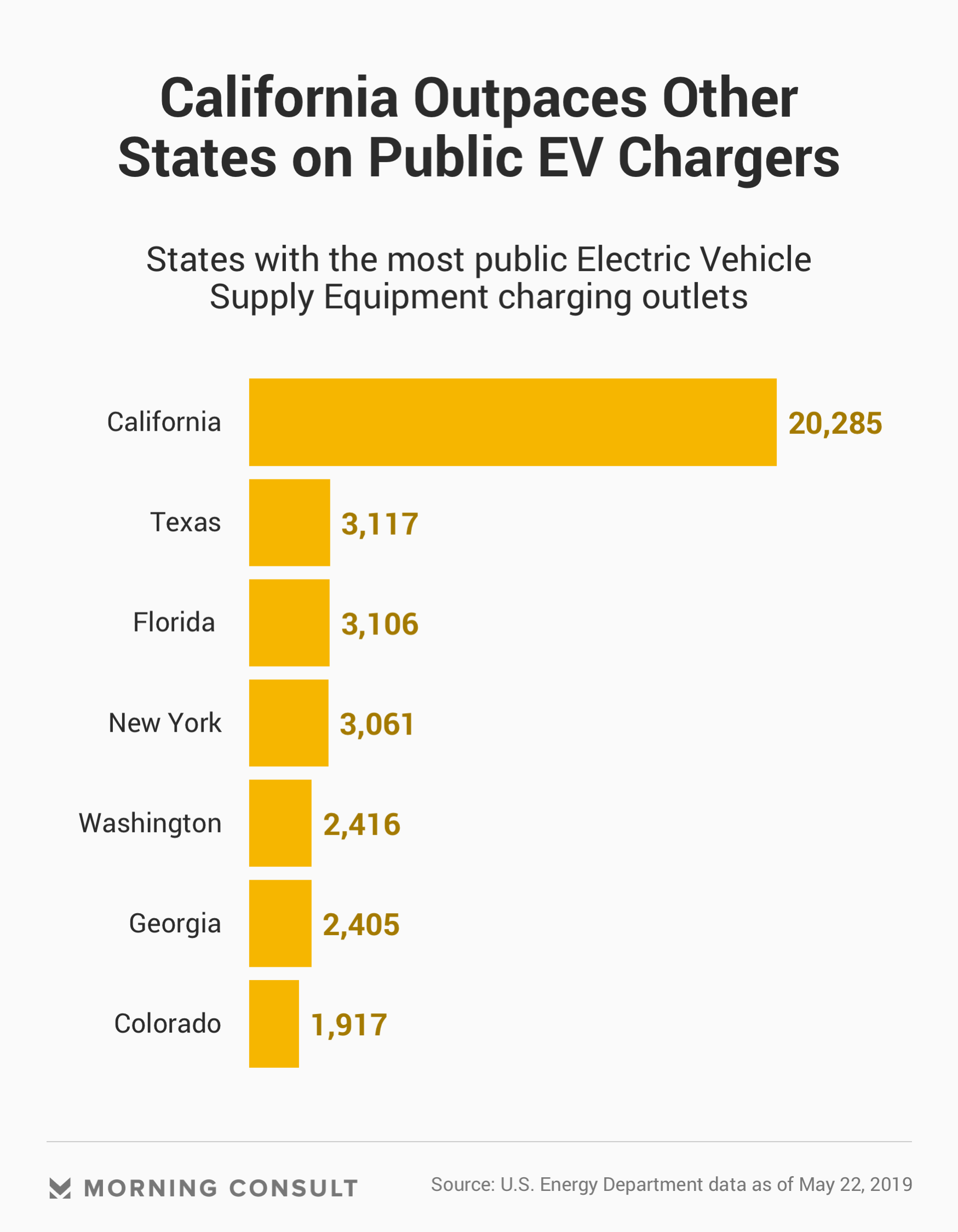

Public charging has been installed at varying rates nationwide. California is in the lead with more than 20,000 public charging outlets as of May 21, according to the Energy Department while Texas, in second place, has substantially fewer at around 3,100.

Consumers’ rationale for buying a car is for “freedom of movement, mobility and convenience,” said Chet Thompson, president and chief executive of the American Fuel & Petrochemical Manufacturers trade group. It is unsurprising that range anxiety is a key concern about electric vehicles, he said, “particularly if an electric vehicle is ever going to be your primary car.”

Most adults also said that the higher price tag attached to an electric vehicle would make them less likely to purchase one. For example, Tesla Inc.’s Model 3 sedan, its lower-priced car intended for a wider audience, retails at over $35,000, compared to the 2019 Toyota Prius L Eco hybrid, which has a manufacturer’s suggested retail price of $23,770. The Toyota Prius Prime plug-in hybrid costs more, at $27,350. By comparison, a 2019 Nissan Altima with an internal combustion engine retails at $24,000.

Sixty-nine percent of likely hybrid buyers identified higher upfront car costs as a downside, compared to 62 percent of likely electric vehicle buyers.

Potential savings on gas costs constitute the top potential perk of an electric vehicle purchase, according to the poll, with 73 percent of all adults saying they were more likely to buy an electric vehicle in light of that benefit.

And majorities of adults said the potential to reduce their emissions and nab a tax credit make them more likely to buy an electric vehicle. But 84 percent of all adults said they are unaware of whether state-specific incentives to electric vehicle buyers are offered where they live. Currently, 20 states offer incentives such as tax breaks or rebates for electric cars, according to Tesla.

Raising public perception

At a consumer level, “there’s a lot of education that I think still needs to go on” regarding electric vehicles, said Devin Lindsay, principal analyst of North American powertrain forecasting at IHS Markit Ltd. “People already know what they’re getting when they buy an internal combustion engine vehicle, and a battery electric vehicle requires a completely different relationship with the car.”

Consumer awareness is a top focus area for the Electric Drive Transportation Association, which promotes electric vehicle and fuel cell technologies for a diverse membership of car companies, utilities and others. The association and the Energy Department, for instance, have put forward many digital tools for consumers to explore electric vehicle models, charger locations and credits.

However, “in order to click to the site, you have to know to want to ask the question” about electric vehicle offerings and incentives, said Genevieve Cullen, the association’s president.

Enhancing confidence in electric vehicle infrastructure is something the organization is examining, Cullen said. Part of raising confidence, she said, is to increase the infrastructure available.

The poll suggests that those currently interested in electric vehicles are more likely to be younger, male, wealthier and belonging to the Democratic Party compared to the overall U.S. adult population. Those demographics “track pretty well with folks who would be technology early adopters,” said Cullen, who expected that increasing market penetration would reduce those distinctions, especially regarding income.

Driving the EV market forward

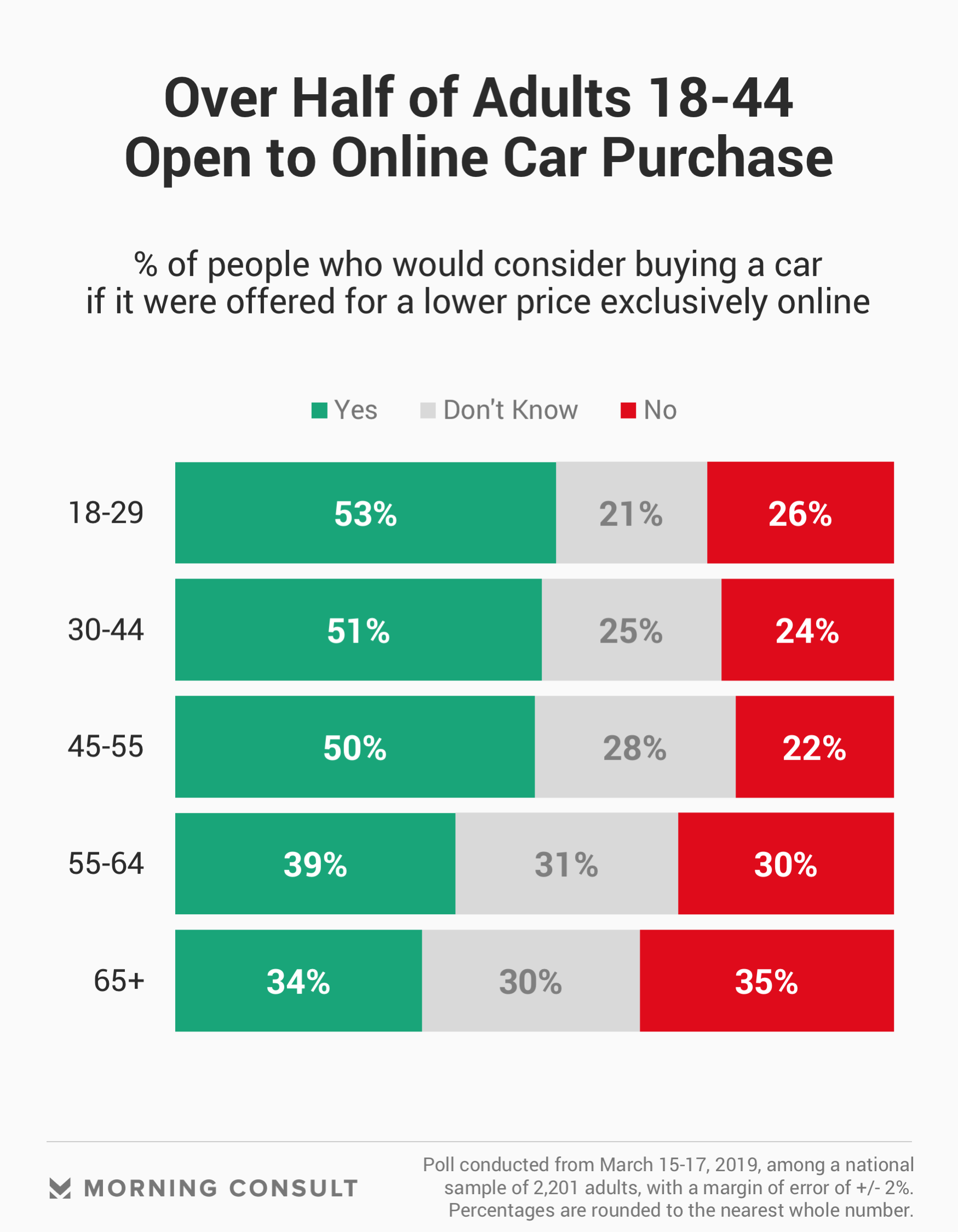

Expanding electric vehicle and hybrid choices are also taking place in the early stages of what could be a shifting sales paradigm. In February, Tesla said it intended to close nearly all of its physical stores and move all sales online to save money, allowing it to lower all vehicle prices by about 6 percent on average. But it rolled back the move, deciding instead to close fewer stores than initially expected and raise car prices as a result.

Tesla might have been on to something: In the survey, 46 percent of U.S. adults said they would consider buying a cheaper car offered exclusively online. But sentiment was split across different age groups. Over half of those ages 18-29 and 30-44 said they would consider such an online exclusive offer, while 39 percent of those ages 55 and 64, and 34 percent of people 65 and older said the same.

Any transition to online car sales is likely to be a drawn-out process, but multiple car manufacturers are examining such methods for both new and used cars, Shepard said. The trend, he said, is “definitely not” in the dealerships’ favor.

Even though the U.S. electric vehicle market did not grow nearly as quickly as predicted a decade ago, IHS Markit has a positive growth outlook for the domestic market, Lindsay said.

And Shepard said battery-electric vehicles with 150-mile batteries are projected to cost the same, without subsidies, as vehicles with an internal combustion engine around 2025-2027.

Growth in the U.S. electric vehicle market has fluctuated each year. For plug-in electric cars, 2019 sales growth is likely to be weaker than last year, when Tesla’s Model 3 release resulted in a surge that brought North American sales in line with that of Europe and China, according to Shepard.

And although dropping battery costs are making electric vehicles less expensive for consumers, electric vehicles are still about $12,000 more expensive for automakers to produce than internal combustion engine vehicles, according to a March analysis by McKinsey & Company Inc.

Meanwhile, the Corporate Average Fuel Economy standards and state-level zero-emission vehicle mandates that started in California are “essentially forcing the industry to invest in electric vehicles,” while the federal electric vehicle subsidy has motivated the auto industry to put more money into electric vehicles, said Shepard.

The speed of electric vehicle adoption is likely to hinge in part on the continuation or expansion of the $7,500 federal tax credit for plug-in electric cars, which is backed by 64 percent of the respondents in the Morning Consult poll.

Jacqueline Toth previously worked at Morning Consult as a reporter covering energy and climate change.