Blog

Morning Consult Price Surprise Index Rises for Fifth Consecutive Month; Price Sensitivity Increases Across Essentials Like Groceries and Clothing

NEW YORK — October 9, 2025 — Morning Consult today released the latest edition of its U.S. Inflation and Supply Chains report, showing the company’s proprietary Price Surprise Index, a measure of consumers' perceptions of prices, rose for the fifth consecutive month across most goods and services.

Based on ~11,000 monthly surveys, Morning Consult’s U.S. Inflation and Supply Chains report measures how consumers experience and respond to price changes and supply disruptions across the economy. Using a nationally representative survey, the data quantifies consumer perceptions and behaviors through six proprietary diffusion indexes that monitor both demand and supply dynamics:

- Price Surprise: Net share of consumers reporting higher-than-expected pricing

- Price Sensitivity: Willingness to forgo a purchase when faced with higher-than-expected pricing

- Trading Down: Willingness to switch to a cheaper substitute

- Unavailability: Inability to purchase a product or service

- Purchasing Difficulty: Extent to which buyers report difficulty obtaining a product or service

- Delivery Delays: Relative change in delivery timing compared to the previous month

Together, these indicators provide a high-frequency, consumer-based measure of inflation pressures and the economy.

Key Findings from the September 2025 Reading:

- Price Surprise is climbing, led by goods inflation: Morning Consult’s Price Surprise Index excluding housing — which measures how unexpectedly high consumers perceive prices to be — has risen steadily since April. Goods categories are driving the increase, fueled by newly enacted tariffs and faster-rising goods inflation.

- Some categories show resilience despite higher prices: Consumers are showing a growing willingness to pay more for certain items. Categories such as furniture, paper goods, and appliances saw higher price surprise but lower price sensitivity, meaning shoppers are noticing higher prices but still buying — a sign of strengthening demand.

- Others are showing signs of price fatigue: In groceries, alcohol, and clothing, both price surprise and sensitivity increased. Consumers are becoming more shocked by prices and more likely to walk away, pointing to rising price resistance in these everyday categories.

- Mixed trends in autos: Price surprise fell for new and used vehicles, but behavior diverged: consumers were more tolerant of higher used-car prices while becoming more hesitant about new cars, indicating shifting affordability thresholds.

- Tariffs could intensify inflation pressures: As new tariffs take effect, goods prices are expected to keep climbing — and may eventually push inflationary pressure into services. Monitoring how consumers perceive and respond to these price changes will be critical for anticipating shifts in demand.

“Our data show that consumers are adapting unevenly to higher prices. While demand is holding firm for some goods, rising tariffs and goods inflation are starting to test the limits of what consumers are willing to pay,” said Kayla Bruun, Head of Economic Analysis at Morning Consult.

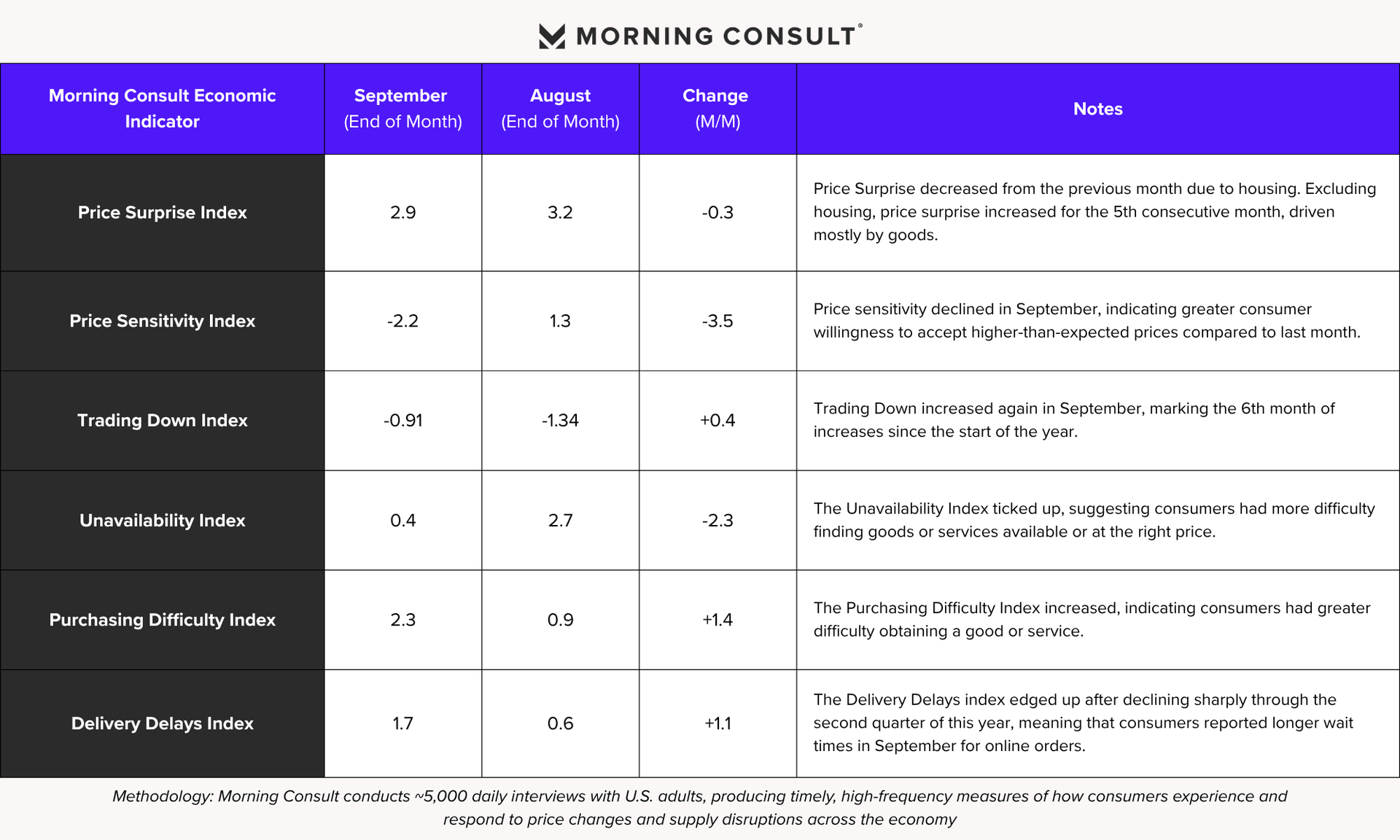

Morning Consult Inflation and Supply Chains Indicators

(September 2025 Readings)

Methodology: Morning Consult’s Supply Chain and Inflation Survey measures the impact of shortages and rising prices on consumers and their purchasing habits. Conducted monthly since September 2021, the nationally representative survey asks 11,000 U.S. adults (2,200 between September 2021 and April 2024; 5,500 in May and June 2024) which products they struggle to find, how long they wait for deliveries, and how they respond to price changes and supply disruptions.

About Morning Consult: Morning Consult delivers the always-on consumer signal. Every day, we survey 30,000 people across 40+ countries, tracking behavior and sentiment in real time. From hidden growth opportunities to emerging reputation risks, we help leaders see around corners and act first. Learn more at morningconsult.com.

Contact:

Anna Rose Pardue: [email protected]

Interested in connecting with a member of the Morning Consult team regarding our recent data and analysis? Email [email protected].