APAC: Leader Approval & Country Trajectory Outlook, November 2023

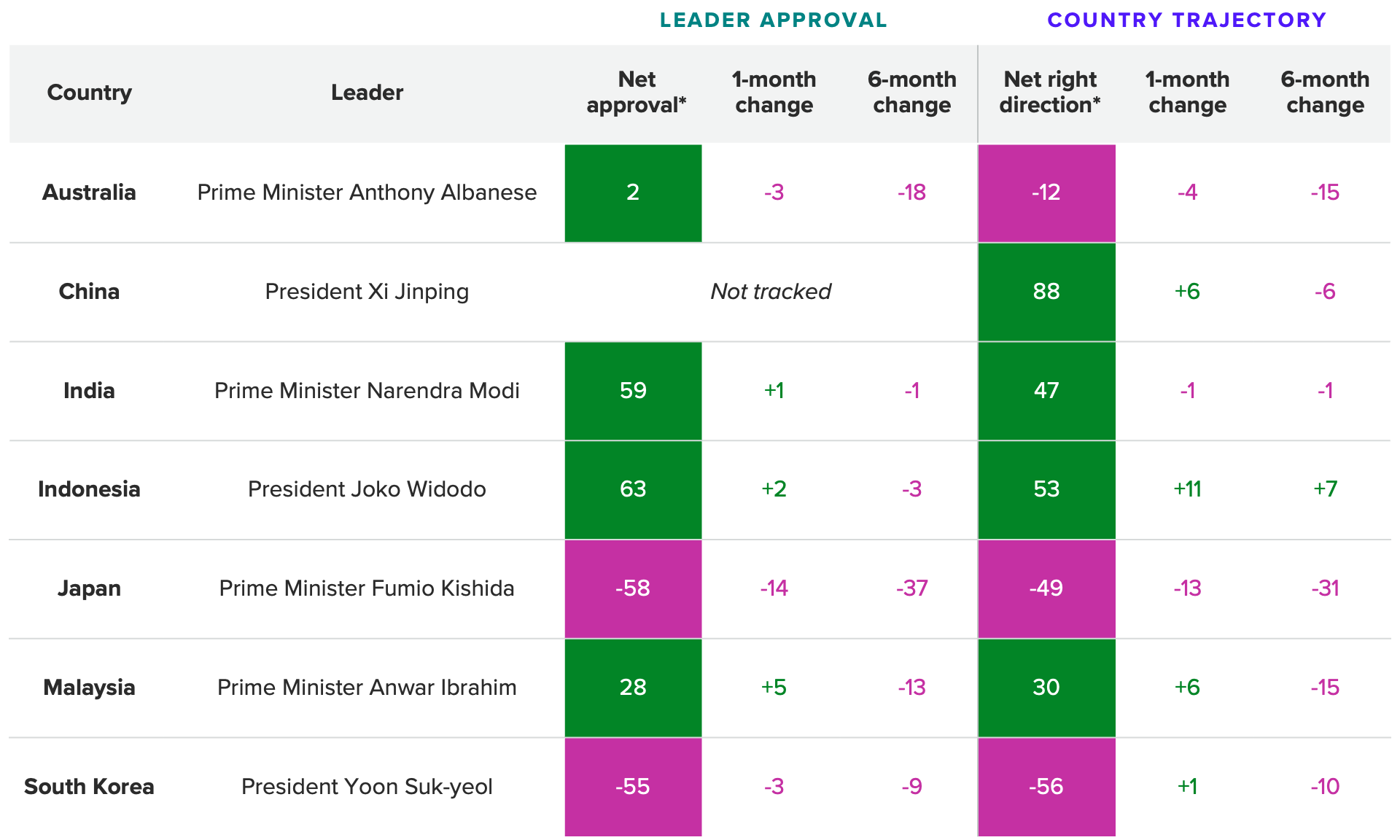

Source: Morning Consult Political Intelligence. Data points in Australia, China, India, Indonesia, Japan and South Korea represent 7-day simple moving averages of daily surveys. Data points in Malaysia represent 30-day simple moving averages of daily surveys. One-month change corresponds to Oct. 15-Nov. 15, 2023. Six-month change corresponds to May 15-Nov. 15, 2023.

Morning Consult’s Leader Approval & Country Trajectory series track the net shares of adults in each country surveyed who approve of the incumbent political leader and say their country is headed in the right direction. For a downloadable version of the charts from this analysis, see the November 2023 APAC Leader Approval & Country Trajectory Chart Pack.

Key Takeaways

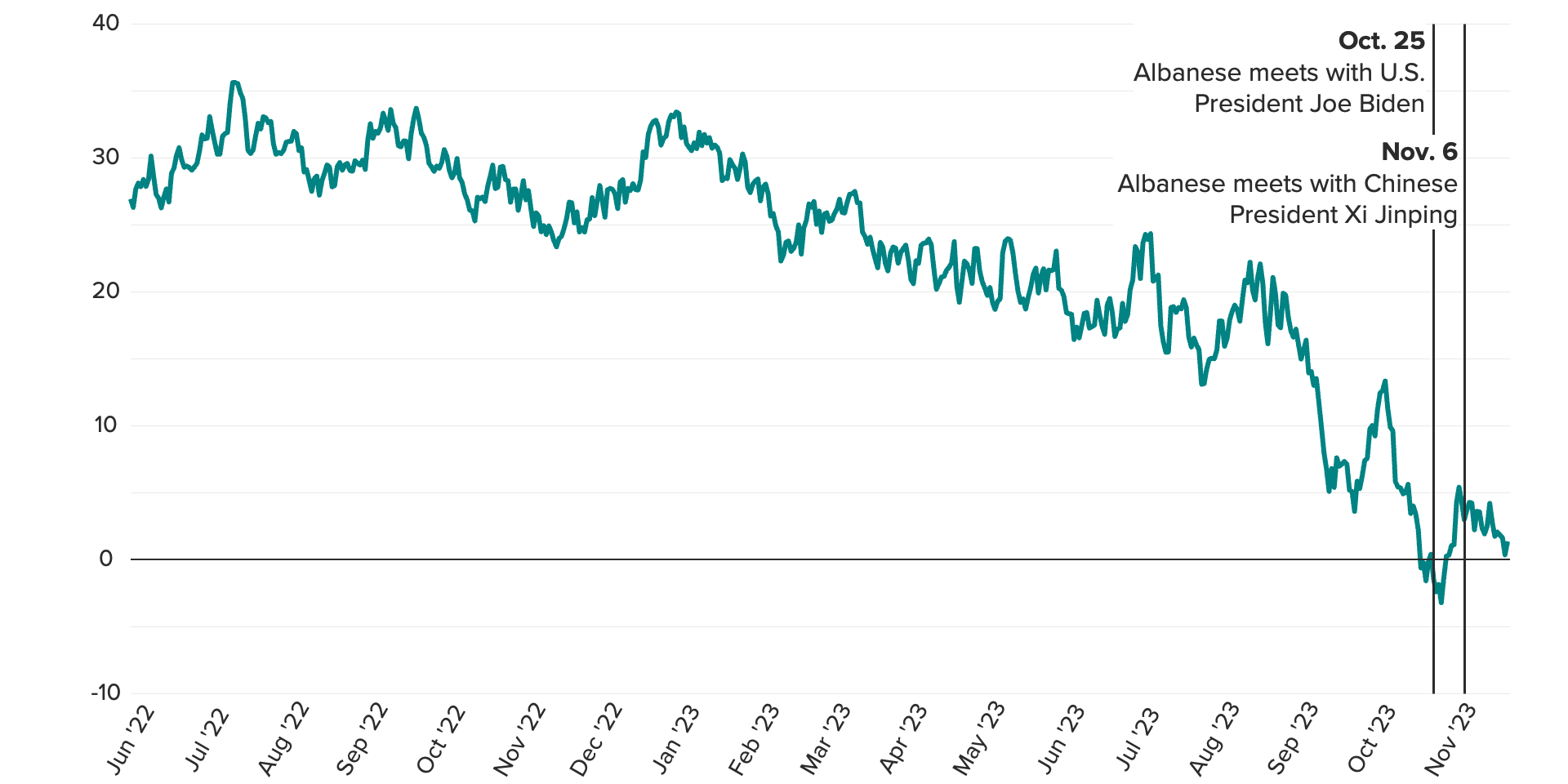

Australia: Despite high-profile wins on the international stage, Australian Prime Minister Anthony Albanese is struggling with pocketbook issues at home and continues to see his net approval hover near negative territory. Convincing constituents he can steer the economy back to calmer waters will be required to right the ship.

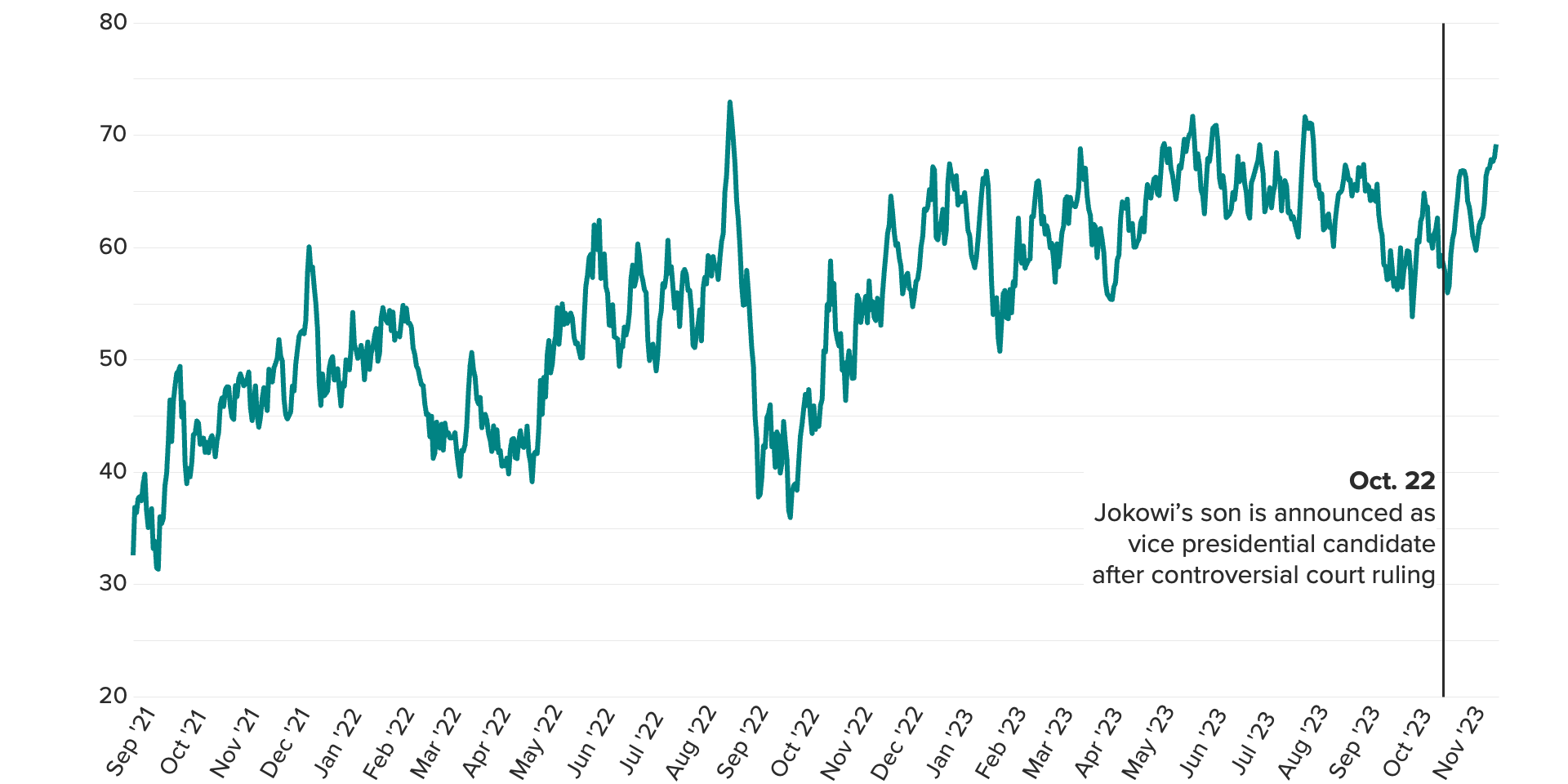

Indonesia: President Joko Widodo remains popular despite there being a whiff of impropriety surrounding a recent constitutional court ruling that made his son eligible to run for vice president.

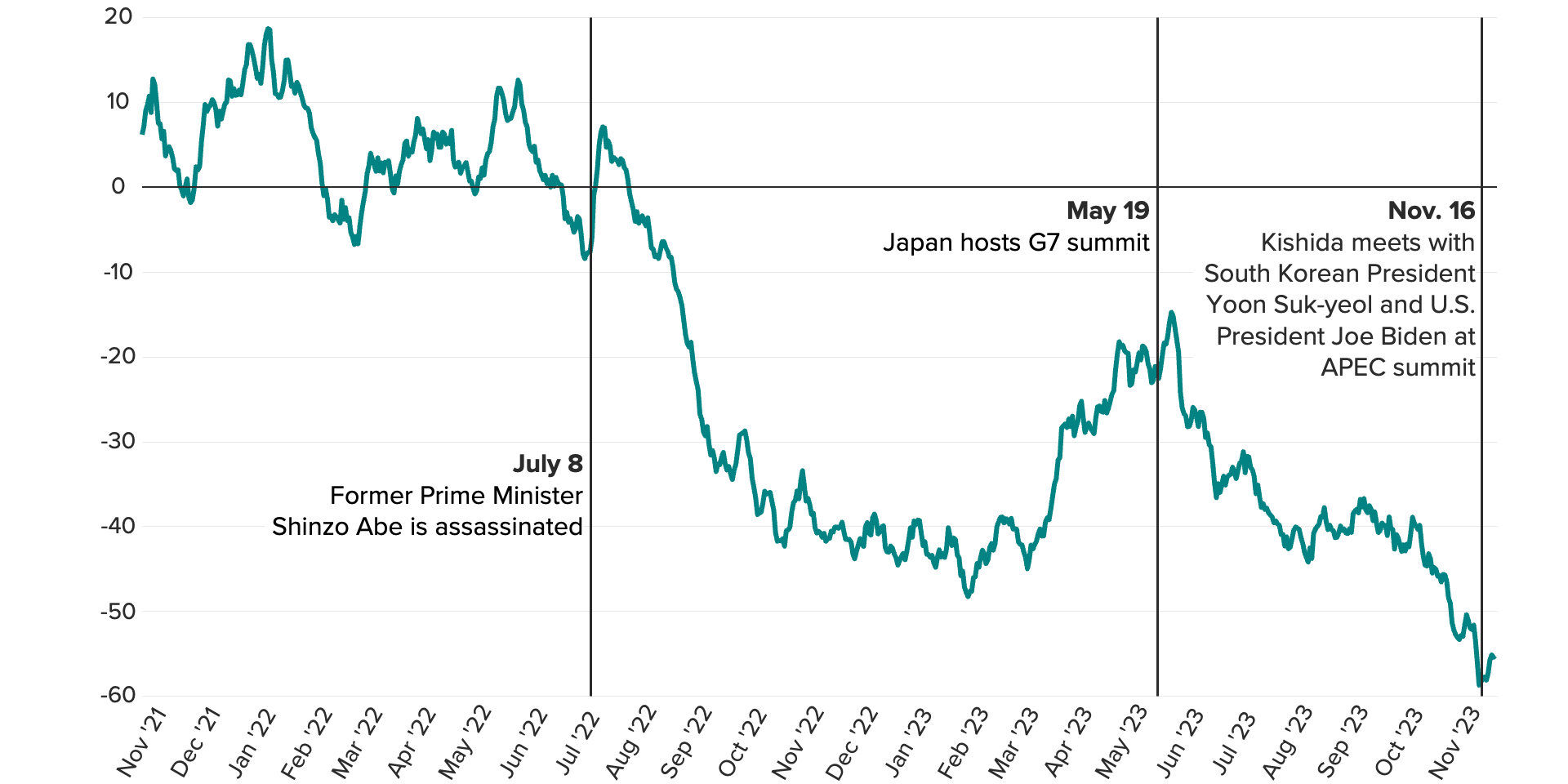

Japan: Japanese Prime Minister Fumio Kishida’s net approval rating has now bottomed out a second time — after falling 14 points over the past month — suggesting he has limited long-term staying power.

Sign up to get our analysis and data on how business, politics and economics intersect around the world.

Australia

High-profile international diplomacy offered only a fleeting lift to Prime Minister Anthony Albanese, whose popularity has continued to decline as Australians wrestle with soaring inflation. His net approval rating has fallen 18 percentage points in the last six months, and dipped into negative territory for the first time in late October on the heels of a divisive national referendum, which we analyzed last month.

Since then, high-profile meetings with U.S. President Joe Biden and Chinese President Xi Jinping bookended a small bump that saw Albanese’s net approval climb back into positive territory. Though largely symbolic, the meeting with Xi was seen as the successful culmination of a year-long effort to ease tensions and normalize trade relations with Australia’s largest trading partner. Yet Albanese’s net approval has since fallen again, sitting just above 0 points by mid-November.

With no elections due until May 2025, Albanese still has time to right the ship. But to do so he will have to convince voters he is focused on Australia’s economy and can steer it back to calmer seas. If not, we could see his net approval rating underwater again.

Source: Morning Consult Political Intelligence. Data points represent 7-day simple moving averages of daily surveys.

Indonesia

Indonesian President Joko Widodo is term-limited, but ahead of next year’s presidential election, critics allege Jokowi is attempting to prolong his political influence by establishing a political dynasty. His eldest son, 36-year old Gibran Rakabuming Raka, was recently announced as presidential hopeful and Defense Minister Prabowo Subianto’s vice presidential candidate, following the lifting of age limits for the office by Jokowi’s brother-in-law, who helmed the country’s constitutional court until he was found guilty of ethics violations over the issue. A special exception was made for those who have held regional offices and Gibran happens to be mayor of Surakarta, another role in which he has followed in his father’s path.

While critics slammed Jokowi following the ruling, our data indicates it has not meaningfully dented his popularity with the public, which remains considerable: His net approval has risen 2 points in the last month to 63 points as of Nov. 15, and appears to be trending upwards. Moreover, the net share of Indonesian adults who say their country is headed in the right direction has increased 11 points in the last month. The prospect of stability and continuity appears to outweigh the risks a prospective dynasty could pose to Indonesia’s relatively recent and arguably tenuous democratic transition. The trends also bode well for Prabowo, a longtime rival of Jokowi’s, who has surged ahead in the polls since naming the outgoing president’s son as his running mate.

Source: Morning Consult Political Intelligence. Data points represent 7-day simple moving averages of daily surveys.

Japan

Things looked bad for Japanese Prime Minister Fumio Kishida last month, and they have only gotten worse since: His net approval rating declined an alarming 14 points between mid-October and mid-November. This came on the tails of a 7-point decline in the previous 30-day window, suggesting his troubles are accelerating. At minus 58 points, Kishida’s net approval rating is now 10 points lower than the nadir reached at the start of 2023 when his long-ruling Liberal Democratic Party was mired in scandal over connections between senior lawmakers and the controversial Unification Church in the wake of former Prime Minister Shinzo Abe’s assassination last summer.

A previous recovery in Kishida’s net approval came on the heels of multiple diplomatic successes in which he pushed for Japan to play a more prominent role in regional and global security issues, including a surprise visit to Ukraine and culminating in Japan's hosting of the G7 this past spring. But our data shows little evidence of a similar bump from his attendance this November at the annual APEC summit, where he met with U.S. President Joe Biden and Korean President Yoon Suk-Yeol and spoke about the need to increase regional security cooperation.

This suggests international affairs are indeed taking a backseat to public concerns over the economy, with Kishida’s proposal of a limited tax rebate next year failing to appease voters. Talk of an early election — widely expected when Kishida was riding high in May — have now been roundly dismissed. Our data suggests this is a smart near-term move. That said, while a lower house election is not required to be held until October 2025, time is not necessarily on Kishida’s side. As we have previously noted, Kishida’s two predecessors both resigned shortly after their approval ratings reached historic lows. The fact that Kishida’s net approval has now bottomed out a second time — and by an even larger margin — suggests he has limited staying power regardless of the timeframe.

Source: Morning Consult Political Intelligence. Data points represent 7-day simple moving averages of daily surveys.

Scott Moskowitz is senior analyst for the Asia-Pacific region at Morning Consult, where he leads geopolitical analysis of China and broader regional issues. Scott holds a Ph.D. in sociology from Princeton University and has years of experience working in and conducting Mandarin-language research on China, with an emphasis on the politics of economic development and consumerism. Follow him on Twitter @ScottyMoskowitz. Interested in connecting with Scott to discuss his analysis or for a media engagement or speaking opportunity? Email [email protected].