When It Comes to Investing, Nearly 3 in 5 Frequent Investors Prioritize Profitability Over Social Responsibility

The popularity of environmental, social and governance investing has soared in recent years, capturing the attention of the investment industry and sparking respective criticism from the left and right over so-called “greenwashing” and “woke capitalism.” The Securities and Exchange Commission has started weighing in on the issue with new proposals targeting investment firms that use ESG marketing in a deceptive manner.

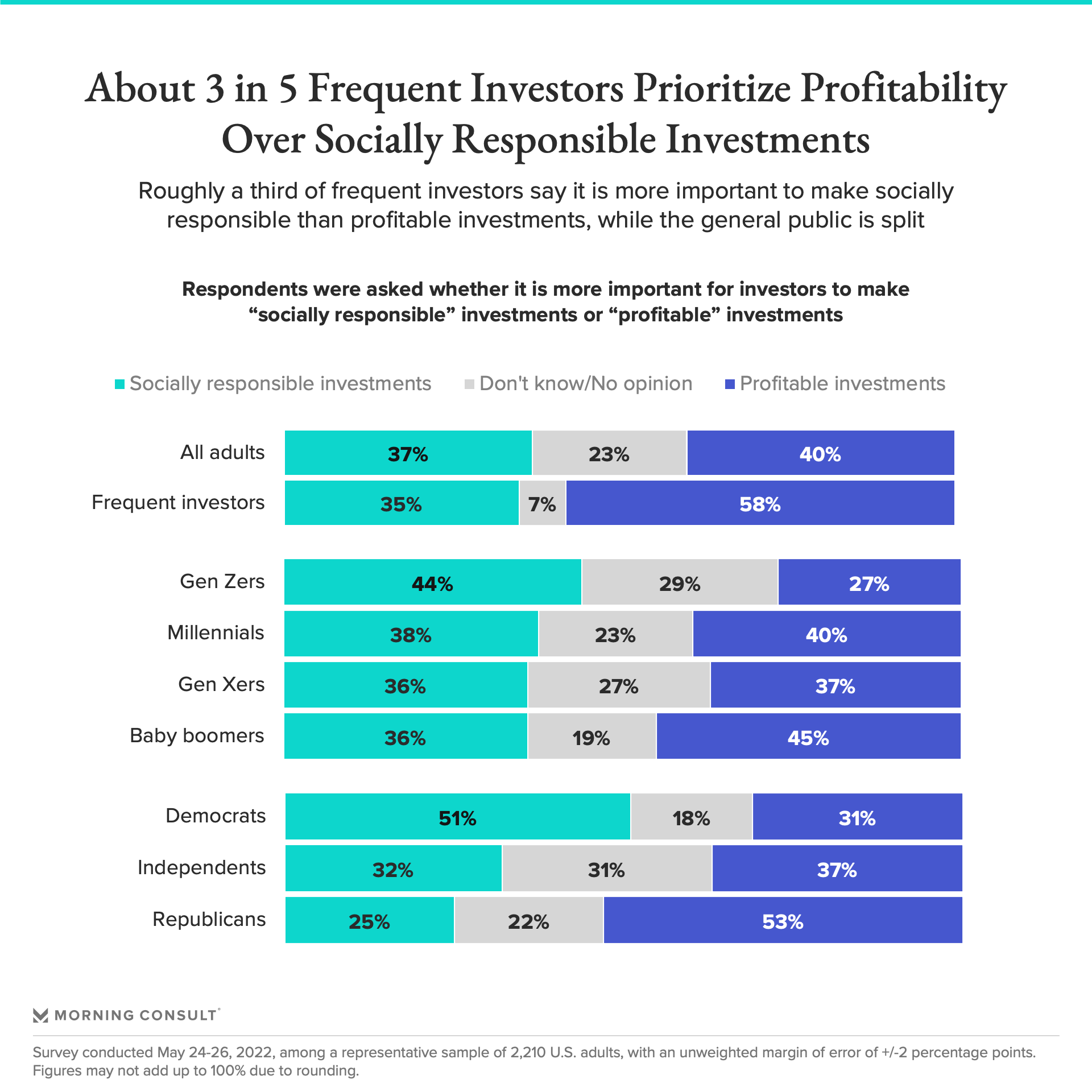

As lawmakers, regulators and investors continue to spar over ESG’s role in the markets, a new Morning Consult survey indicates that the public is mostly split on whether investors should value socially responsible investments over profitable ventures, though frequent investors were clear on their preference.

Americans are generally split on ESG vs. profitability

- U.S. adults were nearly as likely to say it is more important for investors to make investments based on profitability instead of social responsibility (40%) as they were to say the opposite (37%). But among the 15% of respondents who reported investing in or trading stocks, bonds, CDOs, EFTs, mutual funds, real estate, cryptocurrency or commodities “very frequently,” 58% prioritized profitability.

- Across generational groups, Gen Zers (44%) were more likely to prioritize social responsibility, while baby boomers (45%) were most likely to prioritize profitability.

- Democrats were more likely to prioritize socially responsible investing (51%) over profits (31%), and most Republicans (53%) held the opposing view.

ESG investing becoming harder to navigate

The debate over socially responsible lending has picked up as regulators in Washington propose rules on ESG investing in an effort to curb efforts to exploit consumers.

The SEC last month released proposals to require investment advisers and investment companies to “promote consistent, comparable, and reliable information for investors” regarding ESG practices. Meanwhile, the agency fined BNY Mellon Investment Adviser Inc. over claims that some U.S. mutual funds managed by the firm were not subjected to a quality review of ESG factors between July 2018 and September 2021.

ESG can also be a tricky topic for industry leaders: HSBC reportedly suspended Stuart Kirk, the global head of responsible investing for the bank’s asset management unit, after he was said to have accused regulators and policymakers during a presentation of overhyping climate change’s threats to the financial system.

JPMorgan Chase & Co. Chief Executive Jamie Dimon recently refuted conservative scrutiny of the industry’s increased focus on ESG investing, telling conference-goers at an Autonomous Research event that he promised he hadn’t become “woke” and was still a “red-blooded free-market capitalist.”

The May 24-26, 2022, survey was conducted among a representative sample of 2,210 U.S. adults, with an unweighted margin of error of plus or minus 2 percentage points.

Amanda Jacobson Snyder previously worked at Morning Consult as a data reporter covering finance.