Gen Z Keeps Sports Executives Up at Night. Here's What They're Doing About It

Gen Zers are no longer a mere fascination: They now wield serious purchasing power and cultural capital as they put their imprints on the global economy. Morning Consult surveyed Americans between the ages of 13 and 25 about their media tastes and habits, relationships with brands and interest in sports in order to better understand where, exactly, the youngest adult generation is now taking us.

Read Our Gen Z Coverage: Favorite Pro Leagues | Favorite Athletes | Sports Influencer Q&A | Favorite Celebrities | Social Media Usage | Preferred Online Content | Opinion on Advertising | Movie Marketing Trends | Favorite Film Franchises | Favorite Genres | Preferred Entertainment Length | Favorite Video Games | Surprising Tidbits

Key Takeaways

32% of Gen Zers said they watch live sports through authorized streaming services, compared with 28% who watch via broadcast or cable TV.

YouTube, Instagram and TikTok are Gen Z’s most popular sources of sports news.

Nearly half of Gen Zers (47%) said they have never watched a professional sporting event in person.

With the global value of sports media rights expected to eclipse $60 billion by 2024, and the overall North American sports market projected to surpass $83 billion in value next year, America’s love affair with top-tier athletic competition is showing little sign of slowing down.

Still, despite the sports industry’s momentum, strong headwinds remain in the form of Gen Z. At a recent conference, ESPN Chairman Jimmy Pitaro said the industry’s relationship with younger consumers is “the one thing that keeps me up at night.”

Gen Z’s overall interest in sports remains significantly below that of older generations. Their appetites for attending live games and watching them on TV are accordingly lower, per new Morning Consult research. It’s a nagging problem that executives in all corners of the sports industry aim to address heading into 2023 and beyond.

“Engaging Gen Z and building fandom with Gen Z is a top priority for the entire league,” said Ian Trombetta, the NFL’s senior vice president of social and influencer marketing. He joined the league four years ago with the specific task to “modernize the marketing approach” and “ensure that we were not losing eyeballs and engagement, especially with younger audiences.”

A recent survey of 1,000 U.S. Gen Zers between the ages of 13 and 25 found that 33% do not watch live sporting events, compared with 24% of U.S. adults and 22% of millennials who answered the same in a corresponding survey.

About 2 in 5 Gen Zers (38%) said they have watched a professional sporting event on TV in the past four months, while 53% said they had done the same at least once in 2022. About 1 in 5 of the cohort (18%) said they have attended a professional game this year, compared with 25% of millennials.

“We’re on alert [about Gen Z],” said David Bruce, MLS’ senior vice president of brand and integrated marketing.

Added Chris Marinak, MLB’s chief operations and strategy officer: “It’s a complicated ecosystem where, probably more so than any other time in history, people across generations are consuming very differently.”

Gen Zers who watch live sports are doing so more via digital platforms, with 32% of respondents saying they utilize authorized (read: legal) streaming services, compared with 28% who said they consume through broadcast or cable TV —a slight change from a 2020 Morning Consult survey, when traditional TV was still the preferred viewing method. Gen Z is the only generation that said it streams more live sports than it watches on traditional TV, the 2022 survey found.

1 in 3 Gen Zers Don’t Watch Live Sports

In recent years, sports leagues like MLB have partnered with Alphabet Inc.’s YouTube, Meta Platforms Inc.'s Facebook and Apple Inc. to livestream regular-season games. Starting in 2023, Apple and MLS will begin a comprehensive 10-year pact to livestream more than 1,000 matches a year.

“Gen Z's shift from traditional methods of consumption is not a pivot away from sports, rather a nod towards streaming,” said Mike Foss, ESPN’s vice president of digital production, who added that the network’s ESPN+ streaming service has more than 24 million subscribers since its 2018 launch.

How sports other than football can get more Gen Z viewers

In 2021, 75 of the top 100 most-watched U.S. telecasts were NFL games. The league is still the most popular sports property among Gen Zers, according to the new survey.

More than half of the respondents (53%) said they were either an “avid” or “casual” fans of the NFL, followed by the NBA (47%), college football (41%), MLB (35%) and college basketball (34%). One-third of Gen Zers said they are at least a “casual” fan of esports, a higher share than the amount who were fans of the NHL (25%) and MLS (16%).

“If your league does not have the word ‘football’ in it, you should be not just concerned — you should be very concerned,” said Rich Greenfield, partner and media and technology analyst at New York City-based LightShed Partners.

Almost half of millennials (48%) and adults overall (46%) said they watch live sporting events on a weekly basis, compared with just 27% of Gen Zers.

The young generation’s relative lack of interest in sports was also reflected in how infrequently they watch their own favorite teams — if they even have one. Nearly 2 in 5 Gen Zers (38%) said they don’t cheer for a favorite team, 13 percentage points fewer compared with all adults.

Nearly 2 in 5 Gen Zers Don’t Have a Favorite Sports Team

What’s more, nearly 2 in 5 adults (37%) said they watch “all” or “most” of their favorite sports team’s games in a season, while only 1 in 4 Gen Zers said the same.

Despite what the data suggests, Greenfield argued Gen Z is “immersed with sports 24/7.”

“Sports are a constant part of their life,” Greenfield said, but “how they interact with sports has changed dramatically.”

Dallas Mavericks owner Mark Cuban told Morning Consult that he doesn’t view Gen Z’s relationship with sports “as a severe issue.”

“[Sports] leads social media platforms in views,” Cuban said via email. “Our athletes are some of the most influential public figures on the planet.”

Los Angeles Lakers’ LeBron James and Golden State Warriors’ Stephen Curry tied as Gen Z’s most popular athletes, the survey found, while NBA stars accounted for six of the generation’s top 10 favorite athletes. James alone has more than 139 million followers on Instagram, good for 27th in the world. Soccer superstar Cristiano Ronaldo has the most in the world with 513 million.

Gen Z’s complicated sports relationship

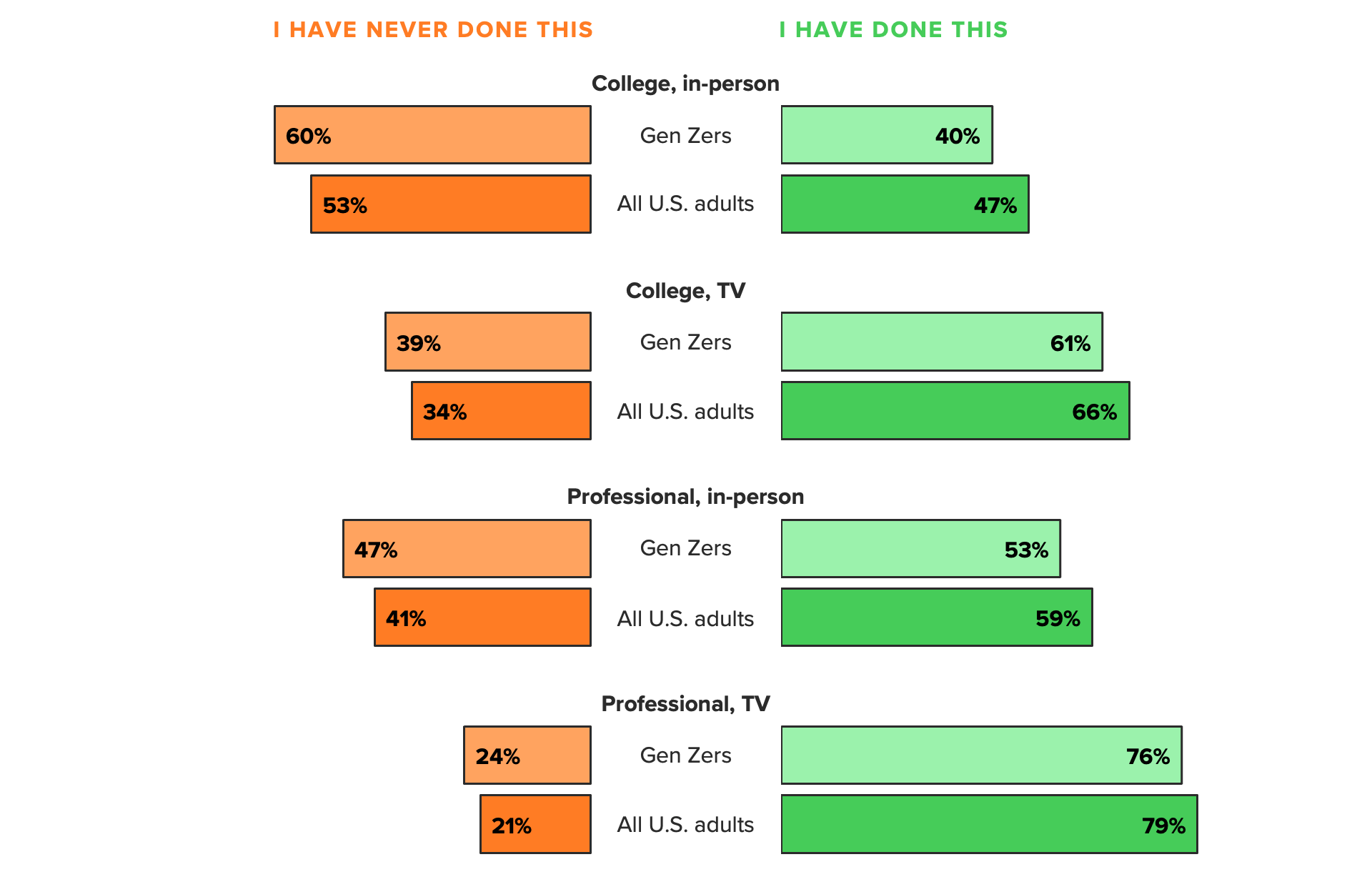

But Instagram attention isn’t equating to ticket sales. Roughly half of Gen Zers (47%) said they have never attended a professional sporting event, while 3 in 5 said they have never attended a college game.

Nearly Half of Gen Z Has Never Attended a Pro Sports Event

Less than 1 in 5 of the cohort said they have attended a professional game (18%) or college event (16%) in 2022, even as Americans increasingly become comfortable attending live events again in a post-pandemic environment.

Some experts suggested that teams and leagues should create their own Gen Z incubators to better understand how the group consumes sports, as well as what would really motivate them to attend live games. In 2019, the NHL recruited youth advisers between the ages of 13 to 17 to participate in its “Power Players” program and provide marketing recommendations and insights into social and content strategies.

The struggle for sports to latch on with Gen Z, relative to their older counterparts, is exacerbated by the multitude of other readily accessible entertainment options, the popularity of established and emerging social media platforms, the fragmented nature of sports media rights distribution, accessibility to games and ticket affordability, executives said.

The average cost for a family of four to attend an MLB game is $256.41, according to sports marketing firm Team Marketing Report. That’s actually the cheapest average in-person experience among America’s five major men’s professional sports leagues. The most expensive experience is an NFL game, which carries an average cost of $590.64, per the report.

“Pro sports run the risk of pricing young fans out of attending games,” Cuban said. The Mavericks have looked to address this, he said, by offering 4,000 tickets for under $29 for every game. Other teams, like the MLB’s Boston Red Sox, have sold thousands of discounted tickets through student-focused marketing initiatives.

Themed sports nights — which cover everything from ‘90s Nights and Dog Nights to the return of the NBA’s Star Wars Nights this season — are aimed, in part, at attracting Gen Zers and more casual sports fans, according to league and team executives.

The venues themselves must be equipped to cater to Gen Z’s digital-first habits, including fast WiFi, reliable mobile ordering and communal spaces to gather with friends, where users can show off their experiences. When consumers share these moments via Instagram, Snapchat and their other social media accounts, it’s like “a badge of honor,” said MLS’ Bruce.

“Gen Z then converts that experience into content, into currency, that ultimately influences their peers to say, ‘Wow, look at that. I need to get to that arena, too,’” said Mark Beal, a Gen Z expert and assistant professor in the Rutgers University School of Communication.

Bruce said MLS is encouraging its 29 teams to not only embrace what makes each in-stadium experience different — including elements like the players’ march to the field, tifos, chants and team-specific goal songs — but also to effectively market that experience digitally to younger fans.

While “the live experience is important” since it can turn casual fans into avid ones, said Pete Giorgio, leader of Deloitte Consulting LLP’s global and U.S. sports practice, “it’s only one piece of the puzzle.”

Matt Wolf, the NBA’s senior vice president of global strategy and innovation, agreed, stating that because “99% of NBA fans are never going to attend” a game due to multiple factors, there’s an emphasis to make the league’s content accessible online as well.

“We’re always going to continue to migrate toward this digital-first strategy to ensure that we can resonate with as many of our nearly 1 billion global fans,” Wolf said.

Gen Z sports fandom is synonymous with digital

Nearly 3 in 5 Gen Zers (57%) who have not watched a sporting event on TV in a few years said a “major reason” was because they just aren’t interested in sports, followed by 20% who said games are too long.

Still, some league and team executives, in addition to experts, pushed back on the idea that growing Gen Z’s sports fandom is a lost cause.

“You can still be a fan by choosing a platform or medium to view our content in a way that’s more conducive to your lifestyle,” said MLB’s Marinak.

Over Half of Gen Zers Don’t Watch Live Sports Because They Simply Aren’t Interested

That fandom may exist by following teams, leagues and athletes on social media platforms, Marinak and others said. Four of the top five media platforms where Gen Z gets their sports news are social channels, the survey found. YouTube, Instagram and TikTok ranked as the top three platforms.

Adults overall, meanwhile, preferred traditional outlets — think ESPN, CBS Sports and NBC Sports — to stay updated on sports news. Facebook and YouTube were the top social media platforms for adults to obtain sports information.

Gen Z Gets Sports News Via YouTube, Instagram and TikTok

While Gen Zers who follow LeBron James on Instagram might consider themselves to be basketball fans, they aren’t necessarily paying fans who will boost teams’ and leagues’ bottom lines. But they have to start somewhere.

Sports entities are increasingly focused on the game beyond the game — converting mildly interested fans or fan-adjacent consumers into more passionate ones. They spotlight players’ personalities, fashion interests and general lives beyond their roles on the field to try and pique the curiosity of a younger consumer.

When asked if the amount of NBA content available to fans online has hindered traditional TV viewership, Wolf said the league — which saw a 19% uptick in average national TV viewership during the 2021-22 season — sees the NBA’s widespread adoption of social media as complementary, and not cannibalistic.

“We are realistic about the fact that not every NBA fan has interest in watching the full game, whether that’s live or in person,” Wolf said. “Our willingness to be comfortable with that is one of our strengths.”

The league prioritized the relaunch of its flagship app in 2022, with some of its functionality, like the prominence of vertical video, tailored toward younger fans and their TikTok-inspired consumption habits, according to Wolf. He noted a 200% increase in engagement with in-app videos this year compared with 2021.

ESPN has also emphasized its YouTube account, which has amassed 20 billion views in 2022 through various forms of video — from “First Take” and “Get Up” studio clips to condensed first-person video content, dubbed “Shorts,” featuring digital media personality Omar Raja.

“Gen Z expects an integrated and immersive experience across all the different ways that they touch a team,” Deloitte’s Giorgio said. “Apple and Amazon have taught them to expect that.”

Technological advances now support sports entities that look to offer the broadcast, digital and online experiences to all fans, Giorgio added, in “not just one, two or three ways, but 1,000 ways, if not a million ways.”

Anmol Malhotra, head of sports partnerships for Snap Inc., said Snapchat’s body-tracking lenses, custom filters and creative stickers provide younger consumers with new ways to express their fandom with friends.

Esports could point the industry toward thinking differently about content distribution, Giorgio said. The Drone Racing League, which was founded in 2015, was built specifically with a Gen Z audience in mind. Almost 90% of DRL fans globally are under the age of 34, said Chief Marketing Officer Anne Marie Gianutsos.

While DRL has a linear broadcast deal with NBC Sports Group, it also livestreams races across YouTube, Amazon.com Inc.-owned Twitch and TikTok, among other platforms — a new initiative implemented for the 2022-23 season that features more first-person-view content via a pilot’s perspective. In the past year, DRL’s TikTok following has grown from 500,000 to over 5 million, Gianutsos said.

“When you think about Gen Z and their obsession with digital storytelling and content creation, the drone is the ultimate tool to stand out in a sea of content,” Gianutsos said.

The NFL’s Trombetta said that, beyond current alternative broadcasts such as ESPN’s “ManningCast” and trick-shot group Dude Perfect’s livestream of “Thursday Night Football” on Prime Video, the league is exploring additional “alt-casts” with Twitch and other media partners.

“We’re doing everything possible to make the game more accessible,” he said.

Bring on the creators

Then, of course, there is the evolving role of online content creators.

“Every team should absolutely hire a personality to constantly be in their content,” SnapBack Sports founder Jack Settleman told Morning Consult in a recent interview. “That connects so much deeper with a fan base.”

Settleman, whose brand has more than 2 million subscribers across its three Snapchat accounts, said teams and leagues should “quadruple down on Snapchat” and “dominate YouTube” to reach Gen Z.

Media outlets like ESPN and Warner Bros. Discovery Sports’ Bleacher Report are among the properties to lean into influencer marketing. In September, the former announced its first Creator Network, billed as a four-month program to provide 10 emerging creators across Instagram and TikTok with access to ESPN’s properties to create content and build awareness for the network.

Doug Bernstein, senior vice president of digital audience strategy for Warner Bros. Discovery Sports, said the median age for followers of Bleacher Report’s social media accounts is 26.

He, like others, said Gen Z is still interested in sports, but the type of competition the cohort generally wants to watch has expanded to include content like House of Highlights’ 1-on-1 tournaments, or knockout-style basketball contests featuring top creators.

In the past two years, MLB has worked with two classes of creators to produce content for TikTok and other platforms, and is expected to launch a third installment in 2023.

The NFL and its teams have tried to find that breakthrough via content creation by working with thousands of influencers across industries that interest Gen Z, including video games, music, fashion and wellness, according to Trombetta. The Morning Consult survey revealed that 45% of Gen Zers said they’ve purchased clothing because an influencer or celebrity sponsored it. Perhaps game tickets, cable TV packages and sports subscriptions aren’t far behind.

“We’re infusing influencers into everything we are doing,” said Trombetta, who pointed to collaborations ranging from rapper Lil Wayne and actor Miles Teller to influencer Frankie LaPenna, who’s gone viral for “pretending” to attend Zoom meetings.

Next up: The NFL wants to work with more female creators and Latino influencers to increase fandom among younger consumers in those demographics, he said.

While the sports industry is focused on fixing its issues with younger consumers, most executives and experts interviewed for this story agreed there’s no magic formula. It’s a slow and long journey, they said, but one the industry can’t shy away from.

“This isn’t a three-year game that we’re playing,” said MLB’s Marinak. “This is a 60- to 70-year game. We have a lot of time to get it right.” By then, though, who knows what the youngest consumers will be into.

Mark J. Burns previously worked at Morning Consult as a sports analyst.