What Black Friday/Cyber Monday Means for the Current State of Shopping and Rest of the Holiday Season

Key Takeaways

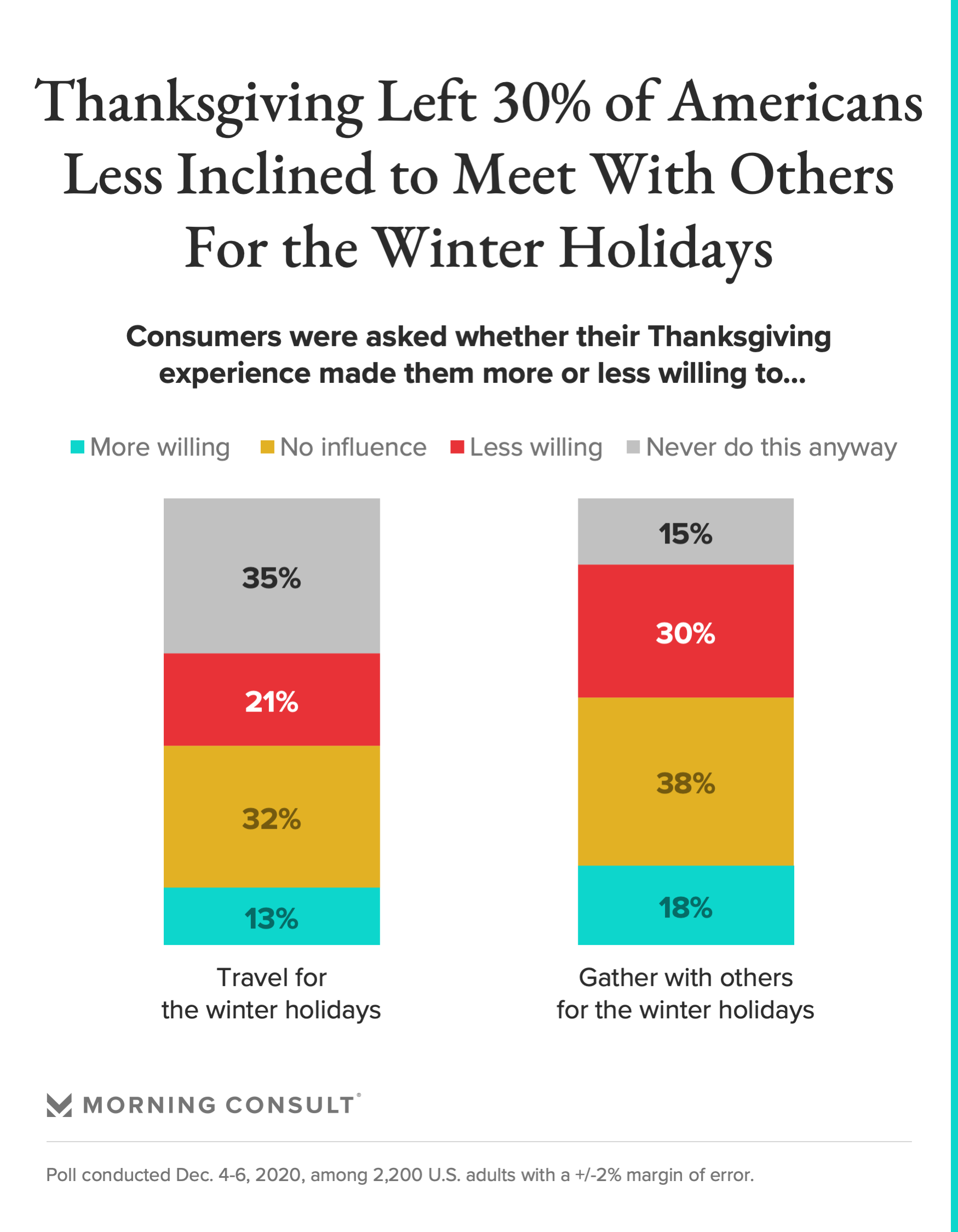

21% of Americans are less willing to travel this holiday season, and 30% are less likely to gather with others based on their experiences over Thanksgiving. Those who participated in Black Friday or Cyber Monday are notably more likely to be more willing to travel this winter however.

Black Friday and Cyber Monday shoppers are significantly more likely to be mostly or entirely done shopping compared to those who didn’t participate in either shopping event (just 28% of those who didn’t participate in Black Friday or Cyber Monday said the same).

65% say news of a vaccine won’t impact their holiday spending, but 16% -- particularly Gen Zers and online-first holiday shoppers -- say this would lead them to save more to fund either post-vaccine travel or purchase of items or experiences hindered by the pandemic.

Company ads were especially influential in driving purchases for Black Friday consumers shopping both in-store and online (23%) and higher-income shoppers (22%). Shoppers -- high-income ones in particular -- are increasingly likely to buy from companies whose ads feature their holiday promotions or their products or services: 30% and 26% respectively would be more likely to purchase from a company with this type of advertising.

From the way consumers will celebrate and travel to how they’ll shop and spend, Morning Consult has been closely monitoring how consumer spending, channel preferences and shopping needs, preferences and habits are changing this holiday season, and what brands can do to navigate this landscape as it evolves.

With Black Friday and Cyber Monday now in the rear view, only a few weeks remain in the 2020 holiday shopping season. But what can be learned from Americans’ preferences, spending, and experiences during BFCM weekend and the Thanksgiving holiday -- and how have these events impacted how consumers will shop, spend, gather and celebrate through the end of the year?

We debrief on the implications of key themes from BFCM for the remainder of the holiday season and highlight notable developments around what’s changed -- and what hasn’t -- for the 2020 holiday shopper in recent weeks.

Celebrating the season, or toning it down?

Thanksgiving experiences made 2 in 10 (21 percent) less willing to travel this holiday season, while 33 percent and 31 percent of higher-educated and higher-income Americans respectively have become more willing to travel over the winter holidays due to their experiences. Those who participated in Black Friday or Cyber Monday are also notably more likely to be more willing to travel this winter based on their experiences over Thanksgiving.

These audiences feel similar willingness to gather with others over the winter holidays, though a greater share of Americans overall indicate they’re now less willing to do so because of their Thanksgiving experiences (30 percent).

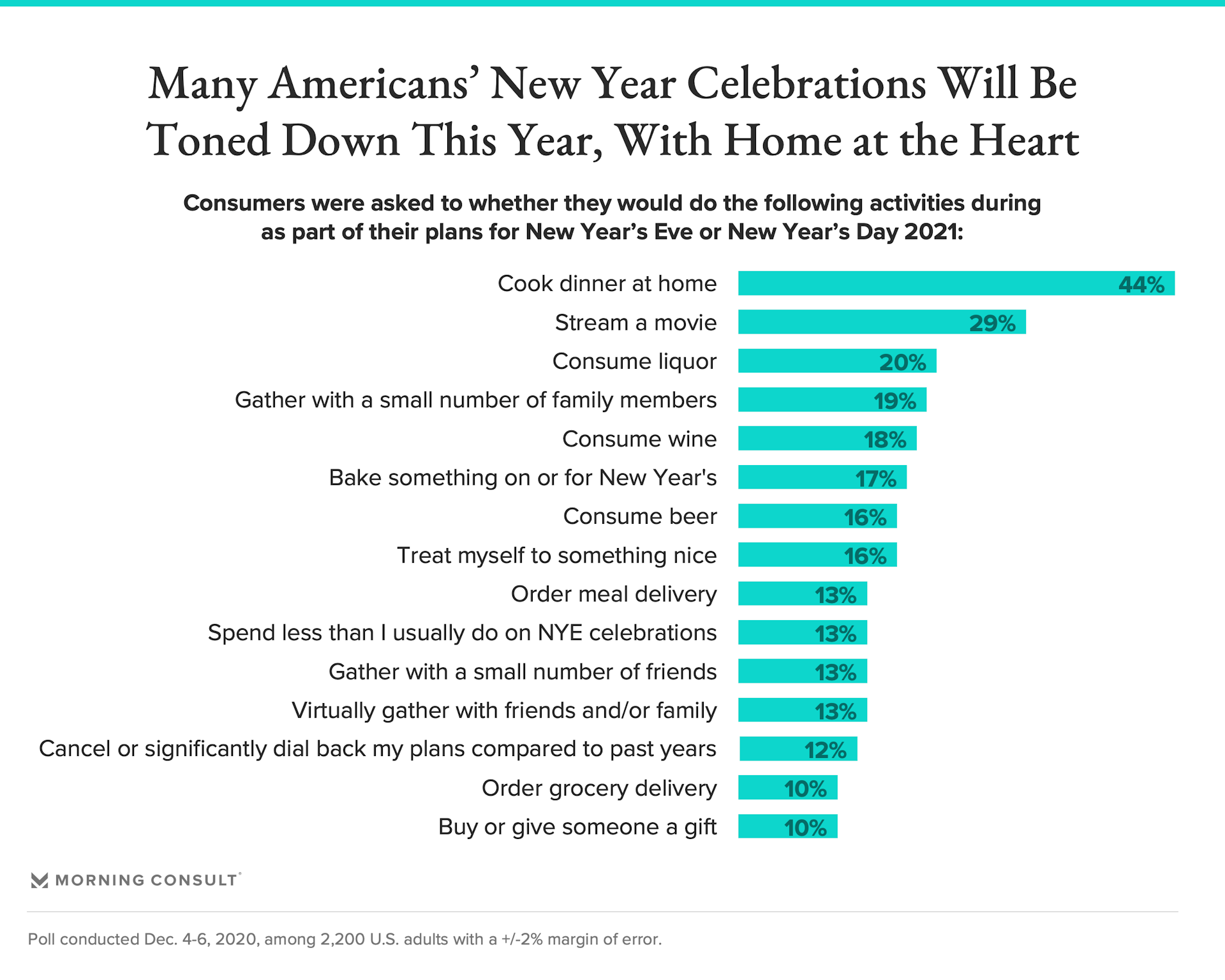

A stark departure from typical New Year’s traditions, the most common activities Americans cite for ringing in 2021 include cooking dinner at home (44 percent) and streaming a movie (29 percent).

It’s worth noting that aside from cooking dinner or baking something at home, younger generations are notably more inclined to partake in all activities surveyed while Boomers are significantly less likely to do so. The share of elder adults planning to cook at home, however, is 20 points higher than the share of millennials or Gen Z planning to, suggesting that while youth may be heading home for home-cooked meals, there may also be an opportunity for restaurants and meal delivery to play a role in ringing in the new year.

Higher-income earners and urbanites are also significantly more likely to partake in all potential celebratory activities proposed, particularly streaming movies (33 percent and 35 percent, respectively, plan to do so) and consuming wine (34 percent and 25 percent, respectively).

However, just 7 percent plan to go to a restaurant as part of their New Year’s celebrations; 5 percent or fewer plan to go on vacation, stay in hotels or rent an Airbnb, travel long distance, fly on a plane or use a ride-hailing service -- all of which would’ve been commonplace any other year.

The home stretch for holiday shopping: What’s left?

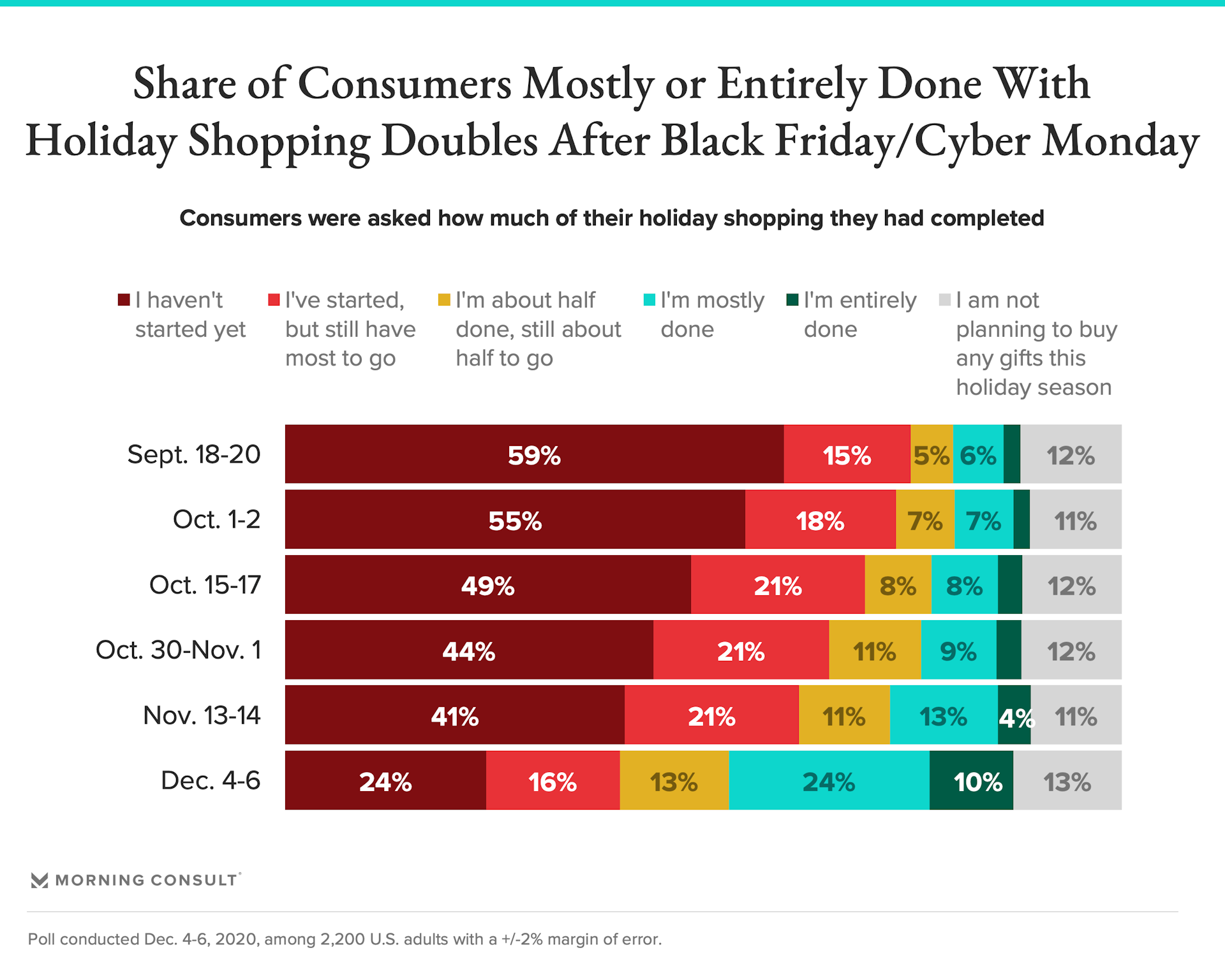

Only a quarter of Americans (24 percent) have not yet started their holiday shopping as of early December, while the share saying they are either mostly or entirely done is up 17 percentage points since before BFCM to 34 percent. Indeed, at 42 percent and 46 percent respectively, those who shopped on Black Friday or Cyber Monday are significantly more likely to be mostly or entirely done shopping compared to those who didn’t participate in either shopping event (just 28 percent of those who didn’t participate in Black Friday or Cyber Monday said the same).

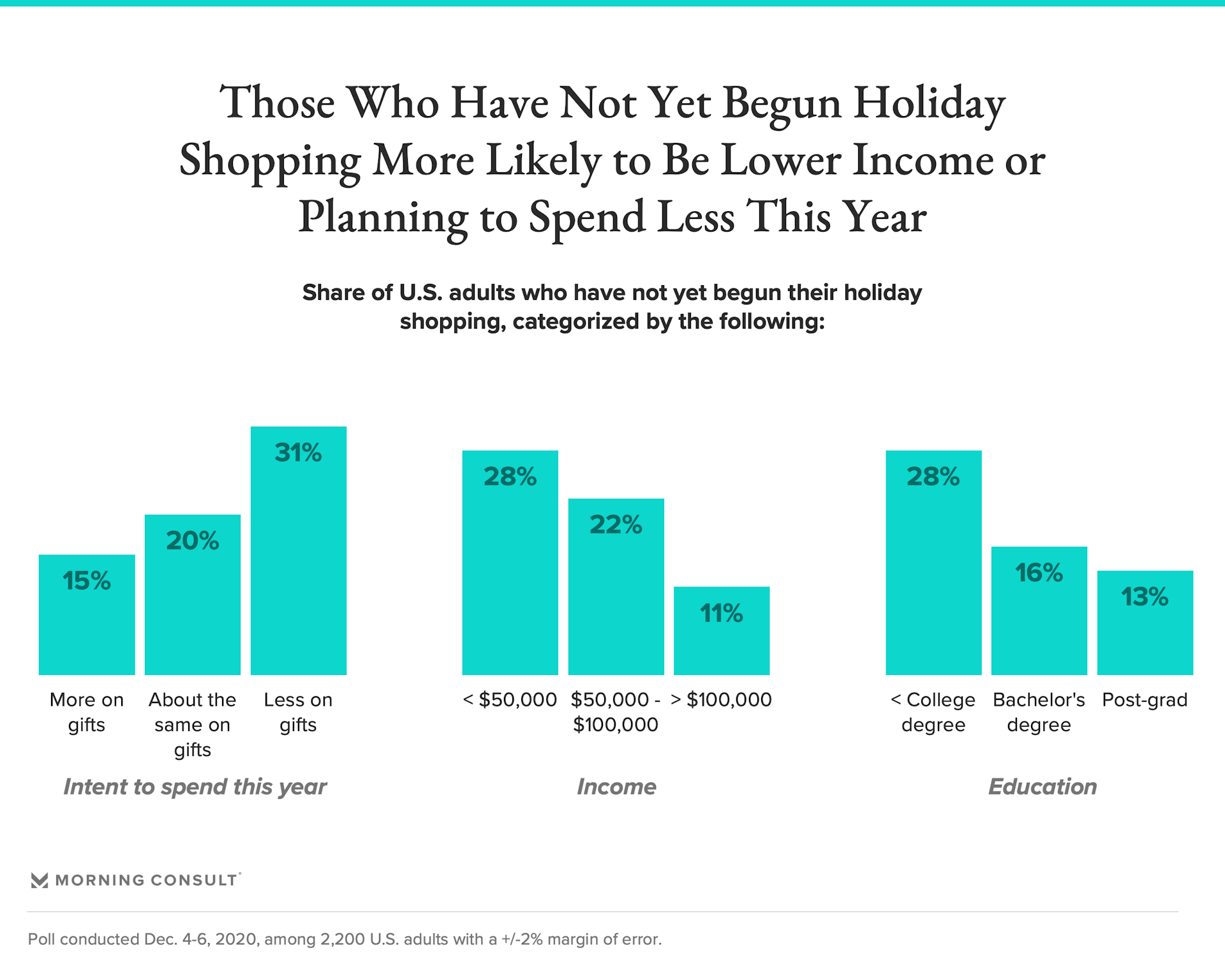

But digging deeper into those who have yet to begin holiday shopping reveals a worrying trend: Americans who have not yet begun their holiday shopping are more likely to be lower income and more likely to spend less on gifts this year. While this could be a coincidence, those expecting to spend less this holiday season are also much more likely to put off the start of gift shopping until late December (56 percent plan to do so) compared to their higher-spending peers who’ve also not yet begun gift shopping (71 percent of whom plan to start their gift shopping in early December). With a growing share of Americans, particularly lower-income cohorts, more financially vulnerable, this suggests that holiday gift purchases may never ultimately be made among those who are struggling financially this season.

For those who have or will shop this holiday season, nearly half (48 percent) are relying on online options for the majority of their holiday shopping, a share that has remained consistent since tracking began in early September.

Still, most of those shopping online anticipate spending less on gifts this season. Indeed, only 16 percent of Americans anticipate spending more on gifts this year, particularly younger shoppers, urbanites and, unsurprisingly, high-income earners. Black Friday and Cyber Monday shoppers are also notably more likely to anticipate spending more this season, while 50 percent of those who didn’t participate in either shopping event definitively expect to spend less.

Post-BFCM pulse check: What have we learned?

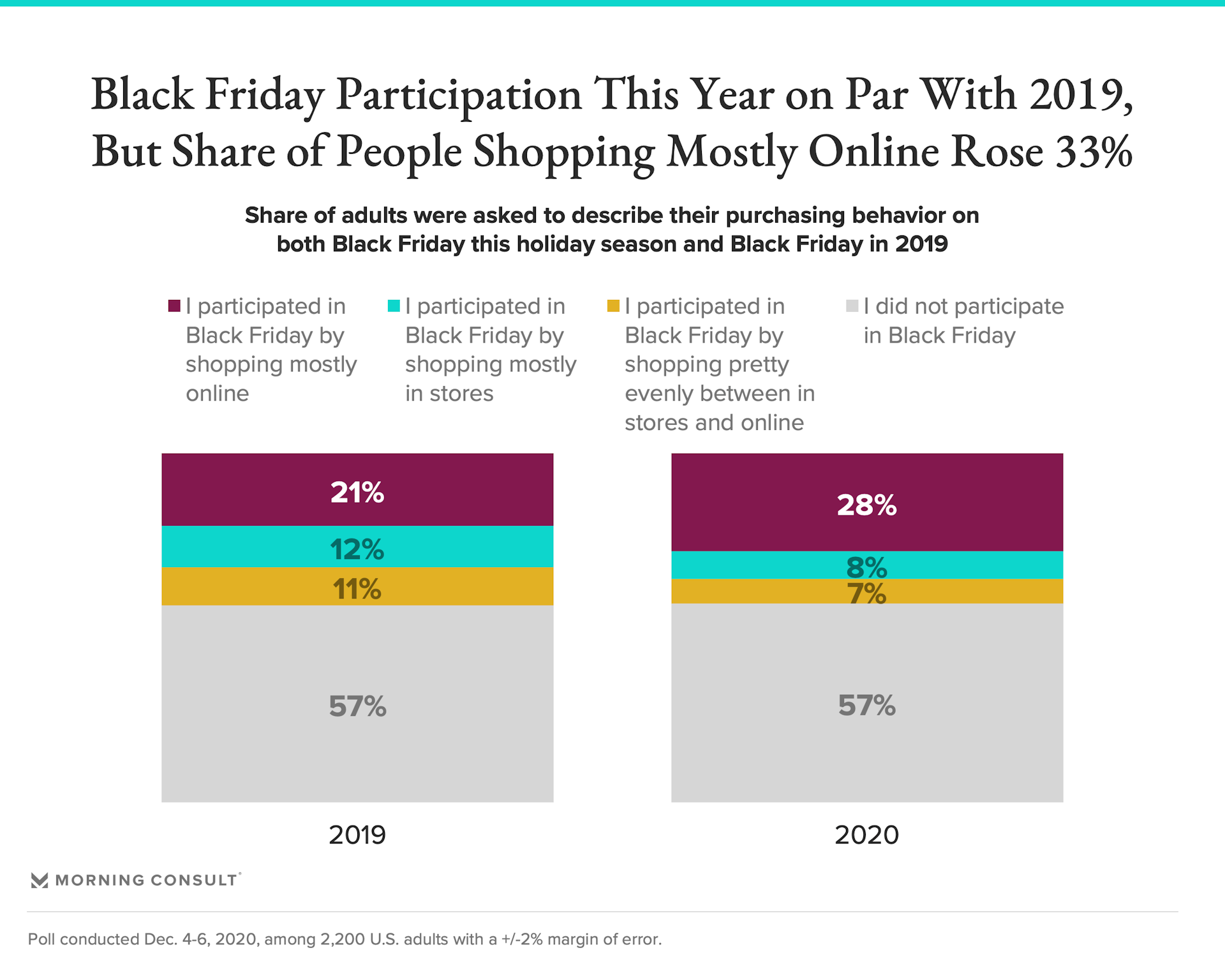

Though 55 percent said they planned to participate in Black Friday before the shopping event, only 4 in 10 (43 percent) report ultimately doing so. However, online versus offline activity was largely as expected: Online shopping was most popular, with 65 percent of those who participated shopping this way compared to 19 percent shopping mostly in stores and the remaining 16 percent of Black Friday shoppers purchasing via a mix of both options.

Indeed, while the share participating in Black Friday overall remained largely consistent year on year, the share participating mostly online versus partially or mostly in store rose notably, by 7 points. It’s worth noting that 88 percent of those who participated in Black Friday this year also participated in Black Friday last year; 1 in 10 2020 Black Friday shoppers (the remaining 12 percent) were newcomers to this shopping event versus 2019. Interestingly, those who took part both years seemed to stay consistent in their preferred shopping method year on year.

As expected, COVID 19-related health and safety concerns were the primary reason behind online-first Black Friday shopping, though sizeable minorities also cited convenience (40 percent), preference (31 percent) and better sales (31 percent) as reasons for shopping primarily online. Preference for in-store shopping (30 percent), trust in retailers’ COVID-related compliance (29 percent) and the desire to see or try items before purchasing them (26 percent) were top reasons driving in-store Black Friday shopping, suggesting that though e-commerce has its benefits both in the pandemic and during more normal times, familiarity with and the tangible nature of in-store shopping are likely to protect its appeal even as digital shopping options proliferate.

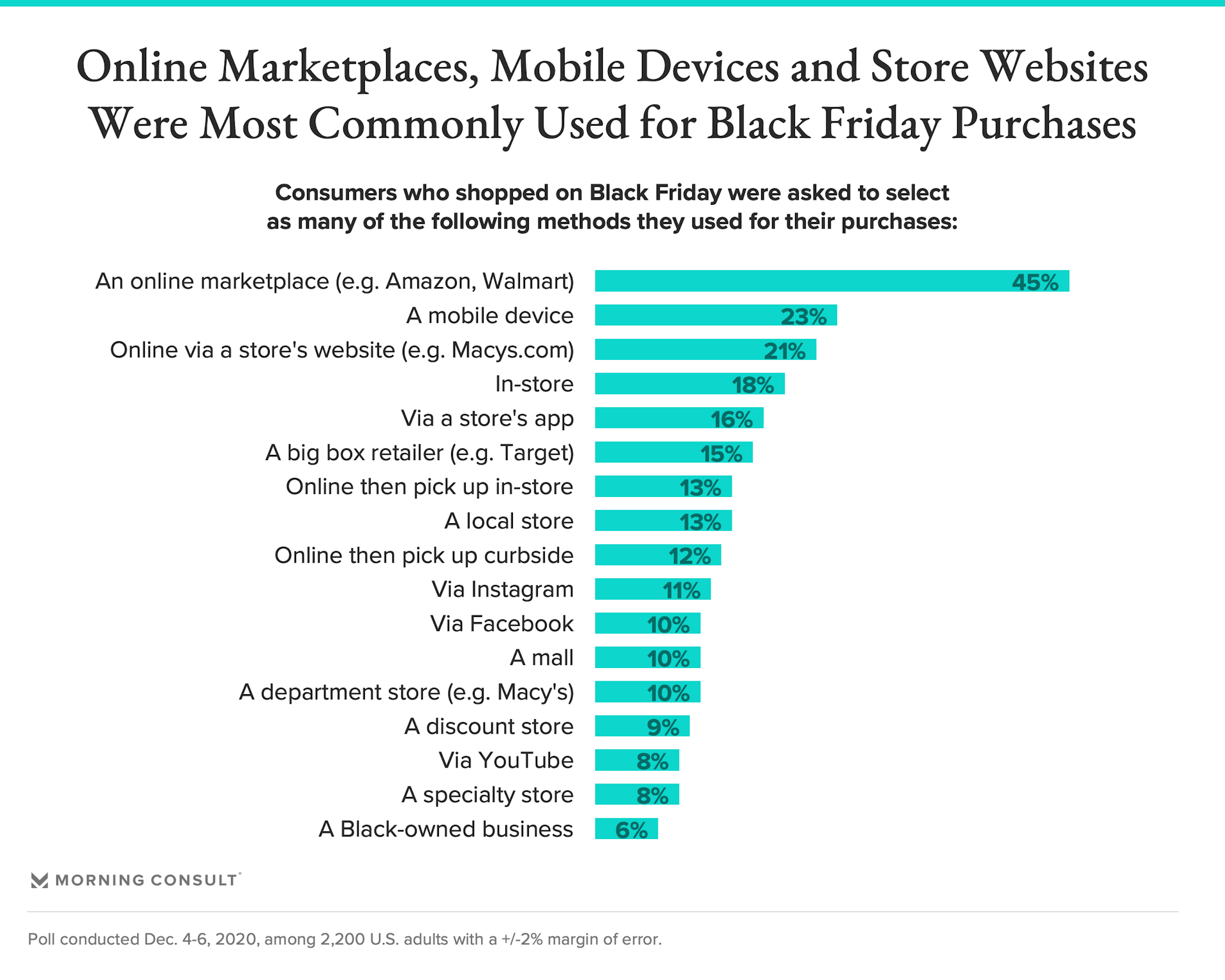

The predominance of Black Friday purchases (45 percent) were made on online marketplaces like Amazon, though mobile devices (23 percent) and store websites (21 percent) were also reasonably popular, underscoring shoppers’ reliance on e-commerce shopping methods. Thirteen percent and 12 percent, respectively, used either in-store or curbside pickup methods in conjunction with their online purchases, shares that rise to roughly 2 in 10 among higher income shoppers and those planning to spend more this holiday season. The popularity of these methods roughly corresponds with likelihood to shop these ways throughout the holiday season overall.

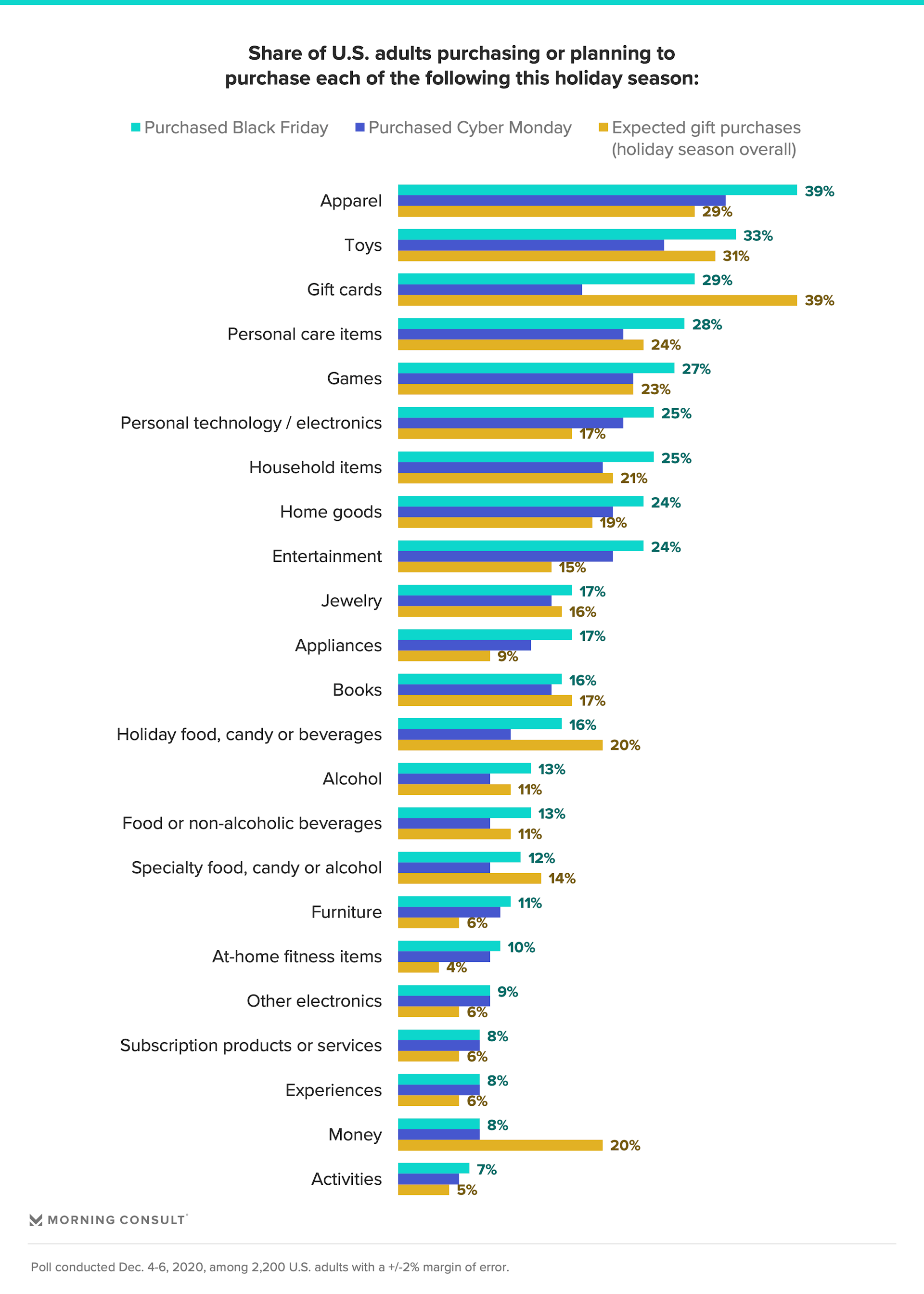

Gift cards were expected to be far and away the most popular gift category this holiday season, but apparel and toys were the most commonly-purchased categories during both shopping events.

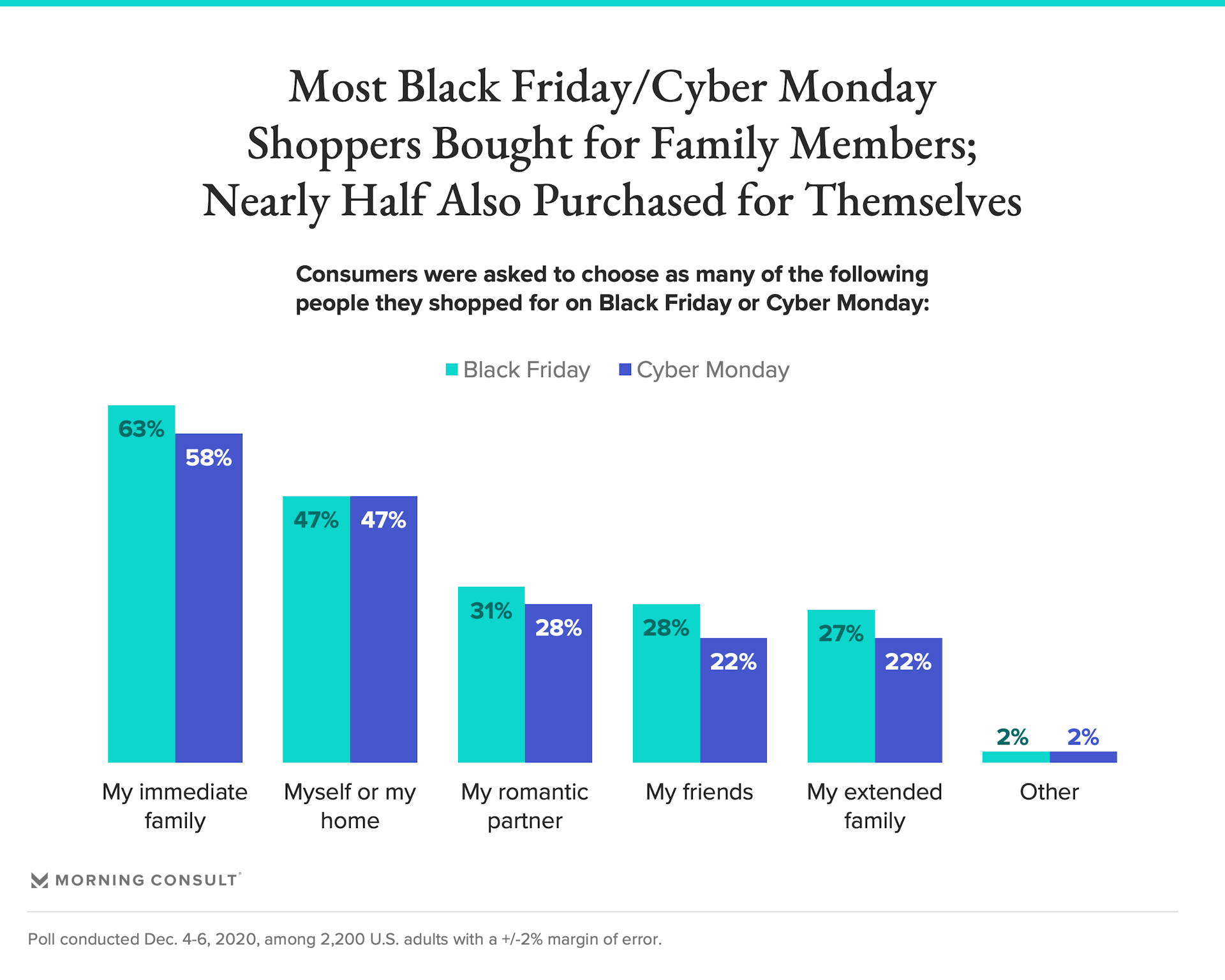

Most BFCM purchases were for shoppers’ immediate family members, though nearly half of all shoppers also report picking up items for themselves or their homes.

As might be expected, deals on either items themselves (50 percent) or related to delivery (37 percent) were top drivers of choice as far as where to shop. These were significantly more important to elder shoppers: 71 percent of 65+ consumers cited deals and 50 percent cited delivery deals as factors driving decisions on where to shop this Black Friday. Return policies also played a role for nearly a quarter of Black Friday shoppers (24 percent).

COVID-19 compliance was a factor 30 percent considered, though this rises to 40 percent among Northeast shoppers and to 39 percent among high-income consumers. Still, a retailer offering curbside or in-store pickup was less of a requirement, with roughly 1 in 10 citing these as important factors they considered.

In a time when purchasing is moving online specifically to avoid stores, it’s no surprise that coronavirus-related compliance is less of a concern for consumers: Shoppers seem content to shop from home, especially where deals are available to help mitigate the financial pain many are feeling this year. However, so few taking advantage of in-store or curbside pickup options suggests that while e-commerce may be here to stay, retailers still have work to do in encouraging shoppers to consider last-mile options beyond at-home delivery.

Given the costs and logistical headaches of shipping, potential reputational damage from angry shoppers with delayed deliveries, the upsell potential from shoppers coming in or near a physical location, and the 24 percent of Black Friday shoppers who factored in return policies when choosing where to shop, building the appeal of these alternate last-mile offerings should be especially top of mind for retailers.

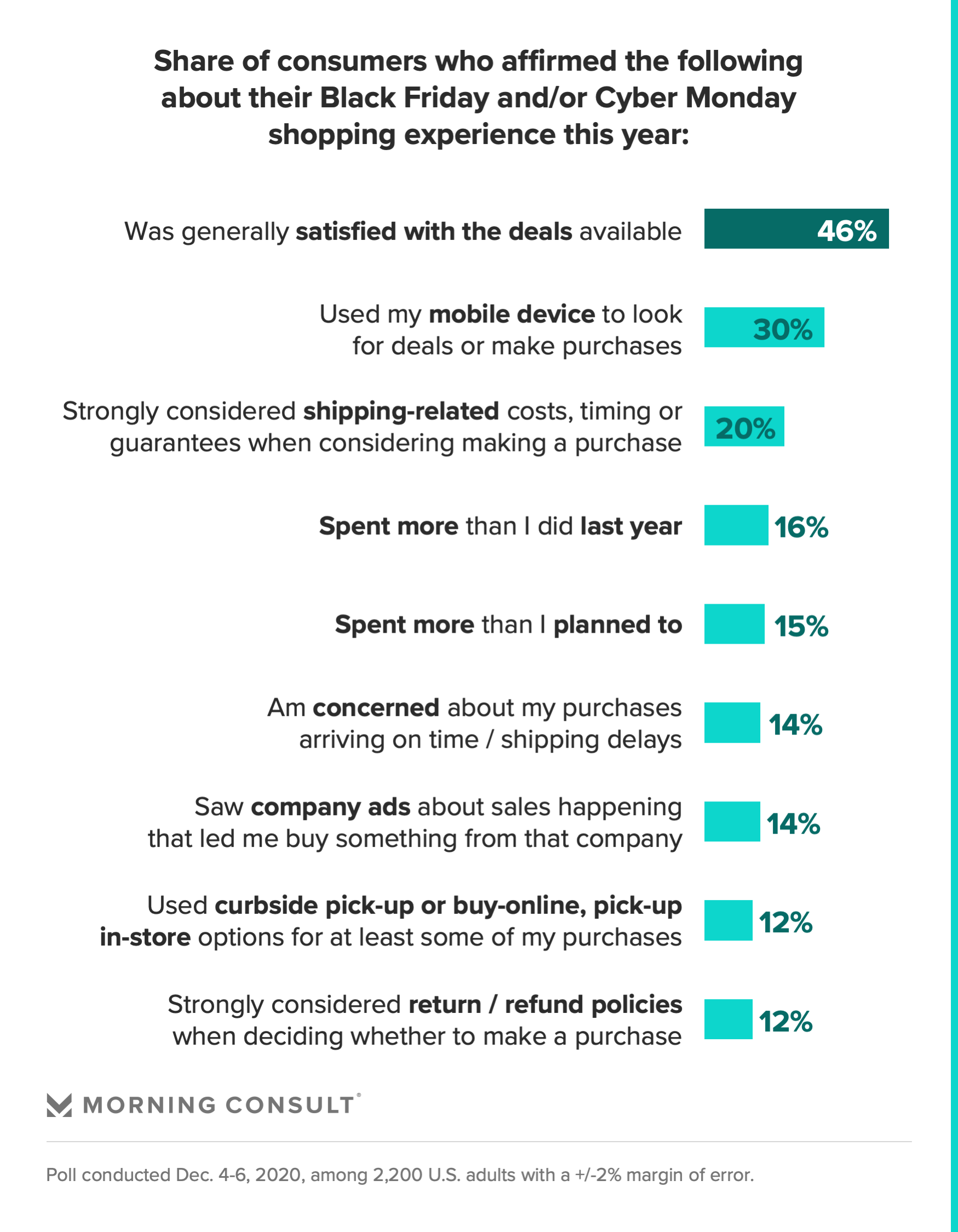

A sizable minority of shoppers (46 percent) was generally satisfied with the deals available over the BFCM shopping weekend -- though Baby Boomers much more so than Gen Zers (55 percent and 33 percent, respectively, said they were satisfied). Shipping-related costs, timing and guarantees were strongly considered by online-first Black Friday shoppers when deciding whether or not to make a purchase from a given company. And company ads were particularly influential in driving purchases for both Black Friday consumers shopping both in-store and online (23 percent) and higher income shoppers (22 percent). This comes as shoppers -- high-income ones in particular -- are increasingly likely to buy from companies whose ads feature their holiday promotions or their products or services: 30 percent and 26 percent, respectively, indicate they’d be more likely to purchase from a company with this type of advertising.

Together, these confirm the deal-focused nature of these shopping events (of greater importance in a year where financial concerns are rampant and affecting spending), the heightened pressure on shipping providers this year -- and on retailers themselves who are now dealing with shipping as part of new e-commerce offerings -- and the nuance required for resonating with broader audiences in holiday advertising, as the lack of impact company ads had on large swaths of the population suggests room for improved relevance.

Three in 10 BFCM shoppers used their mobile device to search for deals, with no notable nuances across demographic groups or channel preference, but different consumer audiences turned to different sources to find deals:

- 40 percent started their deal searches on specific websites of preferred brands, but this varies greatly by generation: 49 percent of Boomers used these while just 25 percent of Gen Zers did.

- 30 percent began with Google searches for either specific items or for BFCM deals in general, though Boomers much less so (just 2 in 10 turned to Google for either of these searches).

- Facebook and Instagram also played a role in surfacing promotions for BFCM shoppers with 25 percent and 21 percent, respectively, saying they used these to look for deals. But Instagram was used notably more by younger shoppers (33 percent of Gen Zers and 31 percent of millennials versus just 3 percent of Boomers) while just 9 percent of Boomers used Facebook.

- Men were nearly twice as likely as women to use social media platforms for inspiration (33 percent of men vs. 16 percent of women looked for deals on Facebook; 27 percent of men vs. 15 percent of women turned to Instagram).

- Interestingly, higher incomes were significantly more likely than lower incomes to use all of these.

This highly nuanced landscape underscores the tailored approach brands must take to build awareness among, communicate with and engage diverse audiences they seek to target -- whether promoting holiday season deals, other shopping events or everyday purchasing.

Still, the majority of the population reports having done either none of their holiday shopping on BFCM weekend or not planning to do any in the first place. And, just 8 percent and 7 percent of Americans, respectively, participated in Small Business Saturday or Giving Tuesday, likely due to a combination of the relative novelty and niche nature of these newer shopping events and consumers’ priorities being especially deal-oriented given the events of this year.

The final countdown: A shot in the arm for holiday spending?

With Black Friday and Cyber Monday behind us, consumers and retailers alike face the final countdown to not only the holidays themselves and therefore the end of the holiday season, but also to the arrival of a vaccine, which comes with the hope of a quick return to normalcy.

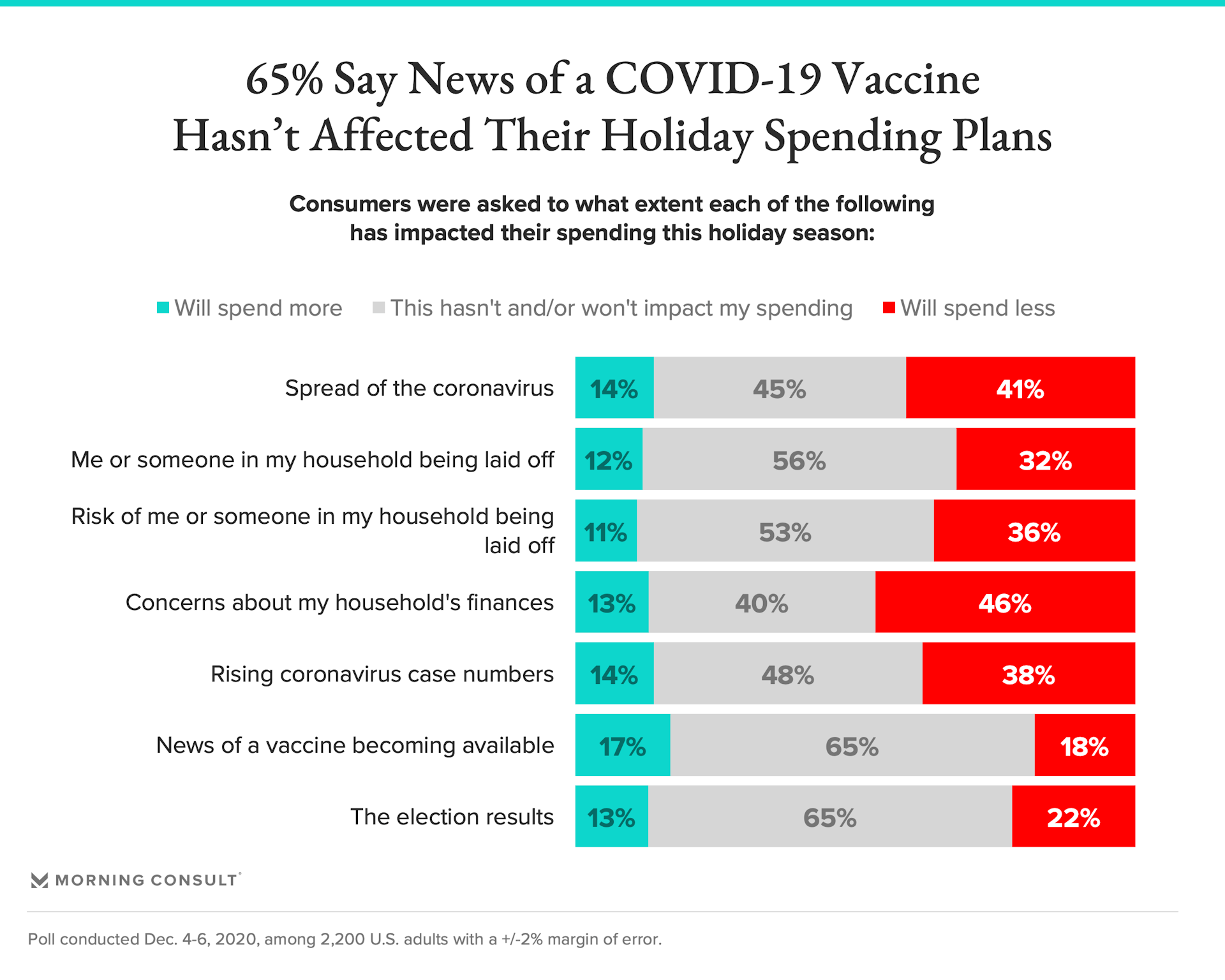

Authorization of a COVID-19 vaccine isn’t likely to materially impact Americans’ holiday spending or gathering plans, but a quarter (including 34 percent of those 65+) say this news makes them more likely to hold off on gathering with friends or family this holiday season, preferring to wait until they can be vaccinated. Conversely, compared to 16 percent of the overall population saying this news increases their likelihood of gathering with friends and family over the holidays, 23 percent of Millennials and 22 percent of urbanites are likely to do so.

Sixteen percent say that upon news of an authorized vaccine, they would start saving more to spend on either travel or on items or experiences hindered by the pandemic; Gen Zers and online-first holiday shoppers are particularly inclined to do the latter (27 percent of each audience is ready to save money for spending on items or experiences in a post-vaccine world). Just 8 percent say this would lead them to buy more holiday gifts people can do or use once things open up again, but this rises to 16 percent among millennials, 21 percent among online-first holiday shoppers, and 18 percent among high-income earners.

Seventeen percent say vaccine authorization would lead them to spend more in general this holiday season, though this more than doubles among online-first holiday shoppers (41 percent), and rises to 31 percent among millennials and 37 percent among high-come earners.

But news of a vaccine won’t impact holiday spending for the vast majority (65 percent), and significant headwinds around holiday spending driven largely by financial and pandemic-related concerns remain. Indeed, concerns about household finances, the coronavirus’ spread and rising case numbers are nearly three times higher among shoppers planning to spend less this holiday season compared to those spending more: 6 in 10 of those planning to cut back cite these reasons compared to just 2 in 10 of those spending more this year -- emphasizing the drastically different realities in personal financial conditions for high- and low-income cohorts exacerbated by the pandemic.

As many expected, Black Friday and Cyber Monday reflected ongoing developments in consumption preferences and spending levels. But reflecting on what resonated, what didn’t and what remains of the 2020 holiday season after these blow-out shopping events is just as critical -- especially as it’s only a matter of weeks until the December holiday shopper becomes the 2021 consumer with similar preferences, needs and realities that brands and retailers need to understand in order to act on.

Victoria Sakal previously worked at Morning Consult as a brands analyst.