How Household Income Levels Are Impacting Debt Burdens and Payments

Key Takeaways

Despite elevated inflation and interest rates, higher- and middle-income household finances have proved secure enough to cover strong spending and debt repayments.

Heading into the fall, higher earners have been prioritizing paying down debts, reducing exposure to rising interest costs on items like outstanding credit card balances.

Lower-income adults are falling increasingly behind, frequently spending beyond their means and reporting rising monthly debt obligations relative to incomes.

Sign up to get our data on the economy, including trends in inflation and consumer spending.

Who is the resilient consumer?

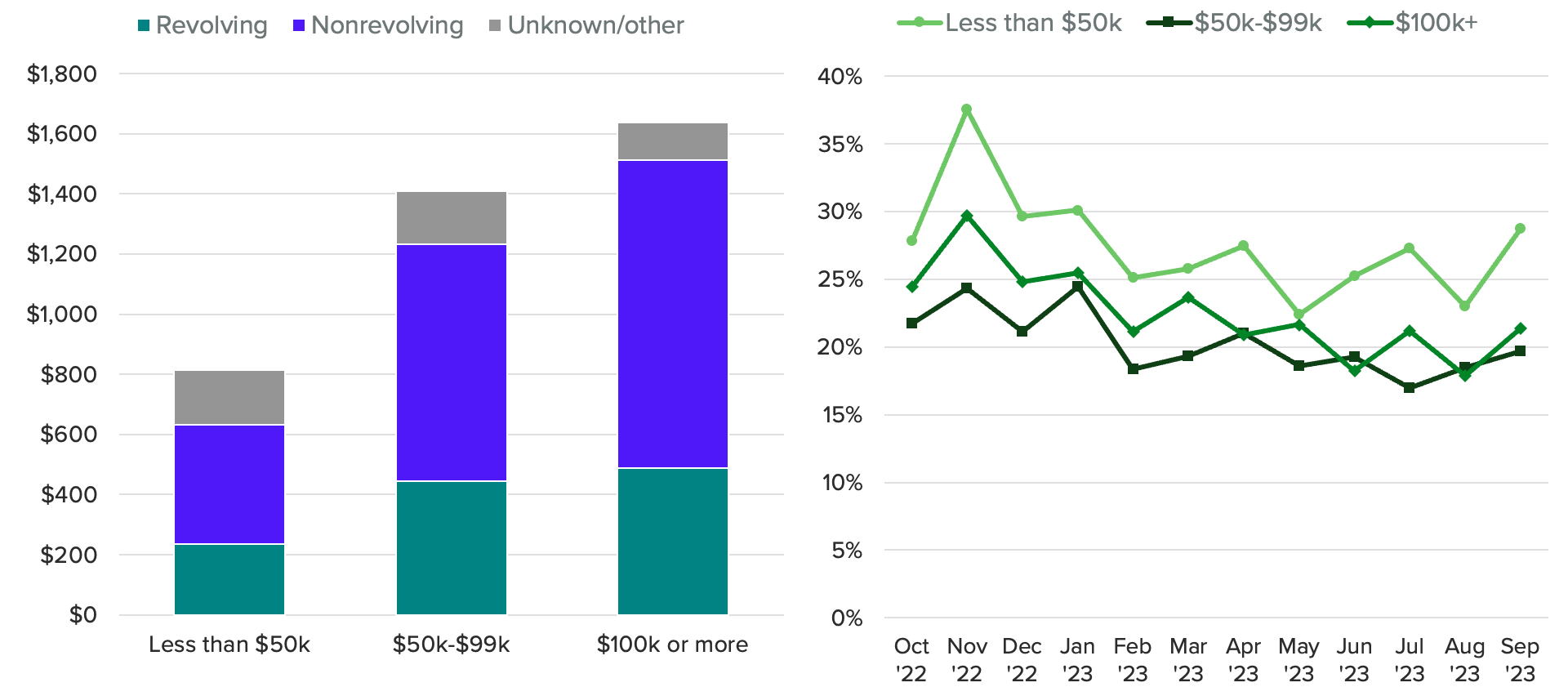

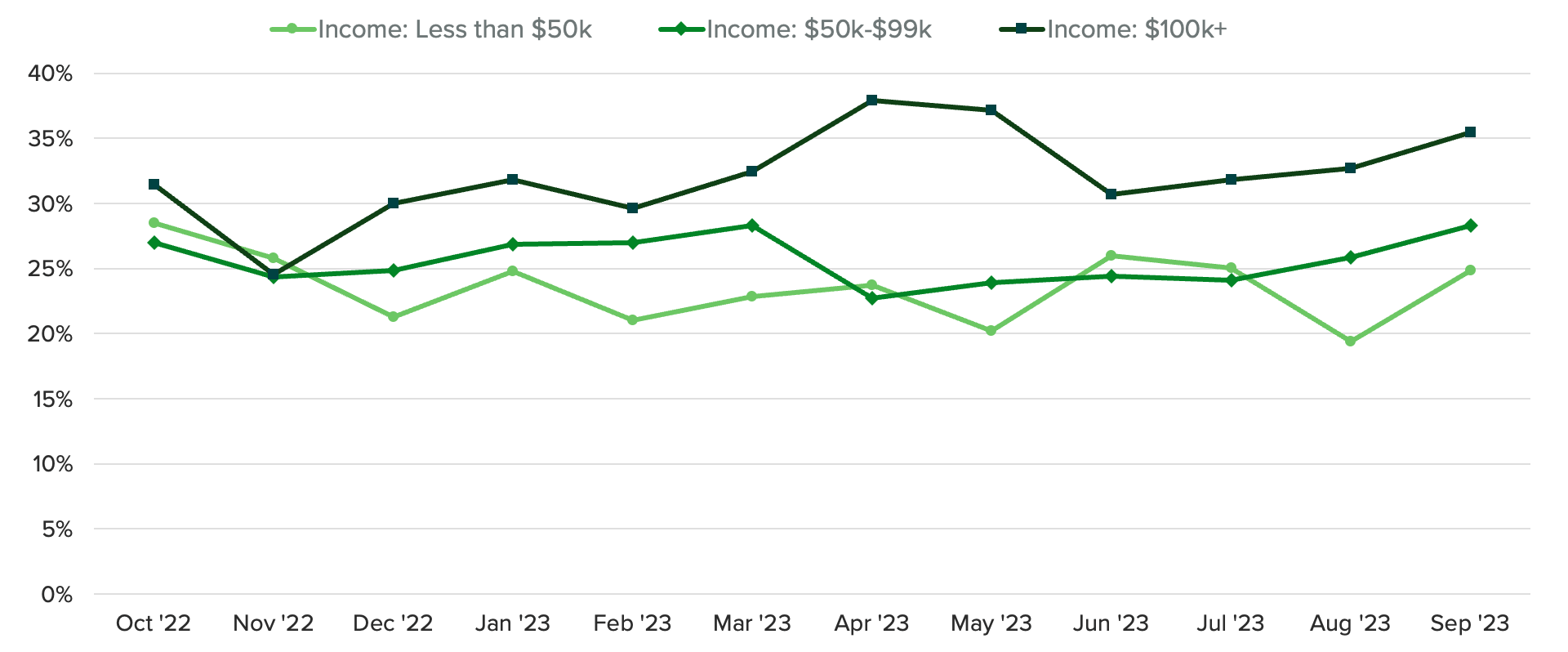

U.S. adults from households earning $50,000 or more per year tend to have larger total monthly debt payments compared to those earning less than $50,000, but so far in 2023 these consumers’ incomes have been sufficient to cover both spending and debt obligations. Higher- and middle-income earners’ monthly financial obligation ratios (debt-to-income ratio) have trended lower since late 2022 and remain subdued.

The relative strength in these households’ finances helps explain resilient top-line consumer spending observed this summer, seemingly in defiance of elevated interest rates. Heading into the fall, high- and middle-income households are moderating their expenditures as buying conditions turn less favorable, but the pullbacks appear to be more voluntary than driven by substantial budgetary pressures. While spending less and paying down debt seems to be the current choice for the higher-earning cohort, low-income households do not have this luxury of choice but are facing financial strains.

Higher- and Middle-Income Adults Have the Highest Debt Amounts, but Low Earners Have More Debt Relative to Income

What is the resilient consumer doing?

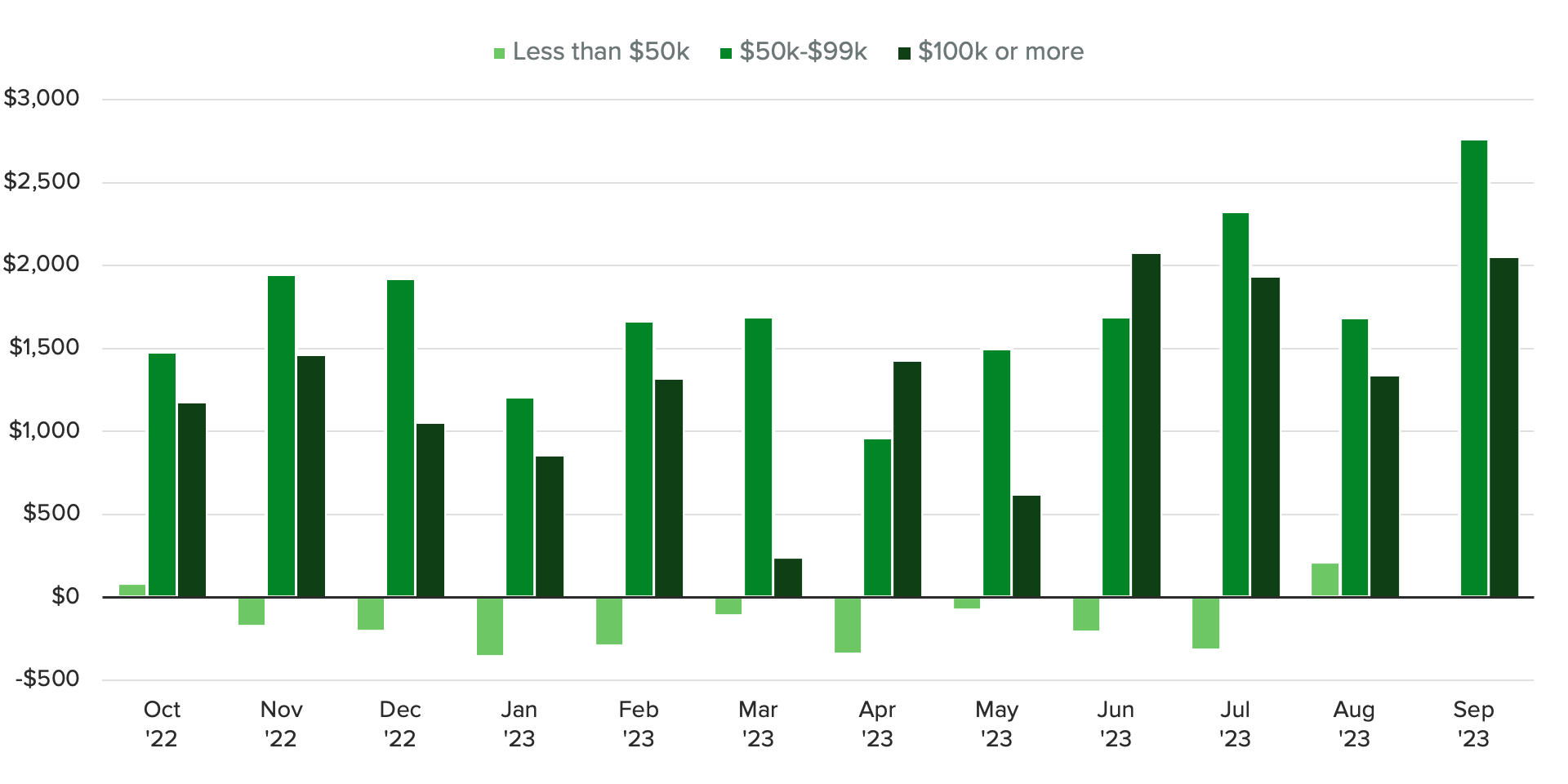

In addition to spending more, U.S. adults from households earning $50,000 or more per year are taking advantage of their relatively healthy financial situations to prioritize paying down credit card debts. Since tracking began in October 2022, this group has paid off a larger portion of outstanding credit card debt each month — reducing their exposure to higher interest charges on unpaid balances. Households earning less than $50,000 annually, in contrast, paid off a lower share of total credit card debt in September compared with last October. As pandemic-era assistance measures are phased out and interest rates remain elevated, lower-income households find themselves in a financially precarious situation, raising the risks associated with this cohort.

High Earners Are Paying Down Debt as Credit Card Interest Climbs, While Middle and Lower Earners Hold Steady

The divide: who will miss payments in the new post-pandemic world and what that means

U.S. adults from lower-income households do not report having as much monthly debt as those earning $100,000 or more per year, but their relatively larger debt-to-income ratio suggests they are less likely to be able to stay on top of payments. Furthermore, this group reports frequently spending more than they earn in a given month, pushing them to rely on debt or leftover savings. Lower earners’ monthly financial obligations ratio ticked higher in September, suggesting a growing strain to make debt payments for this cohort amid elevated interest rates.

Lower Earners Frequently Report Higher Spending Than Income in a Given Month

What we do that’s different: We survey thousands of U.S. consumers monthly to measure their spending patterns and habits, asking questions on topics including household income, spending, savings, debt, housing payments and more.

Why it matters: Morning Consult’s consumer spending data provides a detailed assessment of U.S. adults’ self-reported household financial conditions and spending, as well as consumers’ perception of inflation and supply chain disruptions and the impact of both on purchasing decisions.

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]