China’s Public Ranks Economic Growth, Not Defense, as Top Priority

Key Takeaways

Faced with a stalled recovery, Chinese people now see economic growth and social stability as their top concerns, outpacing even defense.

This represents a shift in priorities since Morning Consult first surveyed on these issues in May, and speaks to growing concerns about the Chinese economy and stalled growth.

Despite narratives about geopolitical rivalry, “competing with foreign rivals” has consistently polled as the Chinese public’s lowest priority.

Shifting views could lead to openings for multinationals, especially if concerns about the economy dull hostilities that have increasingly kept foreign investors at bay.

Nearly 1 in 5 Chinese adults now see improving relations with Western countries as a top priority, which could augur well for a U.S. Senate delegation’s upcoming visit to Beijing.

Sign up to get our analysis and data on how business, politics and economics intersect around the world.

As China’s economy continues to struggle after the country’s reopening, its public wants Beijing to prioritize economic recovery and social stability above all else, even national defense. Meanwhile, over the past five months, competition with foreign rivals has consistently been the Chinese public’s lowest policy priority.

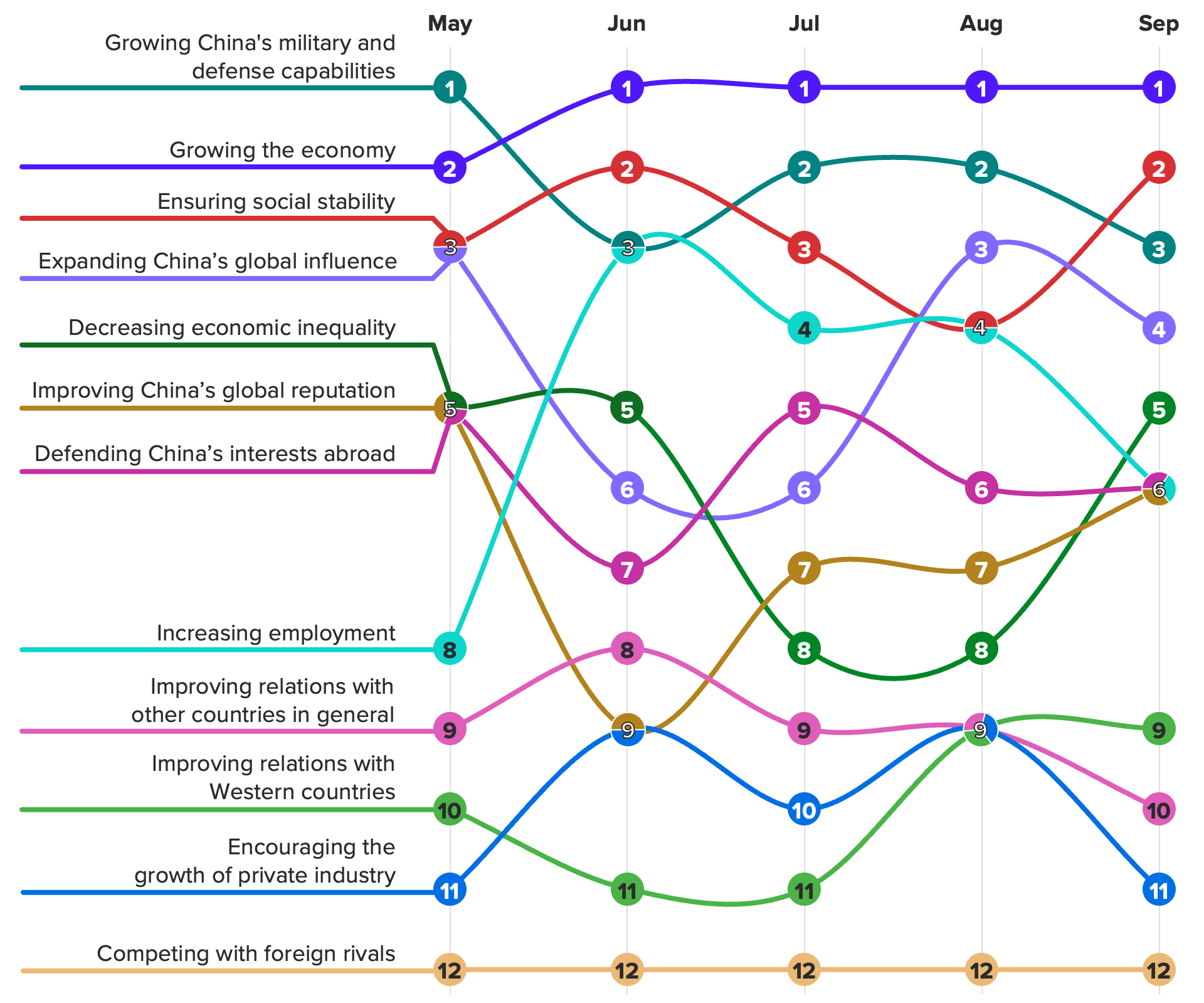

Since May, Morning Consult has surveyed Chinese adults monthly on what they believe their country’s top priorities should be, asking them to select up to three from a list of 12. While respondents were initially most likely to cite the expansion of China’s military and defense capabilities as a top priority, economic growth displaced this choice in June, and has remained the most pressing concern since. As of September, more than 1 in 3 Chinese adults said economic growth should be among the country’s top priorities, compared with just over a quarter (27%) who said China should prioritize its defensive capabilities. In fact, military expansion has now fallen behind maintaining social stability (29%) as a top priority.

China's Public Sees Economic Growth as the Country's Top Priority

Surveys conducted monthly from May 4 to Sept. 14, 2023, among representative samples of roughly 1,000 Chinese adults each, with unweighted margins of error of +/-3 percentage points. Respondents were allowed to select up to three choices.

Despite Beijing’s shifting priorities, China’s anxious public wants economic growth

Economic growth has long been a top policy priority for Beijing. The Communist Party’s political legitimacy in the reform era has primarily been linked to its ability to deliver on the promise of continued development. But as growth has slowed, Xi Jinping has indicated a shift in Chinese strategic thinking, prioritizing economic autonomy and “comprehensive national security” over pure economic growth.

As such, our recent findings could speak to a mismatch in priorities between the Chinese government and its citizens, whose sensible response to a worsening slowdown has been to prioritize growth above all else. This goes hand in hand with a focus on maintaining social stability — a hard-won gain of economic development during the reform era, following decades of political and economic turbulence. The Chinese public may worry about the destabilizing effects of failing to combat slowing growth.

All of this speaks to a tenuous policy environment in Beijing that could further spook markets and foreign investors in the short term. Yet there is a potential upside, especially for foreign investors: The public’s continued fixation on economic growth could lead to a softening of Beijing’s recent hostility toward foreign businesses.

China’s complicated employment picture

Our research shows that, despite mixed signals from Beijing, China’s public continues to crave foreign investment, especially when it creates jobs. With China facing a youth unemployment crisis over the summer, the ranked share of adults who said increasing employment should be a top national priority rose from eighth in May to third in June.

China’s overall unemployment numbers held relatively steady over the summer, but after youth unemployment hit a record high of 21.3% in June — the month respondents were most likely to cite raising employment as a top priority — Beijing stopped releasing these figures.

A declining public focus on unemployment could speak to the success of the government’s efforts to downplay the issue: The ranked share of respondents prioritizing employment fell in the following months and is now tied for sixth, with 1 in 5 Chinese adults saying it should be one of the country’s top priorities as of September.

Economic struggles may have dulled public appetites for combativeness and competition

While a quarter of Chinese adults said the country should focus on expanding its global influence, it is notable that they do not see this as a zero-sum prospect. Just 14% said China should be focused on competing with foreign rivals, which has consistently ranked last as a priority over the past five months.

In an era of constrained economic circumstances, China’s public may not have as much of an appetite for competition and combative foreign policy as its government. And while 20% of Chinese adults saw defending their country’s interests abroad as a priority, the same share said it is important to improve China’s global reputation — two viewpoints that in many ways balance each other out.

In terms of rank, both issues fell one spot from the first survey in May, though a desire to improve China’s global reputation has improved three spots since June.

Amid geopolitical tensions, China’s investment needs could yield common ground

High-level visits by U.S. officials have resumed but remain strained. However, the Chinese public’s desire to improve the country’s global reputation could bode well for an upcoming visit to Beijing by a delegation of U.S. senators. Notably, the delegation is planning to meet with Chinese business leaders as well as officials. As of September, the share of Chinese adults who view improving relations with Western countries as a top priority (19%) is just 1 percentage point smaller than the share who prioritize defending China’s interests abroad.

Moreover, the share prioritizing improved relations with the West specifically has grown 8 points since May, just surpassing the share who see improving relations with foreign countries in general as a top priority.

Specific demographics at scale: Surveying thousands of consumers around the world every day powers our ability to examine and analyze perceptions and habits of more specific demographics at scale, like those featured here.

Why it matters: Leaders need a better understanding of their audiences when making key decisions. Our comprehensive approach to understanding audience profiles complements the “who” of demographics and the “what” of behavioral data with critical insights and analysis on the “why.”

While increasingly adversarial positioning by both the United States and China has coincided with extreme pessimism about the state of bilateral business relations, it seems that the Chinese public isn’t ready to turn away from the West just yet. Multinationals able to navigate the tense political environment could win long-term reputational gains if they are seen as contributing to economic growth, which China’s public — already wary of Western investors being deterred by narratives of decoupling and derisking — sees as a pressing need.

Such companies should pay careful attention to their operational strategy and messaging around these issues, as international perceptions of overt support for or commitment to Beijing could also lead to reputational risks among customers in the West. But we see the potential gains outweighing the risks in the near term. At worst, businesses already active in China should hesitate before making any long-term decisions about decoupling, and follow Morning Consult’s geopolitical analysis for news of softening attitudes toward foreign businesses that could make the Chinese market more hospitable going forward.

Scott Moskowitz is senior analyst for the Asia-Pacific region at Morning Consult, where he leads geopolitical analysis of China and broader regional issues. Scott holds a Ph.D. in sociology from Princeton University and has years of experience working in and conducting Mandarin-language research on China, with an emphasis on the politics of economic development and consumerism. Follow him on Twitter @ScottyMoskowitz. Interested in connecting with Scott to discuss his analysis or for a media engagement or speaking opportunity? Email [email protected].