Where Consumer Sentiment Has Recovered the Most

Key Takeaways

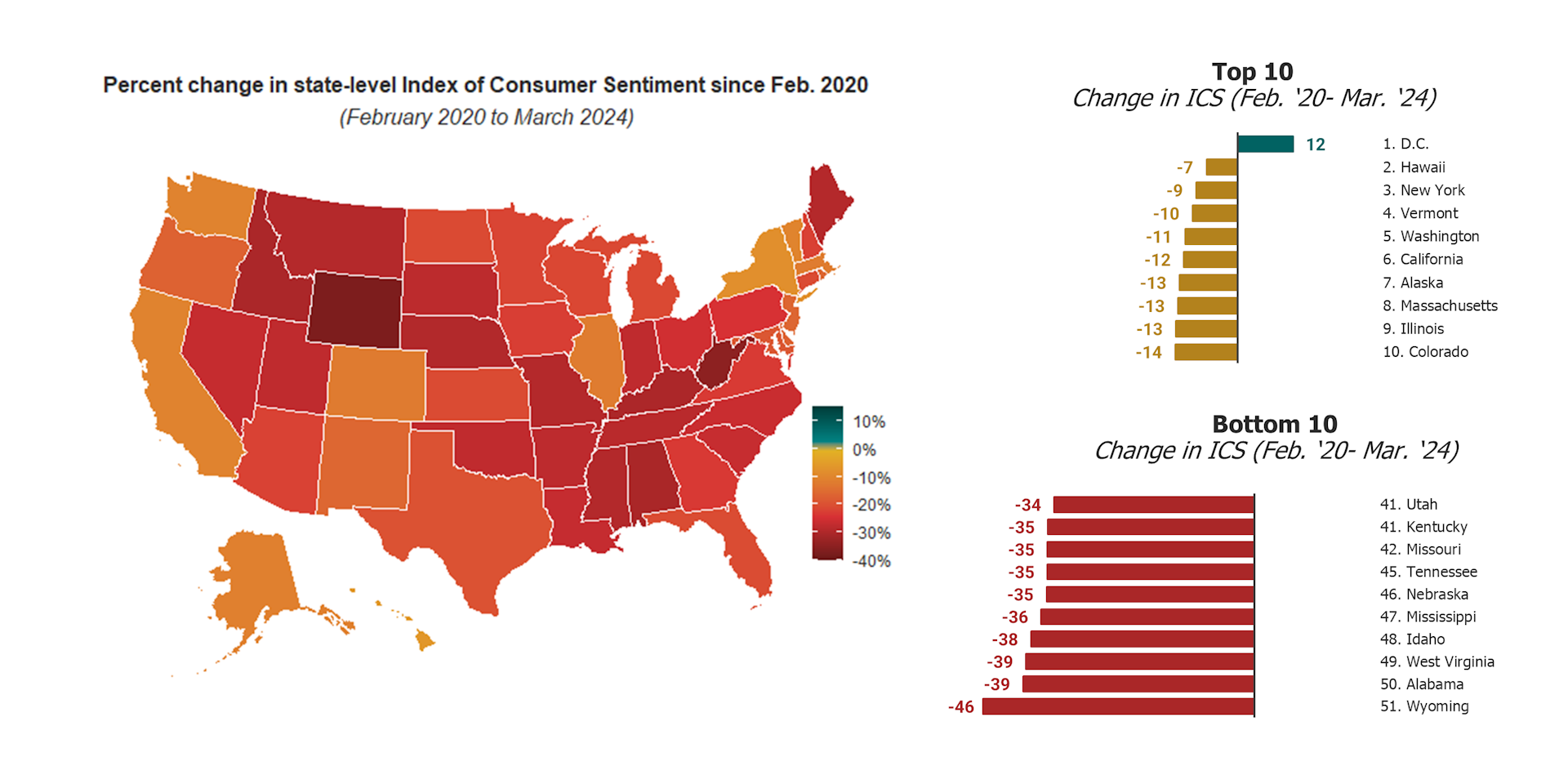

All U.S. states have yet to recover to their pre-pandemic levels of consumer sentiment, but some states are closer than others.

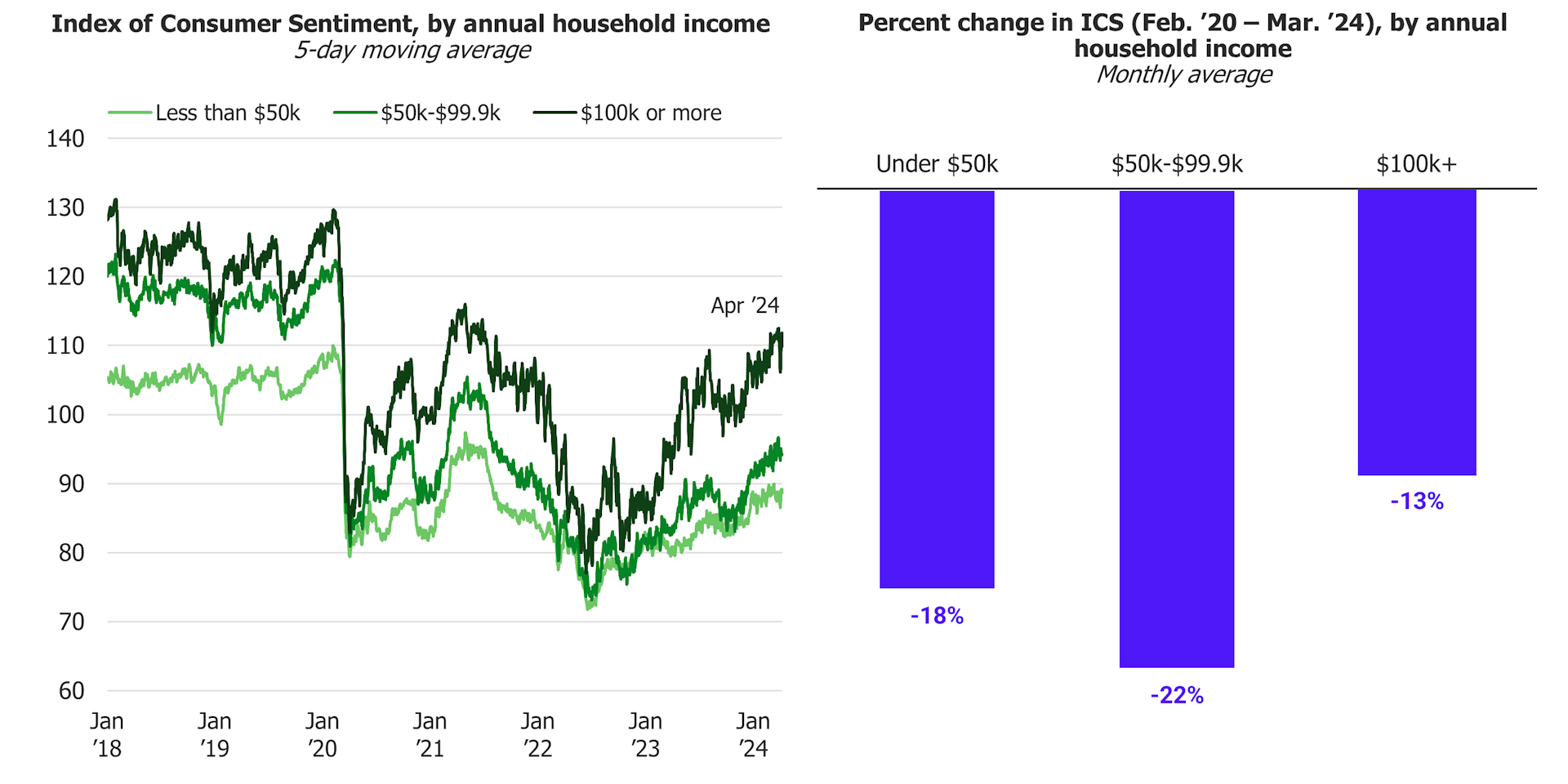

Middle-income earners’ consumer sentiment is recovering slower than their lower and higher income peers.

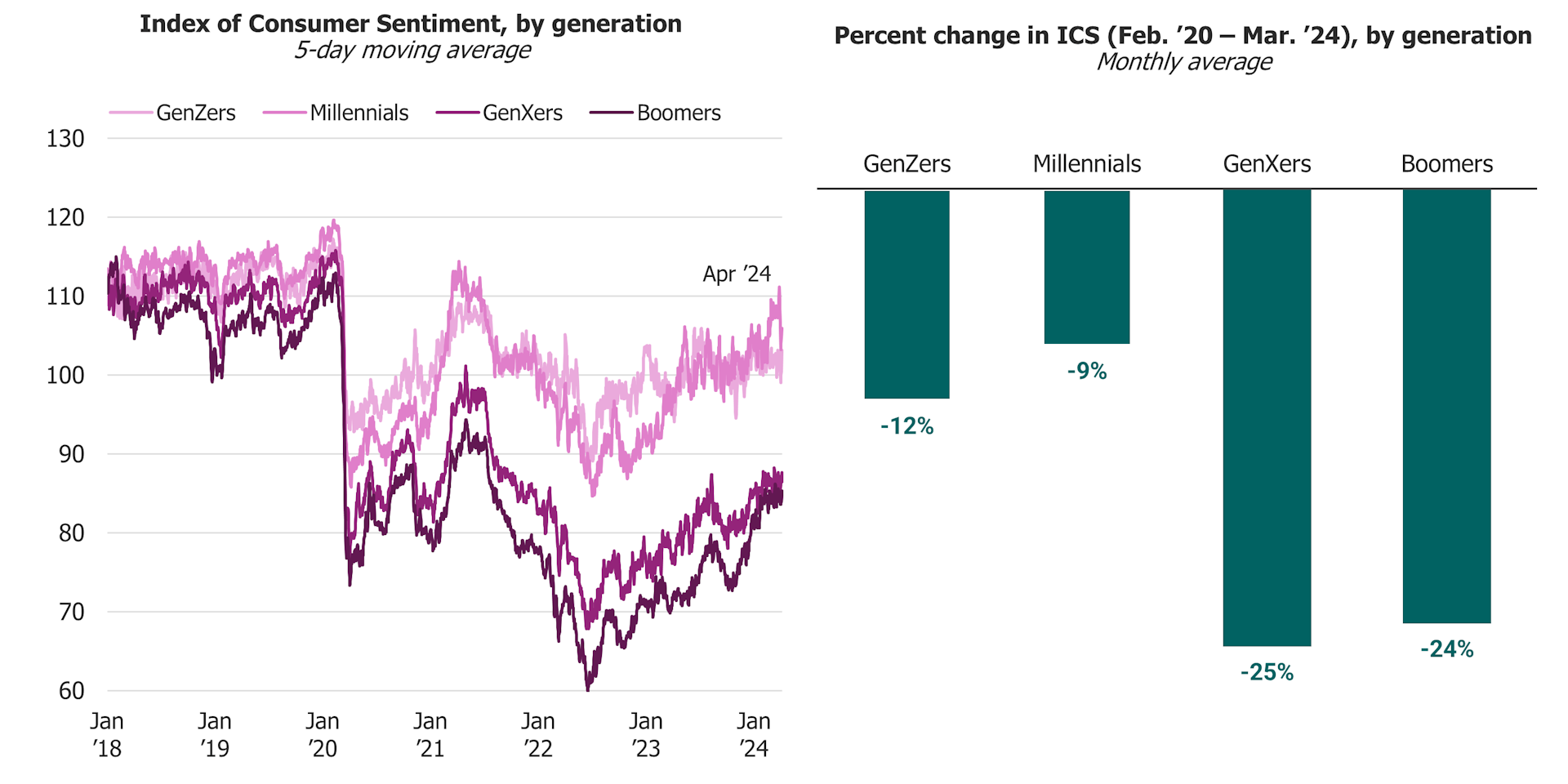

Generational divides in consumer sentiment widened after the pandemic. With the recent surge in inflation, older generations’ sentiment is lagging behind their younger counterparts.

Data Downloads

Pro+ subscribers are able to download the datasets that underpin Morning Consult Pro's reports and analysis. Contact us to get access.

Did you know that Morning Consult surveys close to 6,000 consumers daily? Reach out here if you are interested in our consumer sentiment data, which mirrors University of Michigan’s but can be cut by hundreds of demographics and psychographics as well as layered with Brand-specific data. Morning Consult Intelligence customers can access the platform here.

All states have yet to recover to their pre-pandemic averages for consumer sentiment, but the recovery rates vary widely by state. The leader of the pack is not technically a state: The District of Columbia leads all of the others as the only state or territory tracked that is above its February 2020 levels.

Some States are Closer to Pre-Pandemic Averages Than Others

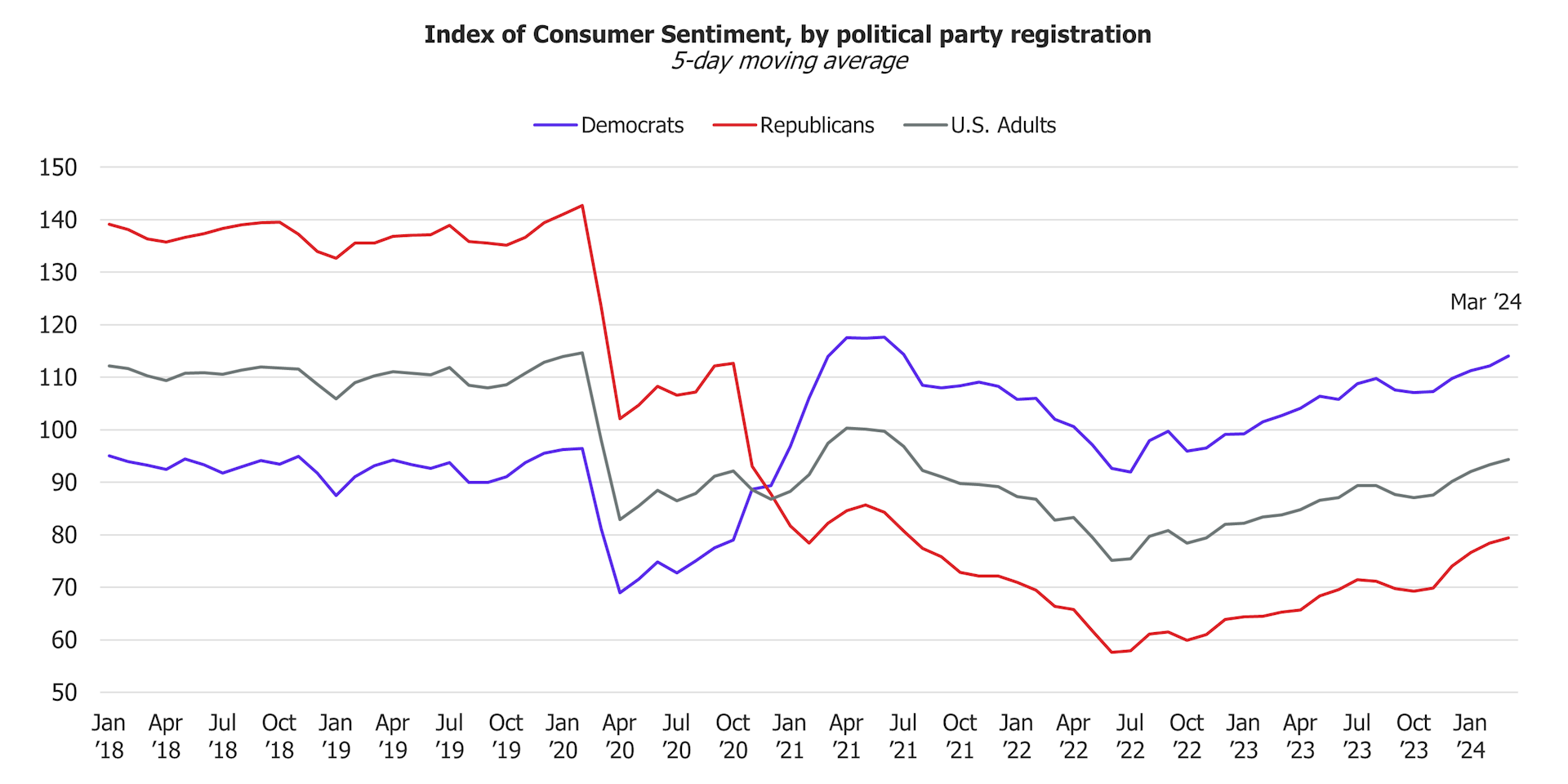

Much of the discrepancy among states could be due to political affiliation: When an incoming president belongs to a different party than the outgoing president, consumer sentiment for members of the political parties usually flip, as seen in Morning Consult’s data when the ICS score for Democrats overtook that of Republicans after the election of President Joe Biden. Notably, all of the states and territories in the top 10 voted Democratic in the previous presidential campaign, with the exception of Alaska. Alaska has had strong GDP and wage growth over the past year, which could explain some of the recent growth in economic optimism.

Consumer Sentiment Has Been Historically Highly Sensitive to Political Leadership Changes

On the other hand, all of the states with the slowest recovery in their consumer sentiment scores are states that voted for former President Donald Trump in 2020. In fact, Wyoming has had one of the strongest growth rates of wages from September 2022 to September 2023 and relatively middle of the road levels of inflation, yet still was by far the most behind its pre-pandemic levels for consumer sentiment. However, for many of these states, party affiliation alone may not be the reason for dour moods. Many of the states where sentiment is recovering the slowest are in the South, which continues to face inflation above the national average at about 3.79% annually, potentially putting downward pressure on consumers’ perceptions on the economy.

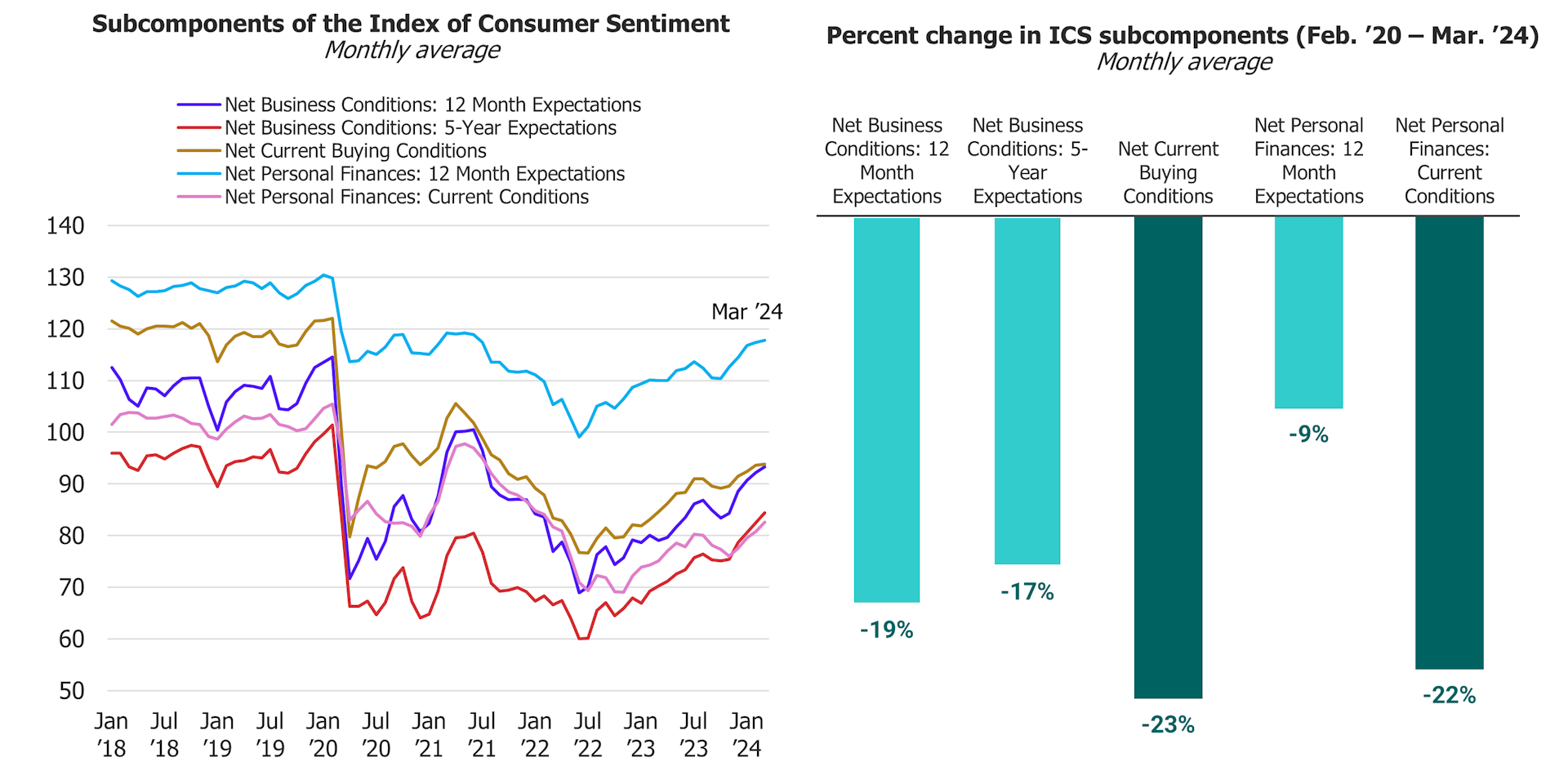

Views of Current Conditions are Recovering Slower Than Expectations for the Future

Morning Consult asks five questions relating to personal finances and business conditions in the country as a whole and averages them together in order to calculate the ICS . When examining the subcomponents of the ICS, future expectations for personal finances have historically been higher than those of business conditions and since the pandemic the gaps have widened. The index for 12-month expectations for personal finances remains the highest and closest to its pre-pandemic levels but future expectations across the board are closer to their pre-pandemic levels than both measures of current conditions – personal finances and buying conditions. Consumers could be noticing improving economic conditions like easing inflation and a strong labor market leading to a more optimistic outlook for the future, but still feeling the pain of elevated interest rates and price levels dampening feelings about conditions today.

Middle-Income Earners Are Recovering the Slowest

Recent growth in consumer sentiment has been particularly strong for adults making $100,000 or more annually, widening the gaps between higher earners and everyone else. Counter to the pre-pandemic trend, middle-income earners, although generally feeling more optimistic than their lower earning peers, have been tracking closely with low-income consumers since inflation began falling from its heights. In addition, middle-income adults have the largest discrepancy in current levels of consumer sentiment when compared to their levels in February 2020.

Signs of economic stress on the middle class have been manifesting across many of Morning Consult’s Economic Intelligence surveys including labor and spending, which could be putting a damper on their consumer sentiment.

Younger Consumers Are Increasingly More Optimistic Than Their Older Peers

Another growing divide in Morning Consult’s consumer sentiment data is generational: Younger adults are faring better than their older peers. While younger adults, including GenZers and Millennials, have generally had higher levels of consumer sentiment even before 2020, the divide has grown even wider, especially after inflation began to climb to recent highs in 2021. Older adults are the most likely to be retired, and therefore on a fixed income, which makes inflation relatively more painful: Growing prices eat away at savings and in addition, they don’t benefit as much from strong wage growth. In addition, Boomers and GenXers expect higher near-term price growth as measured by Morning Consult’s Indirect Consumer Inflation Expectations, which could explain some of the pessimism they feel about the economy compared to their younger counterparts.

However, consumer sentiment growth for boomers has been particularly strong since inflation began easing in mid-2022 as the oldest generation has largely caught up with GenXers in recent months. If inflation continues to ease lower towards the Federal Reserve’s 2% target, the sentiment gaps between younger and older generations could narrow somewhat closer to historic trends.

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]