Middle Class Americans Are Acting More Like Lower Income Earners

Key Takeaways

Post-pandemic economic recovery reduced income inequality, but that trend has been reversing as higher earners pull ahead.

Historically, middle-income earners tracked more closely with high-income earners in many of Morning Consult’s economic indicators, but in recent months middle class adults have become increasingly likely to feel and behave like low-income consumers.

Early signs of a weakening middle class could spell trouble for the strong U.S. economy, particularly if stagnating disinflation leads to higher interest rates for longer.

By many measures, the U.S. economy has outperformed expectations, bouncing back from the widespread unemployment brought on by the pandemic and the recent inflationary surge that followed. In fact, it is still possible that the Federal Reserve could achieve the elusive ‘soft-landing’ of bringing inflation down to their 2% target without triggering a recession. In addition, consumer spending has remained robust: In fact, inflation-adjusted personal consumption expenditures outpaced expectations in February.

Strength in consumer spending is in large part supported by the labor market. Unemployment continues to remain below 4%, and although wage growth has slowed from its historic highs in 2022, average hourly earnings have been growing faster than inflation for 10 months. Additionally, U.S. adults of all income levels have benefitted from recent income gains. One unique element of the economic recovery following pandemic-related lockdowns was that lower income earners had the largest gains in income.

However, conditions have slowly started changing since last summer. As disinflation has appeared to stagnate in recent months, elevated interest rates continue to pressure debt-saddled consumers, and wage growth eases somewhat, Morning Consult’s data shows a widening in inequality across a variety of different economic measures.

Gaps Are Widening in Economic Sentiment

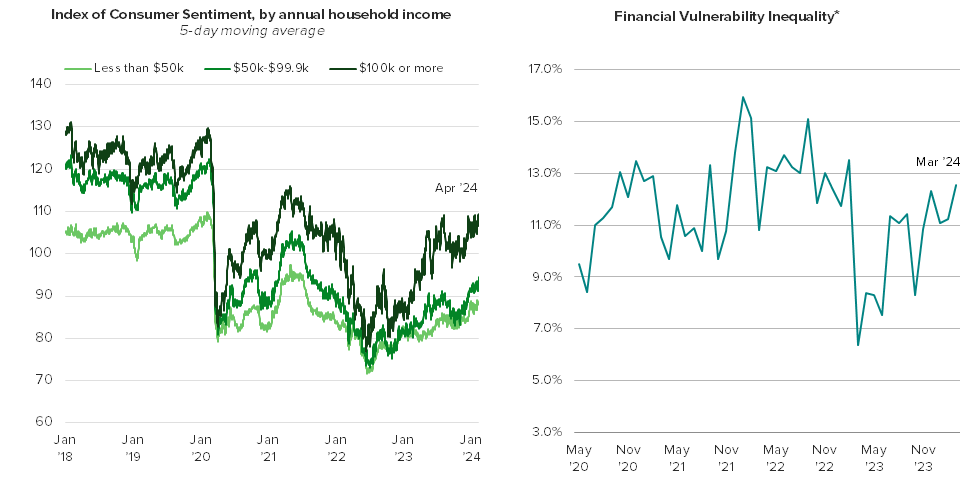

Although consumer sentiment continues to lag behind its pre-pandemic levels, economic optimism is at a more than 2-year high at an index score of 93, about 26% higher than its low of 74 in July 2022.

Recent growth in consumer sentiment has been particularly strong for adults making $100k or more annually, widening the gaps between higher earners and everyone else. In fact, when sentiment reached a low in July of 2022, high-income earners’ consumer sentiment was on average 9 points higher than the lowest income earners, but today that difference more than doubled to 22 points. Some of this gap could be explained by the strength in the stock market: High-income consumers are more likely to have equity and are often swayed both positively and negatively by the market.

But it’s not just the lowest income consumers who are being left behind by the wealthiest consumers. Middle-income earners, although generally feeling more optimistic than their lower earning peers, have been tracking closely with low-income consumers since inflation began falling from its heights. This recent development runs counter to the pre-pandemic trend where sentiment for middle- and high-income adults trended more closely together while lower income adults lagged considerably behind.

In addition, the Morning Consult/Axios inequality index has also been trending up since late 2022. The inequality index takes into account several inputs, including consumer sentiment, to measure inequality. Recent increases in inequality have been driven not only by sentiment, but also by increased financial vulnerability: The share of low-income adults who say they lack savings to cover a month’s worth of basic expenses, were they to lose their income, has increased, while the same share has decreased for the highest earners.

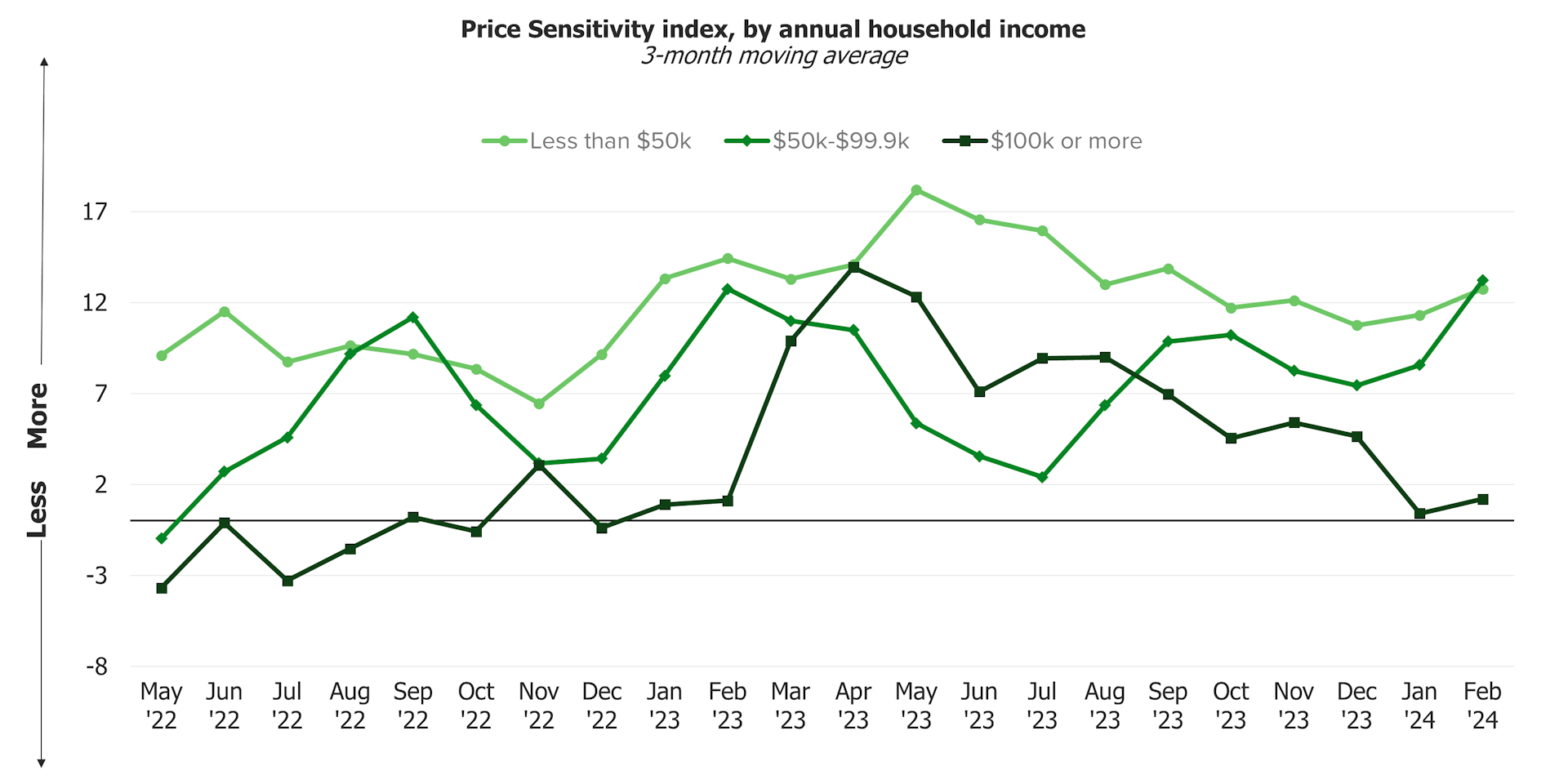

Middle- and Low-Income Earners Walk Away From High Prices While Higher Earners Are Willing To Pay

Feelings about the economy are one thing, but actions are another and we’ve started to see these disparities across income groups play out behaviorally as well. Both middle- and high-income consumers had sharply reduced their price sensitivity through the summer of 2023, meaning they became decreasingly likely to walk away from purchases with higher-than-expected prices. Lower price sensitivity index scores coincided with large increases in spending, including splurging on many nonessentials such as travel, recreation, and apparel. However, while that trend continued into 2024 for higher earners, it reversed for middle-income adults. In February, middle earners had the largest level of price sensitivity, reaching above even the lowest income cohort who generally leads the pack in walking away from higher priced goods and services.

These income group dynamics have played out similarly for Morning Consult’s other demand indicator, the Substitutability index – in recent months middle-income consumers have become more likely to trade down to cheaper substitutes, in line with lower earners.

For the overall basket of consumer goods tracked by the Bureau of Labor Statistics, prices are around 20% higher today than they were in February 2020 before the pandemic. After splurging alongside their higher earning peers last summer, perhaps middle-income consumers are now feeling budgetary pressures to cut back, particularly when prices are too high.

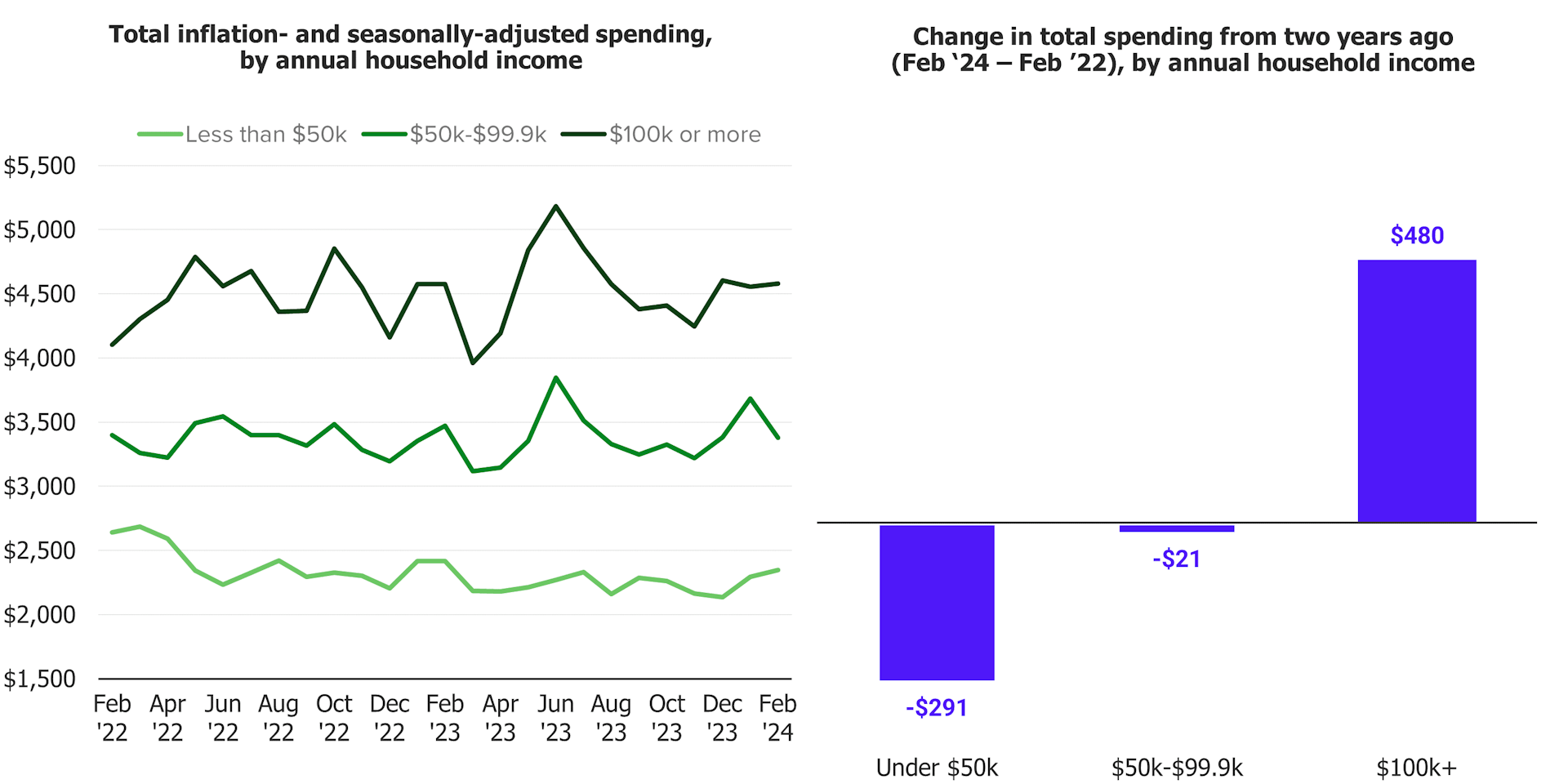

Low-Income Consumers Are Spending Less, While Higher Earners Are Spending More

As expected, high-income earners, who are the least likely to walk away from higher-than-expected purchases, are also spending the most. After adjusting for inflation and seasonal effects, wealthier consumers spent on average $480 more this February than the same month two years ago. At the same time, middle-income consumers are spending slightly less (-$21) while the lowest earners are spending considerably less (-$291), suggesting that much of the continued strength in consumer spending is coming from higher earners.

Despite Wage Gains, Low-Income Adults’ Debt-to-Income Ratios Are on the Rise

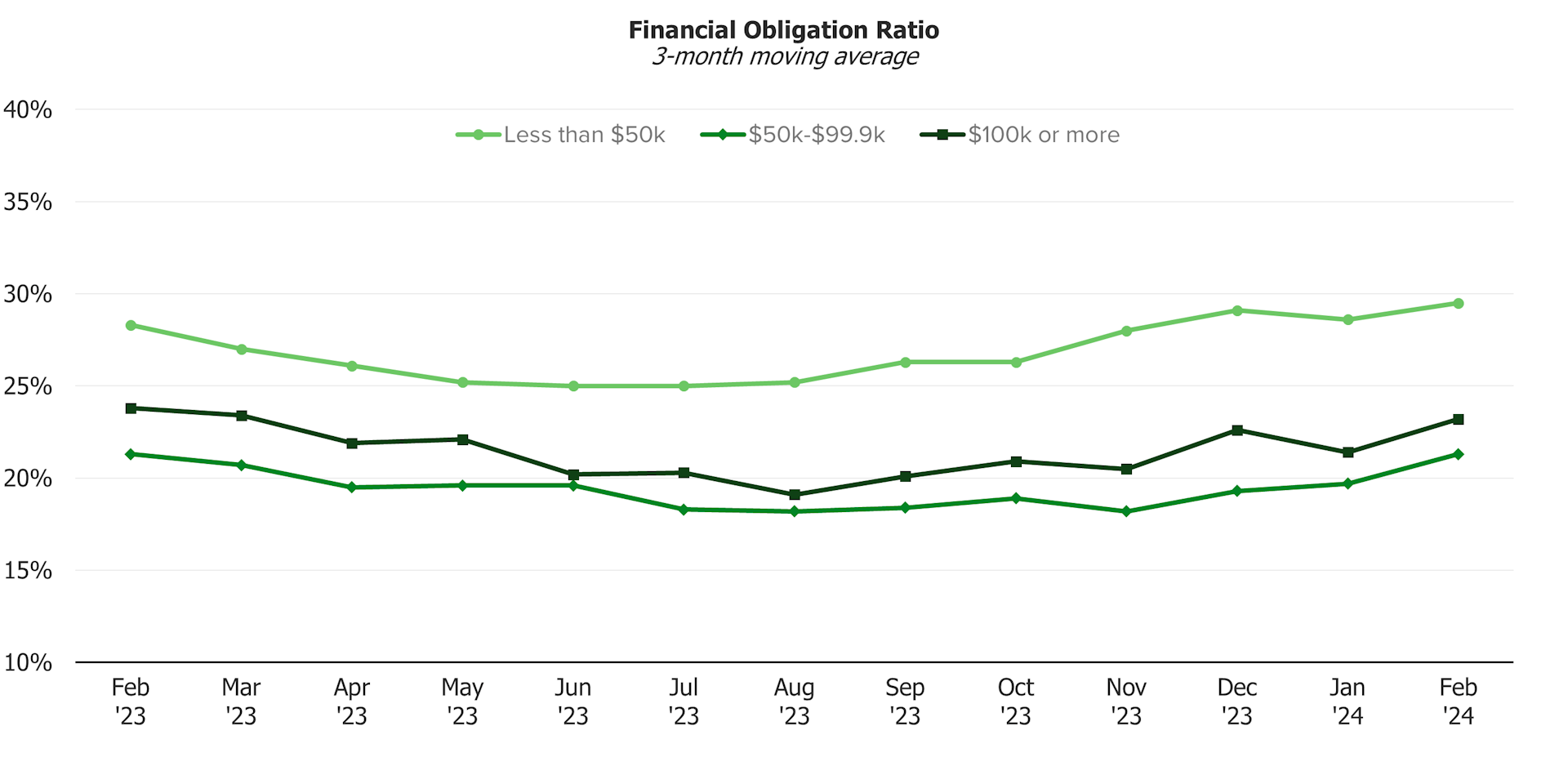

As mentioned above, adults at all income levels have experienced wage gains over the past few years. Despite this, Morning Consult’s debt-to-income ratio (financial obligation ratio) has been increasing for all income groups since mid-2023. Increases have been particularly pronounced for lower income earners, who in February dedicated nearly 30% of their income to paying down debts. As a greater share of disposable income is allocated to debt payments, consumers’ budgets become more constrained, leading to less room for spending, especially on nonessentials.

With elevated interest rates, debt becomes more costly and eats up a larger share of household budgets. While the Fed has indicated rate cuts as early as June of this year, they have also made clear that they are taking a ‘data dependent’ approach. In other words, if the rate of disinflation continues to stagnate, rate cuts could come later, leading to prolonged pressure on debt-saddled consumers including low-income earners with higher debt-to-income ratios.

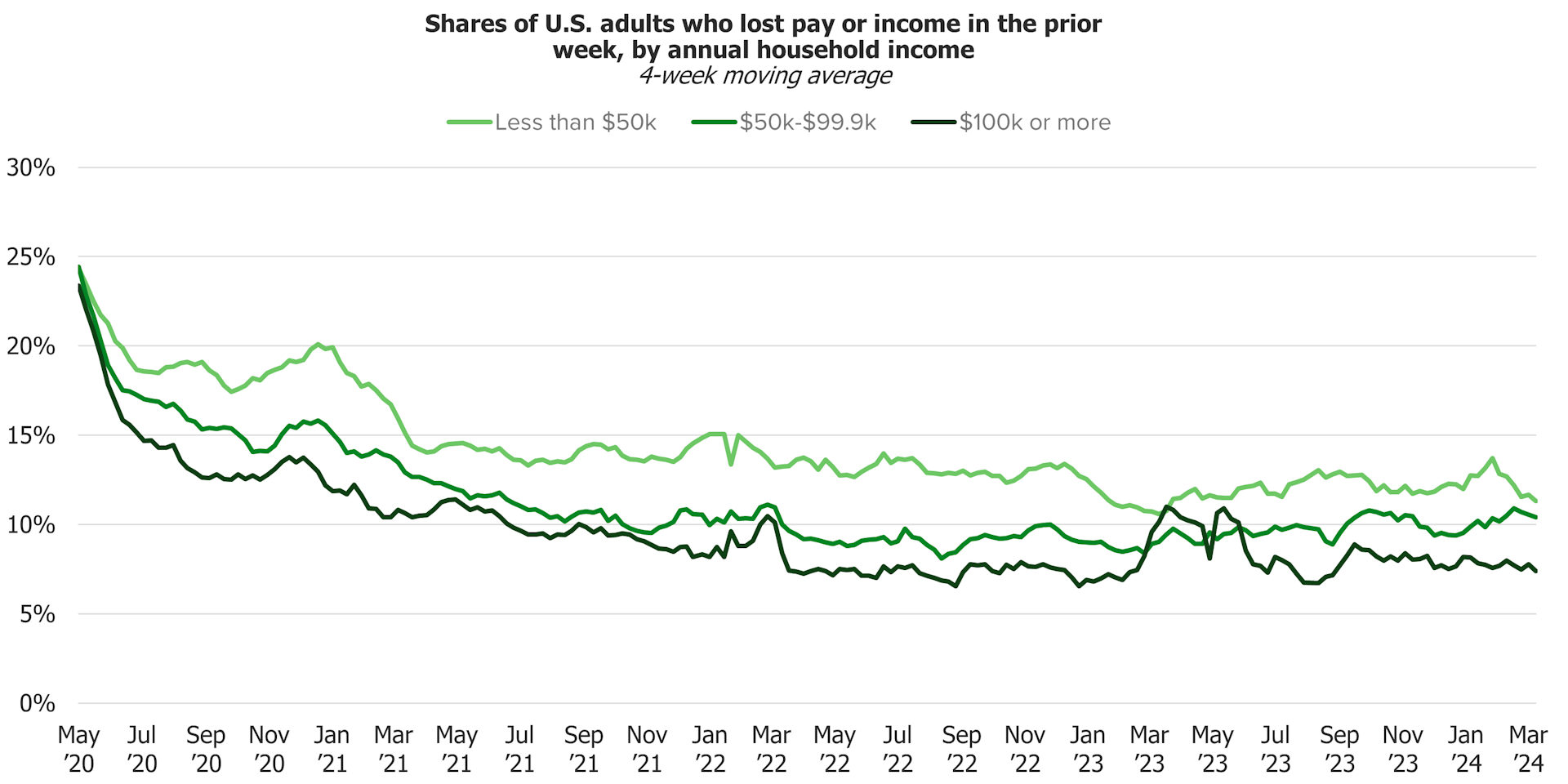

Lost Pay for Middle-Income Earners Has Crept up Closer to the Lowest Income Cohort

The shares of adults reporting lost pay in the prior week have declined for all income groups since their heights at the start of the pandemic. Employment income losses tend to be higher at the lower end of the income spectrum, as these workers tend to be younger and in positions that are less secure week to week. Over the past few years, middle-income earners generally tracked closer to the highest income cohort rather than the low earners. However, lost pay shares for middle-income earners have been creeping up over the past year, now moving closer to the lowest income group and away from the biggest earners.

A weakening middle class could put a damper on future economic growth

By most measures, the US economy is in good shape. However, it could be the case that much of the persistent strength is being driven by high-income earners, and particularly by their spending patterns. While it’s not a sign of an impending recession by any means, weakening economic measurements for middle-income earners is a sign that there could be some stress bubbling under the hood for the U.S. economy. If inflation continues to move towards the Fed’s 2% target, reduced interest rates this summer could prevent any dampening in economic activity. But on the other hand, if rates need to remain higher for longer, a weaker middle class could start to slow the roaring economy.

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]