What’s Driving Increases in Consumer Spending — Even As Core Inflation Remains Stubborn

Key Takeaways

Consumer spending ticked up in May after two consecutive months of declines.

High-income consumers drove much of the increase in total spending, especially for discretionary categories, reversing the pullbacks earlier this year.

Monthly top-line inflation eased from April to May, but core inflation remained stubbornly elevated. Supply-and-demand mismatches in housing and the used car market are putting pressure on prices.

Sign up to get our data on the economy, including trends in consumer spending and consumer confidence.

Consumer spending increased in May after two straight months of reduced outlays. All income earners contributed to monthly spending gains, but May’s growth was largely driven by high-income consumers. High-income earners, and to a lesser extent middle-income earners, had particularly large spending increases in vacation-related categories such as airfare and hotels ahead of the summer travel season. They also drove increases in other discretionary spending categories like apparel and home furnishings after withdrawing from these categories earlier in the year.

High- and middle-income earners rebound their spending, willing to swallow higher prices

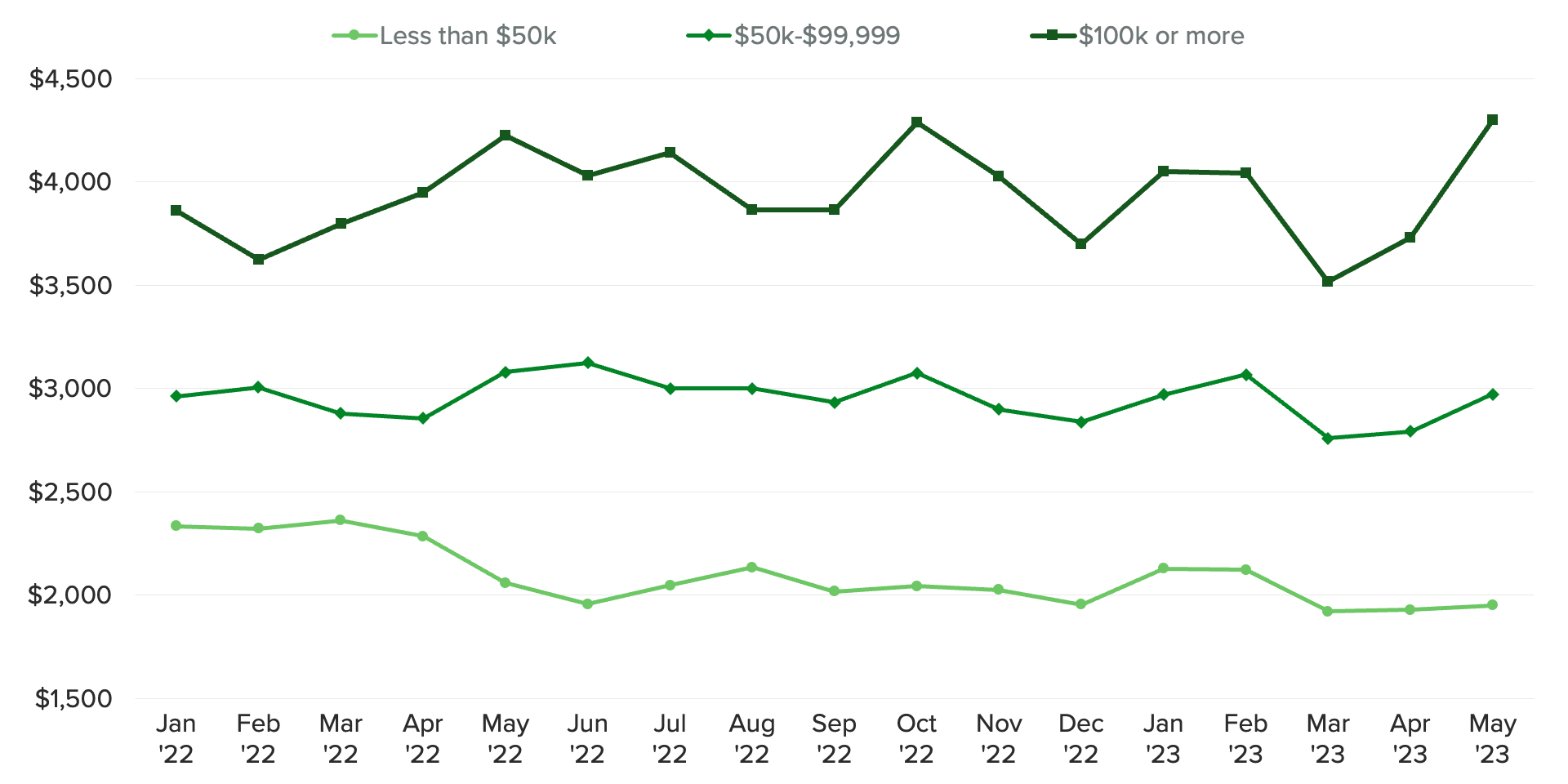

In May, consumers across all income groups increased their total spending. However, the highest earners had the largest increase, with a 15% increase in total spending month over month, whereas the average low-income consumer only increased their spending by 1%. Earlier this year, news of tech layoffs, banking instability and market volatility may have prompted high-income earners to pull back on spending. As these events have come to pass, high-income earners have rebounded their spending in full force. Job prospects are also improving for this group, as the share who experienced a loss of pay and income fell from May to June, as highlighted in June’s Morning Consult/ Axios Inequality Index.

High- and Middle-Income Earners Increased Spending in May

Discretionary spending driven by high-income households

After approaching record lows in April, spending on travel expenses, such as airfare and hotels, ticked up for all income groups in May ahead of the summer travel season. However, most of the increase came from the high-income group, where the average spending on hotels and airfare increased from $161 to $280.

These shifts may be tied in part to differences in monthly income sources among these groups, as well as recent positive developments in market conditions and how the negative news from tech-sector layoffs and banking turmoil have died down. High-income consumers have a greater capacity to bounce back fast in terms of spending behavior and are more likely to indulge in discretionary spending.

Middle- and high-income groups drive demand in a tight used car market

Annual top-line inflation slowed for the 10th straight month to 4.1%, moving closer to the Federal Reserve’s 2% target. The primary driver of price growth continues to be core inflation, which excludes volatile food and energy categories. Annual core inflation in May was 5.3%, running hotter than top-line inflation. Following the trend from April, core goods exerted significant upward pressure on overall inflation, again driven by used car prices. Although the Fed decided to pause interest rate increases in June, persistently elevated core inflation will likely bring another rate hike this year.

What we do that’s different: We survey thousands of U.S. consumers monthly to measure their spending patterns and habits, asking questions on topics including household income, spending, savings, debt, housing payments and more.

Why it matters: Morning Consult’s consumer and spending data provides a detailed assessment of U.S. adults’ self-reported household financial conditions and spending, as well as consumers’ perception of inflation and supply chain disruptions and the impact of both on purchasing decisions.

Following last month’s trend, used cars prices increased 4.4% month over month, while new car prices decreased by 0.1%. Although prices have begun to decline for new cars, they’re still at historic highs. Historically, the low-income cohort leads the demand for used cars in Morning Consult’s net intentions to buy data. However, net intentions to buy a used car jumped quite sharply for the highest-income group at the beginning of this year. Net intentions to buy also increased steadily for middle-income consumers for the past three months.

Relative to new cars, Morning Consult’s data shows a drop off in price sensitivity for used cars in April and May compared to new cars, suggesting that consumers are more willing to swallow higher-than-expected prices for used vehicles. The sharp increase in Morning Consult’s Unavailability Index for used cars in May suggests that used car supply has tightened amid heightened interest from all income groups.

This memo offers a preview of Morning Consult’s June U.S. Consumer Spending & Inflation Report. Morning Consult Economic Intelligence subscribers can access the full report here.

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]

Related content

Americans Are Spending Less on Just About Everything as Persistent Inflation Hits Their Wallets

It's Going to Be a Busy Summer for the Travel Industry