Morning Consult’s Consumer Spending Data Coverage Expands Globally

Key Takeaways

For the first time, Morning Consult is publicly releasing its proprietary consumer spending data and associated validation for Germany, France, Spain, Italy and Australia, building on the initial release of international spending data in March 2023.

The international data complements our robust coverage of U.S. consumer spending, offering a unique opportunity to compare consumer spending patterns based on apples-to-apples data spanning a growing number of countries.

Morning Consult global spending data allows clients to compare and analyze how price changes in different countries are affecting their respective consumer spending patterns.

Sign up to get our data on the economy, including trends in consumer spending and consumer confidence.

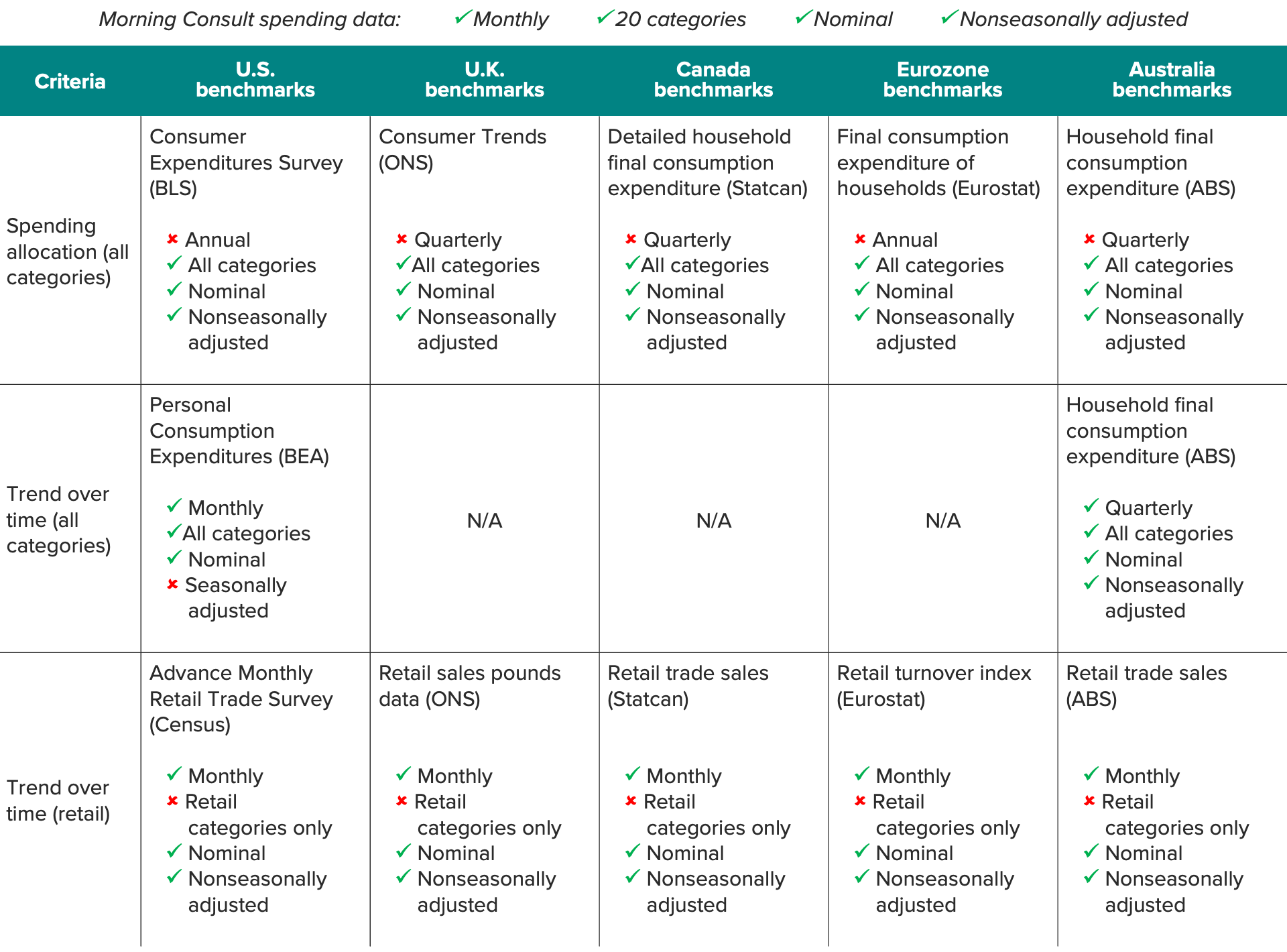

The validation process for Morning Consult’s proprietary spending data in the eurozone countries and Australia followed the same blueprint established for the United Kingdom and Canada: We compared our survey data to government statistics tracking similar concepts.

These comparisons were used to select appropriate test statistics (i.e., trimmed means) per category, with three primary goals:

- To maximize correlation between Morning Consult spending allocations and consumption expenditures government data sets,

- To maximize correlation over time between Morning Consult’s retail categories and corresponding government benchmarks, and

- To maximize consistency in methodological approach across countries.

The process and findings for the eurozone countries and Australia are described in more detail below.

Identifying government benchmarks for consumer spending

The primary benchmark we sought to match was consumer expenditures allocations across categories. Government data generally reflects total spending in a given month or quarter by the entire population, while Morning Consult’s data tracks consumer-level average reported monthly spending.(1) Therefore, the levels are not comparable — but the share of spending allocated to each category should theoretically align.

The table below provides a methodological comparison between our benchmarking approaches in the United States, the eurozone and Australia. Because of differences in the variables being tracked, the frequency of data collection and category-level definitions, there were slight variations in the application of this validation process relative to what was done in our previous benchmarking of the U.K. and Canada, but the general approach remained consistent.

(1)For more information on the conceptual differences between government spending data and consumer-level average reported spending, please see Introducing Morning Consult’s International Spending Data.

For example, the statistical offices of the U.K. and Canada each release quarterly personal consumption expenditures data, enabling contemporaneous comparisons with Morning Consult’s monthly data. Australia’s Bureau of Statistics also produces this data on a quarterly frequency. However, Eurostat releases only annual consumption expenditures data, with 2021 as the most recent year available. Morning Consult’s global spending survey launched in early 2022, so it is not yet possible to benchmark this data against government figures covering the same time period in Europe. Still, spending allocations across categories usually don’t change much from one year to the next, so using the lagged data from Eurostat as a benchmark is a reasonable proxy in the absence of a contemporaneous data set.(2)

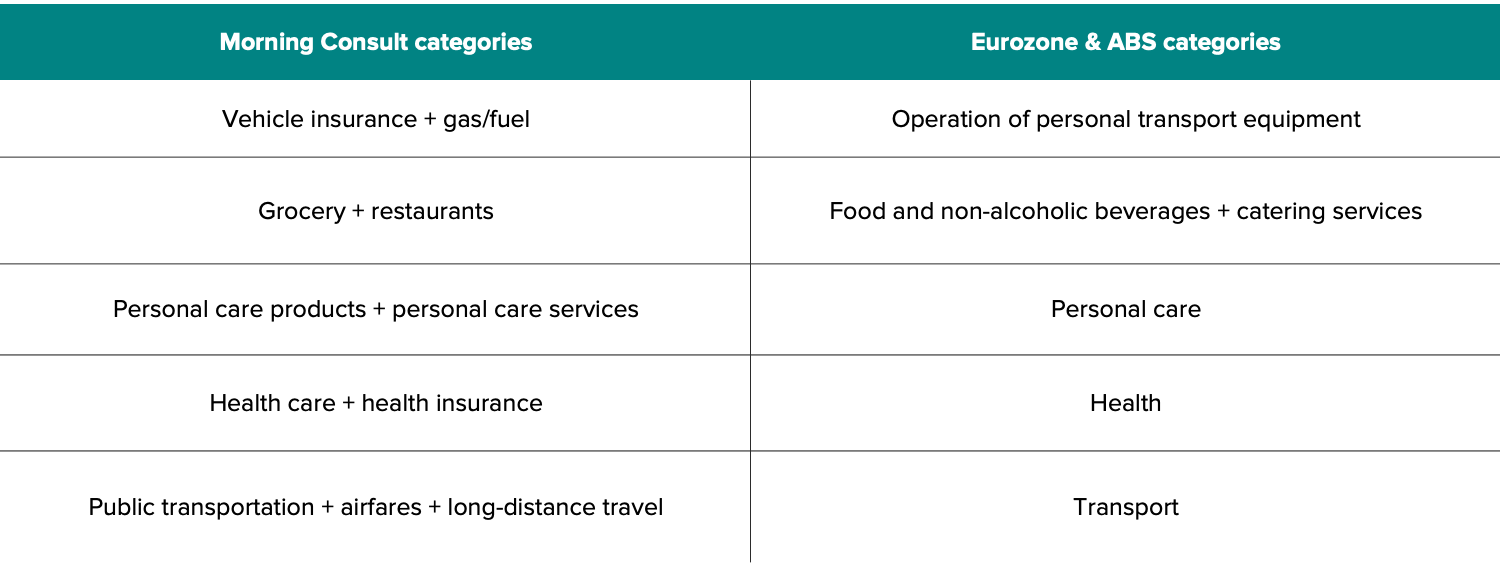

Another challenge that arose in benchmarking Morning Consult’s spending data against government data was mismatched category definitions. In instances where one data set had more or less detail than the other, aggregate variables were formed by combining multiple spending categories in order to better align the series. Eurostat and ABS follow a similar spending categorization theme. The table below shows how components were combined in order to enhance the overlap in the aggregate definitions.

(2)For example, from 2011-2021, total allocated spending on housing and utilities in Germany ranged from 24% to 26%, with similar variation across France, Italy and Spain.

The case of Australia shows why we need to identify the ways in which methodological differences between Morning Consult and government statistical agencies account for differences in empirical findings. Initial benchmarking of the housing component yielded a much higher share of total spending in Morning Consult’s data (42%) than in ABS’ (24%). Further research on ABS’ methodology showed that the imputed rents for this category exclude financing costs and homeowners insurance, whereas Morning Consult’s category includes all-in monthly mortgage costs or rents. ABS’ spending data also includes a separate category for “insurance and financial services,” while we combined these categories with the housing spend component in the benchmark series to create a proxy for financing and insurance costs. The resulting total share for the benchmark housing category more closely resembles Morning Consult’s findings in terms of both the category definition and the share of wallet allocated to housing.

One other difference in the validation process for Australia was that there was no personal care category specified in the government data. Consequently, this component — a small share of total spending (roughly 3%) according to Morning Consult’s data — was excluded from the benchmarking process.

Trimmed mean selection

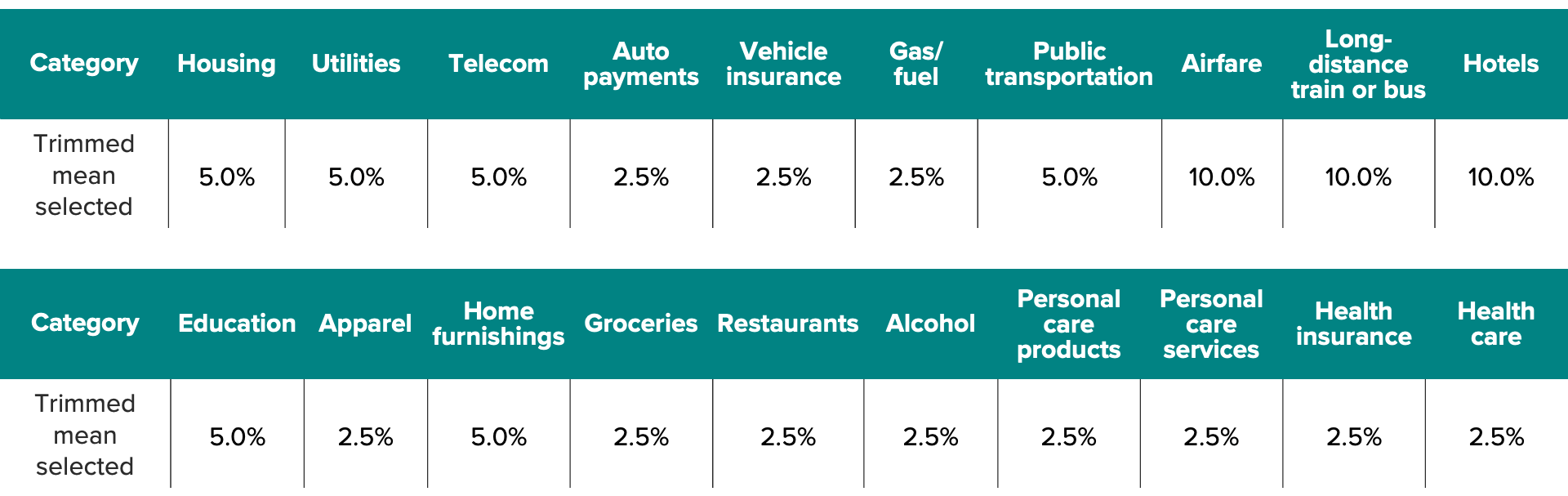

One of the objectives of previous benchmarking exercises in the United States, U.K. and Canada was to determine the optimal test statistic to use in order to estimate an appropriate central tendency for each category. We sought to determine which test statistic would result in the highest correlation in spending allocations across categories between Morning Consult’s data and the appropriate benchmark series from government data sets. Previous research selected trimmed means as the chosen statistic, with trims ranging from 2.5% to 10% depending on the category.

Different purchasing patterns across categories result in varying distributions of spending levels. Since purchasing patterns differ not only among categories within a country, but also potentially among countries within a category, we tested a range of trim combinations for all categories to ascertain whether certain sets improved the fit between Morning Consult’s findings and benchmark data sets. In most cases, using the same combination of trims as was used in the U.K. and Canada resulted in the optimal per-category trim level in eurozone countries and Australia as well. In rare cases where a different trim yielded a slightly stronger correlation with a category benchmark series, the degree of improvement was negligible.

Trimmed Means Selected per Category

We therefore decided to use a consistent approach across countries, applying the same trims per category in the eurozone and Australia as those chosen in the U.K. and Canada validation exercise. The resulting correlations between Morning Consult’s spending allocations and those of their respective benchmark series were all quite high, ranging from .90 to .96. Not only does the decision to use consistent trims across countries simplify the methodological process, but it also reinforces our efforts to create a data set enabling true apples-to-apples cross-country comparisons. To see the full correlation breakdown, visit our Chart Pack page.

Time series comparison: retail sales components

While the government data used as a benchmark for total consumer spending and its components is not available on a monthly basis, monthly retail data from Australian and European statistical agencies is available for a subset of categories tracked by Morning Consult. These data sets allow for time-series comparisons between Morning Consult’s data and the associated benchmark series for certain products as well as an aggregate group of retail categories.

It should be noted, however, that the retail sales and turnover surveys are collecting spending data from businesses rather than consumers, leading to potential methodological differences, three of which we discuss here. First, category definitions could vary since retail trade surveys group by business type, whereas Morning Consult’s spending data is based on product type. Second, surcharges like taxes may be counted by consumers but not by businesses. Third, the timing of purchases reported by consumers might not align with the timing of the revenue being recorded by the business. For example, businesses are likely to immediately record the full sale price of items purchased on credit or paid for in installments, while consumers are likely to report a smaller share of the total purchase price spread out over time.

What we do that’s different: We survey thousands of consumers worldwide on a monthly basis to measure their spending patterns and habits, asking questions on topics including household income, spending, savings, debt, housing payments and more.

Why it matters: This exclusive high-frequency survey research powers like-for-like comparisons of the employment, unemployment and labor force participation rates across countries.

Despite these differences, correlations for monthly retail sales data were moderately positive in all five countries, roughly ranging from .40 to .70. Smoothing out the differences related to purchase timing improved this fit: Viewed as a three-month moving average, correlations ranged from .70 to .80. Correlations for all the countries are displayed in the related Chart Pack.

Consumers’ spending response to changing price levels

Overall, the findings of this benchmarking exercise suggest that there is a strong relationship between Morning Consult’s spending data and government statistics on household consumption expenditures and retail sales for the eurozone and Australia. Morning Consult’s detailed spending data offers a multitude of possibilities for category-level, apples-to-apples comparisons in spending trends by country.

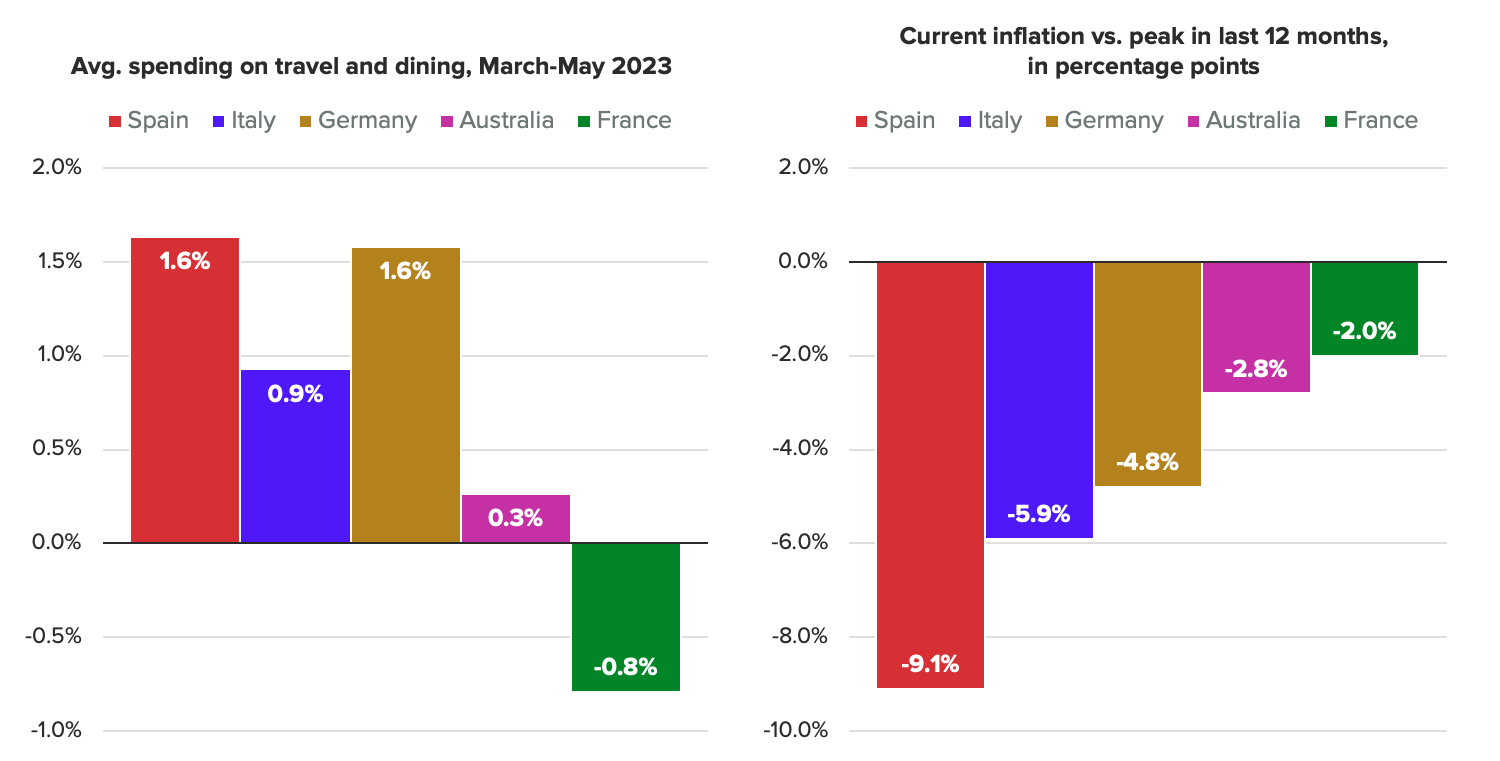

For instance, inflation rates have declined from recent highs in all five of the countries examined for this exercise, but the degree of price relief has varied — Spanish price growth decelerated dramatically from its peak of 10.7% in July 2022 to just 1.6% in June 2023, whereas the French consumer price index is down just 2.0 percentage points since its more recent peak in February of this year. Slower price growth has been driven in large part by the falling costs of energy and food, essential categories for which households have relatively inelastic demand levels.

Consumer Spending and Inflation

Morning Consult’s spending data suggests that consumers may be responding to alleviating price pressures on staple categories by increasing the shares of budgets allocated to discretionary spending, particularly for services categories like travel and dining. Consumers in countries experiencing more price relief in recent months, such as Spain and Italy, have recently directed a larger share of wallet to categories like airfare, hotels, long-distance train travel and dining out compared with a year ago.

Meanwhile, countries in which top-line inflation hasn’t fallen by the same amount, such as Australia and France, don’t appear to have loosened their purse strings as much on these discretionary services. Of course, inflation is only one of the many variables impacting spending, but tracking changes in consumer price sensitivity by category offers critical insights for businesses that seek to anticipate how spending patterns may shift as inflationary pressures subside.

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]