Income Disparities Widen as Inflation Cools and Spending Grows

Key Takeaways

Spending continued to grow in June, a testament to the economic resilience of the U.S. consumer.

Inflation cooled in June, bringing welcome price relief. But despite good news in spending and inflation, disparities between low-income households and their higher-earning counterparts are growing.

Student loan payments are poised to return in September after a yearslong hiatus, which could lead to spending pullbacks from more vulnerable consumers, including younger adults who may be relatively new to the workforce and had less time to build up savings buffers.

Sign up to get our data on the economy, including trends in consumer spending and consumer confidence.

See July 2023 consumer spending data and analysis here.

Inflation-adjusted spending expanded further in June, highlighting the resilience of the average U.S. consumer. The past two months of increased outlays brought average total spending numbers above their recent highs from February, making up all lost ground from March and April. All income levels contributed to monthly spending gains, but middle-income and high-income households continue to outspend their low-income counterparts at higher rates.

Annual spending increased for most goods and services

Inflation-adjusted total spending increased 7% from the same month last year, bucking the trend of year-over-year declines for the past six months. Spending on airfare, hotels and recreation increased sharply in May and June as consumer demand for vacation and services continues to be surprisingly strong despite high inflation. According to Morning Consult data, housing makes up the largest share of the average consumer’s budget. Despite high mortgage rates and home prices, consumers’ pent-up demand is propping up the housing market, driving up spending in this category.

The second-largest category for spending is groceries. Although price growth for groceries has cooled recently, prices remain elevated, putting strain on households and especially lower-income earners. As a result, many consumers are engaging in cost-cutting behavior in order to save on groceries.

Inflation cooled more than expected in June

Annual top-line inflation slowed for the 12th straight month to 3.1%, moving closer to the Fed’s 2% target. Energy price growth ticked up in June after a negative print in May, but the primary driver of price growth continues to be core inflation, which excludes volatile food and energy categories. Annual core inflation also decreased in June to 4.9%, running hotter than top-line inflation but reaching its lowest level since November 2021. Monthly inflation from core goods, housing, and core services excluding housing, or “supercore services,” all declined from the previous month.

Following the trend from the previous two months, consumers across all income groups increased their total spending in June. However, middle- and high-income earners had larger increases of 23% and 31%, respectively, since their lows in March, while the average low-income consumer only increased their spending by 4%. Spending patterns from the past three months suggest that high- and middle-income earners are propping up spending and leaving their low-income counterparts behind.

What we do that’s different: We survey thousands of U.S. consumers monthly to measure their spending patterns and habits, asking questions on topics including household income, spending, savings, debt, housing payments and more.

Why it matters: Morning Consult’s consumer and spending data provides a detailed assessment of U.S. adults’ self-reported household financial conditions and spending, as well as consumers’ perception of inflation and supply chain disruptions and the impact of both on purchasing decisions.

Increases in spending for middle- and high-income Americans may be in part due to less sensitivity to high prices. Morning Consult’s levels of price sensitivity, or “sticker shock,” for middle- and high-income earners dropped from their highs earlier this year, indicating that these consumers are more willing to swallow high prices. Price sensitivity ticked down slightly but continued to stay elevated for members of the lowest-income group, indicating that they are more likely to walk away from a purchase because the price was too high.

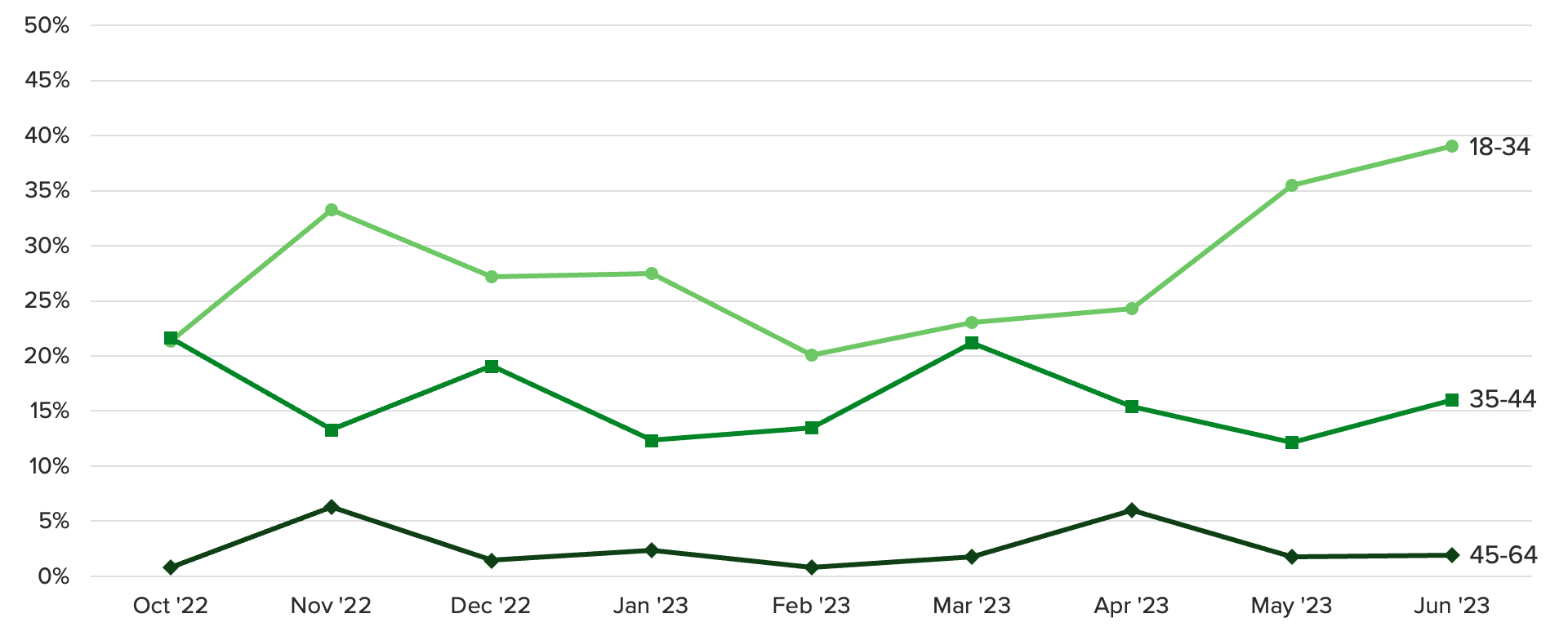

Student loan payments could dampen future spending

Morning Consult’s consumer credit data shows that a growing share of monthly debt spending by young adults is being directed toward student loan repayments ahead of the Sept. 1 expiration of the pandemic-era law that paused interest accruals and suspended payments. This group includes those less likely to be eligible for debt forgiveness under the Biden administration’s recently announced program, which applies only to those who have already made 20 or 25 years’ worth of payments.

Student Loan Payments Constitute a Growing Share of Young Adults’ Debt Burdens

Having given up on previously held hopes for student debt to be forgiven, student loan holders may now be paying down debt ahead of the deadline to reduce their principal at the current 0% interest rate and avoid accumulating more interest down the line.

As educational debt takes up more space in consumers’ total monthly debt burden, less is being put toward auto payments and credit card debt. Young adults who purchased homes since 2020 may also feel a greater pinch.

This memo offers a preview of Morning Consult’s July U.S. Consumer Spending & Inflation Report. Morning Consult Economic Intelligence subscribers can access the full report here.

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]

Related content

Food Insecurity Is on the Rise as Grocery Inflation Persists

What’s Driving Increases in Consumer Spending — Even As Core Inflation Remains Stubborn