Consumers Are Not Spending Like Last Year

Key Takeaways

As we enter fall 2024, we can conclude that a summer boost to spending never materialized, unlike last year.

Consumers at all income levels spent less this summer than last, but low- and middle-income adults in particular have been reporting slower spending throughout 2024.

Demand has been muted from this cohort, but even wealthier households are beginning to show signs of dampened expenditures.

Data Downloads

Pro+ subscribers are able to download the datasets that underpin Morning Consult Pro's reports and analysis. Contact us to get access.

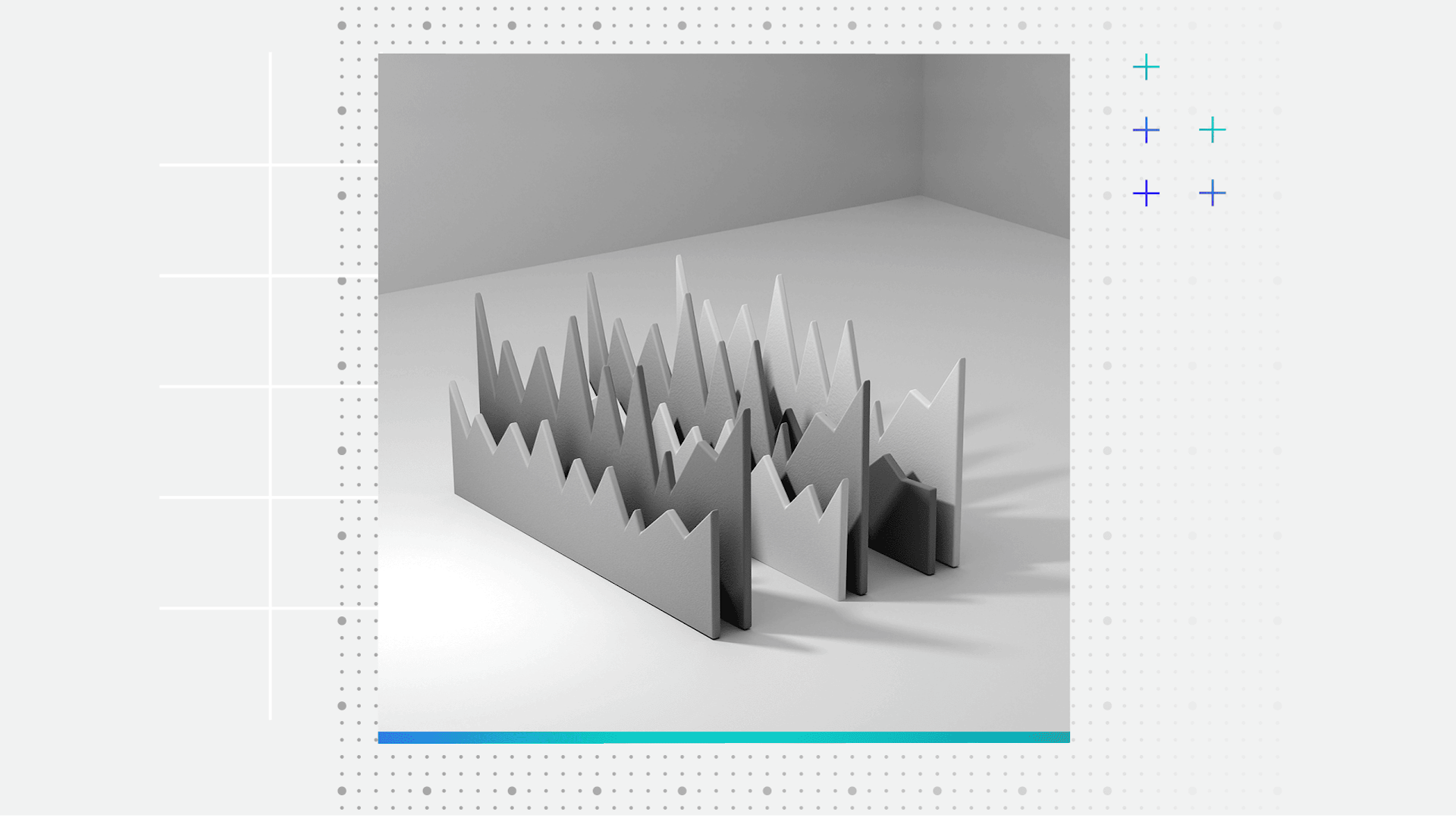

Spending has softened throughout the year

In 2023, despite major headwinds from elevated inflation, there was a large boost to spending in the summer particularly amongst wealthier and younger adults. Strength in spending was driven in large part by discretionary categories, or goods and services that can be categorized as “non essential” including airfare, hotels, concert/sporting events, and more. Some characterized this as “revenge spending”: after pandemic related lockdowns, many consumers spent heavily, particularly on experiences rather than goods.

As the summer of 2024 comes to a close, last year’s boost in spending never materialized. In fact, average inflation and seasonally adjusted consumer spending declined in August, marking the sixth month of declines in the past seven months. Fizzling appetite for spending appears to be coming from (1) middle- and low-income consumers, who have been slowly reducing their spending throughout 2024 and (2) wealthier and younger adults, who were major drivers of the spending boost last summer, but have kept spending relatively steady this summer.

Morning Consult’s monthly spending data is showing a weaker picture of demand than suggested by government retail sales and spending data in recent months. Morning Consult’s spending data is derived directly from consumer surveys each month, and is designed to reflect spending from the perspective of an average consumer, as well as offering demographic detail for both topline spending and category-specific trends. On the other hand, monthly government data report aggregate spending levels, collected mainly from businesses rather than consumers. You can read more about the differences and similarities of Morning Consult’s spending data with government data here.

All consumers are spending less than a year ago, but middle- and low-income households have moderated more through 2024

Last year’s summer spending boost came from primarily high and middle-income households, with high income households splurging at record highs since Morning Consult began tracking. High-income households generally have more wiggle room in their budgets to allocate to discretionary spending, and thus they have greater flexibility to have months with increased splurging. However, even high-income households have tightened their belts compared to last year: inflation-adjusted spending was lower this summer for households at all income levels.

One notable difference between income groups is how their spending patterns have developed throughout 2024. High-income adults, while they didn’t boost their spending this summer like last, have kept their spending levels relatively stable throughout the year. In contrast, low and middle earning households have been slowly drawing down their spending levels as the year has progressed: low- and middle-income earners have reduced their average spending by 10% and 12% respectively since January, while high earners have only reduced their spending by 3%, within a standard deviation of their regular monthly spending fluctuations.

Morning Consult’s Consumer Purchasing Power Barometer (CPPB) combines the Price Sensitivity index with the Substitutability index to measure consumer demand in response to price. A positive CPPB score implies that consumers have more demand – their price sensitivity and substitutability scores are lower, meaning they’re more likely to accept higher than expected prices or trading down to a cheaper alternative. Since tracking began in mid-2022, the general trend for consumers’ CPPB scores, at all income levels, have been down.

Looking ahead, even high earner’s demand scores are starting to wane

Beginning in early 2024, middle-income adults have reported sharply reduced CPPB scores, much closer in line with lower earning adults than they have been historically. This is similar to trends across many of Morning Consult’s surveys – middle-income households, once propped up by excess savings built up through the pandemic, are showing signs of weakness in their household finances, sentiment, and spending. But in recent months, even high-income earners are reporting declining CPPB scores, reaching negative levels in June and July. Although higher earners have been propping up spending, perhaps even their appetite for splurging is beginning to wane as they report higher levels of price sensitivity and trading down behavior. With low- and middle-income households already having pulled back on their purchasing behavior substantially, how aggregate spending in the U.S. economy unfolds in the next few months hinges somewhat on the strength of spending from these higher earners.

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]