Introducing Country Affinity: A New Morning Consult Tool to Safeguard Your Brand in an Uncertain World

Key Takeaways

In a new white paper and companion strategy playbook — both available exclusively to Morning Consult Pro subscribers — we leverage our Brand Intelligence and Political Intelligence data to introduce global “country affinity” metrics, a novel suite of tools that quantify the closeness of the relationship between global consumers’ views of specific brands and their countries of origin.

Use cases include competitor and cross-industry benchmarking with an application to the development of global marketing strategies.

Additionally, we show how crisis communicators can use our data to predict how their brands would fare in foreign markets during major geopolitical shocks, using the war in Ukraine as an example.

Download the corresponding white paper for additional methodological details and the results of related observational and experimental analyses; download the strategy playbook for actionable insights for corporate decision-makers.

A large body of marketing research has examined how a product’s country of origin affects consumers’ perceptions of it. This phenomenon, known as the country of origin effect, differs across markets, products and industries. Morning Consult’s large volume of data on both brands and country favorability — key parts of our Brand and Political Intelligence products, respectively — allows us to expand our understanding of this effect in novel and exciting ways, with an eye toward generating concrete benefits for corporate decision-makers.

Introducing country affinity

In a new white paper released today, we leverage Morning Consult’s Brand and Political Intelligence data to introduce a novel, high-frequency country affinity metric that quantifies the closeness of the relationship between global consumers’ views of 46 major multinational brands and their countries of origin. Higher values indicate a stronger relationship.

Our ability to zoom in to the company level makes our country affinity metrics especially valuable for communications and marketing professionals and government affairs teams working to support the brands included in the study. It also holds value for brands beyond the immediate scope of the study that are similarly positioned by industry or relative to their peers.

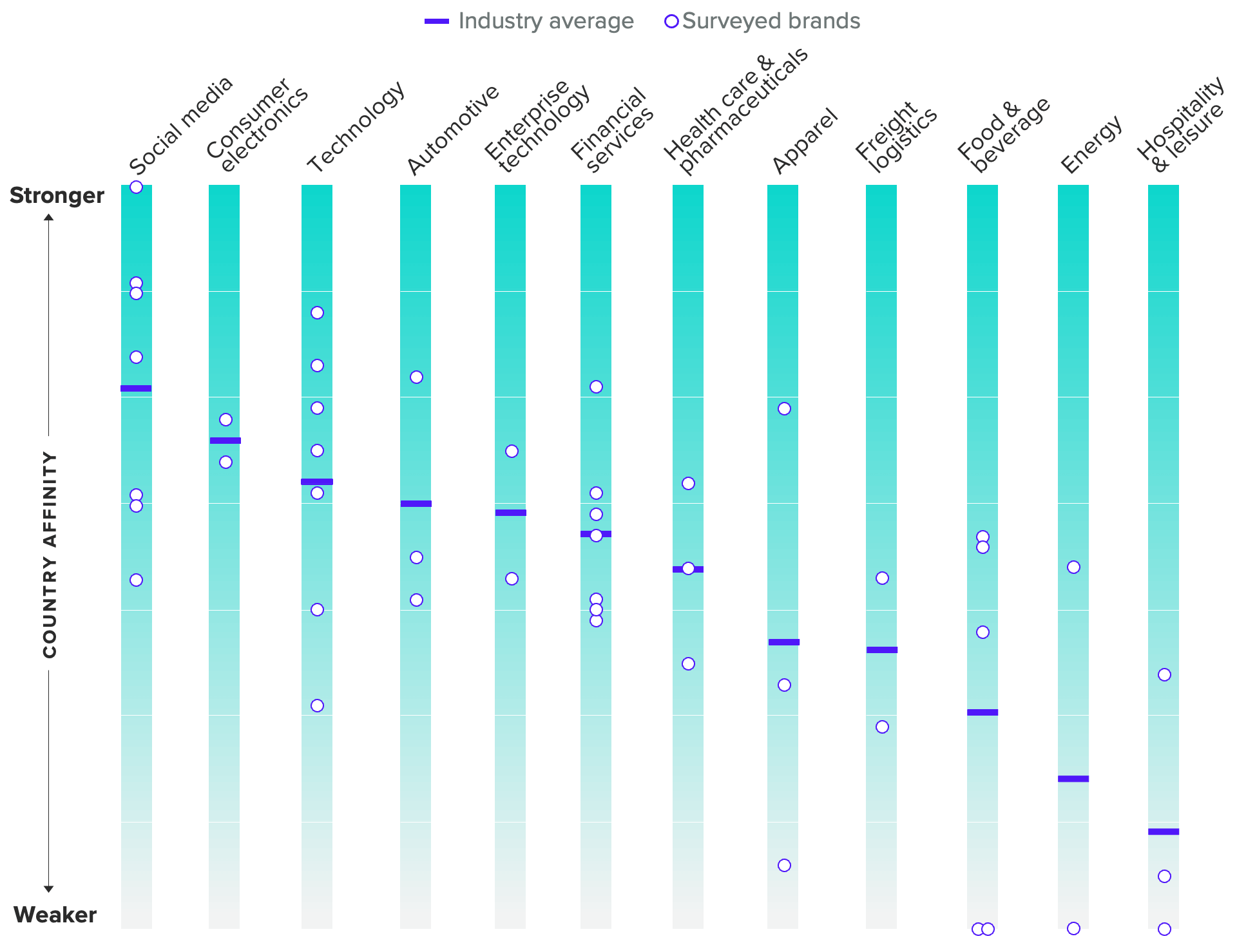

The figure below provides an anonymized snapshot of the 46 brands included in the study, each of which is represented by a white dot. Blue bars represent industry-specific averages.

Country Affinity by Company and by Industry

Just as companies’ country affinity scores are dispersed relatively widely across industries, so too are the industries themselves. Some industries — like social media and automotive — show strong average country affinity, while for others, the average relationship is weaker.

Country affinity is not inherently positive or negative: Strong affinity can yield reputational or material gains for brands when consumers hold positive views of their country of origin; it can also pose risks during geopolitical crises that cause those views to deteriorate sharply.

Understanding these dynamics at the brand and industry level gives brand stewards and executive decision-makers novel insight into how their brand is viewed around the world.

Brands included in the study can request a snapshot of how they are viewed in relation to their home country — and how they stack up relative to their competitors. Our companion white paper, which includes industry-specific breakouts, is intended to help interested parties whose brands are not included in the study approximate their own affinity scores and benchmark themselves.

Geopolitical crisis = brand crisis?

Our country affinity data has an additional application for crisis communicators: examining their brands’ exposure to consumer backlash during major geopolitical events that prime consumers to associate companies with particular countries.

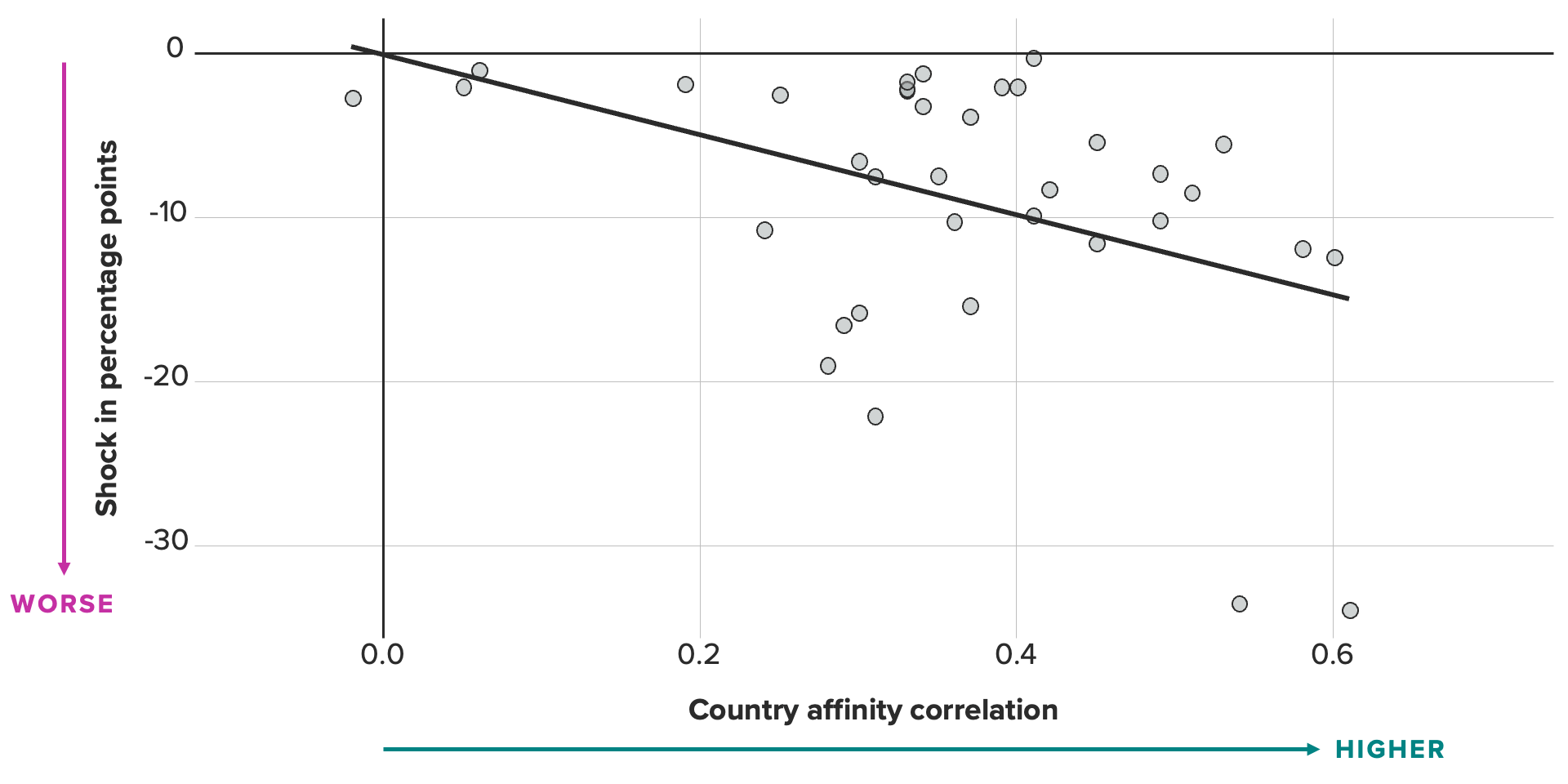

For the purposes of our country affinity project, we used Russia’s invasion of Ukraine to model how a geopolitical shock affects a country’s reputation in a foreign market — in this case, Russian consumers’ views of the United States — and subsequently assessed shifts in favorability among American companies as a function of their country affinity. The metric was highly predictive of how much reputational damage U.S. brands suffered among Russian consumers in the immediate aftermath of the invasion, an analytical feat made possible by our Brand and Political Intelligence data.

As shown in the chart below, U.S. companies with stronger country affinity suffered greater fallout — measured as the percentage-point decline in net favorability among Russian consumers — than those with weaker affinity. Effect sizes are nontrivial and long-lasting, speaking to the damage that a geopolitical crisis can cause to companies in the strong affinity camp and the value of our data in helping to anticipate and plan for such shocks in the future. A global conflict over Taiwan is the most likely analogous event on the horizon that our data can help companies prepare for, but it’s far from the only use case, as we discuss further in our companion strategy playbook.

Country Affinity Scores Are Predictive of Reputational Damage After a Crisis

Knowing is half the battle

This memo and the white paper are geared toward helping corporate decision-makers understand where their brands stand today — and the risks and opportunities they face — in relation to their country affinity scores. The companion playbook offers a concrete, four-step road map to help them get their brands where they want them to go.

Learn more

Interested readers can access both the country affinity white paper and playbook exclusively via Morning Consult Pro (subscribe for access here) and learn more about Morning Consult Intelligence (which houses our Brand and Political Intelligence data) here. For client-, research- and press-related inquiries regarding the above materials, please contact [email protected].

The brands analyzed in the study

Sonnet Frisbie is the deputy head of political intelligence and leads Morning Consult’s geopolitical risk offering for Europe, the Middle East and Africa. Prior to joining Morning Consult, Sonnet spent over a decade at the U.S. State Department specializing in issues at the intersection of economics, commerce and political risk in Iraq, Central Europe and sub-Saharan Africa. She holds an MPP from the University of Chicago.

Follow her on Twitter @sonnetfrisbie. Interested in connecting with Sonnet to discuss her analysis or for a media engagement or speaking opportunity? Email [email protected].