On-Demand Content Will Help FAST Services Compete With Subscription Streamers

Key Takeaways

Cable-like TV channels are a key draw for free ad-supported streamers like Pluto TV, but surprisingly, that’s not the main reason many people turn to them.

Over 2 in 5 FAST users (42%) say on-demand content is a major reason they use free ad-supported streaming services, while just 30% cited linear channels as a major reason.

This should encourage FAST services to expand on-demand libraries, which will make these platforms feel increasingly similar to paid-based streamers in the coming years.

For the latest entertainment industry news and analysis, sign up for our entertainment briefing here.

FAST services have been referenced in media conversations as platforms to keep an eye on for some time, thanks in large part to their novel — streaming landscape-wise — approach of offering linear feeds (pre-scheduled content that plays continuously) for free.

Free digital channels that play nonstop programming simultaneously help consumers address both decision and subscription fatigue. This makes it easy to grasp why more have been tuning in: Four FAST services (counting Peacock) have now been among the most-watched streamers in Nielsen’s monthly rankings, compared to zero this time last year. Meanwhile, Morning Consult data shows that the share of adults who said they used Peacock (which is still free to some who signed up before its hard paywall launch) and The Roku Channel in July were up 7 and 4 percentage points, respectively, from the year-ago period.

Counterintuitively, it’s not the attributes unique to FAST services that have consumers most interested in platforms like Pluto TV. Morning Consult data shows FAST users most commonly cite free access as a major reason why they use free ad-supported streaming TV platforms, despite there being notable free ad-supported video streamers without FAST channels. Meanwhile, the share of these users who said on-demand content is a major reason they use FAST platforms is 12 points higher than the share who cite channels with nonstop programming.

The data suggests FAST platforms would be well-served in applying a greater focus to on-demand expansion. This would be timely as subscription video-on-demand platforms are looking for platforms where they can offload less-viewed shows, and ultimately hints at a future where FAST services and SVODs are less distinguishable, especially as the former group will likely also spend more on originals and live sports (two domains already well-trodden by paid streamers).

Digital linear channels are signature to FAST, but on-demand programming is still a key draw

While pre-programmed linear broadcasts make FAST services stand out to industry players and the media, consumers have other reasons for turning to them. Free access and the ability to see interesting content were most commonly cited as major reasons why FAST users tuned into the platforms in July.

Meanwhile, on-demand content was much more likely (42%) to be cited than channels with nonstop programming — i.e., linear feeds (30%).

On-Demand Content Is a Surprisingly Big FAST Draw

Both monthly and weekly users of major FAST services were more likely to cite on-demand content as a major reason for using FAST services than they were to cite linear feeds. This is unexpected, but not unexplainable: Several of the most popular FAST players — such as Tubi, The Roku Channel and Freevee — place users on a static landing page with on-demand titles upon opening their apps, rather than dropping them directly into a channel with a linear feed like Pluto TV does. The dynamic also explains why some within the industry have already called for FAST players to make a greater investment in on-demand programming.

While this doesn’t mean linear-first FAST platforms should reverse course, it does mean they should more regularly update their on-demand libraries and make those easier to browse. One way to accomplish the latter would be to embrace a “Top 10” ranking, which is now found in the paid streamer space across platforms such as Netflix, Apple TV+ and Prime Video. This feature is not as prominent on FAST platforms, and would give those who adopt it a leg up on competitors.

Specific demographics at scale: Surveying thousands of consumers around the world every day powers our ability to examine and analyze perceptions and habits of more specific demographics at scale, like those featured here.

Why it matters: Leaders need a better understanding of their audiences when making key decisions. Our comprehensive approach to understanding audience profiles complements the “who” of demographics and the “what” of behavioral data with critical insights and analysis on the “why.”

Spending on more on-demand content and to engineer a “Top 10” can be funded by onboarding new customer segments. Redirecting a bigger portion of marketing efforts toward college students would be one way to work toward this, given the relatively lower spending power of Gen Zers. This young cohort tends to be less willing than consumers overall to pay for the privilege of sharing passwords, which Netflix is increasingly monitoring.

Where FAST services must go from here

With more robust on-demand libraries that are easier to browse, FAST services stand a better shot at becoming go-to video streaming platforms, rather than delegated to their current status as second-class streamers.

Morning Consult data shows that, minus YouTube, the most-used video streaming services in the U.S. are paid streamers, similar to last summer’s landscape. But beyond this, our data shows that more FAST users overall view platforms like Pluto TV as destinations to go after they’ve browsed through paid streamers, rather than before.

More Consumers See FAST as a Secondary Streaming Destination

While any engagement is welcome, FAST players should strive to become a primary destination for consumers — streaming sessions would likely be longer if FAST platforms were the first choice instead of the backup.

To achieve that, FAST players should increase investment in sports and original content, on top of acquiring more on-demand rights to classic titles. After all, many consumers turn to FAST platforms after SVOD platforms because they’re able to more easily differentiate the value offerings of the latter, which provides consumers with more access to sports and original content production.

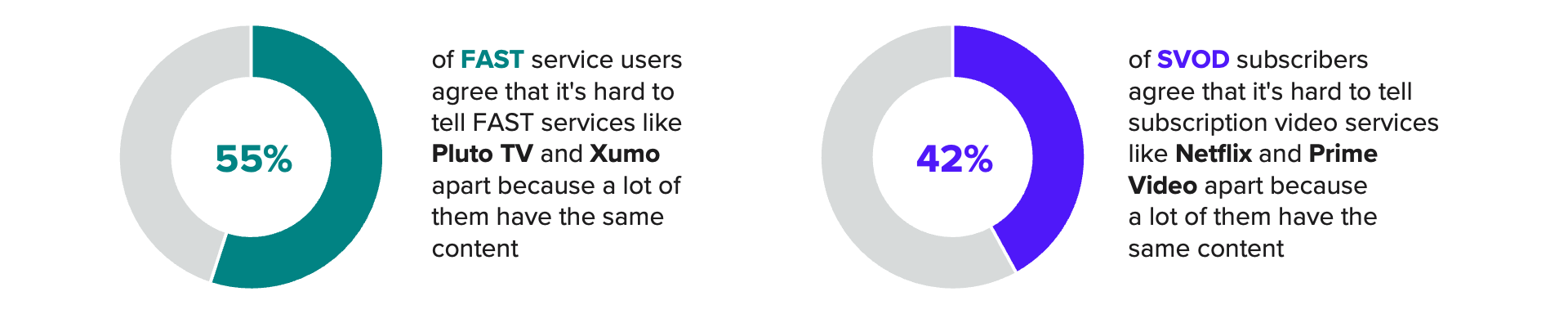

This difficulty in differentiating is evidenced by the fact that the share of FAST users who agreed that it’s hard to tell free ad-supported streaming platforms apart (55%) is higher than the share of video streaming subscribers who agreed that it’s difficult to tell SVOD platforms apart (42%).

Viewers Are More Likely to Say FAST Services Are Hard to Distinguish

We’ve already seen the Roku Channel lock up its first live sports deal with Formula E, and Freevee released “Jury Duty,” one of 2023’s more successful original comedies. And since FAST platforms aren’t yet at the scale of subscription streamers, we should expect similar, less-mainstream sports rights and more modest budgeted originals to permeate FAST platforms. In other words, NBA games or “Game of Thrones” spinoffs won’t air exclusively on platforms like Freevee anytime soon.

Regardless, as more live sports and original programs spread across free ad-supported streamers, it’ll become increasingly difficult to differentiate between FAST and SVOD platforms — especially as platforms in the latter group consider offering linear feeds of their own and dump more of their already-aired originals onto the former group.

Kevin Tran previously worked at Morning Consult as the senior media & entertainment analyst.