Gen Z Embraces Chinese Brands in Departure From the Average Consumer

Key Takeaways

Gen Z adults were much more likely than U.S. adults overall to report favorable views on 9 out of 11 tested Chinese brands.

More broadly, significantly smaller shares of the young cohort reported concerns about shopping from Chinese brands compared to the general population.

Sign up to get the latest global brand, media and marketing news and analysis delivered to your inbox every morning.

Between TikTok, Shein and Temu, Chinese-founded companies are having a moment in the United States. But they’re also drawing extensive criticism from lawmakers and regulators, with data privacy, labor practices and user safety being among the most frequently cited areas of concern.

However, new Morning Consult data reveals a major gap in public opinion on the matter. Compared with all U.S. adults, more young people, specifically Gen Z adults, are enthusiastic about Chinese brands on many fronts — from favorability and shopping intent to general support of their growing stateside presence.

The stark divide mirrors similar ones found in other recent Morning Consult research, including the power of logos, affinity for subscription services and opinions on targeted advertising. The widespread nature of the pattern suggests that, as they age, Gen Zers may fundamentally shift the nature of American consumerism in ways not exhibited by previous generations.

Favorability differences are led by TikTok

Gen Z adults’ diverging opinions are starkest in relation to TikTok: The share of this group (68%) who said they have a “very” or “somewhat” favorable opinion of the short-form video app was nearly 30 percentage points more than the share of all U.S. adults (39%) who said the same. This is unsurprising, given that TikTok is among the brands Gen Z adults trust most relative to the broader public, according to data from Morning Consult's 2023 Most Trusted Brands report.

Gen Z Adults’ Comparatively Sunny View of Chinese Brands

It’s possible that TikTok’s influence on Gen Zers — two-thirds of whom use the platform — is offering a halo effect to other Chinese brands among the cohort. The next-largest positive differences in favorability between Gen Z adults and all U.S. adults were seen by Shein and CapCut, companies that are both deeply entrenched in the TikTok ecosystem, whether through a high volume of influencer content or, more tactically, the ability to edit content itself.

Just behind these two were e-commerce retailers AliExpress and Temu, brands which a higher share of Gen Z adults reported shopping from than any other major demographic group: 26% of Gen Z adults said they purchased from AliExpress at least once in the past month, compared with 10% of all U.S. adults. A larger share of Gen Z adults (37%) also said the same about Temu compared with U.S. adults (23%).

Lenovo and Haier were the only tested companies where favorability was higher among all U.S. adults than among Gen Z adults. These are two brands that tend to sell products that are either pricier (corporate laptops) and more attainable for older adults at different life stages (large home appliances).

Gen Z adults don’t share broader concerns about shopping from Chinese brands

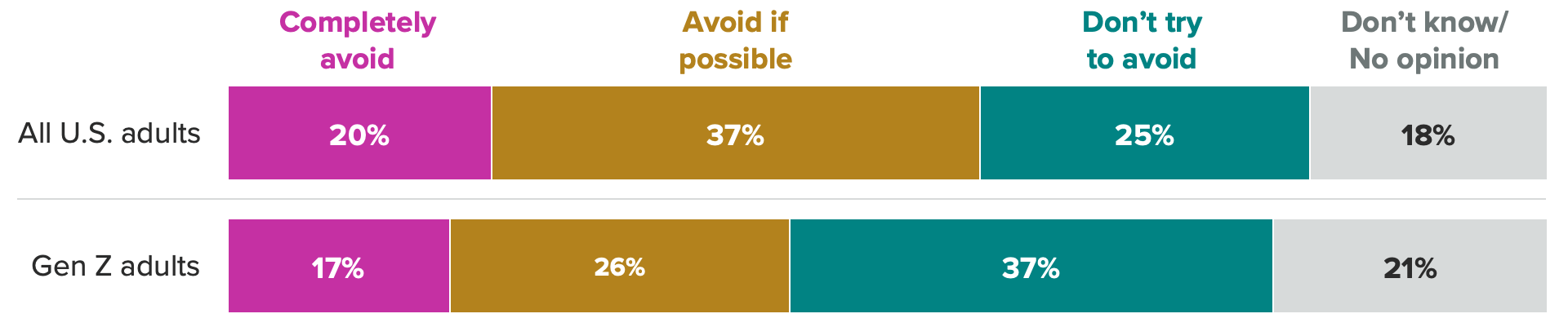

Nearly 2 in 5 (37%) Gen Z adults said they do not actively try to avoid shopping from Chinese brands, another signal of their enthusiasm in relation to all U.S. adults. Conversely, U.S. adults overall were more likely than Gen Z respondents to say they always or sometimes try to avoid purchasing items from China-based companies.

Gen Z Adults Aren’t Compelled to Avoid Chinese Brands

The survey also found that data privacy — a popular talking point across anti-China rhetoric — is a much less pressing issue for the youngest cohort than it is for U.S. adults at large. While approximately 3 in 4 said they have concerns about the safety of their personal data when purchasing from Chinese companies, only a slim majority (51%) of Gen Z adults feel the same.

Gen Z adults are just as likely to be concerned about their data privacy when shopping from American companies (52%), suggesting that young consumers perceive no additional threat from Chinese brands in this regard. In contrast, the 74% of U.S. adults who reported data privacy concerns when shopping from Chinese companies is higher than the share who shared the same concern buying from American ones (63%).

Specific demographics at scale: Surveying thousands of consumers around the world every day powers our ability to examine and analyze perceptions and habits of more specific demographics at scale, like those featured here.

Why it matters: Leaders need a better understanding of their audiences when making key decisions. Our comprehensive approach to understanding audience profiles complements the “who” of demographics and the “what” of behavioral data with critical insights and analysis on the “why.”

On an even broader scale, Gen Z adults are quite accepting of Chinese brands’ expansion into the United States: They are 8 points more likely to support this kind of movement (42%) than oppose it (34%). Meanwhile, results were inverted among all U.S. adults: Just 24% support Chinese brands’ expanding into America, which is less than half the share of those who oppose it (54%).

Gen Z’s enduring diversion

Morning Consult’s research has consistently shown that departing from mainstream public opinion is one of Gen Z’s defining qualities. One of our most recent studies found that U.S. Gen Zers are more similar — at least in their social media usage and shopping habits — to Chinese adults than to U.S. adults.

Of course, it’s possible that Gen Zers’ more avant-garde opinions and behaviors may change as they age. But it’s also possible that they hold, or even deepen, over time. Between the pandemic and a fully internet-equipped childhood, today’s young consumers came of age in a totally unique set of circumstances.

The latter scenario bodes well for the likes of TikTok Shop — which is reportedly launching sometime this month — or any other brand that steeps itself in what, again and again, Gen Zers have shown they gravitate toward: video and variety, among other things.

Ellyn Briggs is a brands analyst on the Industry Intelligence team, where she conducts research, authors analyst notes and advises brand and marketing leaders on how to apply insights to make better business decisions. Prior to joining Morning Consult, Ellyn worked as a market researcher and brand strategist in both agency and in-house settings. She graduated from American University with a bachelor’s degree in finance. For speaking opportunities and booking requests, please email [email protected].