Introducing the Price Surprise Index

Sign up to get our data on the economy, including trends in inflation and consumer spending.

This note provides a brief summary of the Price Surprise Index, a complement to the five Supply Chain and Inflation Indexes of Consumer Inflation Pressures that was created to better understand consumers’ observations on price changes. Below, we discuss both how to interpret the price surprise concept and the index scores themselves. Examples of how this index can be used to analyze consumers’ purchasing behavior can be found in the U.S. Inflation and Price Pressures report, accessible to Morning Consult Economic Intelligence clients.

Defining the Price Surprise Index

We define price surprise as the net share of consumers who report higher than expected prices for purchases.

In the middle of the pandemic, we developed the SCICIP indexes to better understand how consumers are reacting to rising inflation and supply chain difficulties. We have added the Price Surprise Index to our toolbox because it provides another data point on inflation ahead of the Bureau of Labor Statistics Consumer Price Index release.

The Price Surprise Index is distinct from Morning Consult’s Price Sensitivity Index in several ways. The Price Sensitivity Index is designed to capture the prevalence of consumers who are walking away from prospective purchases due to sticker shock, while the Price Surprise Index measures the amount of price-related “surprise” among consumers who completed a purchase.

In other words, the price surprise concept addresses this question: Out of all consumers who purchased a good or service, were more consumers facing a price that was higher than expected or at/below what they expected? On the other hand, price sensitivity isolates only those consumers who faced a higher-than-expected price when considering a potential purchase and traces the outcome. The Price Sensitivity Index is then calculated by subtracting the share who completed a purchase with a higher-than-expected price from the share who walked away from the purchase. While price sensitivity is a proxy for demand, price surprise acts as a proxy for measuring inflation.

Interpreting the Price Surprise Index

As is the case with the other SCICIP indexes, Price Surprise Index scores are calculated for individual product and service categories. The top-line Price Surprise Index is then calculated as a weighted average of these product and service-level index scores, with each category’s relative importance based on its share of household spending.

A positive index score for price surprise corresponds to more respondents who indicate that a price was higher than expected for a purchase. A negative score corresponds to more respondents who find that prices are the same or below the expected price for a purchase. A neutral index score of 0 denotes that there were equal shares of adults who found prices to be above expectations and below or at expectations.

Interpretation of Price Surprise Index and Consumer Price Index Together

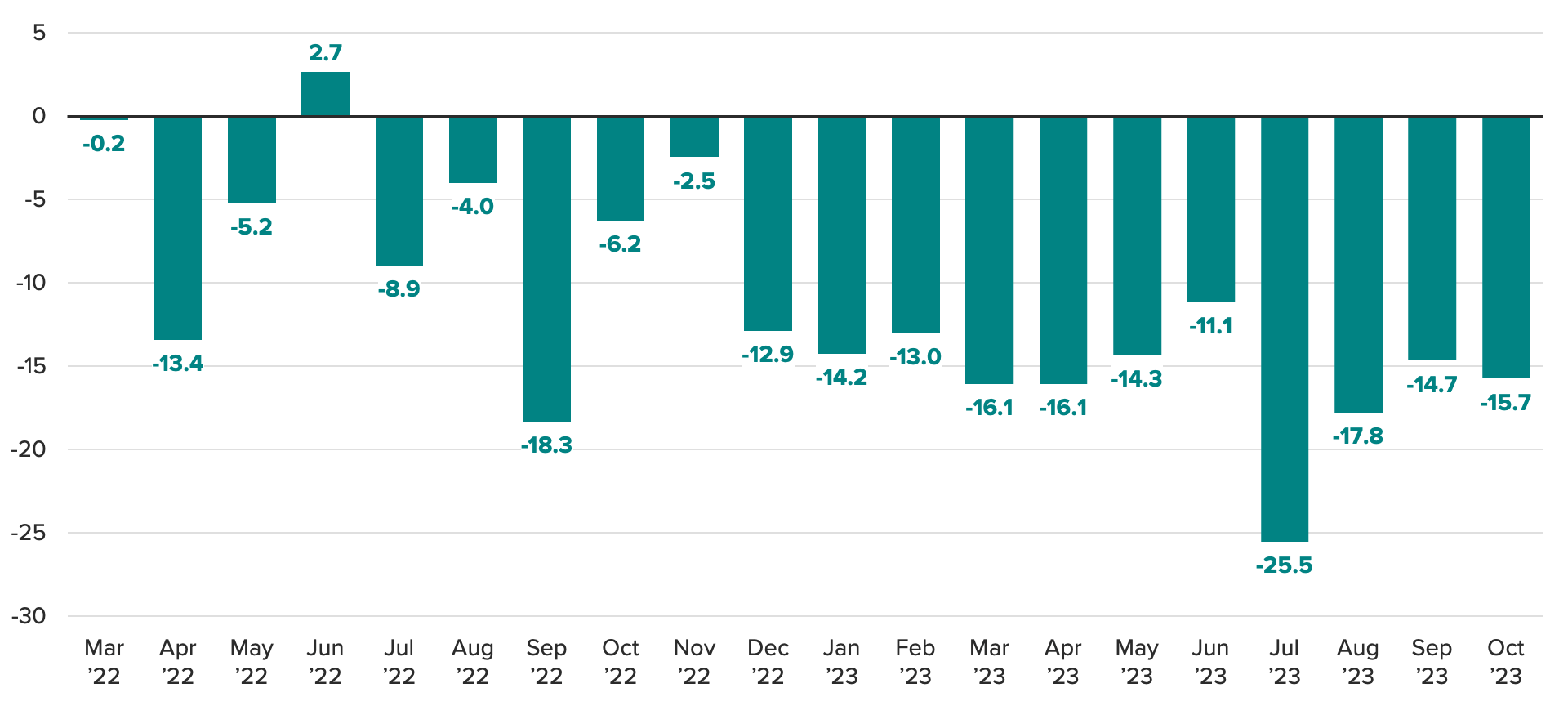

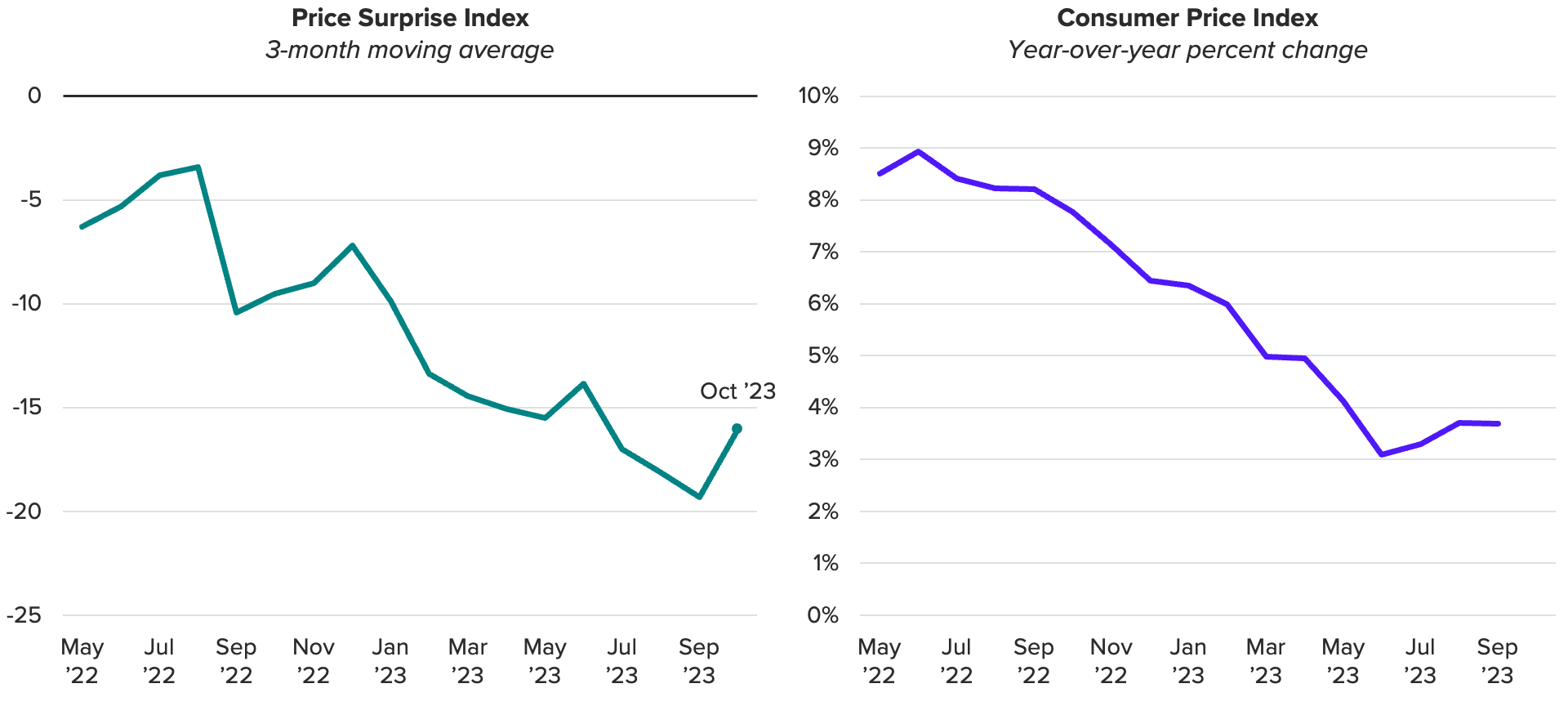

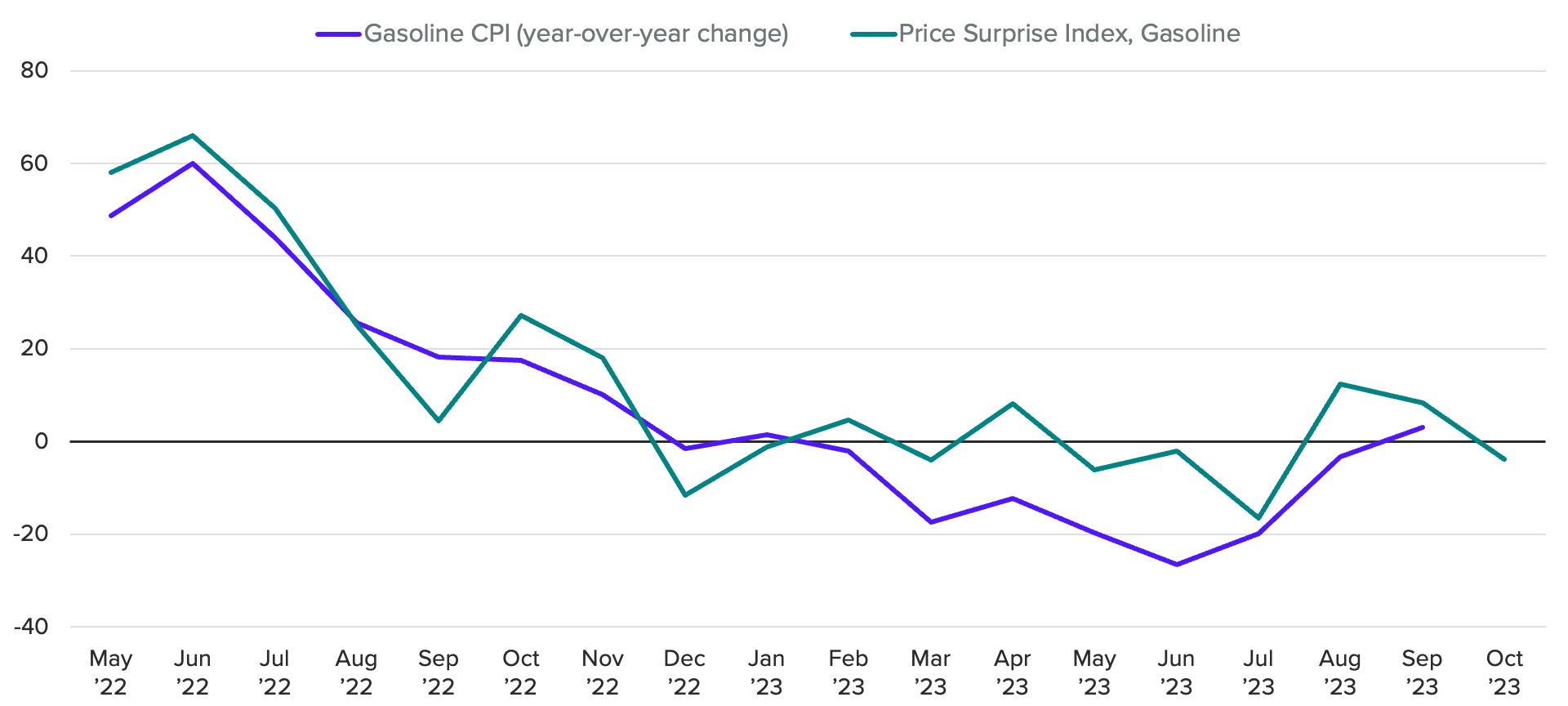

Since tracking began in March 2022, Morning Consult’s Price Surprise Index has tracked closely with annual inflation: The three-month moving average of price surprise registered a .90 correlation with year-over-year CPI. As inflation has eased since its peak in June of 2022, the price surprise index has also declined, suggesting consumers are less and less shocked by the price tags on their purchases.

In addition to the close alignment of the top-line indexes for Price Surprise and CPI, a similar correlation is also present in category-level data. Morning Consult’s Price Surprise Index for gas and fuel ticked up sharply in August, two weeks before the release of the August CPI, which reflected a corresponding jump in energy prices. In October, price surprise for gas began to retract, suggesting that either prices are easing or consumers have grown more accustomed to the recent surge in the cost for fuel. The Price Surprise Index can serve as a leading indicator on consumers’ perceptions of price as well as offering a preview of actual changes in price ahead of the CPI release.

Price Surprise Index at a Category Level

Sofia Baig is an economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency data. Previously, she worked for the Federal Reserve Board as a quantitative analyst, focusing on topics related to monetary policy and bank stress testing. She received a bachelor’s degree in economics from Pomona College and a master’s degree in mathematics and statistics from Georgetown University.

Follow her on Twitter @_SofiaBaig_For speaking opportunities and booking requests, please email [email protected]

Kayla Bruun is the lead economist at decision intelligence company Morning Consult, where she works on descriptive and predictive analysis that leverages Morning Consult’s proprietary high-frequency economic data. Prior to joining Morning Consult, Kayla was a key member of the corporate strategy team at telecommunications company SES, where she produced market intelligence and industry analysis of mobility markets.

Kayla also served as an economist at IHS Markit, where she covered global services industries, provided price forecasts, produced written analyses and served as a subject-matter expert on client-facing consulting projects. Kayla earned a bachelor’s degree in economics from Emory University and an MBA with a certificate in nonmarket strategy from Georgetown University’s McDonough School of Business. For speaking opportunities and booking requests, please email [email protected]